Liquidity fragmentation is rapidly becoming one of the most intractable challenges in decentralized finance (DeFi) as Ethereum’s rollup-centric roadmap matures. The explosion of Layer 2 (L2) rollups such as Arbitrum, Optimism, zkSync, and StarkNet has delivered exponential gains in throughput and cost efficiency. However, these improvements come at a structural cost: liquidity pools are increasingly isolated, composability is diminished, and capital efficiency suffers across the DeFi stack.

Dissecting the Root Causes of Rollup Liquidity Fragmentation

The core driver of rollup liquidity fragmentation is the proliferation of independent L2 environments. Each rollup executes transactions and maintains state separately from its peers. While this modular design optimizes scalability and security assumptions, it creates new silos that undermine DeFi’s traditional strengths.

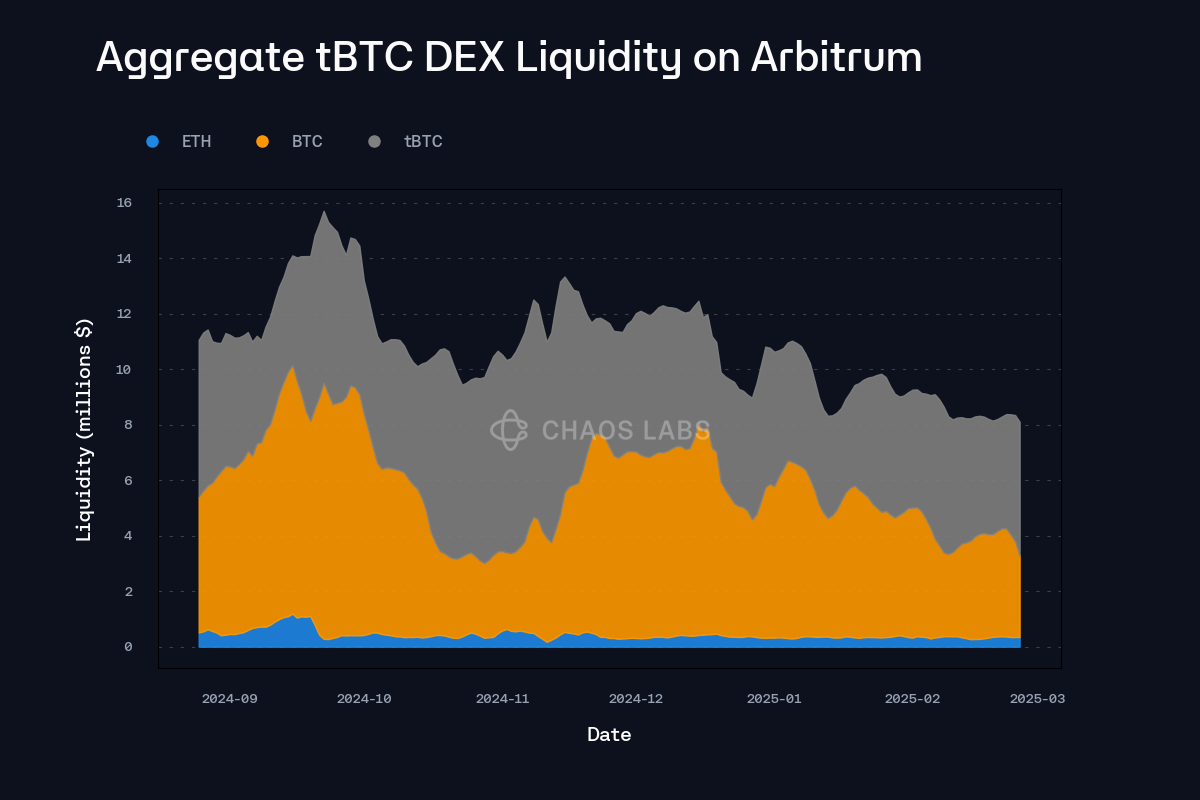

- Proliferation of Layer 2 Rollups: With more than 70 live L2 solutions, each with its own architecture and consensus model, liquidity becomes scattered rather than concentrated. This leads to isolated pools that cannot be easily accessed or arbitraged across domains.

- Liquidity Dispersion: Capital is spread thinly over many L2s. As a result, slippage increases for traders and lending rates diverge between platforms. The high opportunity cost of moving assets between rollups exacerbates these inefficiencies.

- Reduced Composability: The inability for smart contracts on one rollup to trustlessly interact with those on another disrupts the seamless composability that underpins Ethereum’s DeFi flywheel.

This fragmentation not only dampens user experience but also hinders protocol innovation by restricting cross-domain arbitrage, lending optimization, and multi-protocol strategies.

