In late 2025, the Ethereum ecosystem is witnessing a paradigm shift: rollup interoperability is no longer just a theoretical ideal but an urgent engineering priority. The proliferation of OP Stack and ZK Stack rollups has fractured liquidity and siloed user experiences, prompting leading projects to focus less on raw transaction throughput and more on atomic composability between rollups. The catalyst? Shared sequencing networks, which are rapidly becoming the backbone of the Superchain vision.

Why Traditional Rollup Architecture Falls Short

Historically, each Layer 2 (L2) rollup operated with its own sequencer, responsible for ordering transactions before posting them to Ethereum mainnet. While this approach enabled independent scaling and experimentation, it introduced two critical pain points:

- Liquidity Fragmentation: Assets and liquidity pools became trapped within isolated rollups, complicating cross-chain DeFi strategies and limiting capital efficiency.

- Poor Cross-Rollup UX: Users faced cumbersome bridging processes and inconsistent settlement times when interacting across chains.

The result was a multi-rollup landscape rich in innovation but lacking the seamless interoperability that web3 promised. As DeFi protocols and dApps increasingly demand atomic operations spanning multiple L2s, the need for a unified coordination layer has become clear.

The Mechanics of Shared Sequencing

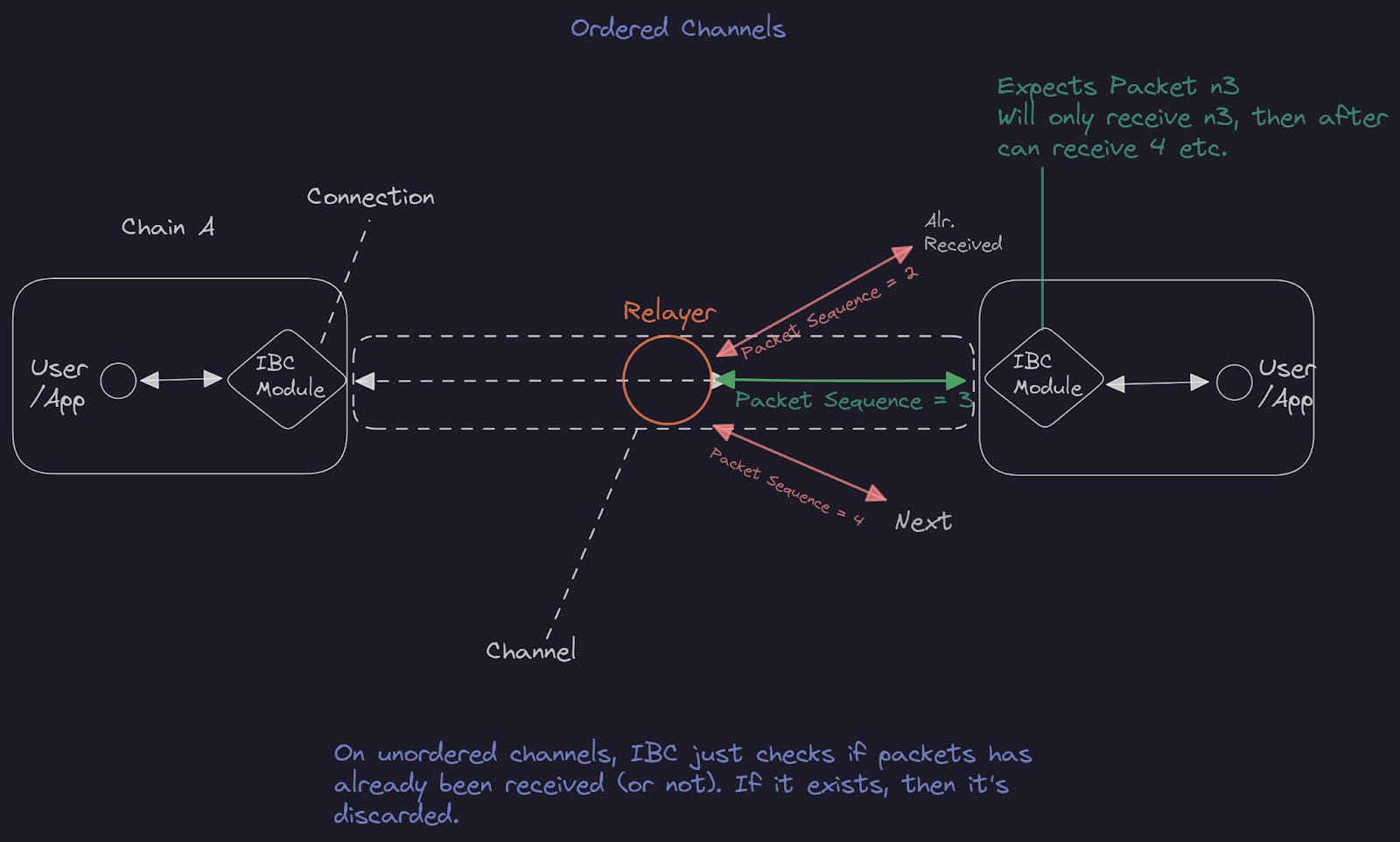

Shared sequencing introduces a common set of sequencers that coordinate transaction ordering across multiple rollups simultaneously. Instead of each chain racing to sequence its own transactions in isolation, shared sequencers aggregate transactions from all participating L2s and produce a single, globally ordered block. This enables:

