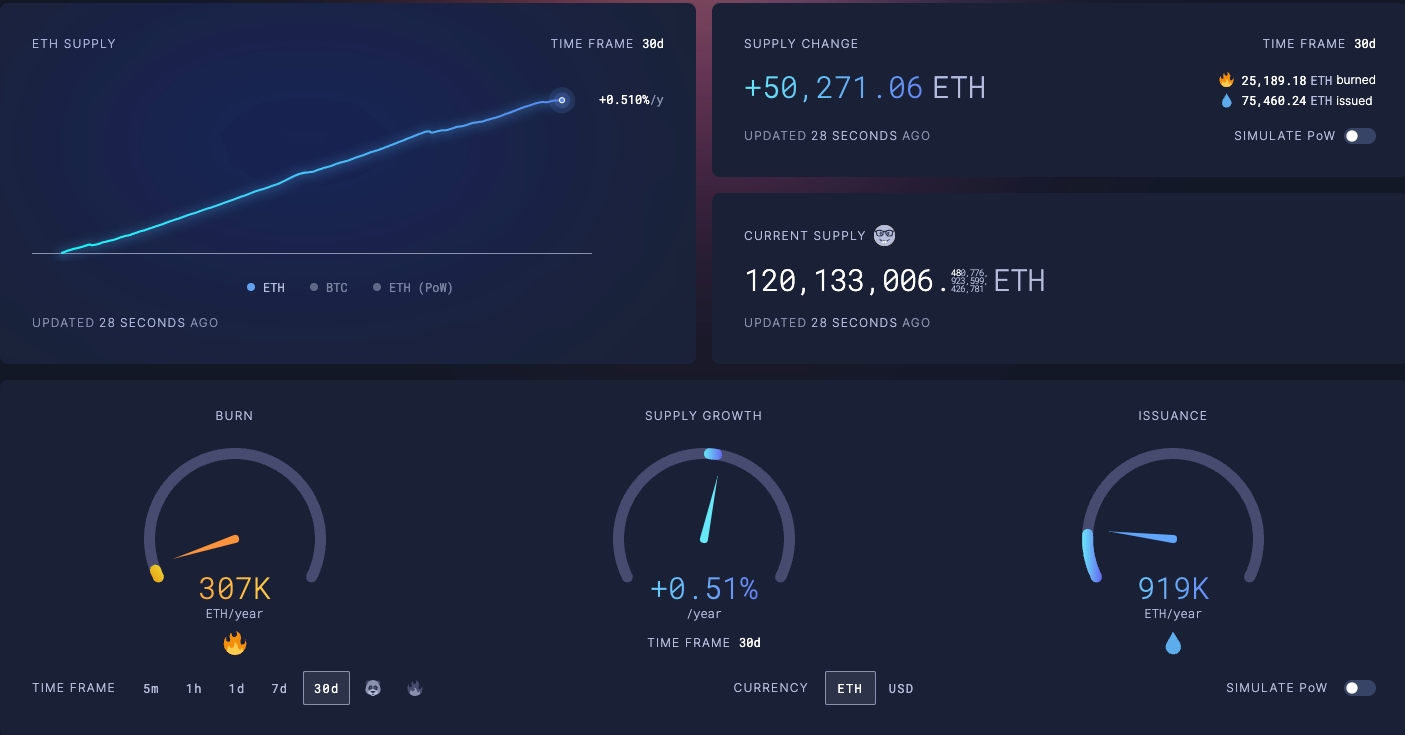

Ethereum’s rollup-centric roadmap has propelled network scalability and throughput to new heights. However, this progress has surfaced a critical challenge: rollup fragmentation. As Layer 2 solutions like Arbitrum and Optimism operate with their own isolated sequencers, the ecosystem faces mounting issues around liquidity silos, fragmented user experience, and diminished composability. The drive to solve these pain points is accelerating the race toward decentralized sequencers: a foundational innovation poised to unify Ethereum’s multi-rollup future.

Why Rollup Fragmentation Matters: The Liquidity Squeeze

Each major Ethereum rollup currently maintains its own transaction ordering system. While this design enables independent scaling, it comes at the cost of liquidity fragmentation. Traders and DeFi protocols must navigate isolated liquidity pools, often leading to higher slippage, inefficient capital allocation, and missed arbitrage opportunities. According to recent research (arxiv.org), these silos complicate cross-rollup lending and trading activities that require minimum liquidity thresholds for efficient markets.

