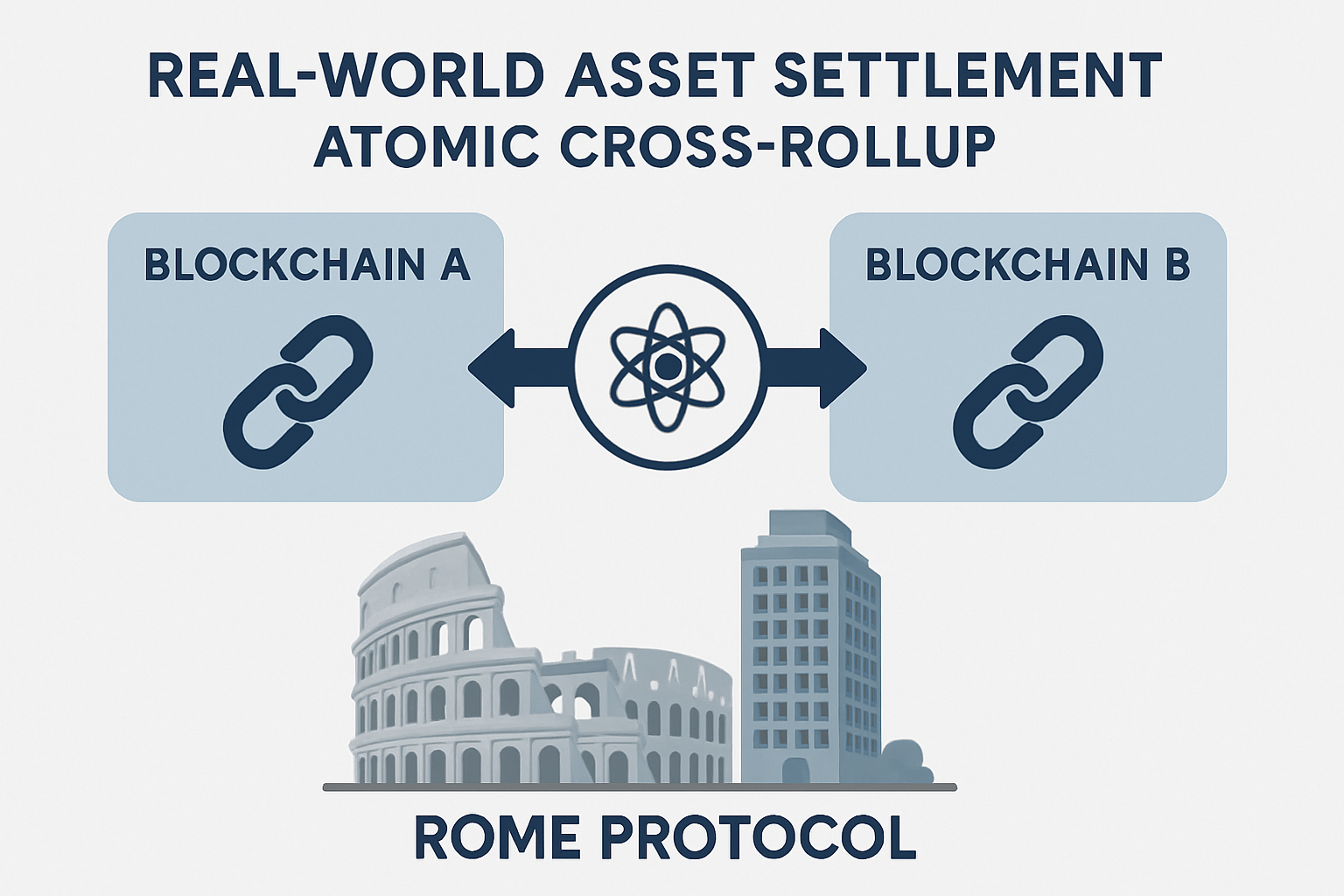

The rapid expansion of Ethereum rollups has brought tremendous scalability but also new challenges: liquidity fragmentation, cross-rollup inefficiencies, and the complexity of interoperability. As developers race to deploy new rollups and appchains, the need for a robust shared infrastructure becomes critical. Rome Protocol has emerged as a pivotal solution in this landscape, leveraging Solana’s high-throughput blockchain to act as a shared sequencer for Ethereum rollups. This article provides an analytical overview of how Rome Protocol addresses atomic liquidity and composability, and why it is gaining traction among both builders and investors.

