As of February 2026, Ethereum hovers at $1,940.01, yet DeFi traders on Base execute complex swaps for under a penny per transaction. OP Superchain rollups, powered by the OP Stack, deliver this efficiency, slashing rollup transaction costs 2026 while boosting throughput. Base leads the pack, capturing over 71% of Superchain sequencer fees in 2025 through compressed L1 data posting and shared security.

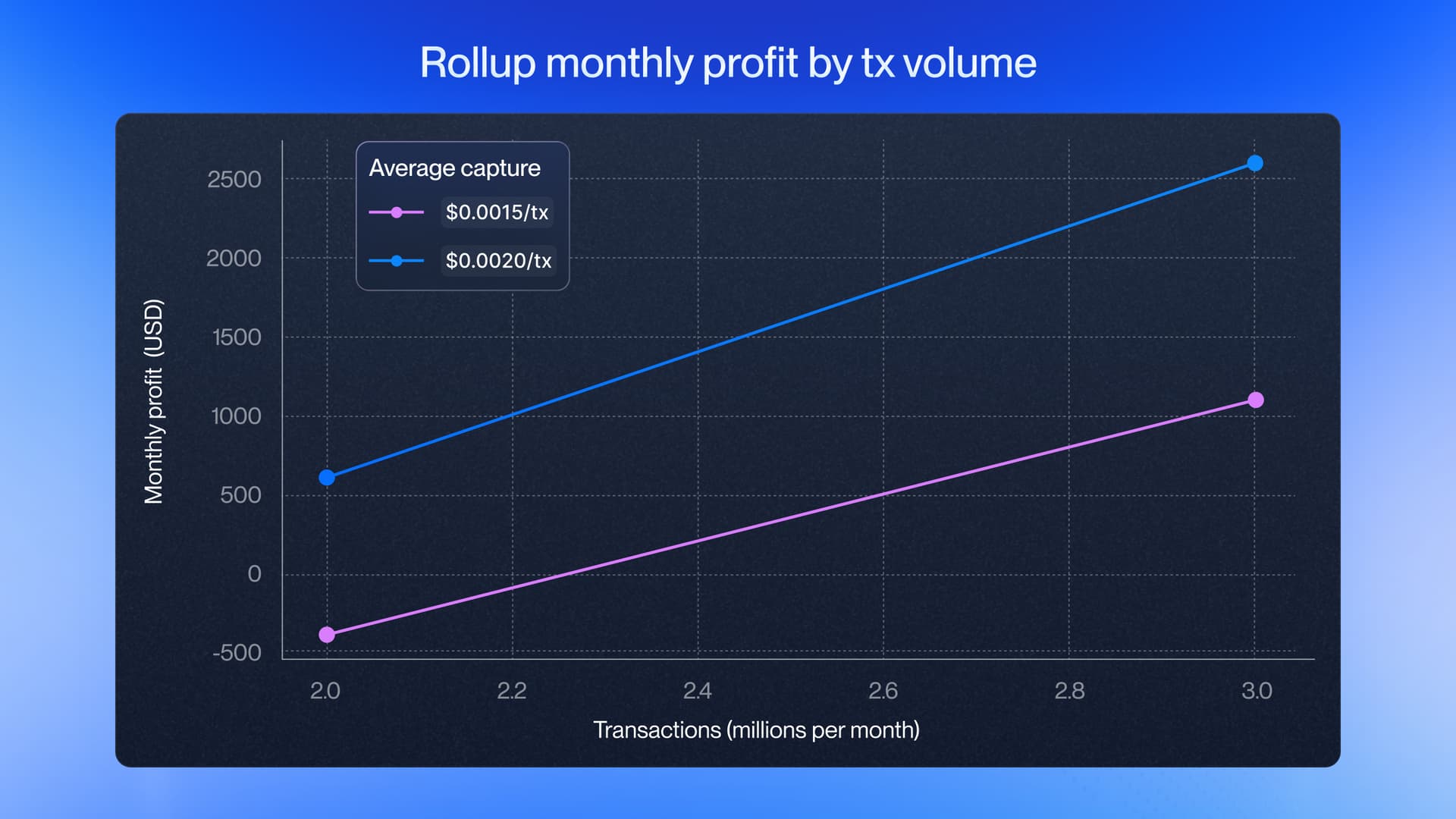

Optimistic rollups batch transactions off-chain, assuming validity until challenged. Dispute windows, typically seven days, resolve via Ethereum L1 fraud proofs. On Base, this yields fees around $0.001, down from $0.20-$0.60 on early Optimism. Daily user spend hits $50K-$100K, all funneled to sequencers.

OP Stack: Modular Backbone for Superchain Rollups

The OP Stack standardizes rollup deployment. Open-source modules handle execution, settlement, and governance. Chains like Base customize sequencers and bridges while adhering to the Superchain’s fault-proof system. Blocks compress before L1 writes, curbing the dominant cost vector. Result: Base chain low fees that scale with adoption.

Superchain interoperability shines via unified bridges and shared sequencing plans. No more siloed L2s; atomic cross-chain swaps emerge. Developers fork Base configs for DeFi apps, inheriting low-latency MEV auctions and data availability.

OP Chains must contribute the greater of 2.5% sequencer revenue or a fixed share under the Standard Rollup Charter.

