Picture this: the Superchain, Optimism’s glittering network of interconnected rollups, humming with activity as sequencer revenue surges from a constellation of L2 chains. Suddenly, the Optimism DAO flips the switch, channeling 50% of that revenue straight into monthly OP token buybacks. With an overwhelming 84.4% approval on January 29, this 12-month pilot kicks off in February 2026, marking a seismic shift in how OP captures the ecosystem’s explosive growth. At today’s price of $0.2503, down a modest $-0.0130 (-0.0495%) over the last 24 hours, OP holders are buzzing about what’s next.

Revenue from Superchain sequencers – those tireless engines processing transactions across OP Stack chains – now has a clear destination. Half of the net proceeds will fund recurring OP repurchases on open markets, with bought tokens funneled into the Optimism Collective Treasury. Future governance calls the shots on their fate: burn for scarcity, distribute as staking rewards, or fuel ecosystem grants. This isn’t window dressing; it’s a deliberate pivot tying token economics to real network utility.

Dissecting the Optimism DAO Superchain Revenue Mechanics

Superchain revenue streams from sequencer fees, the lifeblood of rollup scalability. As chains like Base, Worldcoin, and others proliferate under the OP Stack umbrella, these fees compound. The proposal, championed by the Optimism Foundation, locks in 50% allocation to OP buybacks, ensuring monthly executions regardless of market whims. Delegates and tokenholders didn’t hesitate, smashing quorum with that 84.4% yes vote. It’s a masterstroke in optimism dao superchain revenue strategy, transforming idle treasury funds into a deflationary force.

Visualize the flow: Sequencer profits roll in, half scooped up for market buys at prevailing prices like today’s $0.2503. No arbitrary thresholds or caps – just consistent pressure supporting the floor. This counters the dilution critiques that have dogged OP since launch, where governance weight overshadowed economic capture. Now, as Superchain TVL climbs and transaction volumes spike, OP stands to surf that wave directly.

Why OP Token Buybacks Proposal Reshapes Holder Incentives

For OP holders nursing positions around $0.2503, this screams opportunity. Buybacks act like a reverse auction, systematically reducing circulating supply amid growing demand drivers. The Superchain’s multi-rollup vision – seamless interoperability, shared security, unified liquidity – positions it as Ethereum’s scalability powerhouse. By looping revenue back into OP, the DAO signals unshakeable conviction. I’ve tracked rollup patterns for years; this mirrors successful tokenomics loops in ecosystems like Solana’s fee burns or Arbitrum’s incentives, but with Superchain’s networked twist.

Critics might nitpick the 12-month horizon or treasury lockup, but the optics are electric. At 24-hour highs of $0.2696 and lows scraping $0.2499, OP’s resilience shines through. This proposal elevates it beyond a pure governance play, infusing op token buybacks proposal with tangible value accrual. Holders gain not just voting power, but a slice of the Superchain’s prosperity pie.