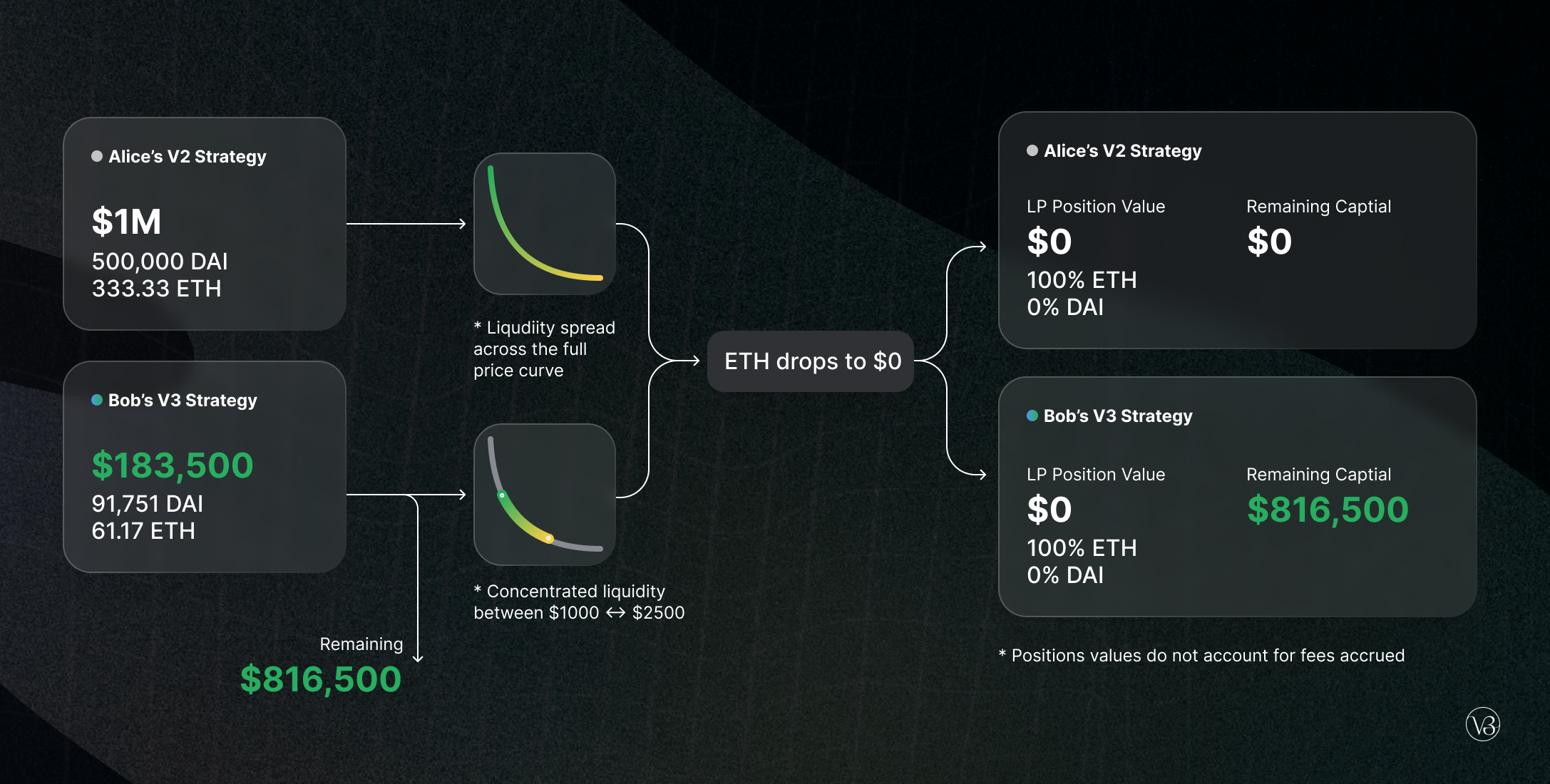

The Economic Cost: Inefficiency in DeFi Liquidity Pools

The consequences for capital efficiency are profound. When liquidity is partitioned across disparate rollups, market depth thins out on each domain. Swaps incur higher slippage; lending protocols face volatile utilization rates; yield strategies become less predictable due to asynchronous asset flows.

This dynamic can be illustrated by considering a simple swap scenario: A trader seeking to exchange ETH for USDC may face drastically different prices depending on which L2 they use due to fragmented order books and AMMs. Arbitrageurs are incentivized to bridge assets between rollups when price discrepancies arise, but existing bridges are slow and often introduce additional risk vectors (custodial risk, smart contract vulnerabilities).

Key Examples of Liquidity Fragmentation Impact in DeFi

-

1. Slippage and Price Inefficiency on Uniswap v3 Across Rollups: When Uniswap v3 pools are deployed separately on Arbitrum, Optimism, and zkSync Era, liquidity is split, causing higher slippage and worse swap rates for users compared to a unified pool on Ethereum mainnet.

-

2. Divergent Lending Rates on Aave v3: Aave v3 operates isolated markets on Polygon, Arbitrum, and Optimism. This leads to inconsistent supply and borrow rates for the same asset (e.g., USDC), as liquidity cannot freely flow between rollups, reducing capital efficiency.

-

3. Missed Arbitrage Opportunities Due to Slow Bridging: Traders seeking to arbitrage price differences for assets (such as ETH or USDT) between StarkNet and Optimism face delays and costs when moving funds via bridges, often missing out on profit opportunities due to fragmented liquidity.

-

4. Cross-Rollup MEV Extraction Challenges: The lack of shared sequencers between rollups like Arbitrum and zkSync Era makes it difficult for searchers to execute atomic arbitrage across rollups, resulting in unrealized MEV and less efficient markets.

-

5. Reduced Composability in DeFi Protocol Stacks: Protocols such as Curve Finance and Balancer are forced to deploy separate contracts on each rollup, limiting the ability to compose strategies (e.g., yield aggregation) across L2s and hindering innovation in DeFi.

