Atomic cross-rollup trades have become a central focus in the evolution of Ethereum’s scaling landscape, particularly within the OP Stack and the broader superchain ecosystem. As decentralized finance (DeFi) grows in complexity, users and protocols increasingly demand seamless, trust-minimized interactions across multiple rollups. Yet, traditional rollup architectures silo liquidity and execution, making truly atomic cross-rollup operations exceedingly difficult. Enter shared sequencers: a pivotal innovation poised to transform rollup interoperability and enable a new era of composable blockchain applications.

The Problem: Fragmented Rollups and Isolated Liquidity

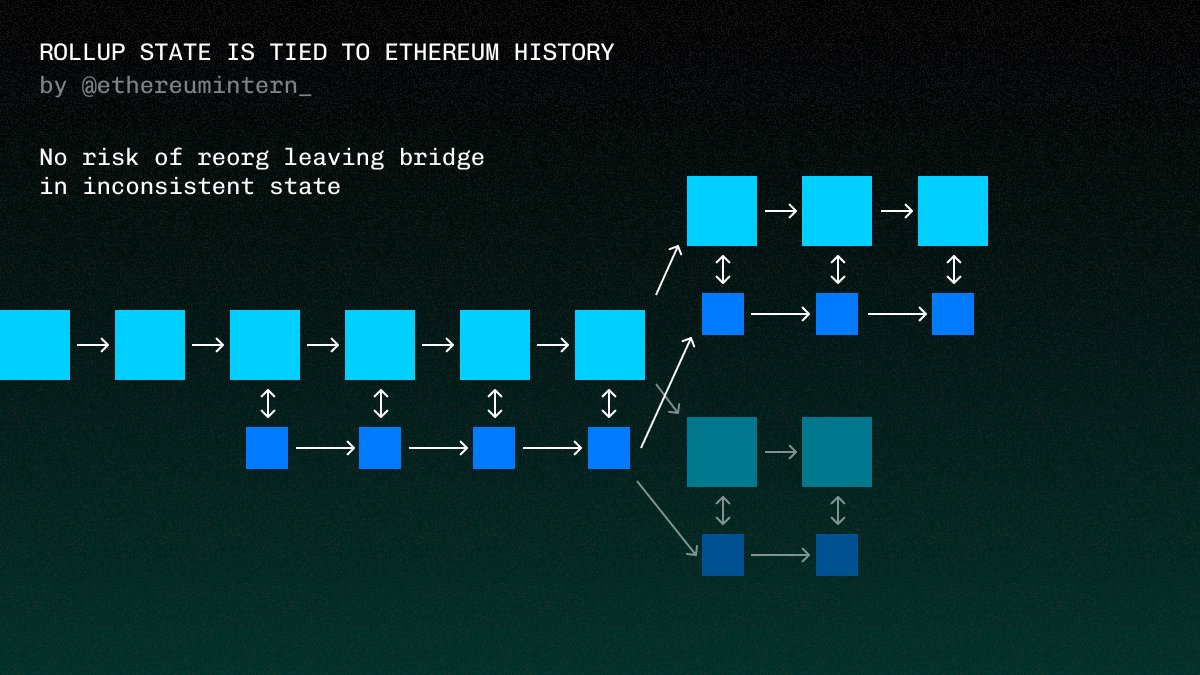

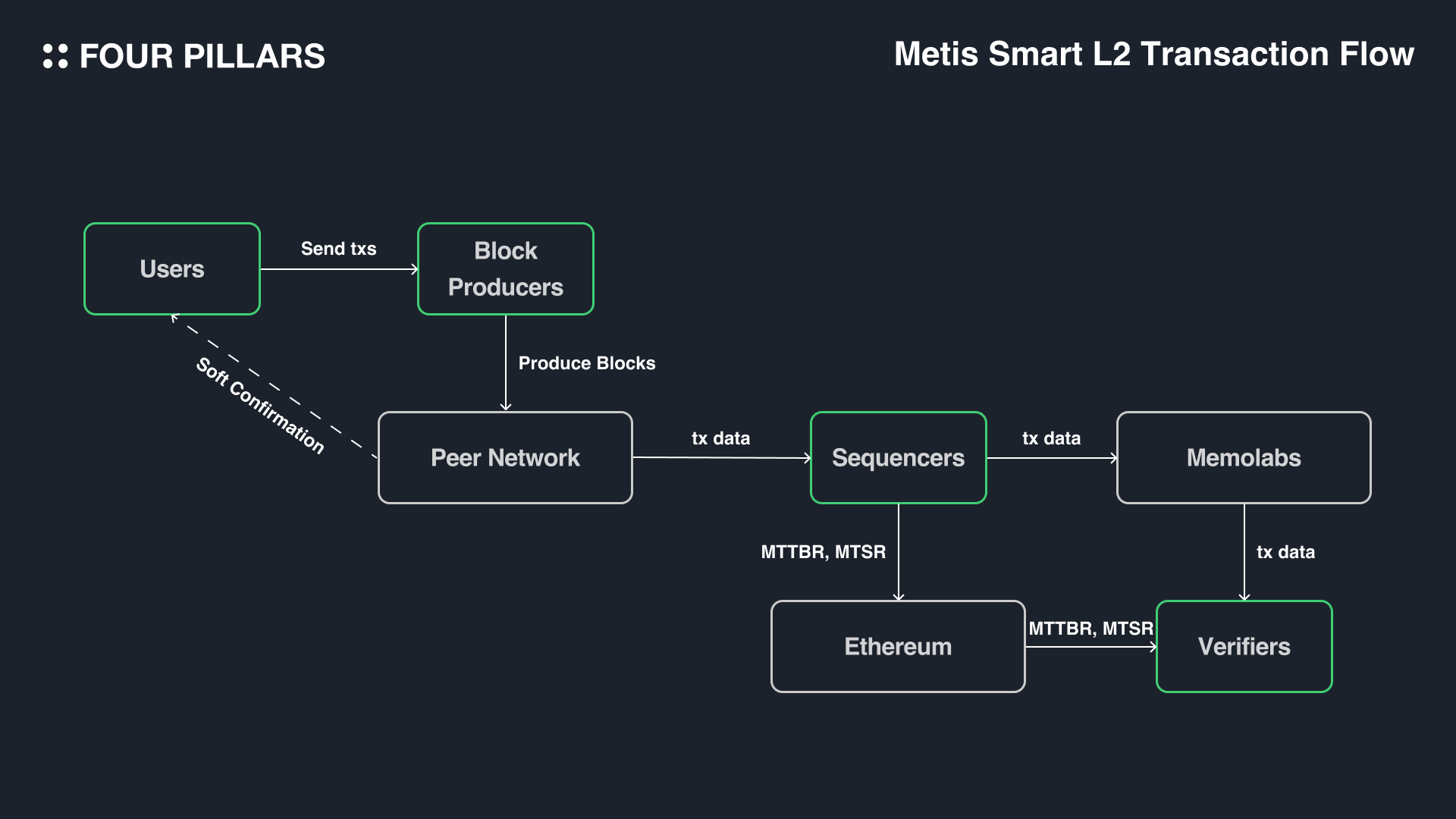

Each OP Stack rollup typically operates its own sequencer to order transactions and produce blocks. While this model enables high throughput and low latency, it also creates silos. If you want to execute an arbitrage trade between two OP Chains or bridge assets atomically, you face a coordination problem: there is no native way to guarantee that transactions on both chains will be included or executed together. This leads to inefficiencies, failed trades, or reliance on third-party bridges that introduce additional trust assumptions.