The problem extends beyond just liquidity. Developers building composable DeFi applications face additional hurdles as atomic transactions across rollups are either expensive or outright impossible with current infrastructure. This undermines Ethereum’s vision of a seamless modular ecosystem where protocols can interact without friction.

The Centralized Sequencer Bottleneck

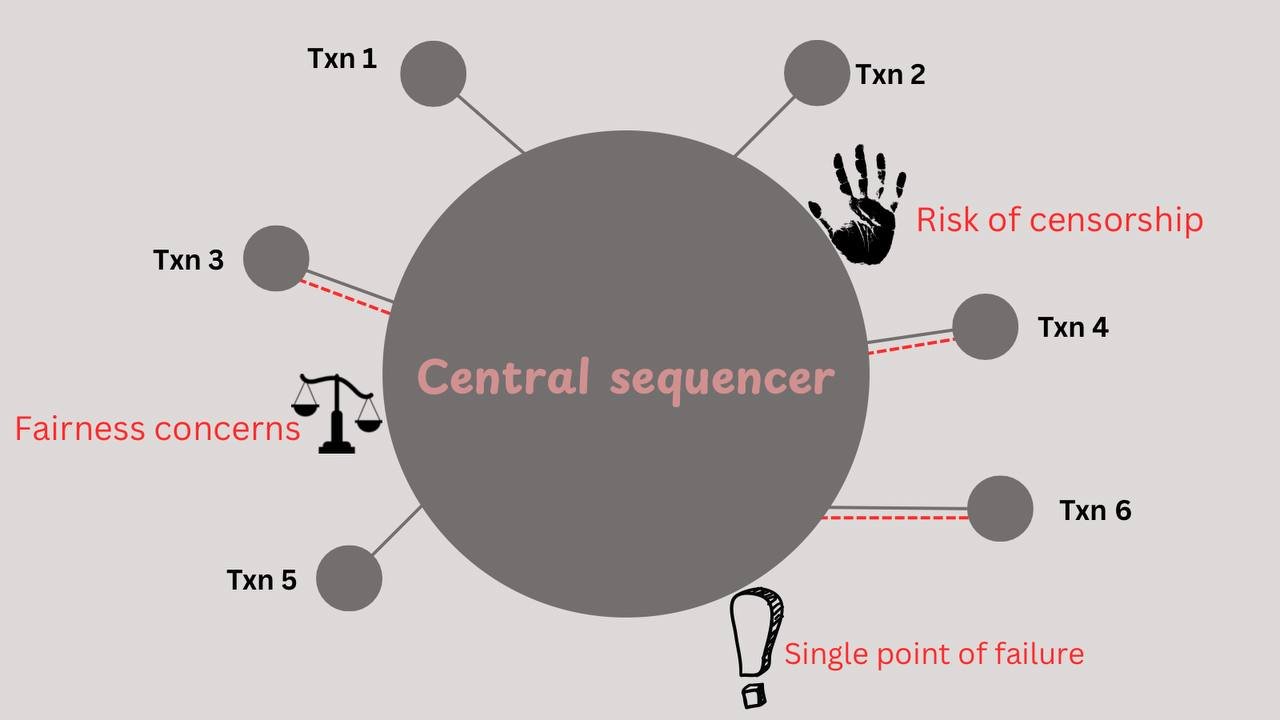

The vast majority of existing Ethereum rollups rely on a single entity, the centralized sequencer: to order transactions before they are posted on-chain. This model introduces two critical risks:

Key Risks of Centralized Sequencers in Ethereum Rollups

-

Single Point of Failure: Centralized sequencers introduce a critical vulnerability—if the sequencer goes offline or is compromised, the entire rollup can halt or become unresponsive, threatening network reliability.

-

Censorship and Transaction Manipulation: With control over transaction ordering, a centralized sequencer can arbitrarily censor, delay, or reorder user transactions, undermining Ethereum’s neutrality and trustlessness.

-

MEV (Maximal Extractable Value) Exploitation: Centralized sequencers can prioritize their own profit by extracting MEV, reordering transactions to benefit themselves at the expense of regular users and fair market operations.

-

Liquidity Fragmentation: Isolated rollups with their own sequencers fragment user liquidity across multiple chains, complicating trading, lending, and cross-rollup asset movement.

-

Reduced Composability: Centralized and siloed sequencers hinder atomic transactions and interoperability between rollups, limiting the ability to build complex DeFi protocols spanning multiple Layer 2s.