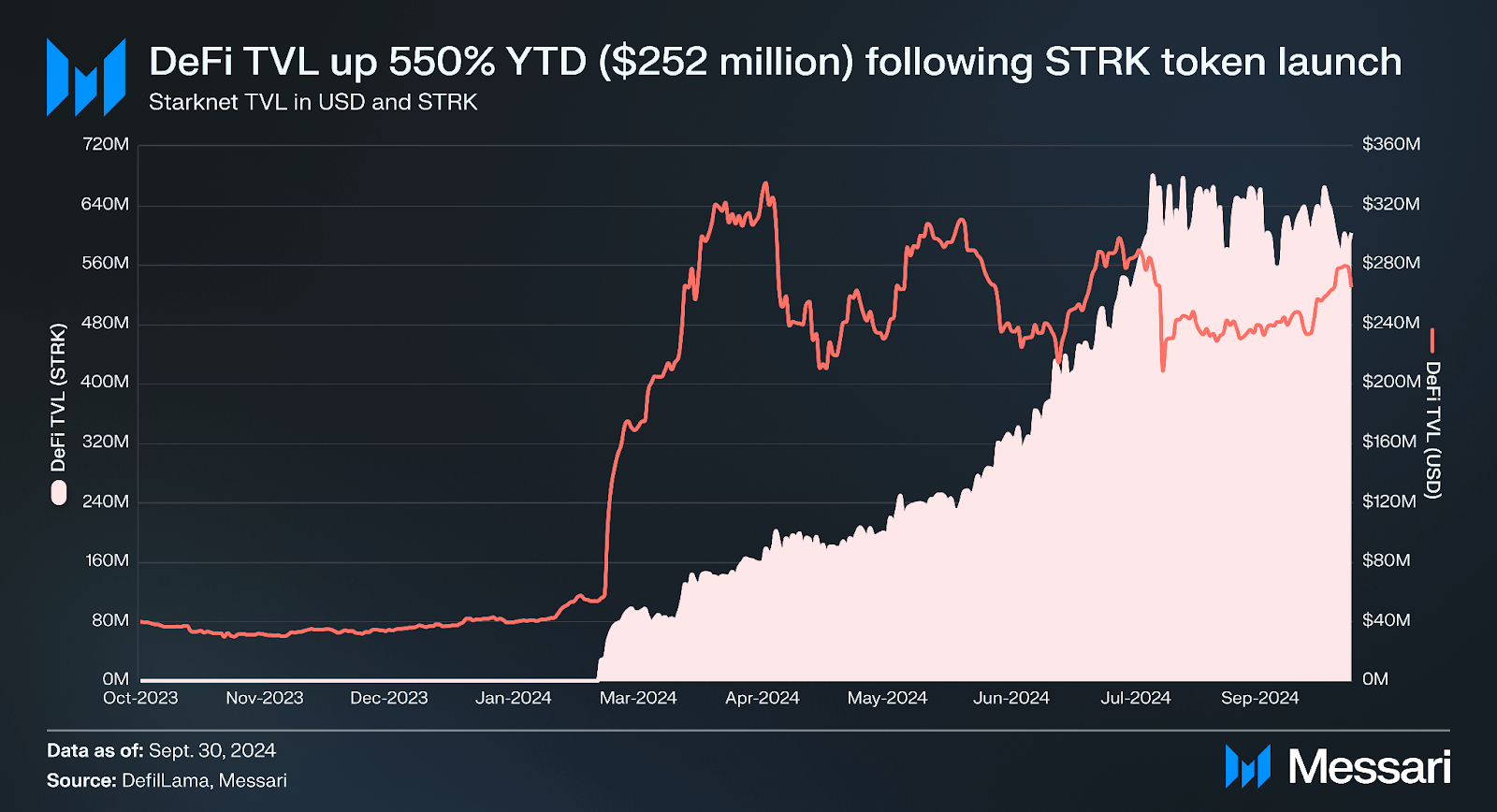

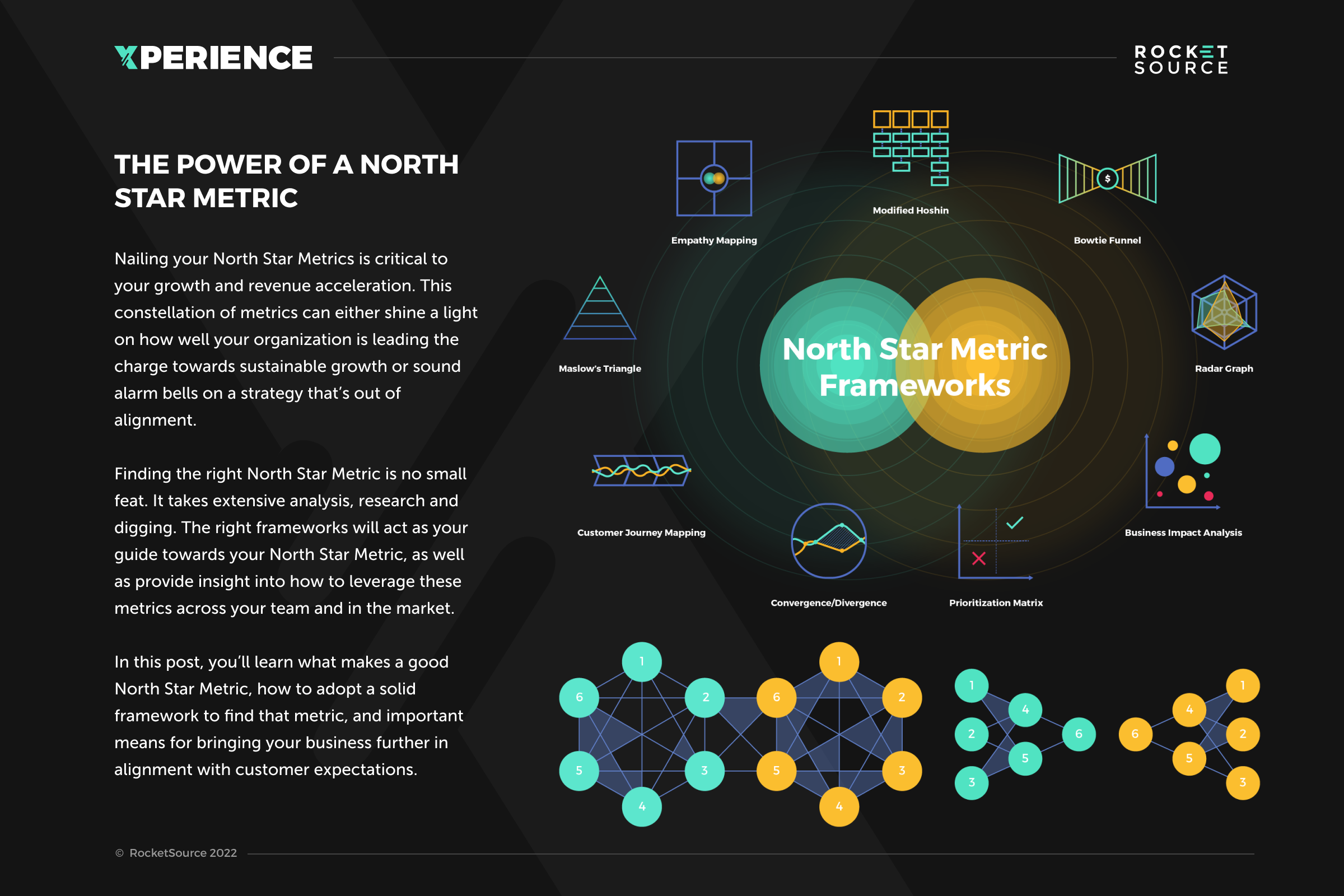

Toward Protocol Solutions: Shared Sequencers and Cross-Rollup Liquidity

The industry has begun responding with architectural innovations designed to unify DeFi liquidity at scale:

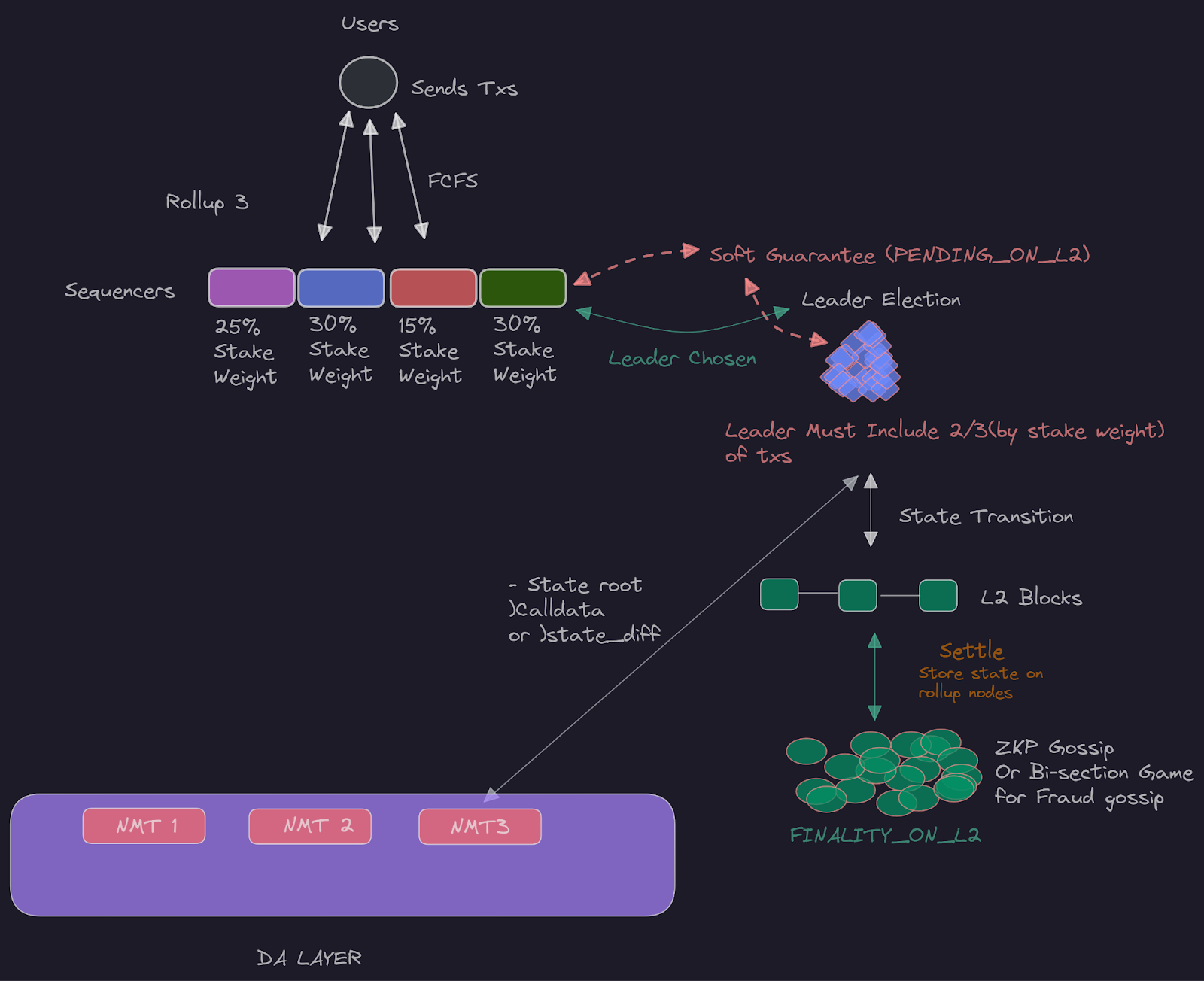

- Shared Sequencers: Shared sequencing protocols enable multiple rollups to coordinate transaction ordering through a common sequencer set. This allows atomic cross-rollup transactions, enabling composability and shared state without requiring assets to leave their origin chain. For an in-depth primer on shared sequencing mechanics and their role in defragmenting L2s, see this analysis on Ethereum’s fragmentation.

