Enterprises eyeing blockchain for high-stakes operations in 2026 have a compelling new pathway: OP Enterprise custom rollups on the Superchain. Optimism’s latest push bridges the gap between open-source innovation and enterprise-grade reliability, offering tailored OP Stack chains that slot seamlessly into the multi-rollup ecosystem. With Superchain enterprise deployment now viable at scale, businesses can harness Ethereum’s security while customizing throughput and governance to fit institutional demands.

This isn’t just another rollup framework; it’s a managed service suite designed to accelerate adoption. Drawing from the OP Stack’s modular architecture, OP Enterprise delivers rollup infrastructure for businesses with guarantees on uptime, support, and performance. As Superchain sequencer revenues fuel OP token buybacks, the economic incentives align network growth directly with enterprise usage.

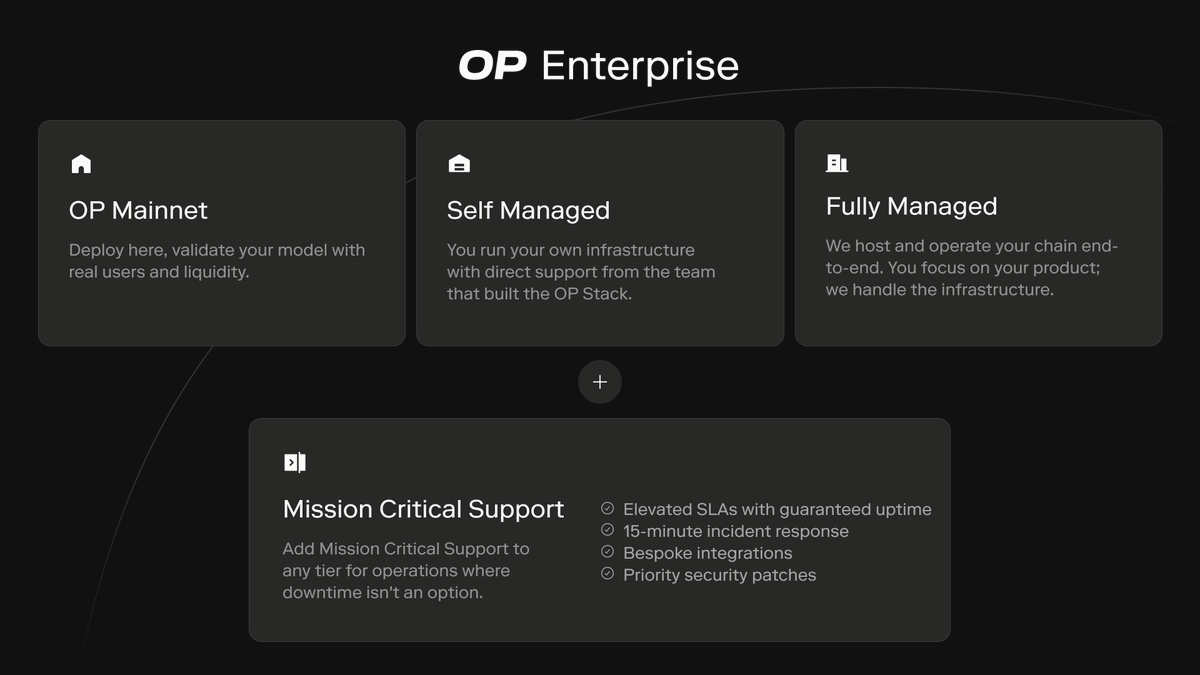

OP Enterprise Tiers: From Fully Managed to Self-Sovereign

Optimism structures OP Enterprise around three tiers, each calibrated for different enterprise appetites for control and support. The fully managed option stands out, providing 24/7 monitoring and 99.99% uptime alongside managed L1 bridge contracts and public RPC endpoints handling up to 5 billion requests monthly. Baseline throughput hits 10 Mgas per second, scalable beyond 100 Mgas, with sub-200ms block times and Stage 1 security via permissionless fault proofs.