First, it creates a single point of failure that threatens liveness and censorship resistance. If the sequencer goes offline or acts maliciously, users may find their transactions delayed or censored entirely (astria.org). Second, centralized sequencers are uniquely positioned to extract Maximal Extractable Value (MEV), reordering or excluding transactions for profit at user expense, a dynamic that erodes trust and fairness in the network.

“There is already a path to solving liquidity fragmentation via shared Sequencers. ”: r/ethereum community member

The Rise of Decentralized Sequencers: Toward Shared Ordering Layers

Decentralized sequencers are emerging as an answer to these challenges by distributing transaction ordering among multiple independent entities. This approach dramatically enhances censorship resistance while reducing MEV extraction imbalances and operational risk.

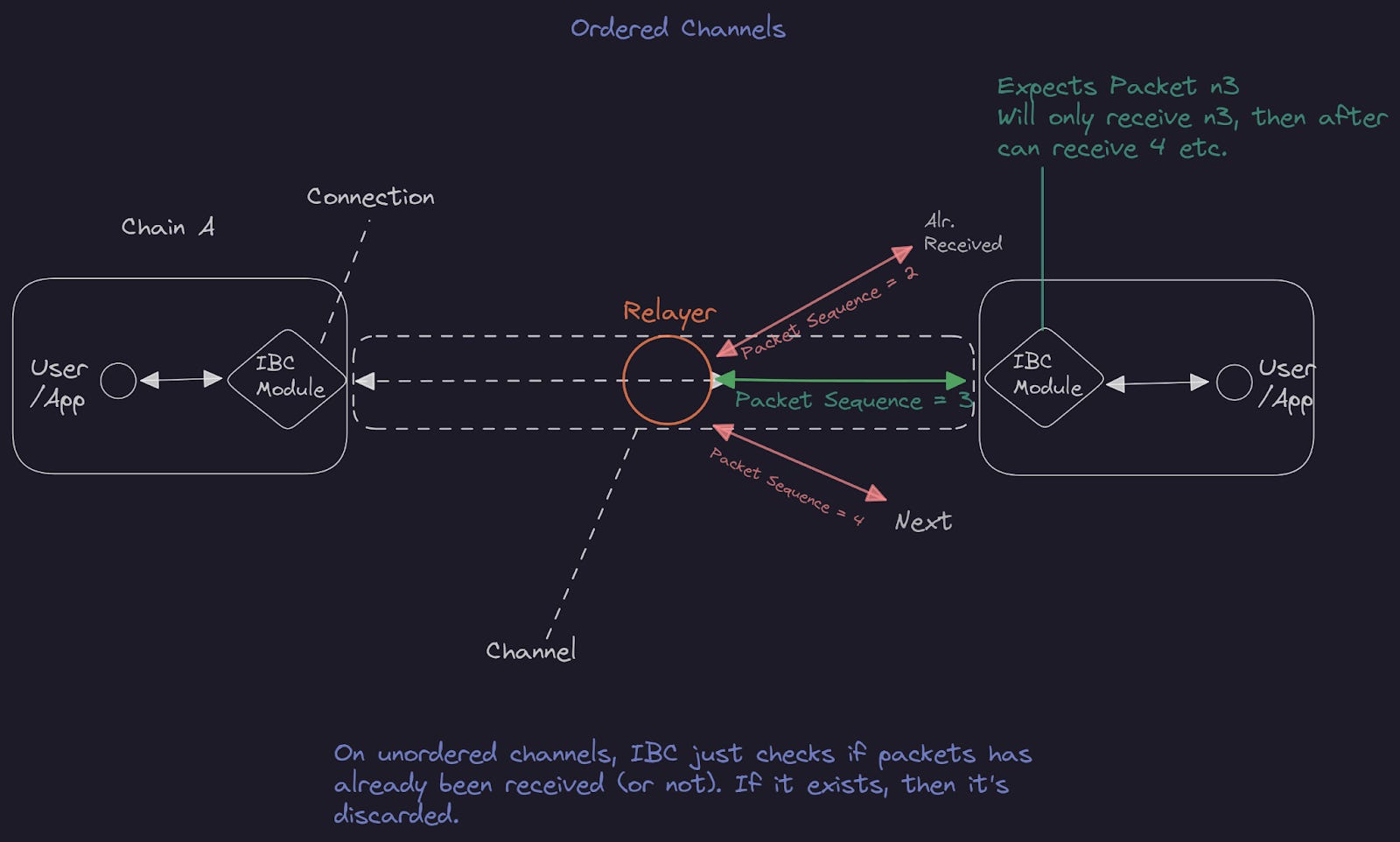

The next evolution provides shared sequencers: takes this a step further by providing unified transaction ordering services across multiple rollups simultaneously. Through shared sequencing layers such as those being explored by Espresso Systems and Rome Protocol, atomic cross-rollup transactions become possible, unlocking true composability and addressing liquidity fragmentation at its core (blockworks.co). Solutions like the UAT20 standard leverage Conflict-free Replicated Data Types (CRDTs) for state consistency across chains, while protocols like CRATE enable secure atomic execution between rollups.