- Cross-Rollup Liquidity Protocols: Projects are developing cross-chain AMMs and universal bridging mechanisms that facilitate seamless asset movement without centralized custodianship or excessive latency.

- Based Rollups: By inheriting Ethereum’s native sequencing layer directly (rather than using external validators), based rollups align security guarantees while enabling shared state access, helping pool liquidity globally rather than just locally.

The convergence toward these solutions signals a new phase in DeFi’s evolution, one where interoperability is not an afterthought but a first-class primitive.

Yet, protocol solutions are not without trade-offs. Shared sequencer protocols, for example, must address the complexities of fair ordering and mitigate the risk of cross-rollup MEV (Maximal Extractable Value) exploitation. As DeFi liquidity becomes more interconnected, new attack surfaces emerge, sequencer collusion and transaction reordering could threaten both user trust and capital safety. The challenge lies in designing sequencing layers that are credibly neutral and resilient to manipulation.

Meanwhile, cross-rollup liquidity protocols such as hyper-bridges and decentralized solver pools are working to abstract away the boundaries between rollups. These systems aim to deliver near-instant asset transfers and unified liquidity pools, but their implementation is non-trivial. Protocols must ensure robust security guarantees while minimizing latency, no easy feat given the asynchronous nature of most rollup designs.

Emerging Architectures: Aggregation and Standardization

Another promising direction is the development of aggregated rollups. By combining assets from multiple L2s into a single, composable environment, aggregated rollups can dramatically enhance capital efficiency. This model not only improves swap depth but also unlocks new forms of cross-protocol strategies previously impossible in siloed environments.

The push for standardized L2 protocols further accelerates this trend. By adopting common frameworks for state proofs, messaging, and settlement finality, rollups can lower integration costs for dApps and liquidity providers alike. Standardization is key to ensuring that future innovations, such as universal AMMs or global lending networks, are accessible across the superchain rather than locked into isolated silos.

Leading Projects Tackling Rollup Liquidity Fragmentation

-

Espresso Sequencer: A decentralized shared sequencer network designed to coordinate transaction ordering across multiple rollups, enabling atomic cross-rollup transactions and reducing liquidity silos.

-

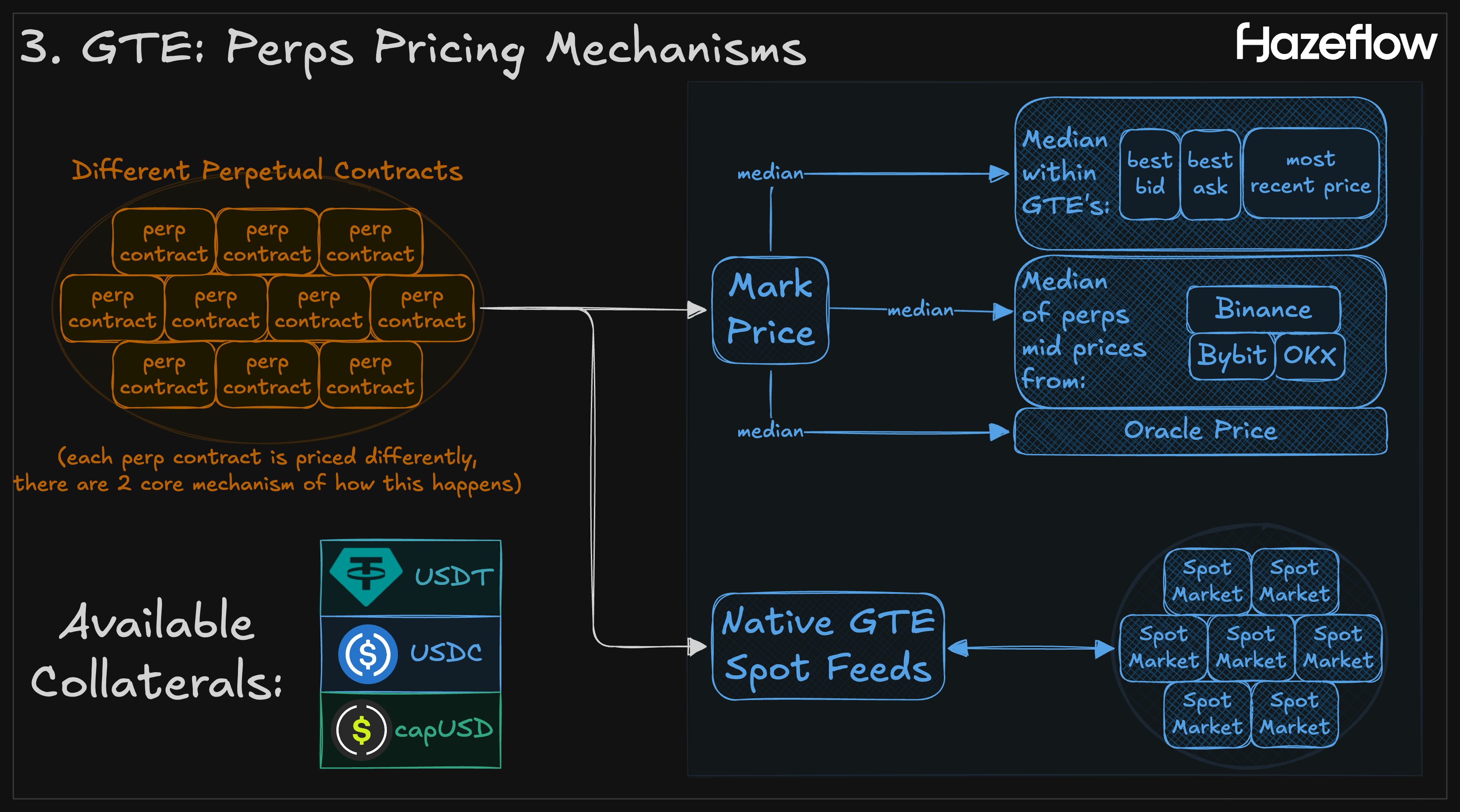

Hazeflow: A protocol focused on merging liquidity pools across all rollups through shared sequencers, aiming to minimize local fragmentation and facilitate global liquidity aggregation.

