Rollups have long been hailed as the key to Ethereum scalability, but a persistent bottleneck has limited their full potential: cross-rollup finality. Today, most rollups must wait 12 to 15 minutes for Ethereum to finalize transactions. This lag not only slows down user experience but also fragments liquidity and hinders seamless interoperability across the OP Superchain. Espresso Systems is directly addressing these pain points with a new approach that could redefine cross-chain composability for the entire OP Stack ecosystem.

Why Cross-Rollup Finality Matters for the OP Superchain

The OP Superchain vision aims to unite multiple rollups into a single, interoperable network where assets and information can flow freely. However, without rapid and reliable finality guarantees, developers are forced to rely on slow, trust-heavy cross-chain bridges or limit interactions between applications on different rollups. This undermines the very premise of a unified superchain and keeps user experiences siloed.

Espresso Systems introduces a decentralized confirmation layer that offers near-instant finality, confirming transactions in roughly six seconds using its HotShot BFT consensus protocol. By providing this shared source of truth for transaction ordering and content, Espresso enables rollups within the OP Superchain to coordinate securely and efficiently without waiting for Ethereum’s base layer.

The HotShot BFT Protocol: Fast Finality Without Sacrificing Security

At the heart of Espresso’s solution is HotShot, a Byzantine Fault Tolerant (BFT) consensus engine designed for speed and resilience. Unlike traditional methods that require waiting for Ethereum block confirmations, HotShot allows participating rollups to reach consensus on transaction batches in about six seconds. This means cross-rollup messages, such as asset transfers or contract calls, can be trusted by other chains almost immediately.

This drastic reduction in latency not only improves user experience but also unlocks new design space for decentralized applications (dApps) that depend on real-time cross-chain composability. For example, DeFi protocols can now create atomic swaps or lending markets spanning multiple rollups without introducing unacceptable settlement risk or long delays.

Trusted Execution Environments: Preventing Sequencer Equivocation

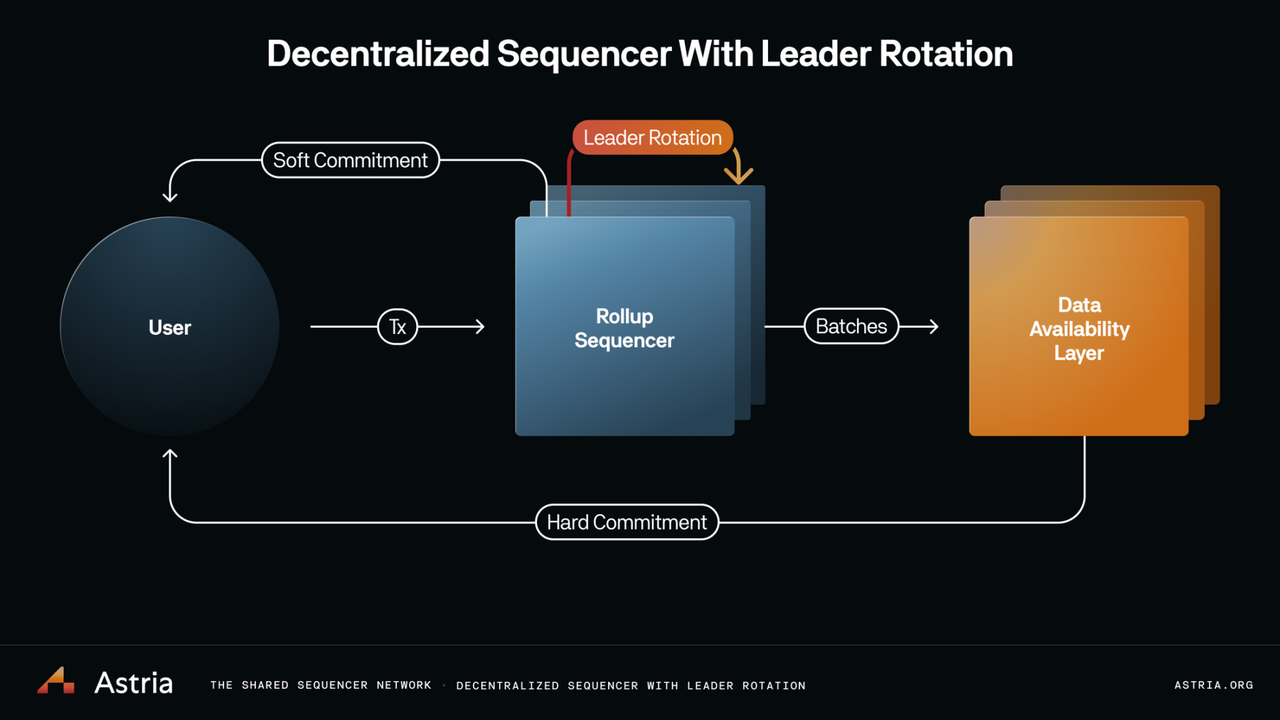

A major concern with shared sequencers is equivocation, the risk that a sequencer might submit conflicting blocks to different chains before final settlement on Ethereum. Espresso addresses this by leveraging Trusted Execution Environments (TEEs). TEEs ensure that once a block is confirmed by HotShot consensus, it cannot be altered or double-submitted before being posted to the parent chain.