Pioneering Implementations Shaping the Future

The landscape is evolving rapidly as both academic research and industry initiatives converge on practical implementations:

- Espresso Sequencer: Aims to provide decentralized sequencing for multiple L2s with enhanced interoperability (HackMD – Espresso Sequencer)

- CRATE Protocol: Enables all-or-nothing cross-rollup execution for complex DeFi operations using secure atomicity guarantees (arxiv.org – CRATE Protocol)

- TEERollup: Utilizes Trusted Execution Environments (TEEs) for efficient sequencing with low gas costs and fast withdrawals (arxiv.org – TEERollup)

- Mitosis University Research: Explores shared sequencing frameworks to reunite fragmented L2s under cohesive transaction ordering (university.mitosis.org)

These pioneering projects are not merely theoretical. They are actively shaping the next phase of Ethereum rollup architecture, with testnets and pilot integrations already underway. Espresso Systems and Rome Protocol exemplify the drive toward shared sequencing, collaborating with leading L2s to demonstrate real-world atomic swaps and cross-rollup DeFi primitives. The result is a rapidly maturing ecosystem where composability, liquidity, and user experience are no longer at odds with scalability.

The implications for decentralized finance (DeFi) are profound. No longer will users need to bridge assets or manage complex workflows to move capital across isolated rollups. Instead, shared sequencers make it possible for protocols to interact natively, enabling seamless lending, trading, and yield strategies that span the entire Ethereum superchain.

What’s Next? Challenges and Open Questions

Despite this progress, several open questions remain. Chief among them: how will these decentralized sequencing networks balance efficiency with security? As more rollups join shared sequencer sets, the coordination overhead grows. Ensuring fast finality without sacrificing decentralization or introducing new attack vectors is a central research focus (arxiv.org). Incentive alignment is another key issue, sequencers must be rewarded fairly while minimizing opportunities for collusion or MEV extraction that could undermine trust in the system.

Key Challenges for Decentralized & Shared Sequencer Adoption

-

Liquidity Fragmentation Across Rollups: Assets and liquidity are scattered among multiple Layer 2 rollups, complicating trading, lending, and DeFi protocols that require deep, unified liquidity pools. This fragmentation persists even as decentralized sequencers emerge, necessitating robust cross-rollup solutions.

-

Censorship and Centralization Risks: Many rollups still rely on single, centralized sequencers, creating potential single points of failure and enabling censorship or preferential transaction ordering. Decentralized sequencing aims to address these risks, but widespread adoption remains a challenge.

-

MEV (Maximal Extractable Value) Exploitation: Centralized sequencers can extract MEV by reordering or censoring transactions for profit. Decentralized and shared sequencers must implement fair ordering mechanisms to prevent MEV exploitation and ensure user trust.

-

Cross-Rollup Composability Limitations: Isolated transaction ordering impedes atomic interactions between rollups, reducing the efficiency and user experience of cross-chain DeFi and dApps. Shared sequencers and protocols like CRATE are being developed to address this, but technical and adoption hurdles remain.

-

Coordination and Governance Complexity: Decentralized sequencer networks require robust governance models to coordinate participants, resolve disputes, and upgrade protocols. Achieving secure, efficient, and decentralized governance is an ongoing challenge.

