The Optimism Superchain has cemented its position as Ethereum’s scalability powerhouse, securing $21.7 billion in assets across 32 OP Stack rollups. This milestone captures 39.8% of Ethereum’s total L2 Total Value Secured, a testament to the multi-rollup architecture’s maturity. Daily transactions hit 20.1 million, powering 58.5% of all Ethereum L2 activity amid Ethereum’s price at $2,742.03.

Adoption by heavyweights like Coinbase’s Base, Sony’s Soneium, Kraken, Uniswap, and Sam Altman’s World underscores the OP Stack’s appeal. These chains don’t just stack blocks; they generate real economic value, with H1 2025 GDP reaching $396.5 million across what was then 34 chains. Superchain stats 2025 reveal a network that’s not chasing hype but delivering measurable throughput and security.

TVL Breakdown: Base Leads, Ecosystem Diversifies

Base dominates with metrics like 11.0 million daily users and $14.9 billion in secured value, per Optimism’s dashboard. Soneium follows at 2.1 million users and $4.6 billion secured. Yet the Superchain’s strength lies in distribution: 32 chains collectively hold this $21.7 billion TVS, up from earlier figures like $6.9 billion in DeFi TVL cited in Optimism updates. Superchain TVL metrics highlight resilience, even as Ethereum dipped 9.65% to $2,742.03 in the last 24 hours.

This growth trajectory positions the OP Stack as the default for rollups. Revenue contributions total around 15,800 ETH, worth over $42 million at current rates, funneled back to Optimism. It’s a flywheel: more chains, more activity, more security. Read more on OP Stack’s explosive growth.

Superchain networks built on Optimism’s OP Stack now power 58.5% of all Ethereum L2 transactions. – Optimism on X

Transaction Supremacy: 58.5% Market Share

Ethereum L2 transactions Superchain handles surged to 20.1 million daily, dwarfing competitors. L2BEAT’s October 2025 update pegged Superchain at 55.9% share, now climbed to 58.5%. Superchain Eco dashboards confirm over 50% of L2 activity, with chains like OP Mainnet, Ink, and Unichain contributing. This isn’t volume for volume’s sake; it’s efficient scaling, processing more with shared sequencing and interoperability.

Blockscout analytics show 29 and chains, evolving to 32, each adding specialized utility. Base’s $320.6K daily revenue exemplifies monetization at scale. Optimism ecosystem chains now drive over 10% of all Ethereum activity, per Superchain Sunday Week 41 reports. As Unichain and Celo launched, GDP hit $396.5 million in H1 alone.

The data paints a clear picture: OP Stack rollups growth is accelerating. With Ethereum at $2,742.03, secured value’s $21.7 billion translates to robust fundamentals amid volatility.

Optimism (OP) Price Prediction 2026-2031

Projections based on Superchain’s $21.7B TVS across 32 OP Stack rollups and 58.5% Ethereum L2 transaction share as of 2025

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2026 | $4.20 | $7.80 | $14.50 |

| 2027 | $5.80 | $11.20 | $21.00 |

| 2028 | $7.50 | $15.50 | $28.50 |

| 2029 | $10.00 | $21.00 | $38.00 |

| 2030 | $13.50 | $28.50 | $50.00 |

| 2031 | $17.00 | $37.00 | $65.00 |

Price Prediction Summary

Optimism (OP) is expected to experience strong growth through 2031, driven by Superchain dominance. Average prices could rise from $7.80 in 2026 to $37.00 by 2031 (375% total growth), with bullish maxima reflecting peak adoption and bearish minima accounting for market cycles.