This cryptographic guarantee adds an extra layer of security to cross-rollup interactions within the OP Superchain, reducing trust assumptions and making it safer for users and protocols alike to operate across multiple chains.

The Data Layer: Beyond Sequencing With EspressoDA

While HotShot handles fast confirmation of transaction ordering, data availability remains crucial for trust-minimized interoperability. Espresso’s roadmap includes EspressoDA, a modular data availability solution designed to work seamlessly with its sequencing layer. By ensuring all relevant data is reliably available when needed, EspressoDA further strengthens the security model underpinning cross-rollup communication.

This holistic approach, combining rapid BFT finality with robust data availability, positions Espresso as an essential infrastructure provider in pursuit of unified liquidity and developer experience across all OP Stack-based rollups.

Looking at the broader ecosystem, Espresso’s architecture is intentionally stack-agnostic. This means any rollup, regardless of its specific technology or implementation, can plug into Espresso’s shared sequencer and data availability layers. As more OP Stack rollups and even non-OP chains integrate, the network effect compounds: cross-rollup composability becomes not just possible but practical, with finality and security guarantees that rival those of the base layer.

From a data-driven perspective, the impact is measurable. Latency for cross-rollup asset transfers drops from 12-15 minutes to under 10 seconds. Liquidity fragmentation, a key challenge for multi-rollup DeFi, diminishes as protocols gain confidence in near-instant settlement across chains. The result: a more unified market structure, where users can move assets and interact with dApps across the OP Superchain as seamlessly as if it were a single chain.

Espresso’s Key Benefits for OP Stack Builders

-

Lightning-Fast Finality: Espresso’s HotShot consensus delivers transaction confirmations in ~6 seconds, a dramatic improvement over the typical 12–15 minute wait for Ethereum finality. This enables OP Stack rollups to offer near-instant settlement and improved user experience.

-

Reduced Bridge Risk: By providing a decentralized, shared confirmation layer, Espresso minimizes the window for bridge attacks and double-spend attempts. Once a block is confirmed by Espresso, its ordering and content are cryptographically locked in, enhancing cross-rollup security.

-

Shared Liquidity Across Rollups: Espresso’s coordination layer acts as a single source of truth for transaction ordering, enabling seamless asset movement and unified liquidity pools between OP Stack rollups. This fosters deeper liquidity and more efficient DeFi protocols.

-

Modular Interoperability: Espresso’s architecture is stack-agnostic and leverages Trusted Execution Environments (TEEs) to prevent sequencer equivocation. This allows diverse rollups to interoperate securely and atomically, supporting complex cross-chain applications and composability.

It’s important to note that Espresso does not force rollups to surrender their sovereignty. Each rollup maintains its own sequencer logic and upgrade path. Espresso simply provides a cryptographically secure coordination layer that all participants can trust. This shared infrastructure unlocks new business models for dApps, think cross-chain lending protocols or NFT marketplaces spanning multiple rollups, without introducing centralized points of failure.

The modularity also extends to governance. Since HotShot consensus is decentralized and TEEs minimize trust requirements on any single operator, Espresso avoids many pitfalls of traditional shared sequencing models. Instead of a single entity controlling transaction ordering or message passing, consensus emerges from a diverse validator set distributed across the network.

Real-World Adoption: Early Integrations and Ecosystem Growth

Several major projects within the OP Superchain have already begun experimenting with Espresso’s stack. For instance, Arbitrum chains are exploring how HotShot-powered confirmation can reduce bridging latency and enable new forms of atomic composability between L2s. Meanwhile, emerging DeFi protocols are piloting use cases like instant cross-chain swaps and unified liquidity pools that would be impossible without rapid finality guarantees.

This momentum is likely to accelerate as more developers see the tangible benefits in user experience and protocol design space. The shift from siloed rollups to a truly interoperable superchain will not happen overnight, but Espresso’s approach makes it far less speculative than it was even one year ago.

Risks, Tradeoffs, and What Comes Next

No solution is without tradeoffs. While TEEs provide strong guarantees against equivocation today, they introduce dependencies on hardware security assumptions that must be monitored over time. Similarly, decentralizing HotShot’s validator set at scale will require ongoing attention to incentives and sybil resistance as adoption grows.

Still, compared to legacy bridge-based architectures or slow L1-dependent finality models, Espresso offers an order-of-magnitude improvement in both speed and trust-minimization for cross-rollup activity on the OP Superchain.

If you’re building on OP Stack or tracking superchain developments closely, keep an eye on how quickly new projects adopt shared sequencing and data availability via Espresso, and how these primitives reshape what’s possible for decentralized finance, gaming infrastructure, and beyond.

For further technical deep dives into how shared sequencers enable next-generation composability in the OP ecosystem, see our guide here.