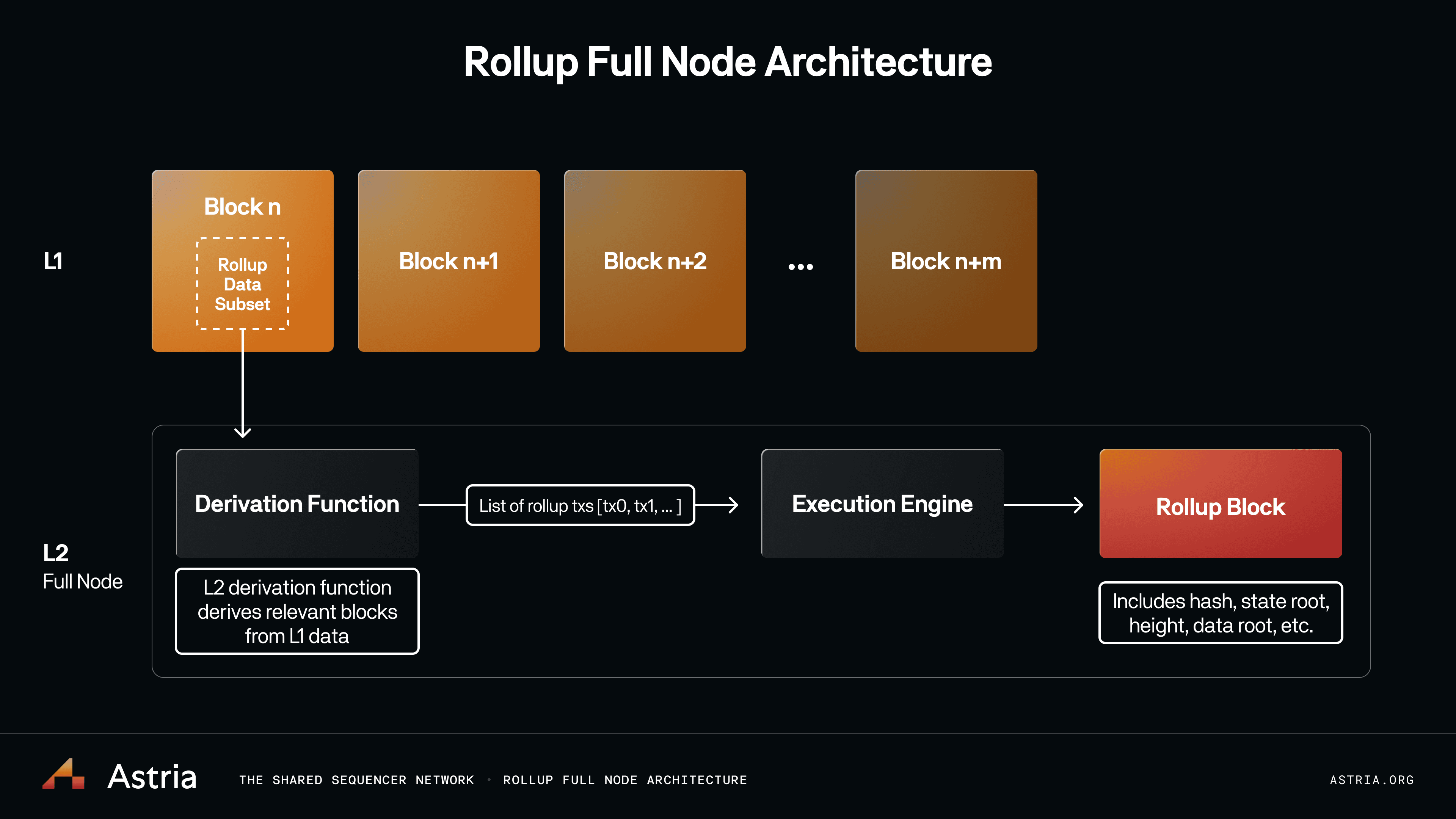

As highlighted in the Optimism Documentation, achieving synchronous cross-chain messaging and atomicity requires more than just fast block times. What’s missing is a protocol-level mechanism that can coordinate transaction ordering across multiple chains, this is precisely what shared sequencers offer.

