In the rapidly evolving world of superchain DeFi, modular rollups are redefining how cross-chain yield and liquidity flow across the OP Stack ecosystem. Among the most notable recent developments is GOATRollup, a modular rollup purpose-built to bridge native Bitcoin liquidity with Ethereum-based protocols, unlocking new opportunities for both yield generation and capital efficiency.

Why Modular Rollups Are Crucial for Cross-Chain Liquidity

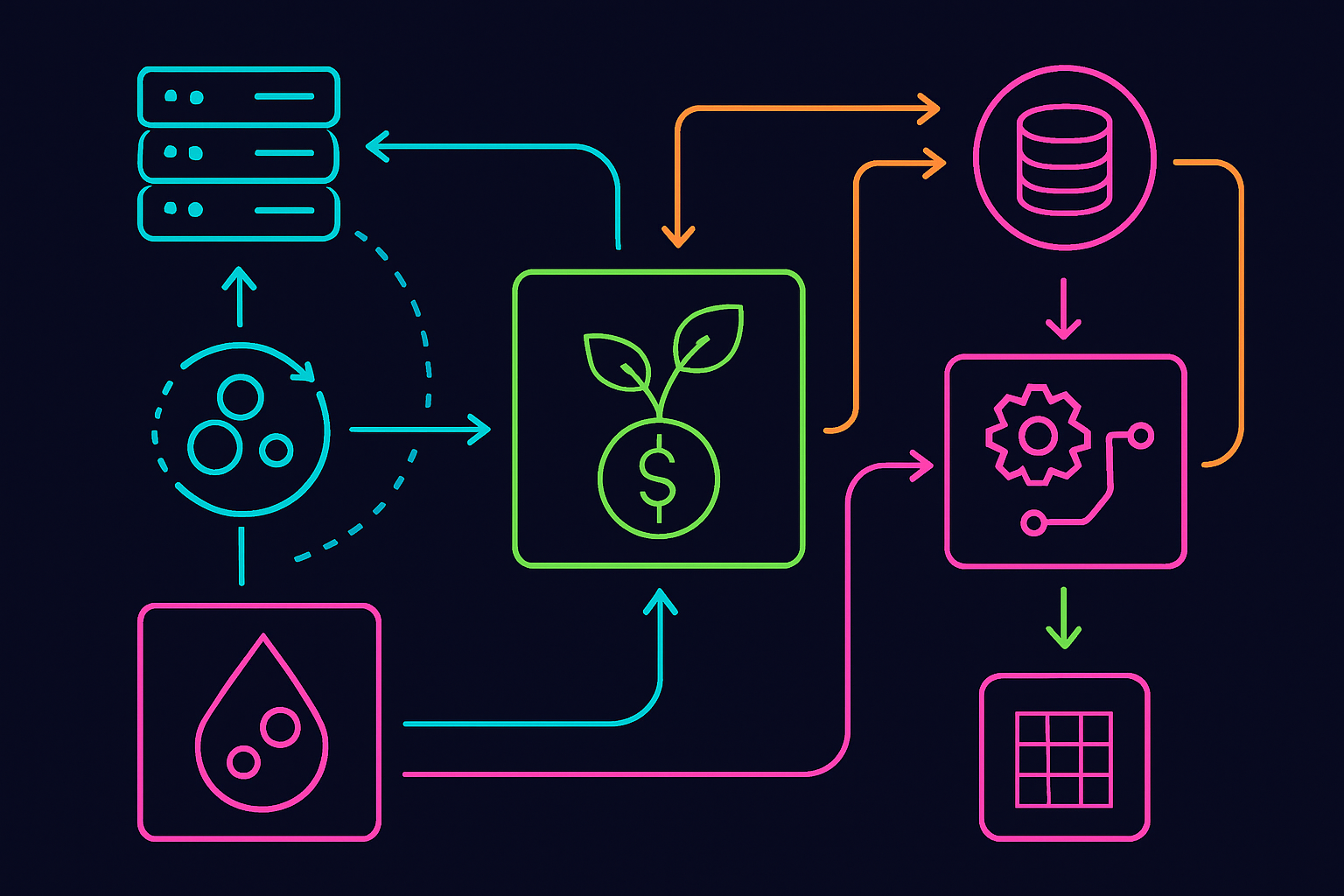

The traditional model of bridging assets between blockchains has long relied on wrapped tokens or centralized custodians, often introducing friction, security risks, and fragmented liquidity. Modular rollups like GOATRollup flip this paradigm by leveraging advanced cryptography (notably zk-Rollups) and smart contract-enabled infrastructure that directly integrates with native Bitcoin. This approach enables users to bridge their BTC without wrapping, using trust-minimized mechanisms that preserve both security and composability.