-

Polygon AggLayer: Polygon’s Aggregation Layer connects multiple L2s and rollups, enabling shared liquidity and unified user experience across the Polygon ecosystem and beyond.

-

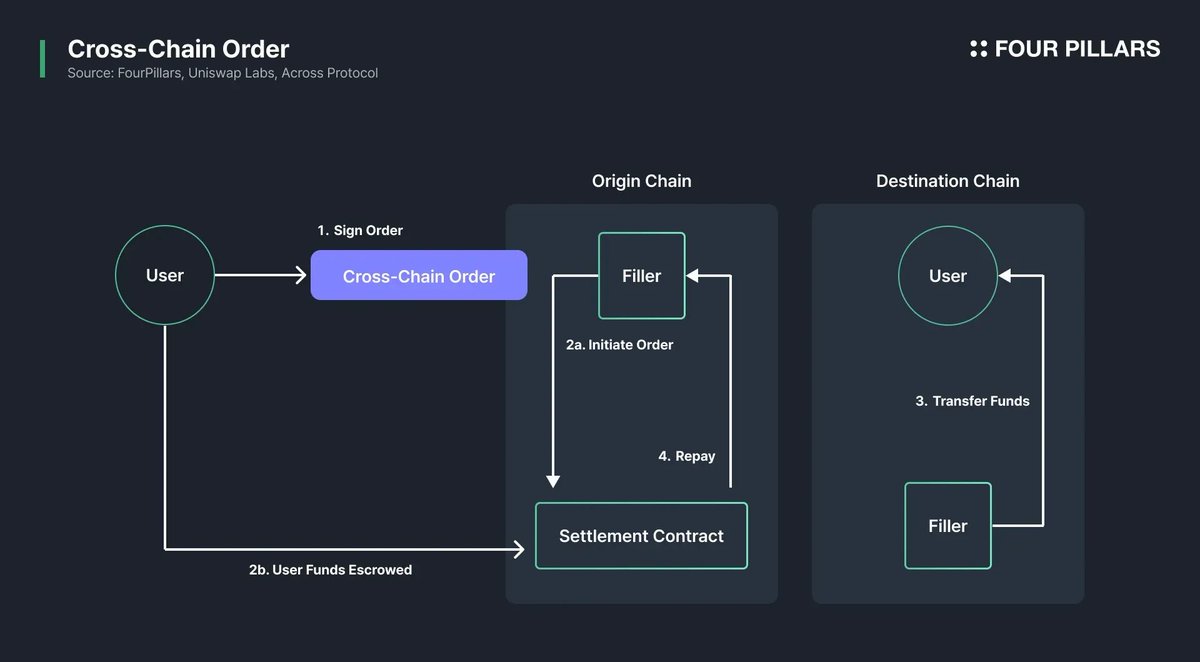

Across Protocol: A cross-rollup bridge and AMM that facilitates fast, secure transfers and liquidity sharing between major Ethereum rollups, improving capital efficiency.

-

UniswapX: Uniswap’s intent-based protocol that aggregates liquidity across L1 and L2s, allowing users to access the best prices and deepest pools regardless of the underlying rollup.