Why Shared Sequencers Matter in the Rollup Ecosystem

The current rollup-centric model on Ethereum is powerful but fragmented. Each rollup typically maintains its own sequencer, responsible for ordering transactions and producing blocks. While this preserves autonomy, it creates silos where liquidity is locked within each individual rollup. The result is a fractured user experience and costly cross-rollup operations.

Shared sequencers offer a paradigm shift. By centralizing transaction ordering across multiple rollups on a high-performance chain like Solana, Rome Protocol enables:

- Rapid deployment of new rollups without bespoke sequencing infrastructure

- Atomic composability, allowing complex transactions to span multiple chains safely

- Decentralization at scale, leveraging Solana’s validator set rather than relying on centralized operators

This approach not only improves the developer experience but also directly addresses the “liquidity tax” that plagues users moving assets between isolated L2s.

Rome Protocol Architecture: Rhea and Remus in Action

The core innovation behind Rome lies in its architecture:

- Rhea (the shared sequencer): Built atop Solana’s existing validator network, Rhea aggregates transaction flow from multiple independent rollups, each deployed as an instance of Neon EVM, to create a single, fair ordering layer. This ensures low-latency block production while preserving neutrality among participants.

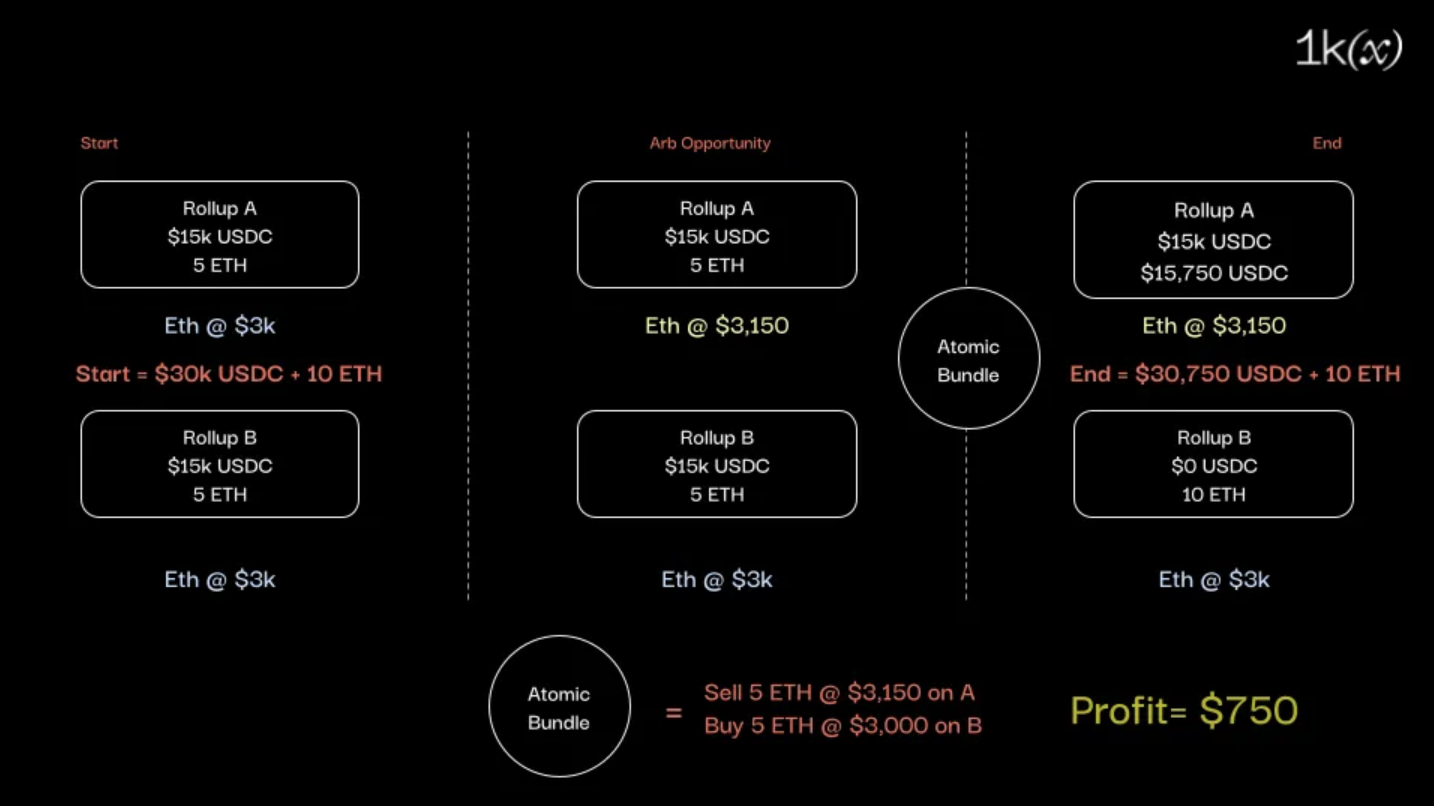

- Remus (atomic execution engine): Remus bundles cross-rollup transactions into atomic batches that are executed in an all-or-nothing fashion on Solana. This guarantees that arbitrage trades, bridges, or multi-chain swaps either fully complete or revert entirely, critical for both DeFi protocols and real-world asset applications.

This dual-component design positions Rome as more than just middleware; it becomes an essential coordination layer for next-generation multi-rollup dApps.

Key Benefits of Rome Protocol for Developers and Liquidity Providers

-

Atomic Cross-Rollup Transactions: Rome Protocol enables atomic execution of transactions across multiple rollups, ensuring that complex operations like arbitrage, bridging, and swaps are processed in an all-or-nothing manner. This eliminates the risk of partial execution and enhances reliability for DeFi applications.