How Shared Sequencers Work in the OP Stack

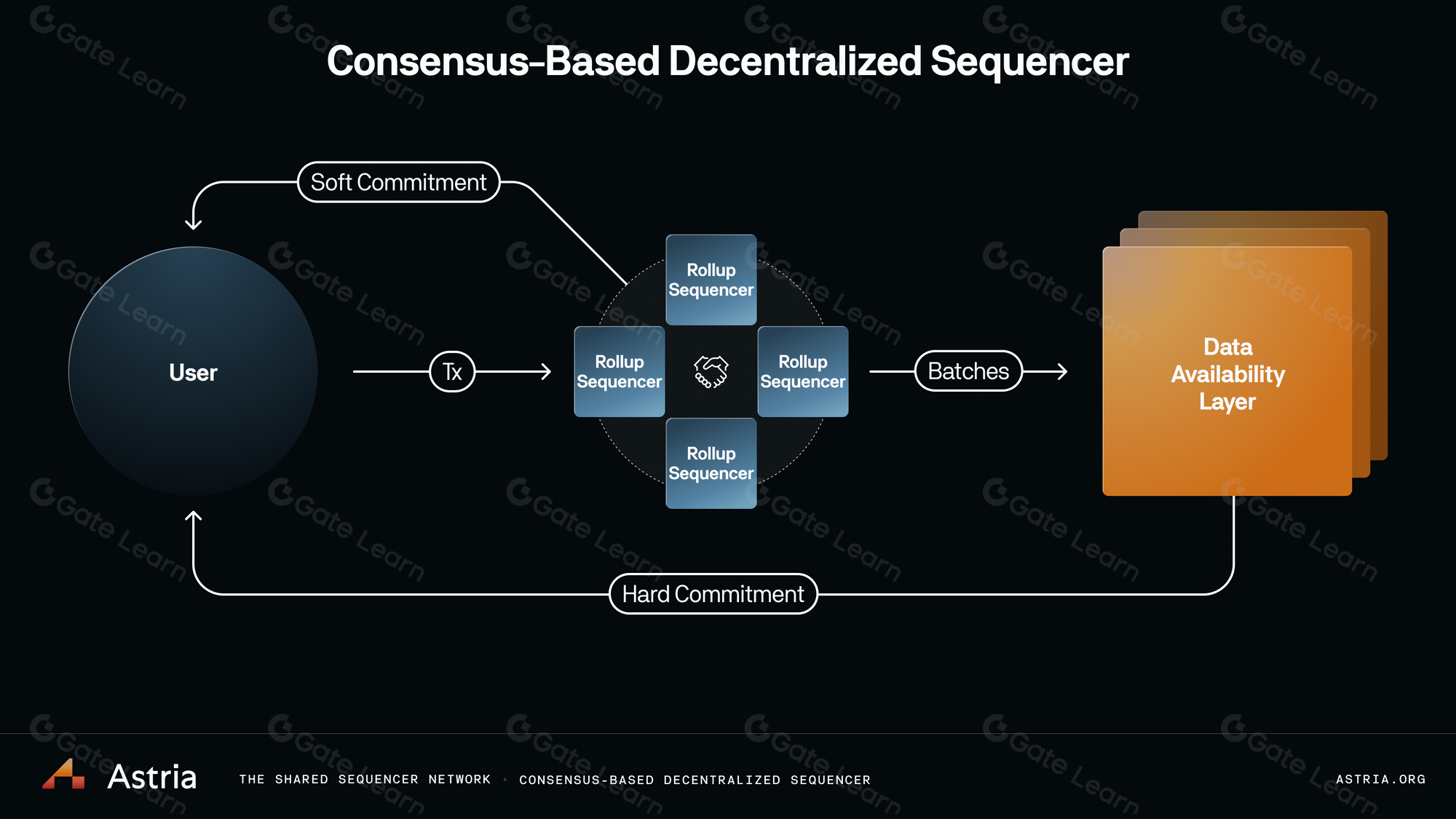

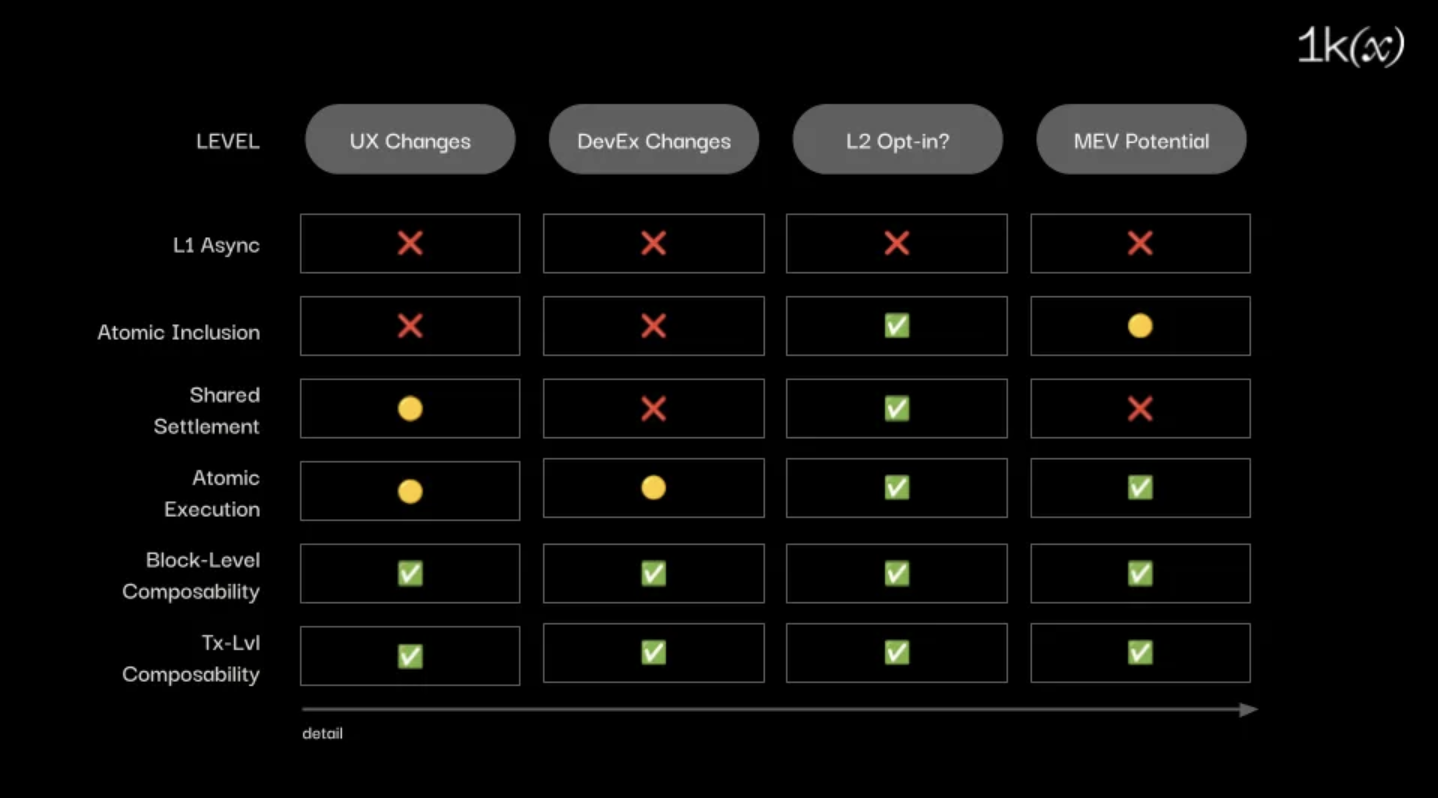

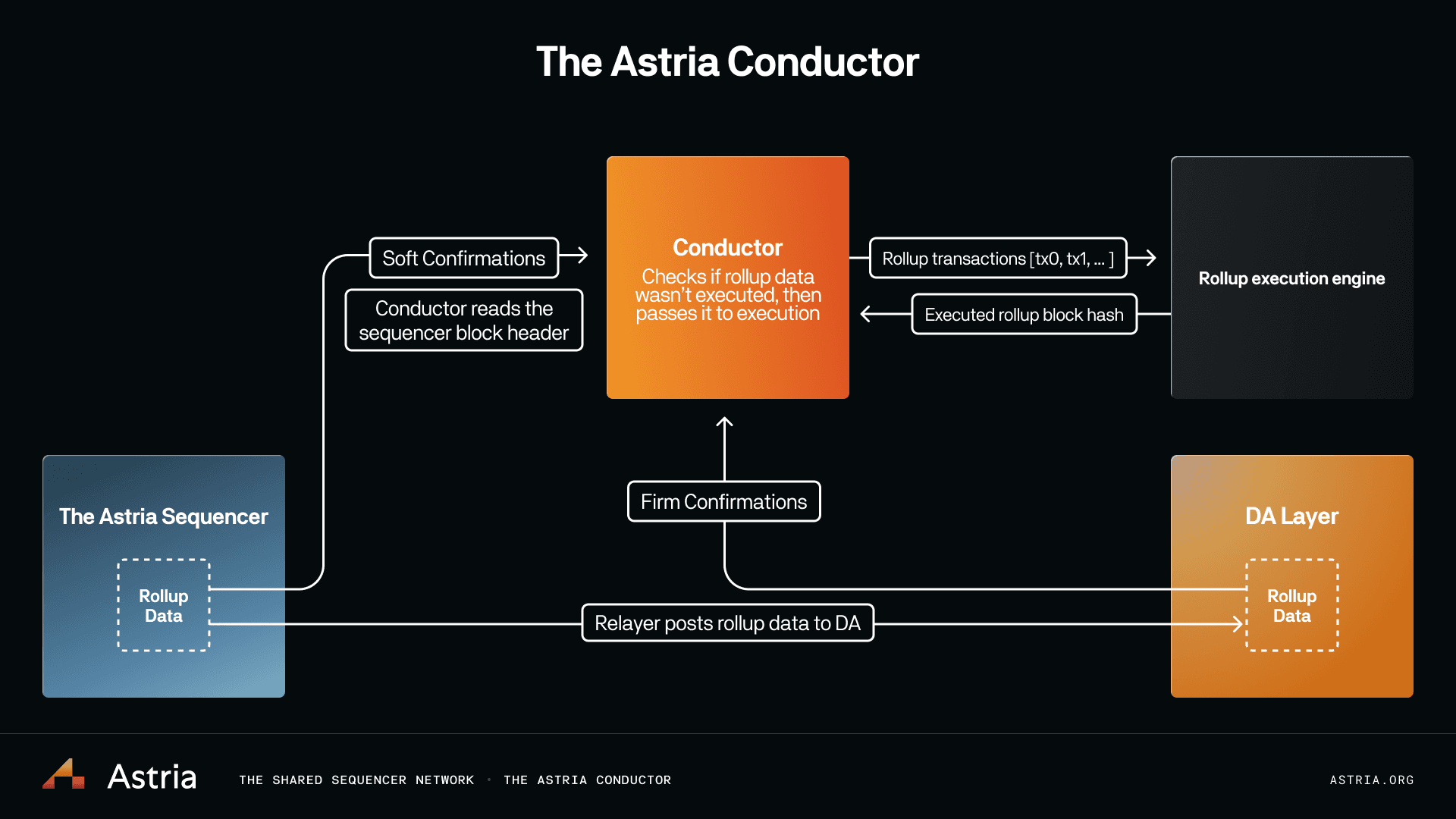

A shared sequencer is a network of nodes that collectively order transactions for a cluster of rollups, rather than for just one. When multiple OP Stack chains opt into this model, they effectively share a common transaction ordering layer. This allows for the creation of atomic inclusion bundles: sets of transactions that are guaranteed to be included in the same block across all participating chains or not at all.

This approach unlocks several powerful use cases:

Key Benefits of Shared Sequencers in the OP Stack

-

Atomic Cross-Rollup Trades: Shared sequencers enable atomic inclusion of transactions across multiple OP Stack rollups, ensuring that cross-rollup trades are processed together or not at all. This is essential for secure arbitrage and bridging operations.