Self-managed tiers appeal to teams wanting direct protocol tweaks, complete with 160 hours of custom engineering in year one, security audits, and vendor discounts. For cautious entrants, OP Mainnet deployment offers a low-risk proving ground before spinning up dedicated chains. This tiered approach democratizes OP Stack custom chains, letting fintechs, banks, and supply chain operators test waters without overcommitting resources.

OP Enterprise Key Benefits

-

99.99% Uptime: Fully managed infrastructure with 24/7 monitoring across all tiers.

-

Scalable Throughput: Baseline 10 Mgas/s, up to 100+ Mgas/s with sub-200ms block times.

-

160 Hours Engineering Support: Custom engineering in first year, plus direct protocol support.

-

Stage 1 Security: Permissionless fault proofs, security assessments included.

-

Managed RPC & Bridges: Up to 5B requests/month, L1 bridge contracts, rapid incident response.

Superchain Scalability Meets Enterprise Realities in 2026

By 2026, Superchain scalability 2026 projections paint a picture of interconnected rollups processing billions in daily volume. OP Enterprise rollups position enterprises to capture this, leveraging the Superchain’s shared sequencer and cross-chain messaging. Unlike siloed L2s, these custom chains inherit Ethereum fault proofs and benefit from collective upgrades, reducing the fragmentation that plagues bespoke blockchains.

Consider the data: Optimism’s governance just greenlit 50% of Superchain sequencer revenue for OP buybacks over a 12-month pilot. This ties token value to throughput across chains, creating a flywheel where enterprise deployments boost network fees and, in turn, OP’s price stability. Quantitative models suggest that if enterprise TVL captures even 10% of DeFi’s $200B and, Superchain could rival L1 throughput while slashing costs by 90%.

Customizing OP Chains for Institutional Use Cases

OP Enterprise rollups shine in institutional applications, from tokenized RWAs to private gaming economies. Fintechs deploying on Superchain gain sub-second finality for payments, while banks pilot permissioned variants with compliant bridges. Zeeve’s analysis underscores suitability for DeFi, gaming, and beyond, with OP Stack’s modularity enabling L3 extensions for hyper-specialized workloads.

Compared to rivals like Arbitrum Orbit, OP Stack’s standardization fosters interoperability within Superchain, a moat for enterprises building multi-chain strategies. Alchemy ranks it top for enterprise rollups due to its separation of concerns: execution, settlement, and data availability layers mix-and-match effortlessly. In practice, this means a supply chain firm could fork OP Mainnet, tweak gas limits for IoT throughput, and deploy via op-deployer tools, now upgraded for seamless versioning.

Deployment hurdles that once deterred enterprises- fragmented tooling and versioning issues with op-deployer- are now resolved in OP Enterprise’s streamlined pipeline. GitHub updates confirm compatibility across protocol versions, enabling one-click forks from OP Mainnet. This lowers the barrier for Superchain enterprise deployment, where businesses can iterate on proven stacks without reinventing sequencing or fault proof logic.