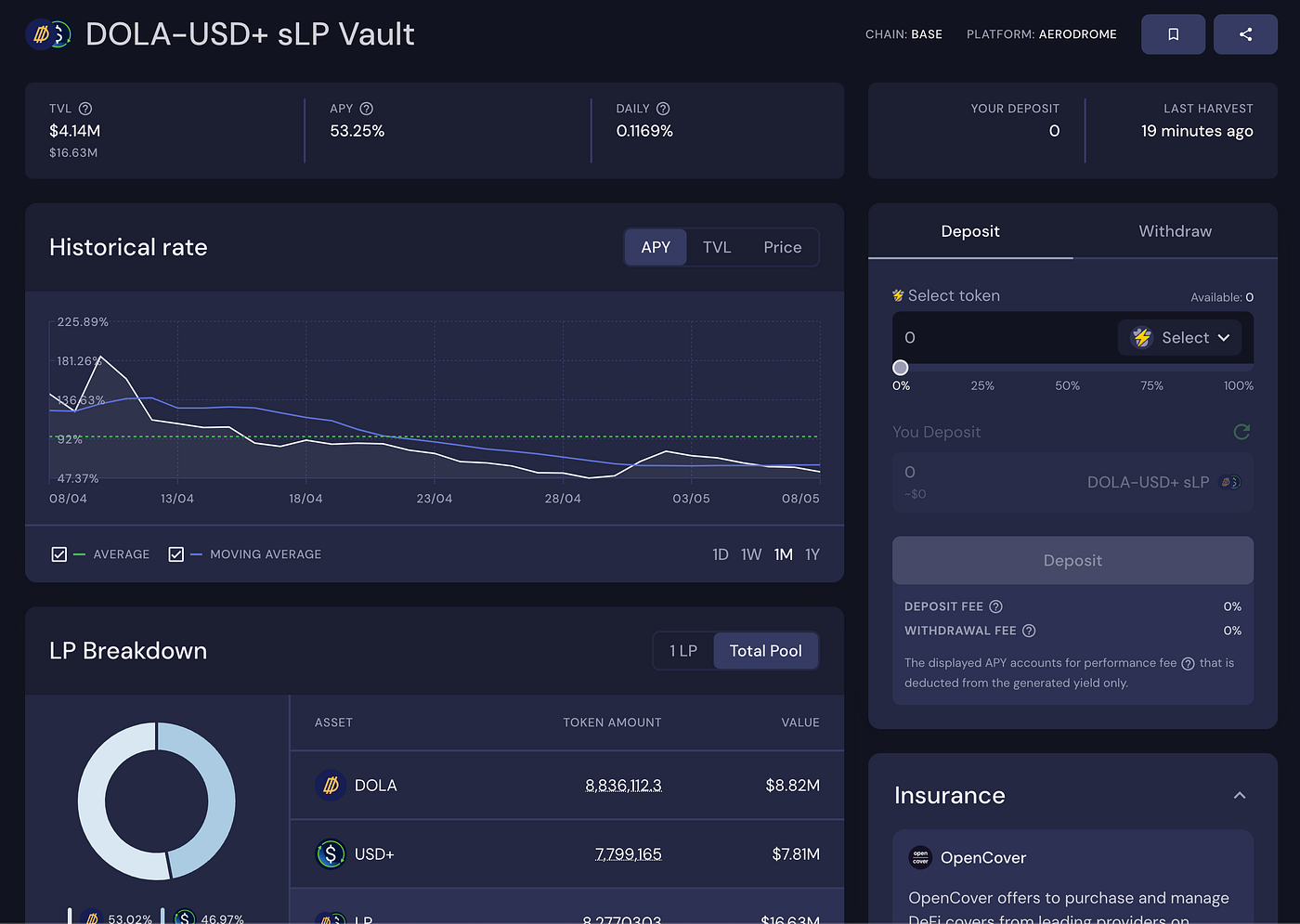

This revenue model sustains growth. Base’s TVL surged to $5 billion by October 2025, a 48% six-month gain, drawing DeFi liquidity from high-fee L1.

Base Dominance: 71% of Superchain Revenue

Base processes the bulk of Superchain activity. Its sequencer pockets most fees at sub-penny levels, yet economic tensions brew. Proposals now route 50% of aggregate revenue to OP token buybacks from February 2026, tying token value to ecosystem output.

