Interoperability is the lifeblood of a thriving multi-rollup ecosystem, and nowhere is this more apparent than in the rapidly evolving Optimism Superchain. As OP Stack developers race to launch new rollups and applications, one challenge looms large: seamless, secure bridging between chains. Enter Hyperlane: an open, modular interoperability framework that’s quickly becoming the backbone for cross-rollup connectivity on the Superchain.

Superchain Interoperability: The New Baseline for Scaling

The Superchain vision isn’t just about stacking more L2s; it’s about making those chains feel like one cohesive network. According to Optimism’s documentation, Superchain interoperability protocols let OP Stack blockchains read each other’s state directly, unlocking new composability and user experiences. But until native interoperability matures across all rollups, projects need a robust bridge today, not next year.

This is where Hyperlane’s approach shines. Its permissionless deployment model means any OP Stack rollup, current or future, can integrate interop with minimal changes to code or infrastructure. No more waiting for upgrades from core teams or jumping through governance hoops. Developers get fast, flexible access to cross-chain messaging, swaps, and asset transfers right out of the box.

What Makes Hyperlane Different? Modular Security Meets Developer Autonomy

Unlike legacy bridges that lock you into one trust model or require centralized relayers, Hyperlane is designed to be modular. This means developers can choose security assumptions that match their app’s needs, whether that’s optimistic verification now or full native Superchain security as it becomes available.

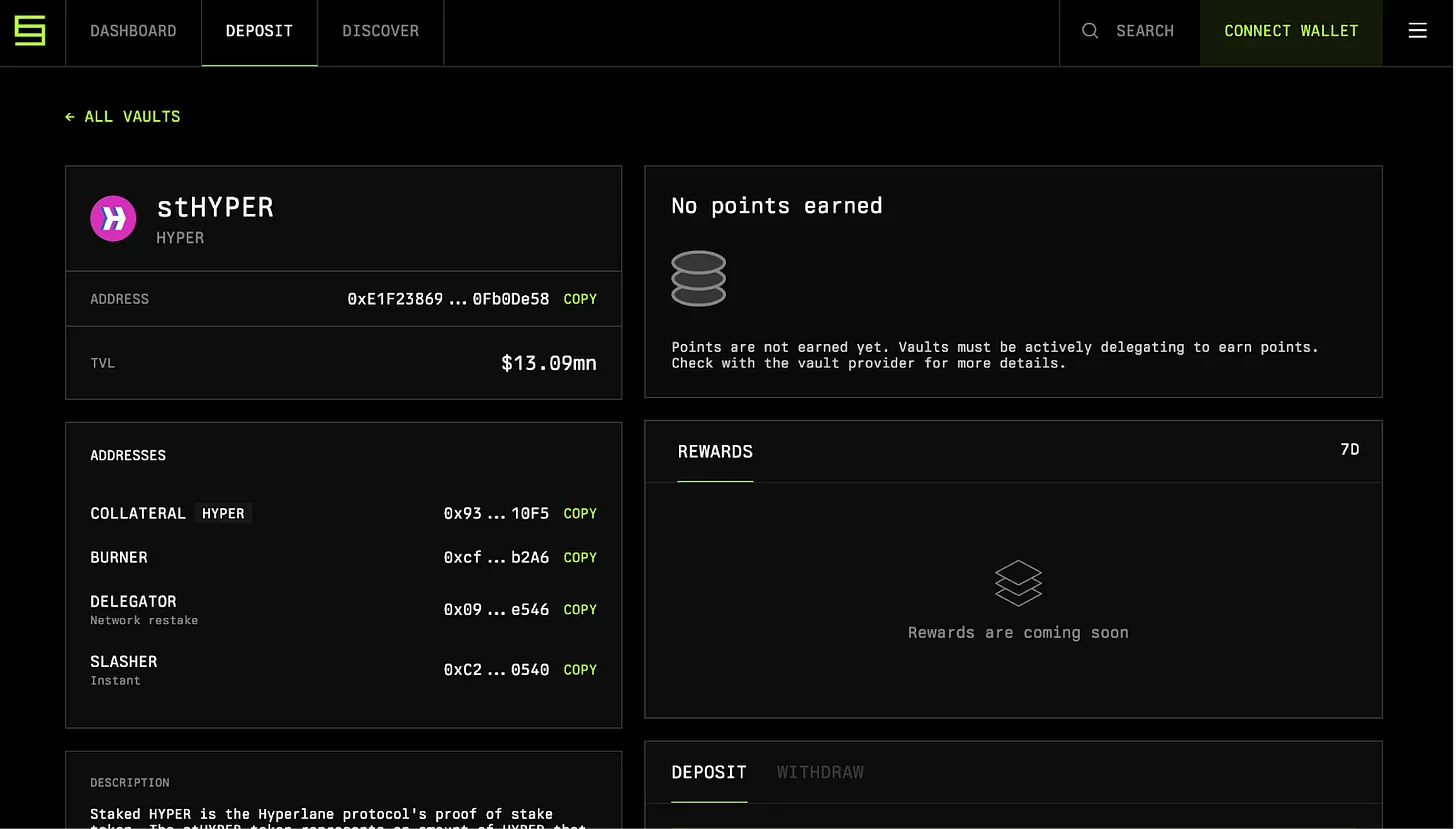

The recent rollout of Superlane, a collaboration between Hyperlane and Velodrome Finance, takes this even further. With Superlane:

- Permissionless deployments: Any developer can launch interop on their OP Stack rollup without waiting for approval.