Streamlined Deployment: From Blueprint to Live Chain

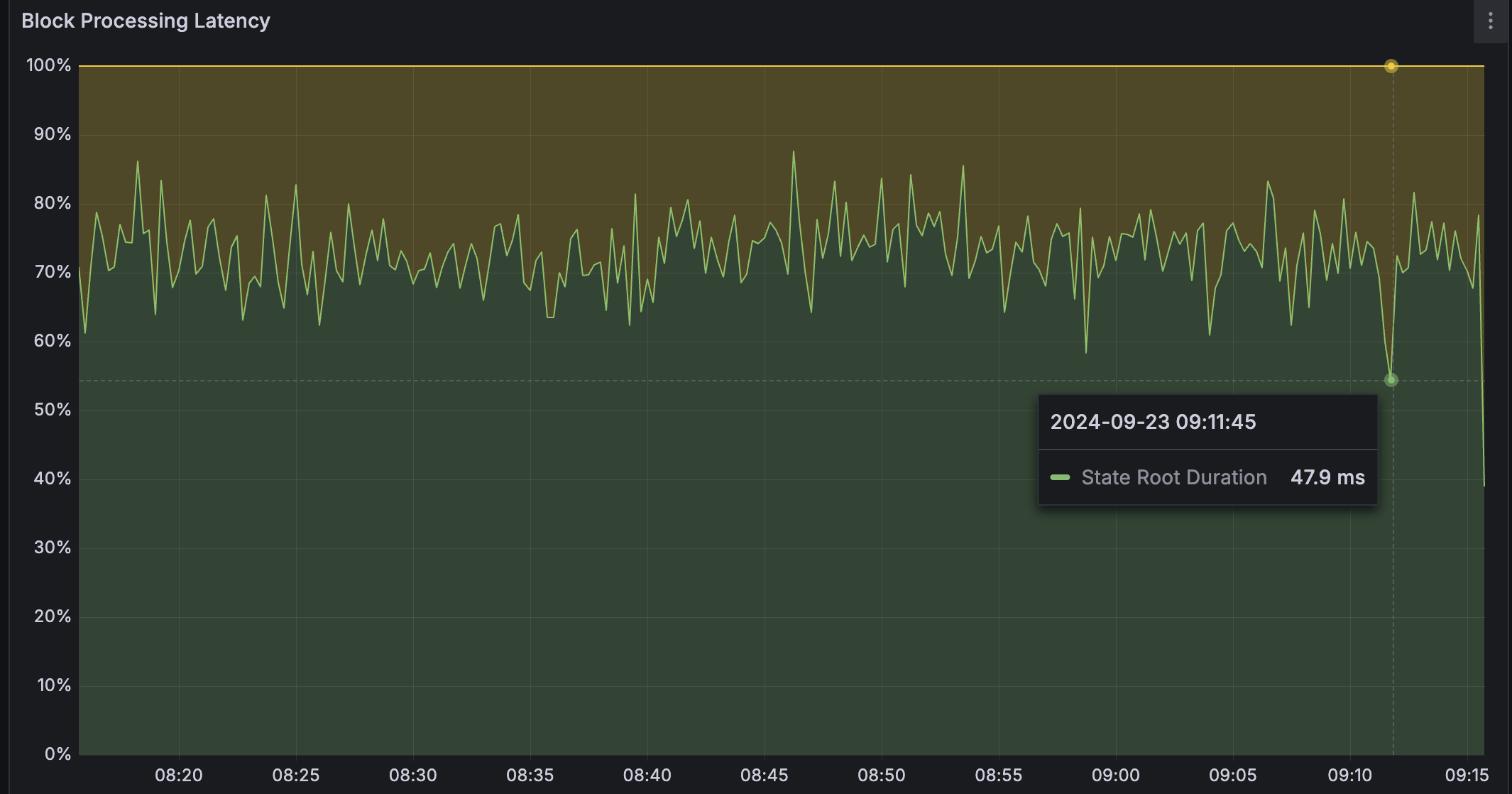

Getting an OP Enterprise rollup live demands precision, but Optimism’s tooling simplifies it into repeatable steps. Enterprises start with governance-approved configs, leveraging the Superchain’s shared standards for instant interoperability. QuickNode’s infra audits highlight OP Stack’s edge in reliability, processing rollups with minimal downtime even under peak loads.

Post-deployment, enterprises tap into collective Superchain upgrades, like the recent protocol enhancements boosting Mgas capacity. This phased rollout- validate on OP Mainnet, then migrate- mitigates risks, aligning with Zeeve’s playbook for institutional L2s and L3s.