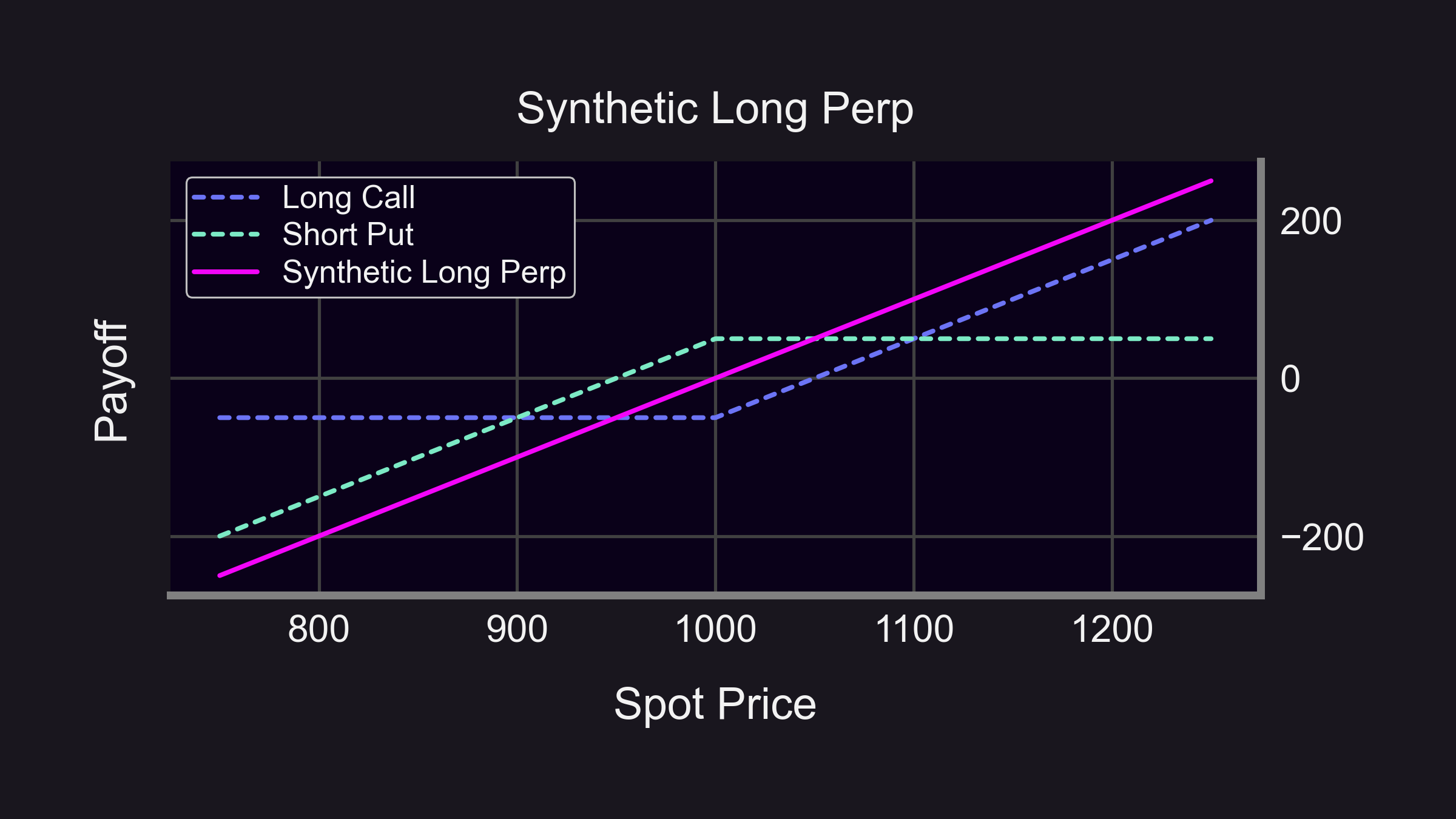

Traders benefit directly. A perpetuals open on Base costs $0.001-$0.01, versus dollars on Ethereum mainnet. High-throughput use cases, from lending to yield farming, thrive without gas wars.

Optimism’s vision materializes: a multi-rollup fabric where Base anchors DeFi volume. Custom OP chains extend this, offering tailored gas tokens or EVM variants for niche protocols.

DeFi Trader Advantages in the Pennies Era

Picture arbitraging yield across protocols: entry fee $0.001, exit same. No more skipping opportunities due to $5 gas. Optimism ecosystem DeFi volume explodes as retail joins institutions.

Sequencer decentralization looms, mitigating centralization risks. Early adopters like Alpha Dune demonstrate throughput exceeding 100 TPS with data reliability. Base’s edge? Coinbase integration funnels users seamlessly.

Revenue recirculation via buybacks could propel OP token amid $1,940.01 ETH stability. Traders position for this alignment, leveraging low-fee environments for high-frequency strategies.

Optimism (OP) Price Prediction 2027-2032

Forecast incorporating Superchain revenue buybacks (50% allocation), Base growth, and DeFi adoption amid low pennies-per-transaction fees

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $6.50 | $12.80 | $22.50 |

| 2028 | $9.20 | $18.90 | $35.00 |

| 2029 | $12.00 | $25.40 | $48.70 |

| 2030 | $16.50 | $34.20 | $65.30 |

| 2031 | $22.00 | $45.80 | $88.50 |

| 2032 | $28.50 | $60.10 | $115.00 |

Price Prediction Summary

OP token is expected to see steady appreciation from 2027-2032, driven by Superchain ecosystem expansion and 50% revenue buybacks, with average prices potentially tripling by 2030 amid bull cycles, though bearish mins account for market volatility and competition.