-

Shared Sequencer Powered by Solana: By leveraging Solana’s high-throughput validator network as a shared sequencer, Rome Protocol allows rollups to benefit from fast transaction processing and reduced latency without building their own sequencer infrastructure.

-

Enhanced Liquidity Aggregation: The protocol breaks down liquidity silos between rollups, enabling native cross-rollup liquidity aggregation. This provides liquidity providers with greater capital efficiency and access to a wider pool of assets.

-

Improved Interoperability for Developers: Developers can build applications that seamlessly interact with multiple rollups using familiar Ethereum tooling, thanks to the Neon EVM compatibility layer on Solana. This simplifies cross-chain development and expands composability.

-

Cost and Infrastructure Efficiency: By utilizing Solana’s existing validator infrastructure, Rome Protocol reduces operational costs for both rollup teams and liquidity providers, removing the need for each rollup to maintain its own sequencer network.

-

Fair and Decentralized Transaction Ordering: The Rhea component ensures first-come, first-served transaction ordering across rollups, promoting fairness, minimizing MEV risks, and supporting a decentralized ecosystem.

The Role of Atomic Liquidity in Rollup Interoperability

A standout feature of Rome Protocol is its support for atomic liquidity across chains, a capability that unlocks powerful new use cases:

- Seamless arbitrage: Traders can execute cross-rollup arbitrage strategies in one atomic transaction, minimizing risk from partial fills or failed legs.

- Natively-bridged assets: Assets can move between Ethereum L2s with near-instant finality, thanks to Solana’s throughput and fast confirmation times (source).

- Diversified DeFi activity: Composability enables dApps to aggregate liquidity from multiple sources without exposing users to fragmented pools or slippage penalties (source).

This atomicity is especially relevant for protocols seeking to bridge the gap between Ethereum and Solana ecosystems, a vision directly supported by Rome’s infrastructure (source). It also lays the groundwork for permissionless innovation across Layer 2s by removing technical barriers to interoperability.