This architecture is especially potent within the OP Stack, Optimism’s open-source framework for building interoperable rollups. By plugging into this multi-rollup environment, GOATRollup is able to route liquidity seamlessly between Bitcoin and a growing constellation of OP Stack-based chains, fueling cross-chain yield strategies that were previously impossible.

GOATRollup: Unlocking Native BTC Yield in the Superchain Era

The latest integrations highlight how GOATRollup is positioning itself as a Bitcoin Layer 2 liquidity hub. Through its partnership with Free Protocol, users can now bridge staked assets – including native BTC – into GOAT Network to access higher-yield opportunities. This marks a significant leap from legacy DeFi models where Bitcoin holders were largely relegated to passive roles or forced to rely on wrapped derivatives.

The launch of GOATSwap, developed by the SpookySwap team, further cements this vision. As a decentralized exchange native to GOAT Network, it introduces features like perpetuals trading, Farms as a Service (FaaS), and an integrated launchpad. These products are designed not just for speculative trading but also for sustainable yield generation across multiple assets – all while keeping settlement on robust rollup infrastructure.

Bridging Ecosystems: Symbiosis and The Rise of Cross-Chain Yield Infrastructure

To make these flows truly frictionless, GOAT Network has also integrated with Symbiosis, a leading cross-chain bridge protocol. This partnership enables seamless movement of assets – particularly BTC – into the GOAT ecosystem without cumbersome manual steps or excessive fees. The result is a more unified liquidity layer where capital can move dynamically between Bitcoin’s unmatched security base and the composability of OP Stack rollups.

This evolution isn’t happening in isolation. Across the broader superchain landscape, projects are racing to leverage modular rollups for unlocking new forms of value transfer and yield generation. For those interested in how these innovations tie into staking mechanics within OP Stack-based networks, our deep dive on staking innovation in the superchain ecosystem offers further insights.

GOATRollup’s architecture exemplifies the next wave of cross-chain liquidity: one where capital can flow natively, securely, and efficiently between Bitcoin and Ethereum-aligned rollups. This is a marked shift from siloed DeFi pools and the risks of custodial bridging, as users now benefit from cryptographic guarantees and rapid settlement times. The ability to deposit native BTC, earn yield through advanced DeFi products, and withdraw without conversion overhead is a game-changer for both retail users and institutional liquidity providers.

What makes GOATRollup especially compelling is its modularity within the OP Stack. By leveraging Optimism’s open-source stack, GOATRollup can interoperate with other OP-based rollups, such as Lasernet for oracles or other DeFi-specific chains, without fragmenting liquidity. This means protocols can tap into a shared security and liquidity layer while customizing their execution environments for specific use cases like perpetuals, lending, or automated market making.

The Superchain DeFi Flywheel: Restaking, Yield, and Network Effects

One of the most exciting trends enabled by modular rollups like GOATRollup is the rise of restaking. By leveraging protocols such as Babylon’s BTC Security Network, staked Bitcoin can now secure new layers of DeFi while earning additional rewards. This unlocks a powerful flywheel: more staked assets attract more protocols to build in the ecosystem, which in turn increases demand for cross-chain liquidity solutions like GOATSwap and Symbiosis.

This synergy feeds broader network effects across the multi-rollup ecosystem. As more projects adopt modular rollups within the OP Stack, each specializing in different primitives but sharing underlying infrastructure, the superchain thesis becomes self-fulfilling. Liquidity deepens, composability expands, and users gain access to an ever-growing menu of yield strategies that would be impossible on isolated L2s or legacy bridges.

The Road Ahead: Challenges and Opportunities

Despite these advances, several challenges remain. User experience for cross-chain operations must continue to improve; abstracting away gas fees and complex bridging steps will be critical for mainstream adoption. Security remains paramount, especially when moving high-value assets like BTC across chains, and ongoing audits plus battle-testing are essential.

Still, the momentum is undeniable. As modular rollups like GOATRollup mature within the OP Stack superchain, we’re witnessing not just incremental improvements but a foundational shift in how value moves across blockchains. The convergence of native Bitcoin liquidity with Ethereum’s composability unlocks opportunities that neither network could achieve alone.

The coming months will reveal which teams best navigate these challenges, but one thing is clear: the future of superchain DeFi belongs to projects that embrace modularity, interoperability, and user-centric design. For those tracking this space closely, keeping an eye on GOATRollup’s integrations with staking platforms, DEXs like GOATSwap, and bridges like Symbiosis will offer front-row insight into where cross-chain yield infrastructure goes next.