-

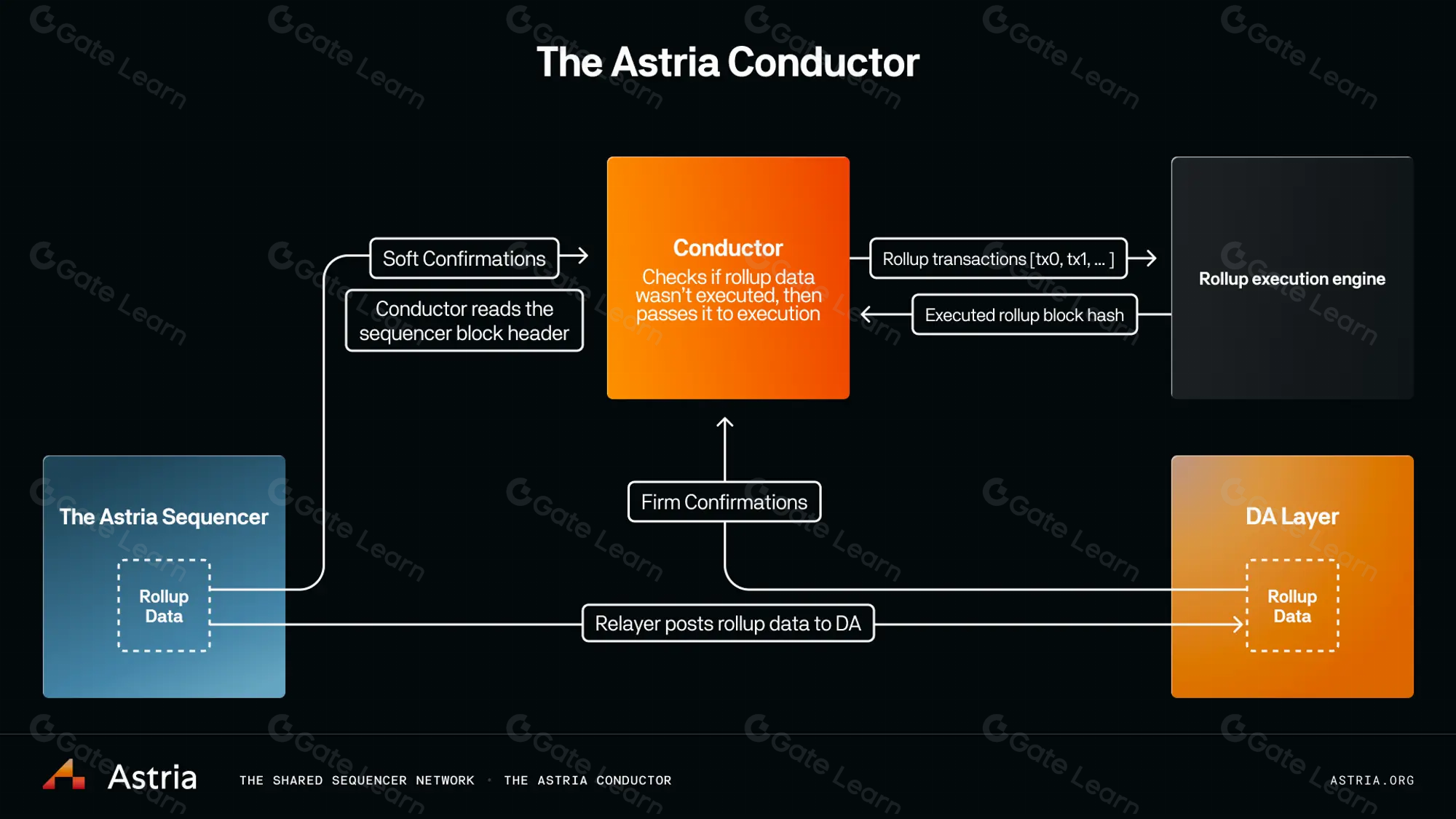

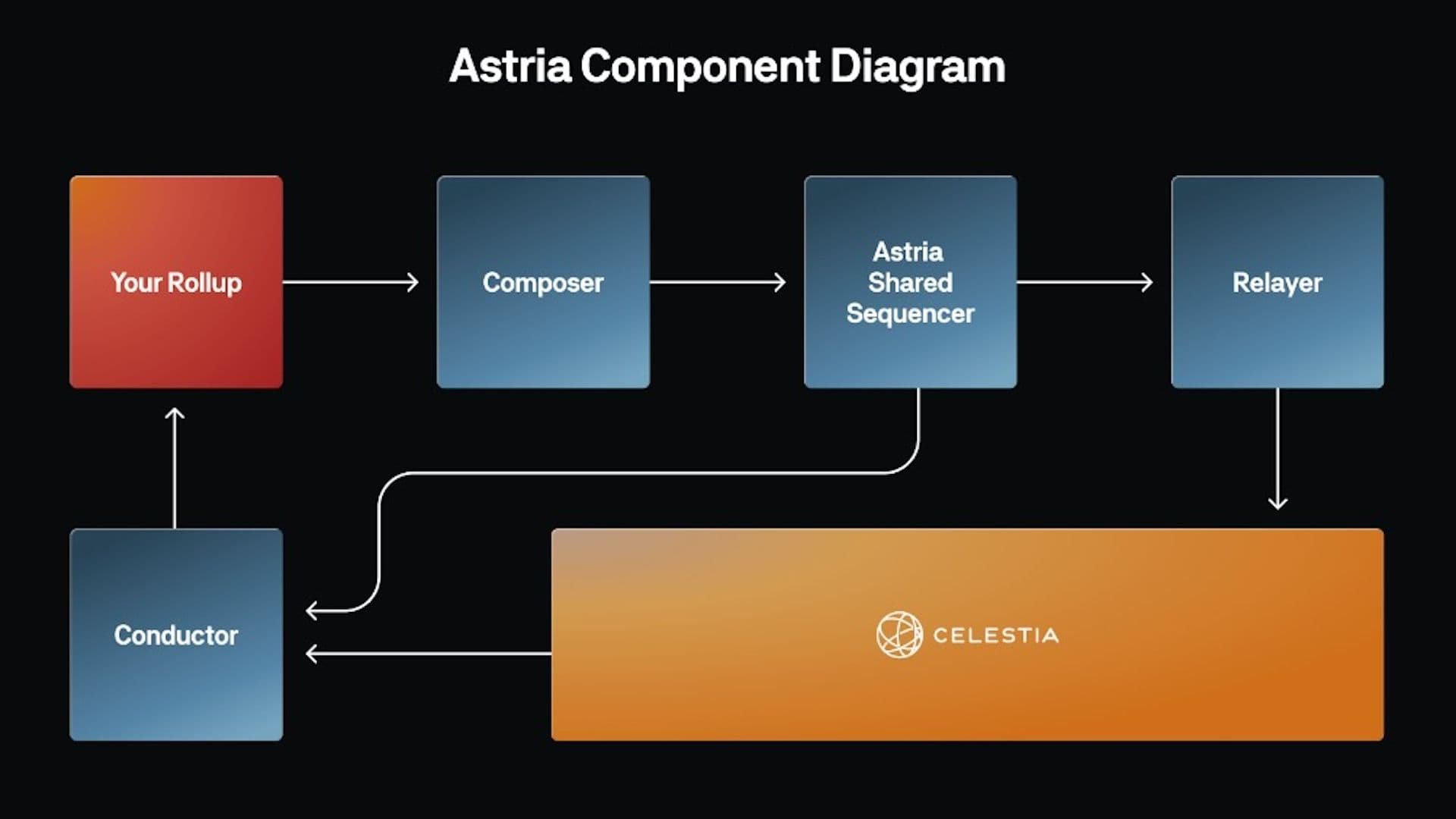

Implementation and Standardization Gaps: Projects like Astria and Cero are pioneering decentralized sequencing, but the lack of universally adopted standards (such as UAT20) and protocols hinders seamless interoperability and slows ecosystem-wide adoption.

Moreover, interoperability standards must mature so that new rollups can easily integrate into shared sequencing layers without custom engineering or security trade-offs. Initiatives like UAT20 and CRATE offer promising blueprints, but broader industry consensus will be essential for widespread adoption.

Strategic Outlook: The Path Forward for Superchains

The momentum behind decentralized sequencers signals a turning point for Ethereum’s modular future. By dissolving liquidity silos and enabling true cross-rollup composability, these innovations unlock new possibilities for builders and users alike. Much like Layer 1 blockchains before them, rollups are now competing not just on throughput but on network effects driven by interoperability and unified user experience.

For investors and developers focused on long-term value creation within the OP Stack or broader superchain movement, monitoring the evolution of decentralized sequencer protocols is critical. Early integration can confer significant advantages in capital efficiency, protocol stickiness, and access to emerging DeFi opportunities spanning multiple L2s.

Which decentralized sequencer project do you think will shape Ethereum’s future the most?

As Ethereum tackles rollup fragmentation and liquidity challenges, several decentralized and shared sequencer solutions have emerged. Which of these projects do you believe will have the biggest impact on Ethereum’s scalability and user experience?

The race is far from over, yet it’s clear that shared ordering layers represent a credible path toward restoring Ethereum’s vision of an open economic network unburdened by fragmentation. As research matures into robust infrastructure and standards solidify across the ecosystem, decentralized sequencers may well become the connective tissue powering a cohesive superchain era.