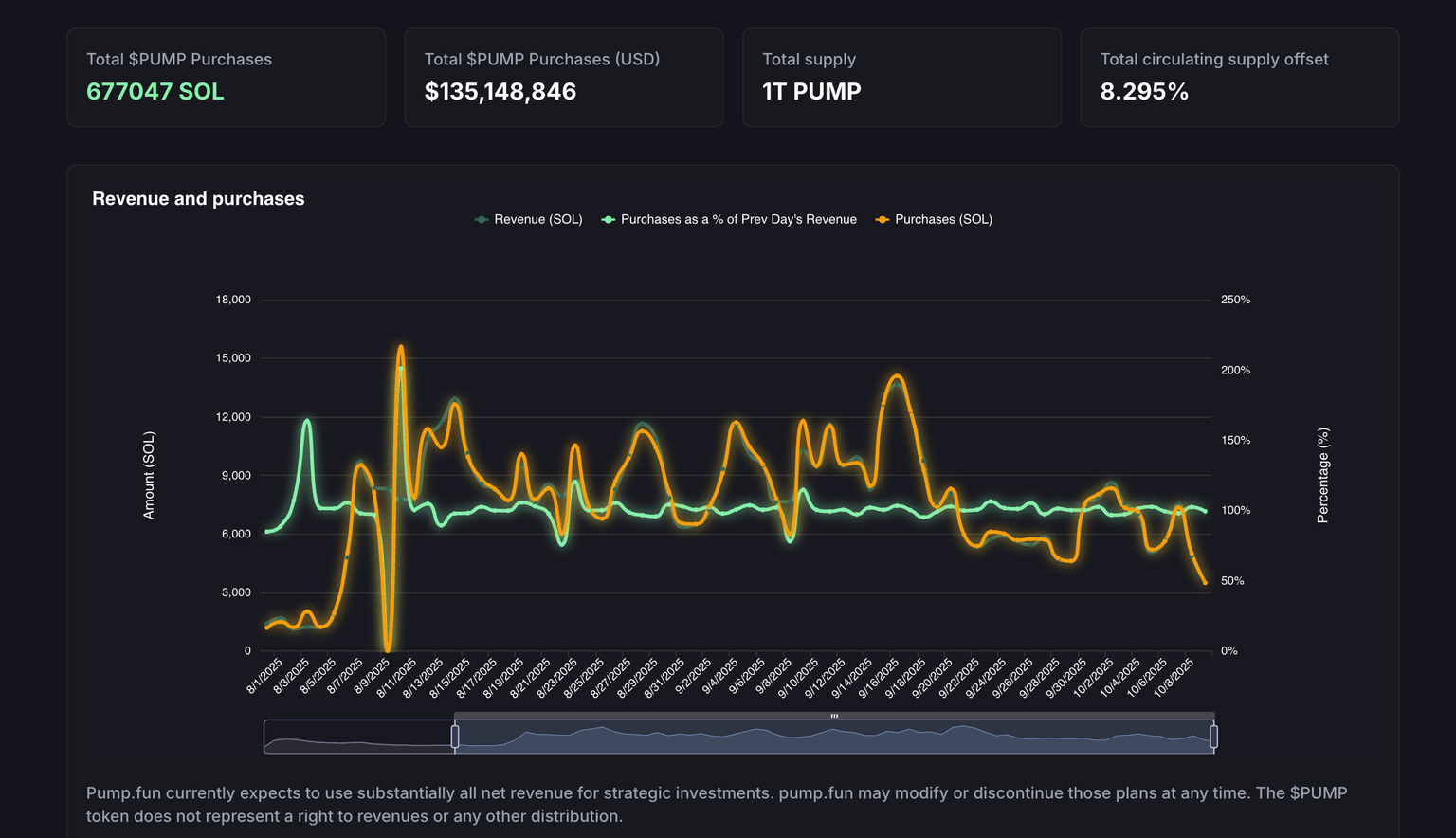

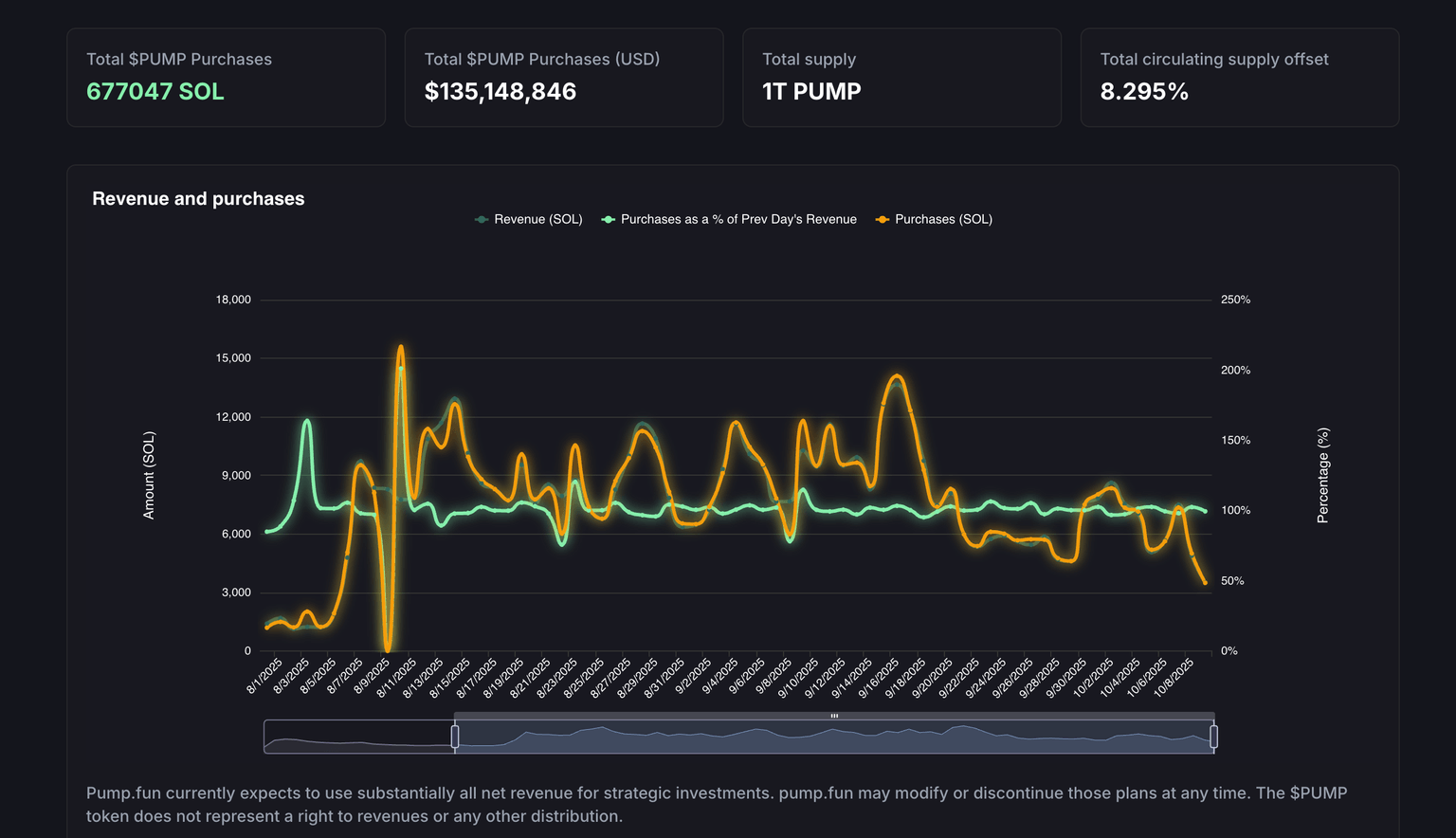

Visualizing Buyback Momentum in the Superchain Ecosystem

Let’s paint the trajectory: Monthly buybacks create rhythmic buying pressure, smoothing volatility in crypto’s wild seas. With Superchain revenue scaling alongside rollup adoption – think DeFi hubs, gaming chains, social apps – even conservative estimates project meaningful OP accumulation. The treasury swells, governance debates ignite over burns or yields, and market perception flips. Patterns I’ve spotted in volatile markets repeat here: revenue-backed tokens outperform when aligned with network flywheels.

Optimism (OP) Price Prediction 2027-2032

Forecast considering 50% Superchain revenue allocation to OP buybacks starting February 2026, market cycles, and L2 adoption trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.35 | $0.75 | $1.40 | +200% |

| 2028 | $0.55 | $1.20 | $2.30 | +60% |

| 2029 | $0.90 | $2.00 | $4.00 | +67% |

| 2030 | $1.40 | $3.20 | $6.00 | +60% |

| 2031 | $2.00 | $4.50 | $8.50 | +41% |

| 2032 | $2.80 | $6.20 | $11.00 | +38% |

Price Prediction Summary

OP token is poised for significant upside from 2027-2032 due to the approved 50% Superchain revenue buyback program, shifting it toward value accrual. Bullish scenarios project up to 44x growth by 2032 amid L2 expansion, while conservative estimates account for market downturns. Average prices reflect base-case adoption growth.

Key Factors Affecting Optimism Price

- Superchain revenue buybacks enhancing token scarcity and value capture

- Ethereum L2 ecosystem growth and Superchain expansion

- Crypto market cycles (post-2024/2028 halvings)

- Regulatory clarity for layer-2 solutions

- Competition from other L2s like Arbitrum and Base

- Technological upgrades in OP Stack and sequencer revenue scaling

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This superchain revenue allocation op isn’t timid tinkering; it’s aggressive ecosystem funding via token strength. As OP Stack chains multiply, revenue multiplies, buybacks amplify. At $0.2503, the entry feels primed for those pattern-spotting traders who thrive on context shifts. Optimism’s bet? The Superchain’s multi-rollup future devours L1 limitations, and OP rides shotgun.

Zoom in on the Superchain’s revenue flywheel: each new OP Stack chain – from DeFi powerhouses to AI-driven apps – pumps sequencer fees into the system. Optimism op stack buybacks now supercharge that loop, creating a self-reinforcing cycle where growth buys tokens, tokens gain value, value draws builders. At $0.2503, OP trades like a coiled spring, ready to unleash as February’s first buyback hits exchanges.