Key Factors Affecting Optimism Price

- 50% Superchain sequencer revenue allocated to OP buybacks starting 2026, directly supporting price

- Base dominance (71% of OP chain fees, $5B TVL) fueling network growth

- Pennies-per-transaction fees boosting DeFi trader adoption and TVL inflows

- Ethereum L2 scalability improvements via OP Stack reducing costs vs. L1

- Market cycles (2028 halving bull run) and regulatory clarity on rollups

- Competition from Arbitrum/other L2s and potential Superchain forks as risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Buyback mechanics hinge on Base’s outsized role. With 71% of Superchain sequencer revenue flowing through its pipes, even modest fee volumes generate substantial capital for OP token repurchases. At current trajectories, this could stabilize OP amid Ethereum’s $1,940.01 price point, rewarding holders tied to rollup transaction costs 2026 compression.

Trader Playbook: Strategies Optimized for Pennies-Per-Tx

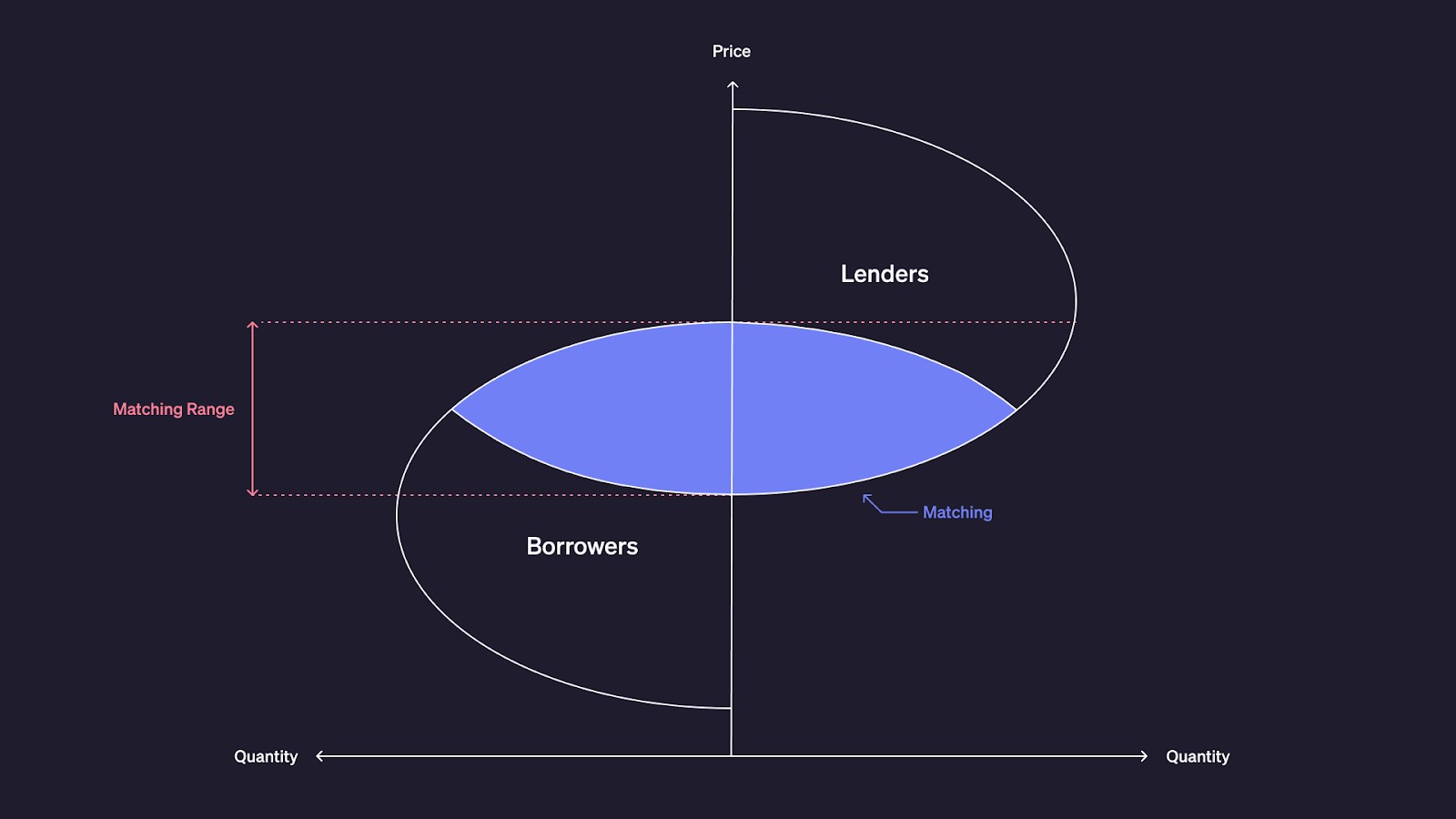

DeFi traders exploit Base’s economics ruthlessly. High-frequency arbitrage thrives: monitor yield gaps across Aerodrome and Uniswap forks, execute in milliseconds at $0.001 per leg. No slippage from gas spikes; position sizing scales infinitely.

Leveraged perpetuals on protocols like Hyperliquid mirrors demand sub-cent entries. A 10x position flips cost just $0.01 round-trip, enabling delta-neutral farms that print basis points hourly. Optimism ecosystem DeFi protocols layer on: restake points from EigenLayer via Base bridges, compounding without L1 friction.

Top 5 DeFi Strategies on Base Superchain

-

Cross-protocol arbitrage: Exploit price differences between Aerodrome and Uniswap V3 DEXes on Base; $0.001 avg fees enable high-frequency bots.

-

MEV-protected perps: Trade perpetuals on Synthetix markets via Flashbots Protect RPCs, dodging front-running at under $0.01 per tx.

-

Yield auto-compounding loops: Use Beefy Finance vaults to auto-compound Aerodrome LP yields, looping deposits seamlessly with penny fees.