- Customizable security: Chains can upgrade trust models over time as the Superchain matures.

- Shared liquidity and interchain governance: Protocols like Velodrome are already using Superlane to bridge governance tokens (like XVELO) and voting power across chains.

This flexibility gives developers a clear path from today’s modular bridges to tomorrow’s fully native interoperability, all while keeping users’ assets safe and workflows smooth.

Practical Use Cases Enabled by Hyperlane on the Superchain

-

Shared Liquidity Pools Across OP Chains: Hyperlane allows protocols like Velodrome Finance to unify liquidity pools across multiple OP Stack rollups, enabling seamless asset swaps and deeper liquidity for users throughout the Superchain ecosystem.

-

Interchain Token Transfers & Bridging: Developers can enable permissionless, cross-rollup token transfers—such as moving OP tokens at the current price of $0.7165—between different Superchain networks without relying on centralized bridges.

-

Cross-Chain Governance & Voting: Hyperlane supports interchain governance mechanisms, allowing users to participate in activities like gauge voting for emissions or protocol upgrades on any connected OP Stack chain.

-

Composable Interchain dApps: Developers can build modular dApps that interact with contracts and data across multiple OP Stack rollups, unlocking new use cases such as cross-chain lending, borrowing, and DeFi strategies.

-

Permissionless Interoperability Deployments: Any OP Stack rollup can self-deploy Hyperlane to instantly connect with the Superchain, enabling fast onboarding for new chains and projects without waiting for core protocol upgrades.

Diving In: How OP Stack Developers Can Get Started with Hyperlane Today

If you’re building on the OP Stack in October 2025, you don’t have to wait another cycle for seamless cross-rollup UX. Superlane is launching across all Superchain rollups this November, bringing immediate access to shared liquidity pools, interchain apps, and unified governance frameworks.

The setup process is streamlined for speed: deploy your chain as usual, integrate the Hyperlane SDK or contracts with minimal changes, configure your preferred security module, and you’re live. It’s a massive unlock for projects looking to capture first-mover advantage in a crowded L2 landscape.

Current OP Price: $0.7165 (as of October 2025). For protocols managing treasury or emissions across multiple chains, real-time price feeds like this are essential when automating cross-chain swaps or rebalancing liquidity pools via Hyperlane-enabled bridges.

For OP Stack developers, the real magic of Hyperlane is in its developer-first tooling and modular design. You don’t need to be a cross-chain expert to get started. The Hyperlane SDK abstracts away complex message routing and security configuration, letting you focus on what matters: shipping features and growing your user base.

Immediate Use Cases: From Cross-Chain Liquidity to Interchain Governance

With Superlane rolling out in November, the ecosystem is about to see a wave of innovation. Take Velodrome Finance’s upcoming integration: by bridging XVELO tokens and emissions across Superchain rollups, they’re setting the stage for unified liquidity incentives and cross-chain gauge voting. This model isn’t limited to DEXs, any protocol can now:

Top Protocols Poised to Benefit from Hyperlane-Enabled Superchain Bridges

-

Velodrome Finance: As the core liquidity hub of the Superchain, Velodrome is already collaborating with Hyperlane to enable interchain XVELO tokens, emissions, and cross-chain gauge voting, streamlining liquidity across OP Stack rollups.