-

Enhanced Interoperability: By coordinating transaction ordering across OP Chains, shared sequencers eliminate the isolation of individual rollups, fostering seamless cross-chain communication and unified user experiences within the Superchain.

-

Liquidity Unification: Shared sequencers help aggregate liquidity across different OP Stack rollups, reducing fragmentation and enabling deeper markets for users and protocols.

-

Reduced Complexity for Developers: Developers can build cross-rollup dApps without designing custom synchronization logic, as shared sequencers provide a standardized coordination layer for transaction ordering.

-

Foundation for Advanced Features: Shared sequencers pave the way for future innovations, such as cross-rollup block builders that can simulate execution across multiple rollups, further improving the reliability of atomic trades.

The shared sequencer does not replace the individual rollup’s state machine or consensus rules; instead, it acts as an ordering service that all participating rollups respect when building their blocks. For developers, this means they can design cross-rollup applications, such as multi-chain DEXes or lending platforms, that rely on atomic inclusion guarantees at the protocol level.

Atomic Inclusion vs. Atomic Execution: The Nuanced Distinction

It’s crucial to understand that atomic inclusion: the ability to include related transactions in different rollups’ blocks simultaneously, is not the same as atomic execution, where all transactions either succeed together or fail together at the state level. Shared sequencers guarantee the former but not inherently the latter.

This distinction matters because real-world failures can occur even if transactions are included together. For instance, if one leg of a trade fails due to insufficient funds or state changes between block proposals, its counterpart on another chain may become invalid. To address this, emerging solutions like cross-rollup block builders are being developed. These builders simulate the execution of bundled transactions across multiple state machines before submitting them to the shared sequencer, reducing the risk of partial failures.

The Superchain Vision: Toward Seamless Multi-Rollup Development

The Optimism Superchain represents an ambitious vision: a family of interoperable OP Stack rollups coordinated by shared infrastructure components like sequencers. As detailed in the Alchemy Superchain deep dive, this architecture aims to combine the scalability benefits of Layer 2s with the composability and user experience of a single chain.

Shared sequencers are at the heart of this vision. By enabling atomic cross-rollup trades, they pave the way for unified liquidity pools, cross-chain DeFi protocols, and innovative dApps that leverage multiple execution environments without sacrificing security or decentralization.

Real-World Scenarios Enabled by Atomic Cross-Rollup Trades

-

Instant Cross-Rollup Stablecoin Transfers: Platforms like USDC enable users to move stablecoins atomically between OP Stack rollups, allowing for fast, risk-free bridging without relying on external bridge protocols.

-

Composable DeFi Strategies Spanning Multiple Rollups: Protocols such as Yearn Finance can deploy yield farming strategies that atomically allocate assets across different OP Stack rollups, optimizing returns while ensuring all legs of the strategy execute together.

-

Unified Governance Voting Across OP Stack Chains: DAOs like Optimism Collective can enable members to cast votes on proposals across multiple rollups in a single atomic transaction, ensuring governance actions are synchronized chain-wide.