Rome Protocol’s shared sequencer model does more than just streamline cross-rollup activity, it fundamentally changes the economics and security assumptions of Ethereum scaling. By leveraging Solana’s validator set, Rome avoids the weakest-link problem common to bespoke sequencers, where the security of a rollup is only as strong as its most vulnerable component. Instead, Rome inherits Solana’s robust consensus guarantees, offering a markedly higher baseline for both liveness and censorship resistance.

For liquidity providers and protocol architects, this means capital can flow freely between rollups without being trapped in isolated silos. The resulting composability unlocks a new wave of DeFi primitives: from cross-chain lending markets to real-time arbitrage bots operating across fragmented liquidity pools. Builders can now design dApps that treat multiple rollups as a single unified liquidity layer, abstracting away the complexity that has historically stifled user experience and growth.

Practical Implications for the OP Stack and Superchain Ecosystem

Rome Protocol is particularly relevant for projects building on the OP Stack or exploring multi-rollup deployments. As more Layer 2s adopt modular architectures, the need for efficient sequencing and atomic execution becomes critical. Rome’s integration with Neon EVM means teams don’t have to choose between EVM compatibility and high-throughput execution, they get both.

This opens up several strategic advantages:

Practical Use Cases Enabled by Rome Protocol’s Atomic Liquidity Layer

-

Cross-Rollup Atomic Arbitrage: Traders can execute arbitrage strategies across multiple Ethereum rollups and Solana simultaneously, ensuring all legs of a trade settle together. This eliminates the risk of partial execution and unlocks new DeFi opportunities.

-

Seamless Cross-Rollup Bridging: Users can move assets between Ethereum rollups and Solana in a single, atomic transaction, reducing friction and risk compared to traditional multi-step bridging solutions.

-

Unified Decentralized Exchange (DEX) Liquidity: DEXs can aggregate liquidity from multiple rollups and Solana, enabling users to access deeper markets and better pricing through atomic swaps that span several chains.

-

Composable DeFi Applications: Developers can build DeFi protocols that interact with smart contracts on different rollups and Solana in a single transaction, enabling complex strategies like lending, borrowing, and yield optimization across ecosystems.

-

Efficient Real-World Asset (RWA) Settlement: Institutions can atomically settle tokenized real-world assets across compliant rollups and Solana, ensuring regulatory and operational consistency for multi-chain asset transfers.

Additionally, by serving as neutral infrastructure, Rome reduces the overhead for new rollups to join the ecosystem. RaaS (Rollup-as-a-Service) providers can offer out-of-the-box composability and deep liquidity access, features that are rapidly becoming table stakes in an increasingly competitive L2 landscape.

Risks and Open Questions

No system is without tradeoffs. While leveraging Solana’s performance brings clear efficiency gains, it also introduces dependencies on Solana’s liveness and network health. For mission-critical DeFi or RWA applications, careful risk modeling remains essential. Furthermore, while shared sequencing solves many issues around fragmentation, it also creates new coordination challenges, particularly around MEV extraction and fair ordering policies among competing rollups.

The success of Rome Protocol will depend on its ability to maintain neutrality while scaling horizontally to support dozens (or hundreds) of rollups without bottlenecks or governance capture. Ongoing research into distributed sequencing models and cryptographic fairness proofs will be crucial as adoption grows.

The Road Ahead: Supercharging Rollup Interoperability

The introduction of shared sequencers like Rome marks a turning point for Ethereum scaling. By abstracting away infrastructure complexity and enabling true atomic liquidity across chains, Rome empowers developers to build applications with unprecedented reach, spanning multiple L2s and even bridging assets natively between Ethereum and Solana ecosystems.

The next phase will see increased experimentation with cross-rollup dApps, permissionless bridges, and novel financial products leveraging these new primitives. As composability becomes less about technical workarounds and more about native protocol features, user experience across Web3 will dramatically improve, lower fees, faster settlement times, deeper markets, all underpinned by robust decentralization guarantees.

For investors tracking the evolution of superchain infrastructure or builders seeking an edge in DeFi innovation, understanding protocols like Rome is no longer optional, it’s essential groundwork for what comes next.