-

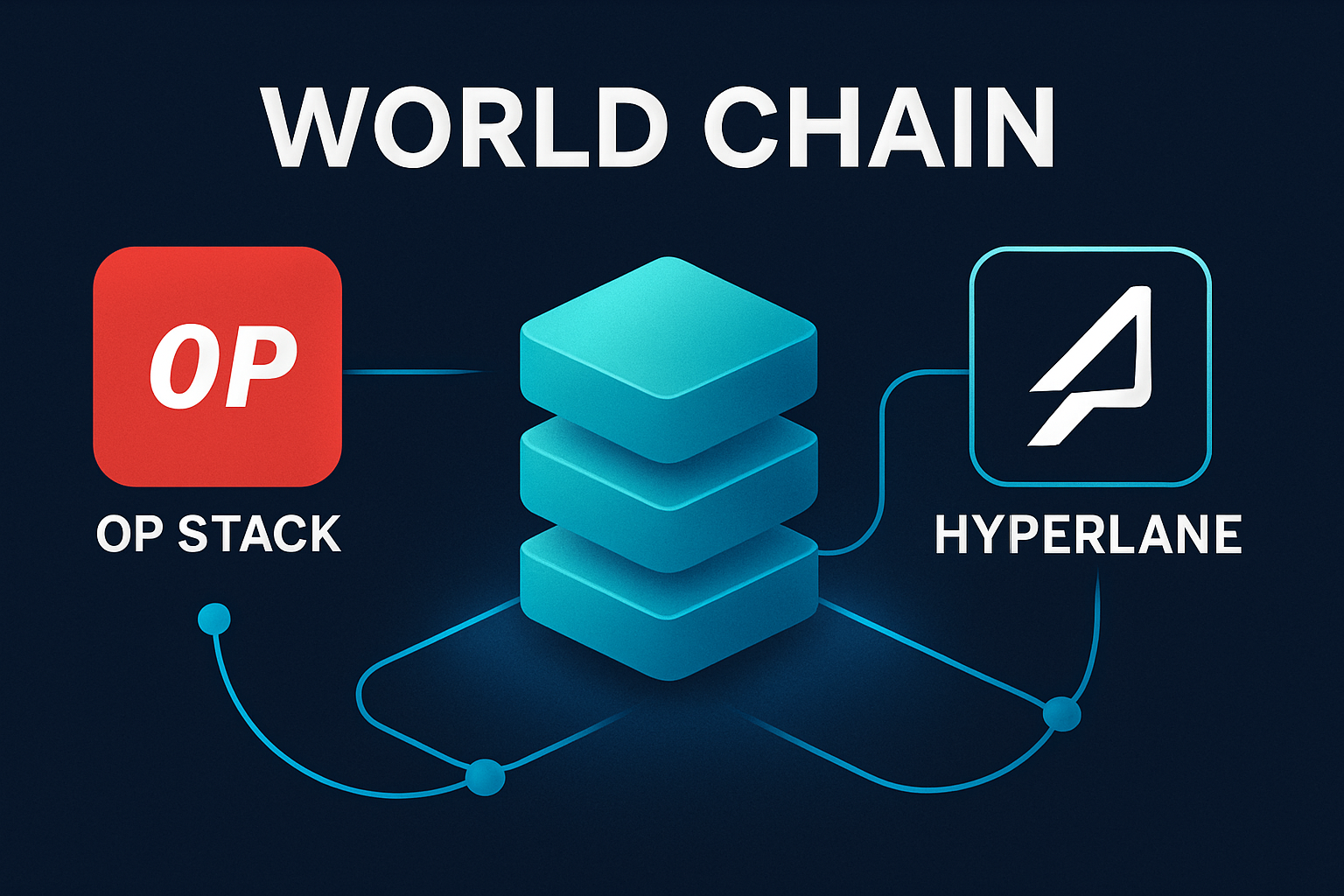

World Chain: Built on the OP Stack, World Chain leverages native Superchain bridges. With Hyperlane, it can achieve faster, permissionless interoperability and enhance cross-chain user experiences.

-

Synthetix: As a leading derivatives protocol on Optimism, Synthetix stands to gain from Hyperlane-powered seamless bridging, enabling synthetic assets to move freely across Superchain rollups.

-

Kwenta: This decentralized trading platform, closely tied to Synthetix and Optimism, can use Hyperlane to offer unified trading and liquidity across multiple OP Stack chains.

-

Beefy Finance: As a multi-chain yield optimizer supporting Optimism, Beefy Finance could leverage Hyperlane bridges to automate cross-rollup yield strategies and boost DeFi composability.

-

Granary Finance: A decentralized lending protocol on Optimism, Granary could use Hyperlane to facilitate cross-chain collateral and lending, expanding its reach within the Superchain ecosystem.

Imagine lending markets with shared collateral pools spanning multiple OP chains, NFT projects enabling instant cross-rollup transfers, or DAOs managing treasury assets with one set of contracts. These use cases are no longer theoretical, they’re live pilots for how the Superchain will operate at scale.

Security Considerations: Modular Trust for a Modular Future

Security remains the single most important factor in bridge adoption. Hyperlane’s approach is refreshingly pragmatic: every OP Stack rollup can choose its own trust model when deploying interop features. Start with optimistic verification or external validators today, then seamlessly upgrade to native Superchain security as it rolls out. This flexibility means you aren’t locked into outdated assumptions as the Superchain evolves.

For devs concerned about exploits or economic attacks, this modularity is huge. You can tune your risk profile based on your app’s needs, whether you’re launching a DeFi protocol moving millions daily or an experimental dApp just getting started.

How to Integrate Hyperlane on Your Rollup

- Deploy your OP Stack chain: Launch as usual with standard OP contracts.

- Add Hyperlane modules: Use the SDK to integrate message passing and bridge contracts.

- Select your security model: Choose between optimistic verification, validator sets, or hybrid approaches.

- Test and go live: Run cross-chain tests before opening up for users.

The documentation is thorough and community support is growing fast, making it easier than ever to future-proof your app for native Superchain interoperability down the line.

Why Move Now? Staying Ahead in a Rapidly Evolving Market

The opportunity cost of waiting for native Superchain features is rising fast. With Optimism (OP) trading at $0.7165, competition among L2s for liquidity, users, and governance power has never been fiercer. By leveraging Hyperlane’s permissionless deployments and modular security today, you position your project at the forefront of multi-rollup UX, a key differentiator as new chains join the network each month.

If you want more technical details or hands-on guides, check out Hyperlane’s official announcement on Superlane. The future of seamless bridging on the Superchain isn’t just coming, it’s here now for those ready to build it.