Key Factors Affecting Optimism Price

- Superchain TVL expansion beyond $21.7B and sustained 50%+ L2 tx share

- Adoption by majors like Coinbase (Base), Sony (Soneium), and Uniswap

- Ethereum scalability synergies and OP Stack improvements

- Market cycles with bull runs in 2025-2026 and 2029-2030

- Regulatory clarity for L2s and potential ETH ETF inflows

- Competition from Arbitrum, zkSync, and Polygon, plus macroeconomic factors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Key Drivers Behind 2025 Momentum

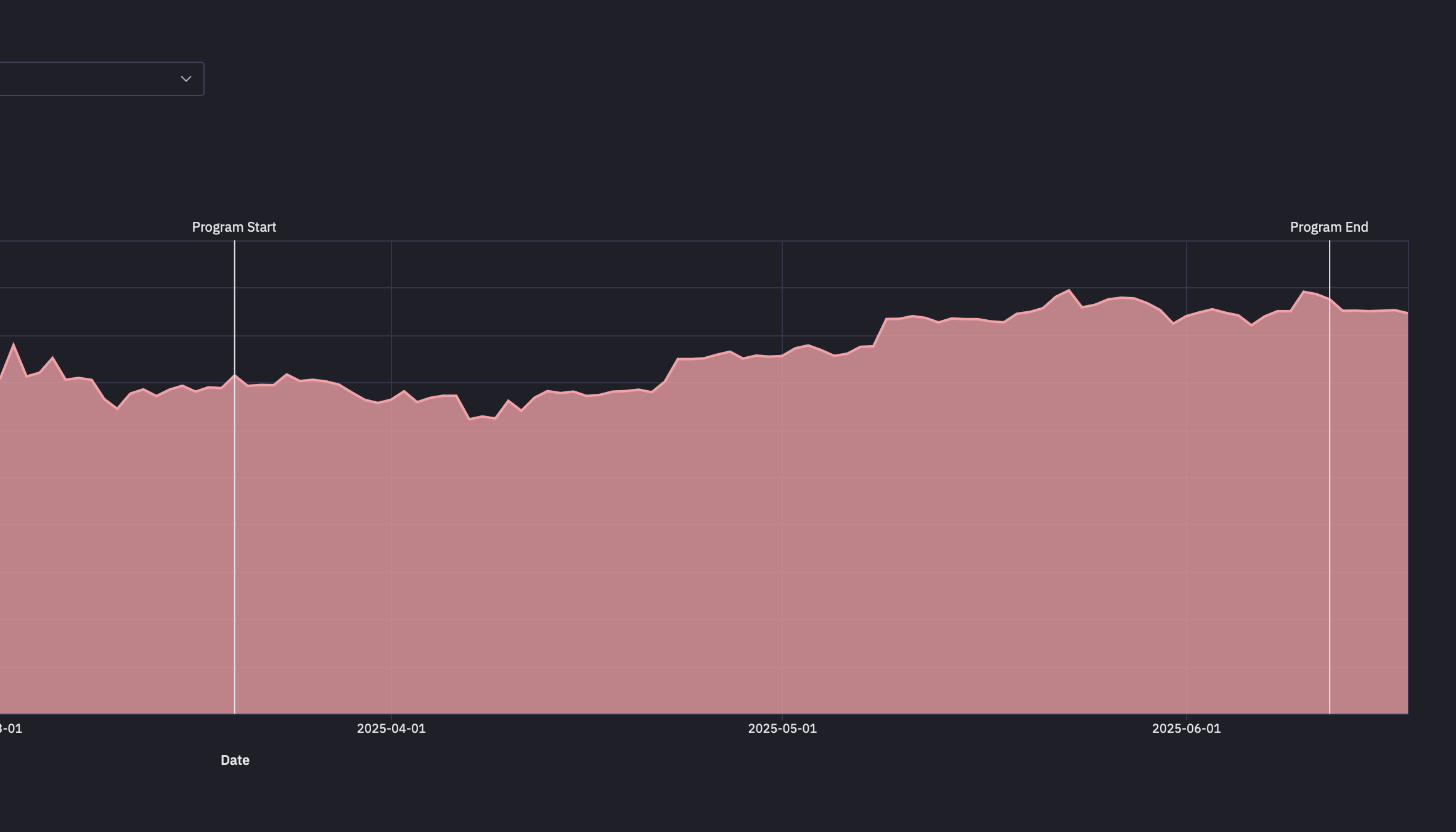

Major launches fueled this: Soneium’s 2.1 million users signal Web2-to-Web3 bridges, while Unichain expands DeFi frontiers. Messari’s State of the Superchain H1 2025 notes 34 chains generating economic output that rivals L1s. Superchain stats 2025 from Superchain Eco’s index, last updated November 17, track daily L2 transactions meticulously.