-

NFT fractionalization flips: Fractionalize blue-chip NFTs on Zora via ERC-1155, flip shares rapidly thanks to <$0.01 tx costs.

-

Social token launches: Deploy and pump tokens on Friend.tech, viral trading viable at Base Superchain’s pennies-per-tx scale.

Real-world throughput hits 100 and TPS on peak days, per Alpha Dune benchmarks. Compressed L1 calldata keeps fees pinned, even as TVL climbs past $5 billion. Sequencer revenue, now $50K-$100K daily, funds further optimizations like native fault proofs.

Scaling Ethereum: Base as Superchain Anchor

Ethereum scalability Base solves the trilemma outright. OP Superchain rollups inherit Ethereum security via shared proofs, yet parallelize execution across chains. Base’s dominance stems from Coinbase’s sequencer reliability and instant deposits, onboarding millions without tutorials.

Interoperability upgrades in 2026 roll out shared sequencing. Transactions route optimally across OP chains, minimizing latency for multi-hop DeFi. Custom rollups fork Base for gasless gaming or ZK-hybrid DeFi, all settling to the Superchain hub.

Risks persist: sequencer centralization invites MEV extraction, though decentralization roadmaps progress. Revenue sharing under the Charter mandates contributions, curbing free-riders as Superchain expands to dozens of chains.

For developers, OP Stack modularity accelerates launches. Deploy a Base clone in weeks: tweak dispute windows for faster finals, integrate custom bridges. DeFi primitives port seamlessly, inheriting Base chain low fees and liquidity pools.

Traders watch OP buybacks ignite. February 2026 allocations from aggregate fees could mirror successful L2 tokenomics, aligning incentives chain-wide. Amid ETH at $1,940.01, Base positions as the DeFi workhorse, where pennies unlock exponential edges.

OP Superchain rollups redefine viability. What took dollars now costs fractions, pulling volume from competitors. Base cements its lead, powering the next wave of on-chain finance.