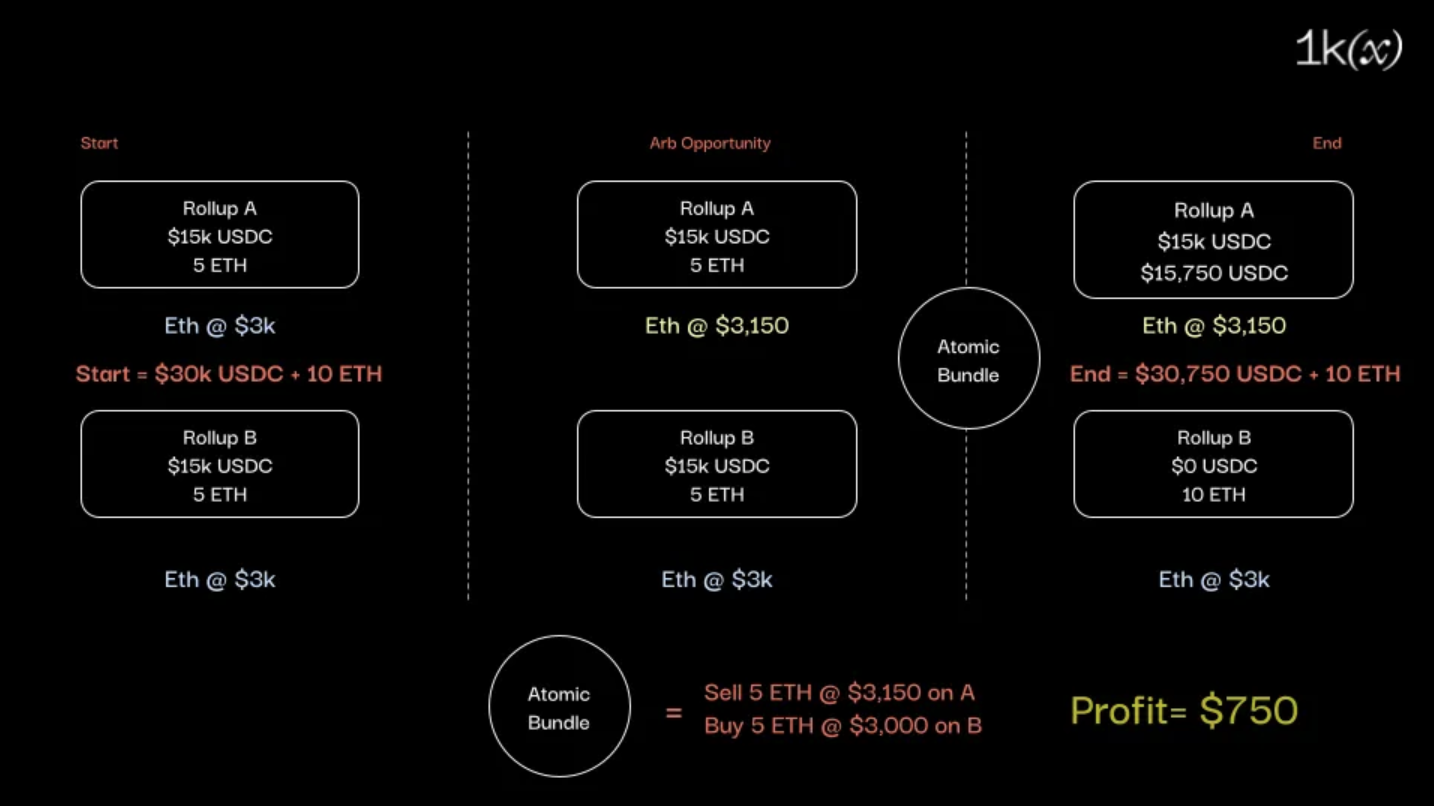

- Atomic Cross-Rollup Transactions: Complex operations (e. g. , multi-chain swaps or arbitrages) can now settle atomically without asset transfers or trust in external bridges.

- Synchronized State Reads: Rollups can reference each other’s latest state securely within the same block window.

This architecture not only eliminates much of the friction associated with fragmented liquidity but also opens up new design space for DeFi protocols that require instant composability across chains. For a deep dive into how this works at the protocol level, see How Shared Sequencers Enable Atomic Cross-Rollup Trades in the OP Stack.