Enterprise strategy shines through. Coinbase and Kraken leverage OP Stack for user onboarding at scale. For deeper insights, explore how the Superchain powers 58.5% of Ethereum L2 transactions. This ecosystem isn’t fragmented; it’s cohesively scaling Ethereum, one rollup at a time.

Optimism ecosystem chains like these aren’t isolated silos; their interoperability via shared bridges and sequencing creates network effects that amplify TVL and throughput. Superchain Eco’s index, tracking 32 chains as of late 2025, shows daily L2 transactions consistently above 20 million, with revenue streams bolstering Optimism’s treasury.

Top 5 Superchain Rollups by Secured Value

| Rank | Rollup | Secured Value | Daily Active Users 👥 | Daily Revenue 💰 |

|---|---|---|---|---|

| 1 | Base | $14.9B | 11.0M | $320.6K |

| 2 | Soneium | $4.6B | 2.1M | $99K |

| 3 | OP Mainnet | $1.8B | 1.2M | $39K |

| 4 | Ink | $1B (est.) | 0.8M | 22K |

| 5 | Unichain | $0.5B (est.) | 1.5M | $48K |

Key 2025 OP Stack Milestones

-

Base dominance: 11M users lead adoption across Superchain

-

Soneium Web3 entry: Attracts 2.1M users via Sony’s OP Stack rollout

-

Unichain & Celo launches boost H1 GDP to $396.5M across 34 chains

-

>58.5% share of all Ethereum L2 transactions powered by Superchain

-

$21.7B TVS secured across 32 OP Stack rollups, 39.8% of L2 total

Revenue Engine: $42M and from 15,800 ETH

Superchain stats 2025 underscore a profitable model. Chains have remitted 15,800 ETH in fees, equating to over $42 million at Ethereum’s current $2,742.03 price. Base alone generates $320.6K daily, per Optimism dashboards, funding further development. This revenue share mechanism incentivizes chain operators while centralizing security upgrades. Messari reports H1 GDP at $396.5 million, projecting full-year figures north of $800 million if trends hold, even with ETH’s 9.65% 24-hour dip.

Superchain TVL metrics reveal diversification beyond Base. While it commands over 60% of the $21.7 billion TVS, emerging players like Ink and Soneium add specialized verticals: gaming for Ink, entertainment for Soneium. Blockscout data confirms 32 active chains, up from 29 earlier, each validating blocks with Ethereum’s proof system for sub-second finality.

Interoperability Edge: Beyond Isolated Rollups

Ethereum L2 transactions Superchain dominance stems from native cross-chain messaging. Superchain Sunday Week 41 noted over 50% L2 activity, now solidified at 58.5%. This cohesion enables atomic swaps and shared liquidity pools, reducing fragmentation plaguing other stacks. For instance, Uniswap’s integration across chains boosts DeFi efficiency, with total DeFi TVL echoing earlier $6.9 billion baselines but scaled to match $21.7 billion TVS.

Enterprise adoption cements this lead. Sony’s Soneium bridges traditional media, Kraken eyes institutional ramps, and World explores AI-blockchain fusion. Optimism’s OP Stack positions as the enterprise default, as detailed in enterprise strategy analyses. Developers benefit from battle-tested modules: fault proofs live on OP Mainnet, ERC-7683 for cross-chain orders rolling out.

“The Superchain now spans 34 OP Chains, driving more than 50% of all L2 activity. ” – Superchain Eco, Week 41 2025

Risks persist: sequencer centralization draws scrutiny, though diversification mitigates. With 39.8% of Ethereum L2 TVS secured, the Superchain’s flywheel spins faster. At $2,742.03 ETH, this $21.7 billion isn’t speculative froth; it’s productive capital yielding returns. Investors eye OP token upside from revenue accrual, developers flock to the stack’s modularity. As 2025 closes, the multi-rollup vision materializes, redefining Ethereum’s throughput ceiling one chain at a time.