-

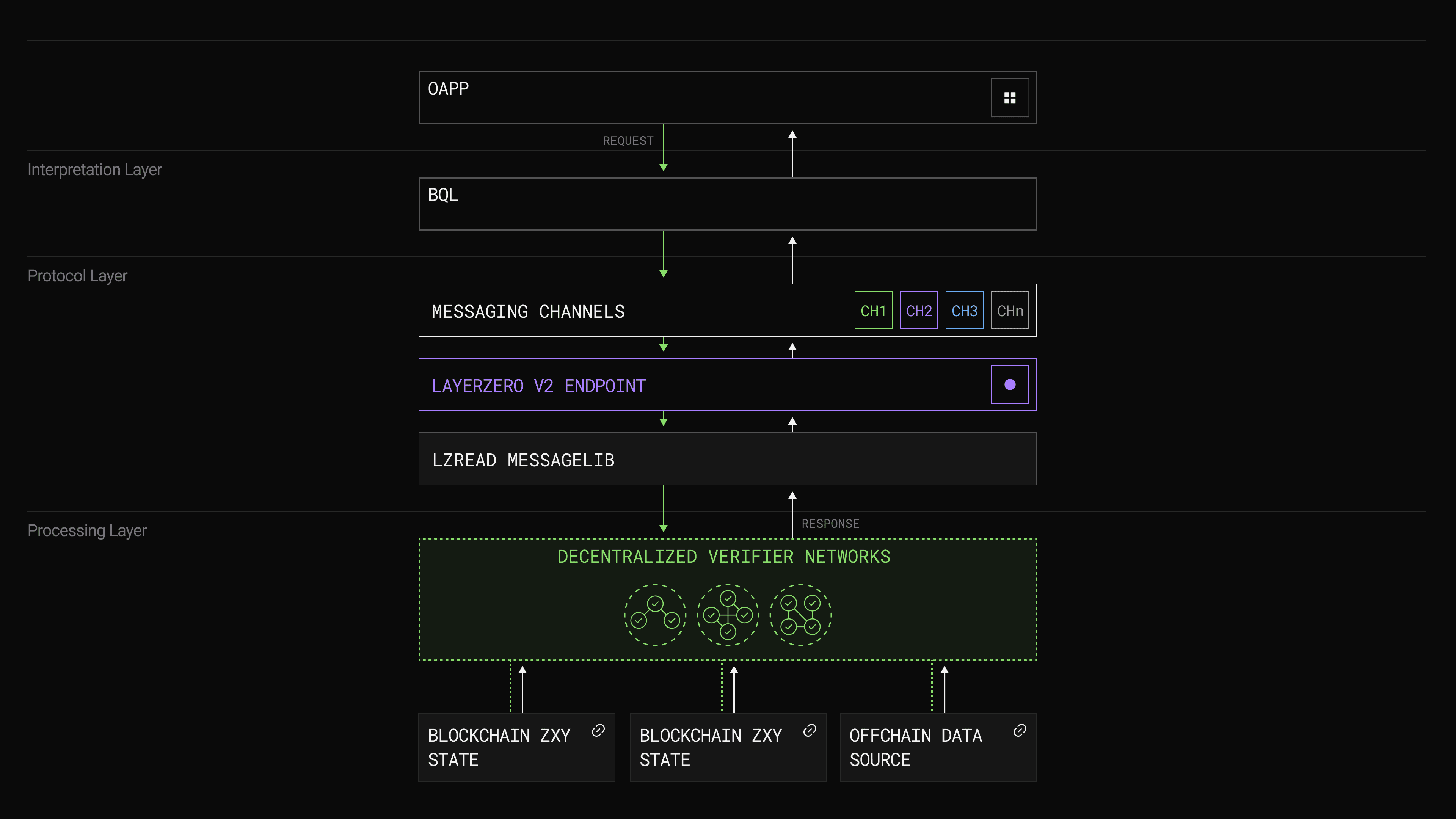

LayerZero: An interoperability protocol supporting omnichain messaging and cross-chain liquidity, allowing DeFi applications to seamlessly access assets across rollups.

-

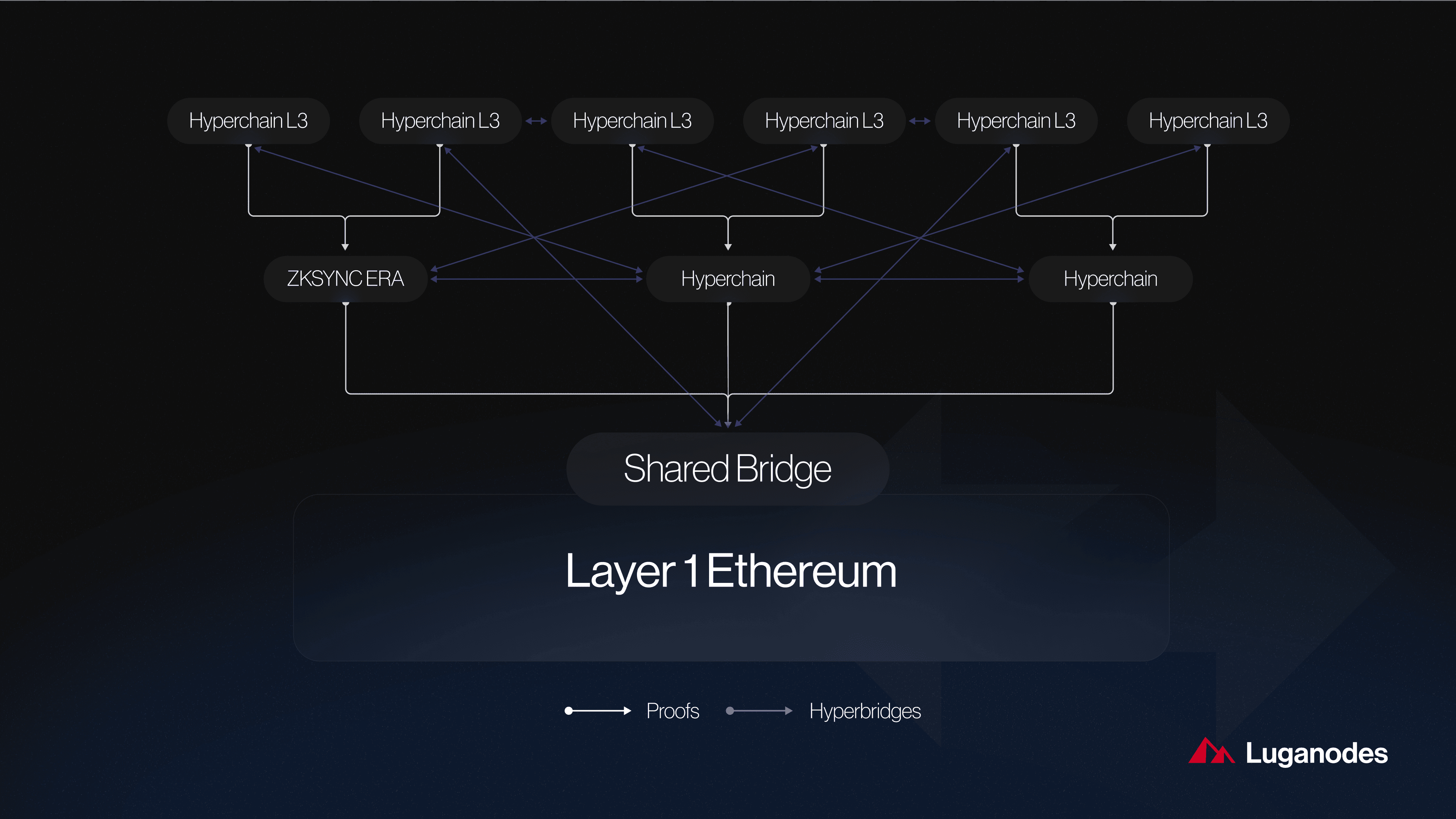

zkSync Hyperchains: zkSync’s modular L2 solution that supports interoperable hyperchains, enabling shared liquidity and composability across zkSync-powered rollups.