The Benefits: Composability, Decentralization, and Fair MEV Allocation

The market has responded decisively to these innovations. According to recent reports from CryptoEQ and t3rn, shared sequencing networks like Espresso are empowering rollups to focus on execution while outsourcing interoperability concerns to neutral infrastructure. Three benefits stand out:

- Atomic Composability: Developers can build applications where actions on one rollup trigger outcomes on another, without slow bridges or duplicated liquidity pools.

- Censorship Resistance and Decentralization: By decentralizing the sequencing layer itself (rather than relying on single operators), shared sequencing reduces risks of downtime or censorship attacks, a major concern with legacy architectures.

- Fair MEV Distribution: Coordinated ordering across chains enables more equitable distribution of Maximal Extractable Value (MEV), aligning incentives between users, validators, and protocol teams. For more technical analysis on MEV dynamics in this context, see our coverage at How Shared Sequencers Are Changing The Superchain’s Rollup Interoperability.

This is not just theoretical: live deployments such as Espresso Sequencer are already supporting both OP Stack-based chains (like those in Optimism’s Superchain) and ZK Stack variants, demonstrating that stack-agnostic interoperability is achievable in production environments.

However, as with any major protocol upgrade, shared sequencing introduces new complexities. The most pressing challenge is cross-rollup MEV exploitation. By providing a unified ordering layer, shared sequencers inadvertently create new surfaces for sophisticated MEV strategies that span multiple rollups. This has prompted both academic and industry researchers to propose solutions such as cryptographic commit-reveal schemes and randomized leader selection to limit sequencer collusion and front-running opportunities.

Another challenge is standardization. With each rollup ecosystem pursuing unique architectures, ranging from OP Stack’s modular approach to custom ZK rollups, achieving consensus on sequencing protocols and governance models remains a work in progress. Yet the incentives are strong: protocols that successfully integrate with shared sequencing gain access to deeper liquidity, improved user experience, and competitive advantages in DeFi composability.

Live Deployments and What’s Next

The deployment of Espresso Sequencer has set a precedent for neutral, decentralized infrastructure underpinning the Superchain. By supporting both optimistic and zero-knowledge rollups, Espresso demonstrates that interoperability does not require sacrificing performance or security. Meanwhile, Optimism’s Superchain initiative is rolling out its own universal interoperability layer, aiming to unify OP Stack chains under a common coordination protocol.

For developers and protocol architects, this means it’s now possible to design applications that leverage atomic actions across multiple L2s, without relying on brittle bridges or duplicative liquidity pools. The result is a richer design space for cross-chain DeFi protocols, NFT ecosystems, and even gaming platforms where state needs to flow seamlessly between chains.

Key Innovations from Shared Sequencing in 2025

-

Atomic Composability Across Rollups: Shared sequencing enables atomic transactions spanning multiple Layer 2 rollups, allowing complex DeFi operations and smart contract interactions to settle simultaneously across chains without manual bridging.

-

Unified Liquidity Pools: By synchronizing transaction ordering, shared sequencers reduce liquidity fragmentation, making it possible for decentralized exchanges and lending protocols to pool liquidity across multiple rollups within the Superchain.

-

Enhanced Decentralization and Censorship Resistance: Decentralized shared sequencing layers, such as Espresso Sequencer, mitigate centralization risks and increase censorship resistance by distributing sequencing power among multiple independent operators.

-

Fair MEV Distribution: Shared sequencers can implement fair Maximal Extractable Value (MEV) distribution mechanisms, aligning incentives for validators and reducing the likelihood of exploitative MEV practices across rollups.

-

Standardized Interoperability Protocols: Projects like Optimism’s Superchain are driving the adoption of universal interoperability layers, establishing common standards for cross-rollup communication and transaction ordering.

-

Stack-Agnostic Sequencing Solutions: Platforms such as Espresso offer sequencing services compatible with both OP Stack and ZK Stack rollups, promoting broader ecosystem integration and flexibility.

What to Watch in 2026

The next twelve months will be pivotal as the race intensifies between competing shared sequencing networks. Key metrics to watch include:

- Liveness Guarantees: How do different sequencer sets handle downtime or malicious actors?

- MEV Mitigation: Are new auction formats or cryptographic techniques effectively curbing cross-rollup MEV?

- User Experience Metrics: Will users finally enjoy seamless asset movement and dApp composability across all major rollups?

The answers will determine which shared sequencing networks emerge as foundational infrastructure for the next generation of web3 applications.

If you’re building on OP Stack or exploring multi-rollup coordination strategies, now is the time to evaluate how shared sequencing can unlock new product capabilities while minimizing operational complexity. For further reading on how these mechanisms are transforming cross-rollup trades and liquidity provision, see our deep dive at How Shared Sequencers Enable Atomic Cross-Rollup Trades in the OP Stack.