OP Enterprise Tiers at a Glance: Performance and Support Breakdown

| Feature | Fully Managed 🏆 | Self-Managed 💼 | OP Mainnet 🌱 |

|---|---|---|---|

| Management | Fully managed infra 24/7 monitoring ✅ |

Self-managed Direct protocol support 🔧 |

OP Mainnet deployment Initial validation phase 🌐 |

| Uptime SLA | 99.99% 🎯 | High availability | OP Mainnet standard |

| Throughput | 10 Mgas/s baseline Scalable to 100+ Mgas/s 🚀 |

10 Mgas/s baseline Scalable to 100+ Mgas/s 🚀 |

OP Mainnet specs 📈 |

| Block Times | Sub-200ms ⚡ | Sub-200ms ⚡ | ~2s (standard) ⏱️ |

| RPC Endpoints | Public Up to 5B req/mo 🌐 |

Public Up to 5B req/mo 🌐 |

Public Up to 5B req/mo 🌐 |

| L1 Bridge Contracts | ✅ Managed | ✅ Managed | ✅ Managed |

| Incident Response | Rapid (minutes) ⏰ | Rapid ⏰ | Rapid ⏰ |

| Engineering Support | 160 hours/yr + custom 🛠️ | 160 hours/yr 🛠️ | 160 hours/yr 🛠️ |

| Security | Stage 1 fault proofs + Assessments 🔒 |

Stage 1 fault proofs + Assessments 🔒 |

Stage 1 🔒 |

| Extras | Vendor discounts 💰 Superchain OP buybacks 📊 |

Vendor discounts 💰 Superchain OP buybacks 📊 |

Vendor discounts 💰 Superchain OP buybacks 📊 |

Choosing the right tier hinges on balancing autonomy with assurances. The table below distills key specs, underscoring why OP Enterprise outpaces generic rollup providers in enterprise contexts.

Comparison of OP Enterprise Tiers

| Tier | Uptime | Throughput | Support |

|---|---|---|---|

| Fully Managed | 99.99% | 10-100 Mgas/s | 24/7 and 160h engineering |

| Self-Managed | High Availability | Custom | Protocol and Audits |

| OP Mainnet | Mainnet Standard | Mainnet | Community |

These metrics aren’t hype; they’re backed by Optimism’s operational track record, where Superchain chains already handle billions in requests monthly. For a fintech processing real-time settlements, the fully managed tier’s sub-200ms blocks mean latency edges over traditional rails, while self-sovereign options suit regulated entities needing audit trails.

Institutional use cases extend further. Picture a bank tokenizing $10B in RWAs: OP Stack’s modular data availability lets them opt for private DA layers, ensuring compliance without sacrificing Ethereum settlement. Gaming consortia build L3s atop custom L2s for player-owned economies, scaling to millions of tx/s via Superchain bridges. Government Blockchain Association notes OP Stack’s simplicity accelerates such pilots, outpacing less standardized alternatives.

The Superchain Flywheel: Revenue, Tokens, and Growth

Economics cement OP Enterprise’s appeal. With 50% of Superchain sequencer revenue earmarked for OP token buybacks in a 12-month pilot, enterprise deployments directly bolster the token’s floor. If OP chains capture modest TVL shares- say 5-10% of institutional inflows projected at $500B by 2026- sequencer fees could generate millions monthly, fueling buybacks and developer grants.

Data models from AggLayer and OKX forecast Superchain eclipsing standalone L2s in throughput, thanks to unified fault proofs and cross-chain comms. Enterprises benefit doubly: cost savings from 90% cheaper txs versus L1, plus liquidity spillovers from public chains. Alchemy’s enterprise rankings place OP Stack first for this reason- its Superchain philosophy turns isolated rollups into a cohesive network effect.

Yet balance tempers optimism. While rollup infrastructure for businesses matures, enterprises must navigate sequencer centralization risks until Stage 2 decentralization lands. Still, permissionless proofs offer robust Stage 1 security, and 160 hours of engineering bridge knowledge gaps.

For portfolio managers like myself, OP Enterprise signals a pivot: blockchain’s enterprise chapter favors interoperable stacks over isolated experiments. In 2026, firms ignoring Superchain scalability 2026 risk ceding ground to agile fintechs already live on custom OP chains. The toolkit is ready; the flywheel spins. Deploy early, iterate fast, and watch institutional capital reshape the Superchain.