-

Optimism’s Superchain: A network of interoperable OP Chains (rollups) that share security, sequencing, and liquidity, reducing fragmentation within the Optimism ecosystem.

-

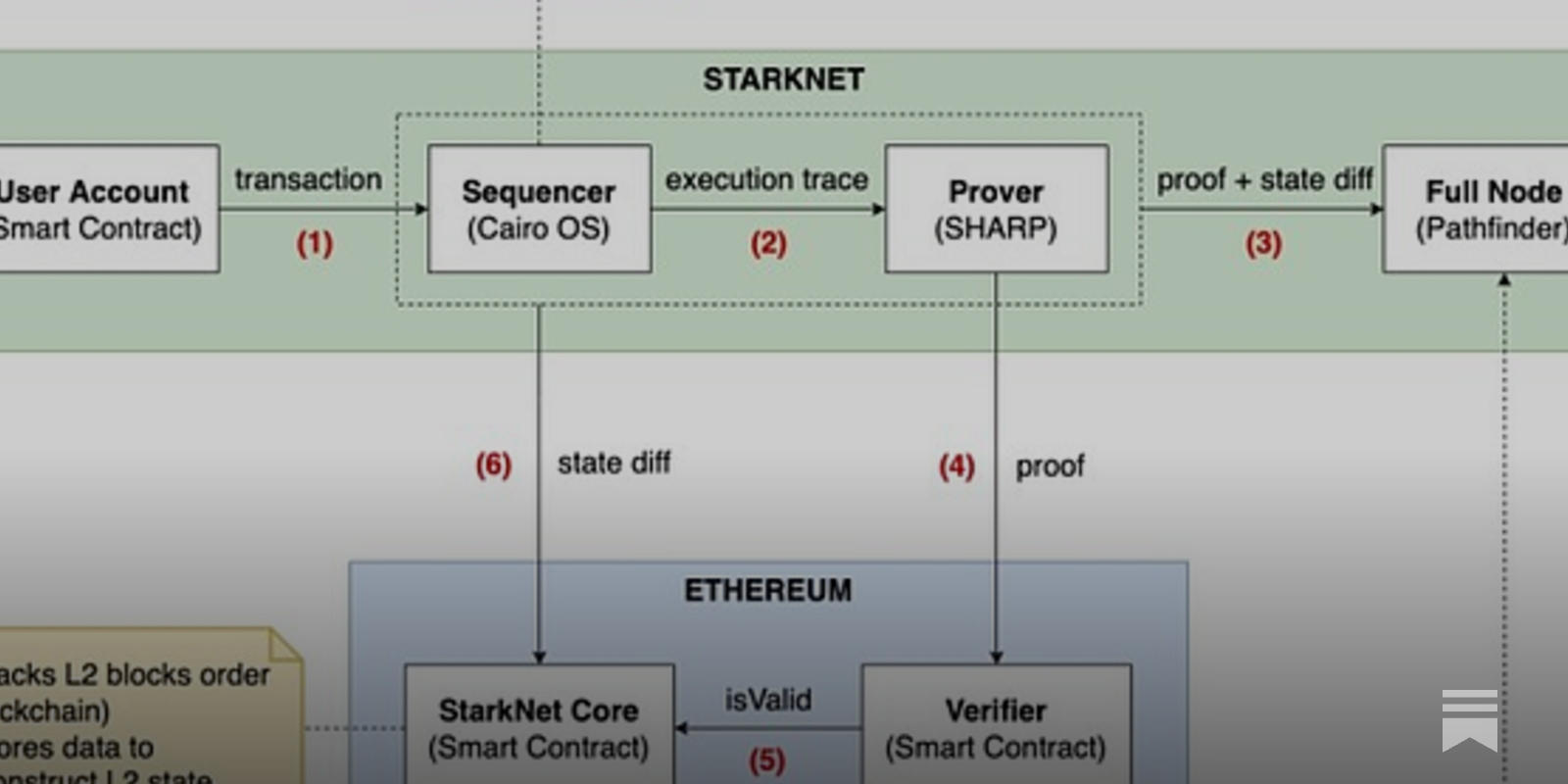

StarkNet’s Shared Sequencer Initiative: StarkNet is developing shared sequencing infrastructure to coordinate transaction ordering and liquidity flow across StarkNet-based rollups.

-

Hop Protocol: A cross-rollup bridge and AMM that enables efficient asset transfers and liquidity pooling between Ethereum rollups, reducing fragmentation and slippage.

The Road Ahead: From Fragmentation to Superchain Synergy

The trajectory is clear: DeFi’s long-term health depends on overcoming rollup liquidity fragmentation. As new primitives like shared sequencers mature, and as aggregation layers gain adoption, the barriers between L2s will erode in favor of a unified capital layer. This transition will require persistent diligence around security assumptions and a willingness to coordinate on standards across fiercely independent developer communities.

The vision of a seamless superchain ecosystem, where users can deploy capital anywhere on Ethereum’s modular stack without friction or fragmentation, is within reach. The next wave of protocol development will define whether DeFi realizes its promise as a truly global financial substrate or remains hampered by balkanized liquidity pools.

If successfully implemented, these solutions will not only improve user experience but also catalyze innovation at every layer of the stack, from DEXs to lending platforms to complex derivatives markets. The outcome will be a more efficient, accessible, and resilient DeFi landscape for all participants.