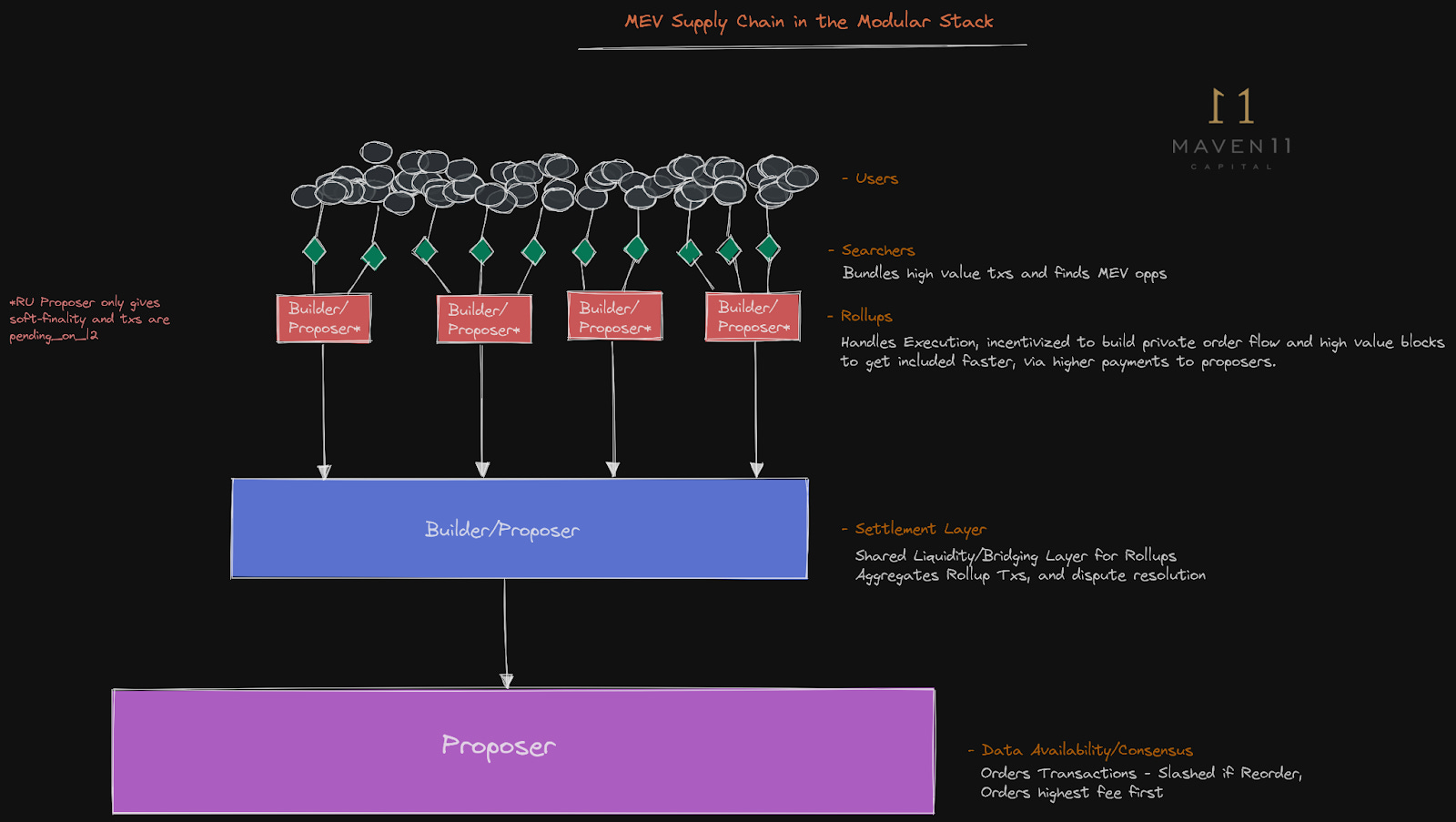

Of course, the implementation of shared sequencers is not without its technical and economic challenges. For one, the coordination overhead increases as more rollups join the shared sequencing set, demanding robust liveness and fault tolerance mechanisms. The design must also prevent MEV (maximal extractable value) centralization and ensure that no single operator can manipulate cross-rollup transaction ordering for profit. Projects like Astria and AltLayer are actively researching decentralized sequencer sets and fair ordering protocols to address these emerging risks.

Another open question is how to handle rollups with different block times or consensus parameters. Synchronizing transaction inclusion across chains with variable finality requires careful engineering, potentially involving time-locked bundles or adaptive batching strategies. The goal is to maintain the user experience of near-instant, atomic trades while safeguarding against edge cases where state drift could undermine atomicity.

Developer Tooling and Ecosystem Growth: Building on Shared Sequencers

The rise of shared sequencers is already catalyzing a wave of new developer tooling within the OP Stack ecosystem. Cross-rollup SDKs, simulation frameworks for multi-chain bundles, and monitoring dashboards are being built to abstract away the underlying complexity. These tools empower teams to focus on application logic rather than low-level protocol quirks.

As highlighted by Optimism’s official documentation, these advances will be critical as more DeFi protocols, NFT platforms, and gaming projects seek to tap into liquidity and users spread across multiple rollups. The vision is a superchain where developers can compose primitives from any OP Chain as easily as calling a smart contract on their own chain, without worrying about fragmented liquidity or settlement risk.

Looking Ahead: The Future of Rollup Interoperability

Shared sequencers are quickly becoming a cornerstone of rollup interoperability strategy across Ethereum’s scaling landscape. As research continues on atomic execution guarantees and decentralized sequencing networks, we can expect even tighter integration between OP Chains and other Layer 2s adopting similar models. The endgame? A seamless superchain where users, assets, and protocols move frictionlessly across trust-minimized boundaries.

For investors and builders alike, understanding the nuances of shared sequencer architecture will be key to navigating this next phase of blockchain composability. As always in crypto infrastructure, the devil is in the details, but the potential upside for DeFi efficiency, user experience, and systemic security is hard to overstate.

Key Challenges for Shared Sequencer Adoption

-

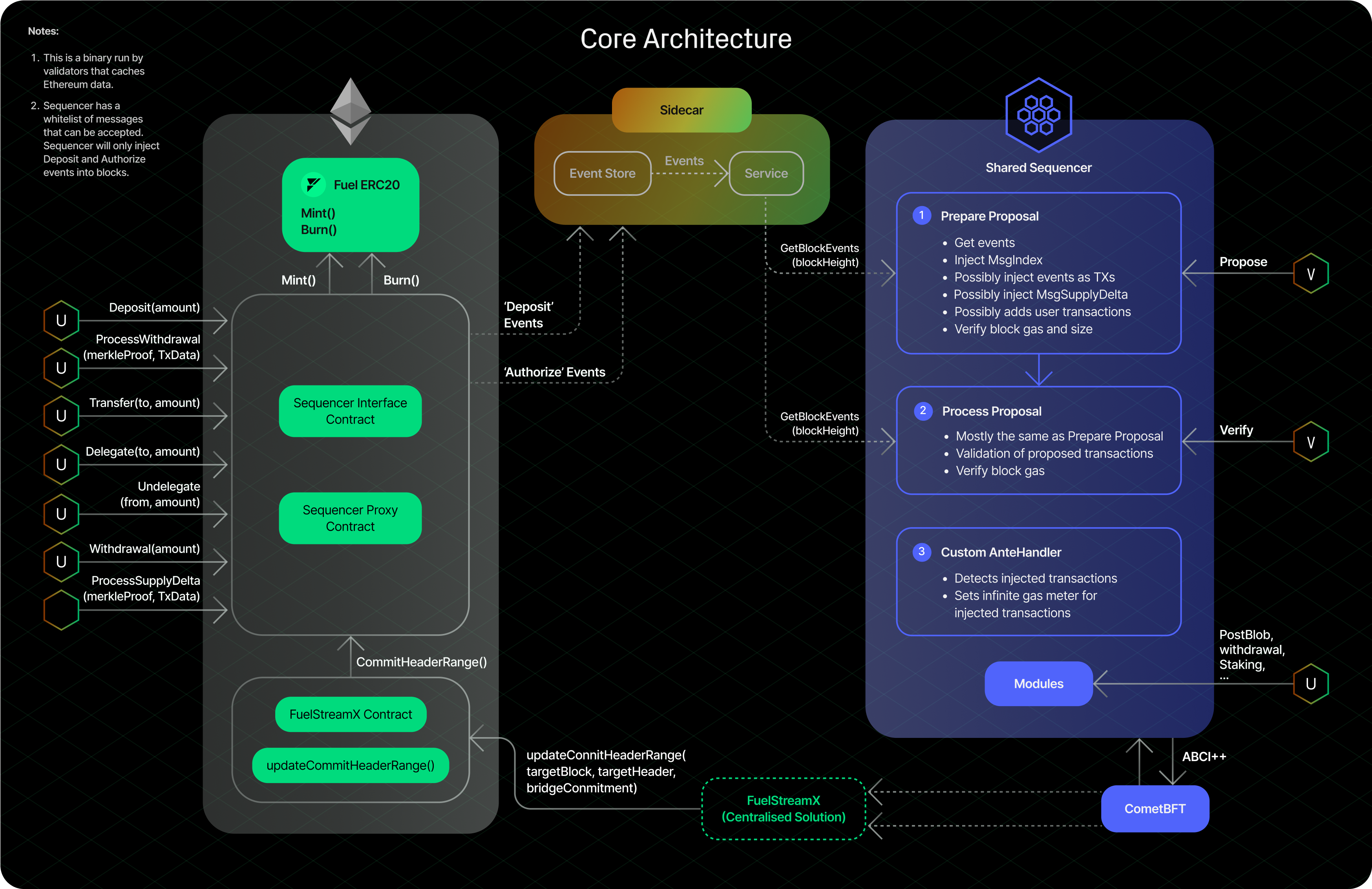

Ensuring Atomic Execution Across Rollups: While shared sequencers can coordinate atomic inclusion, guaranteeing that all transactions in a cross-rollup bundle execute successfully remains a challenge. Failures on one rollup (e.g., due to insufficient funds) can invalidate the entire atomic trade, necessitating advanced cross-rollup block builders and simulation tools. Source: Astria

-

Managing Latency and Throughput: Coordinating transaction ordering across multiple OP Stack rollups can introduce additional latency and affect throughput. Maintaining low-latency, high-throughput performance without sacrificing atomicity is an ongoing technical hurdle. Source: Optimism Documentation

-

Sequencer Set Decentralization and Security: Relying on a shared sequencer set raises concerns about centralization and potential single points of failure. Ensuring a decentralized, robust, and secure sequencer network is critical to prevent censorship and maintain trust. Source: Maven 11

-

Cross-Rollup State Awareness: For atomic trades to be reliable, sequencers or block builders must be aware of the state on multiple rollups. Achieving accurate, up-to-date cross-rollup state awareness is technically complex and requires sophisticated infrastructure. Source: Astria

-

Economic Incentive Alignment: Aligning incentives for sequencers, rollup operators, and users across different OP Stack rollups is non-trivial. Mechanisms must be designed to ensure fair participation and prevent MEV (Maximal Extractable Value) exploitation. Source: Alchemy