Superchain Ecosystem Funding: Buybacks as the Ultimate Growth Hack

Picture the ripple effects. Superchain revenue isn’t a trickle; it’s a torrent scaling with TVL and TPS across interconnected rollups. Allocating 50% to OP repurchases turns passive treasury holdings into active market support, a tactic I’ve seen ignite rallies in nascent ecosystems. Governance retains flexibility – burn for deflation, stake for yields, or grant for innovation – keeping the Collective in the driver’s seat. This superchain ecosystem funding model dodges the pitfalls of one-off airdrops, opting for sustained, revenue-tied reinforcement.

Optimism Technical Analysis Chart

Analysis by Nina Hollis | Symbol: BINANCE:OPUSDT | Interval: 4h | Drawings: 8

Technical Analysis Summary

Aggressively mark this OPUSDT chart with a bold red downtrend line from the Jan 15 peak at $0.32 connecting to the Feb 17 low near $0.25 to highlight the bearish momentum we’re smashing through. Layer on green horizontal lines at key support $0.25 (buyback floor) and $0.24 (ultimate defense). Flip it bullish with a potential uptrend breakout line from Feb 9 $0.2499 low to current $0.2503. Rectangle the recent consolidation Feb 10-17 between $0.25-$0.27. Fib retracement 0.618 from recent swing high $0.27 to low $0.25 for entry zone. Vertical line on Jan 29 for buyback news explosion. Arrows up on MACD divergence and volume spike callouts for reversal signals. Long position marker at $0.252 entry, short if breaks $0.24.

Risk Assessment: medium

Analysis: High volatility in crypto dump, but buyback catalyst de-risks long bias—tight stops mitigate

Nina Hollis’s Recommendation: Aggressively enter longs now, swing to $0.30+ with high conviction—ride the rollup revival!

Key Support & Resistance Levels

📈 Support Levels:

-

$0.25 – 24h low coinciding with buyback catalyst floor

strong -

$0.24 – Psychological round number and prior swing low

moderate

📉 Resistance Levels:

-

$0.27 – 24h high resistance to first break

moderate -

$0.3 – Recent swing high pre-dump target

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$0.252 – Aggressive long on support bounce with buyback news tailwind

high risk -

$0.249 – High-conviction dip buy if breaks 24h low briefly

high risk

🚪 Exit Zones:

-

$0.3 – Profit target at prior resistance flip

💰 profit target -

$0.24 – Tight stop below key support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Drying up on downside, suggesting exhaustion

Volume spikes on ups but fades on recent reds—bullish divergence

📈 MACD Analysis:

Signal: Bullish divergence forming

MACD line curling up vs price lows, crossover imminent

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Nina Hollis is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Market reaction? Muted so far with that $-0.0130 (-0.0495%) dip, but dig deeper: volume spikes hint at accumulation. Whales positioning around $0.2499 lows eye the upside as buybacks commence. From my vantage in pattern recognition, this setup echoes early Arbitrum moves but amplified by Superchain’s network effects – unified bridges, shared sequencers, cross-chain composability. OP evolves from sidekick to star, capturing value as rollups devour Ethereum’s congestion.

Balancing Risks in the OP Token Buybacks Proposal

Not all sunshine. Revenue volatility looms if sequencer fees swing with crypto winters, potentially starving buybacks. Yet the 12-month pilot smartly tests waters without overcommitment, with treasury backstops. Critics flag opportunity costs – could that 50% fund grants faster? Fair point, but token strength magnetizes talent and capital, a multiplier I’ve witnessed firsthand. At $0.2503, downside feels cushioned by this backstop, highs at $0.2696 teasing breakout potential.

OP Buyback Pros & Cons

-

🚀 Value Accrual: 50% Superchain revenue directly boosts OP token value, shifting it from governance-only to economic capture! (84.4% approved)

-

🔥 Supply Reduction: Monthly buybacks shrink circulating OP supply, enhancing scarcity starting Feb 2026.

-

⚡ Growth Alignment: Links OP price ($0.2503) to Superchain expansion for long-term holder rewards.

-

⚠️ Revenue Volatility: Superchain sequencer fees fluctuate wildly, risking uneven buyback impact.

-

🗳️ Governance Debates: Ongoing fights over treasury use (burn? stake?) spark tokenomics drama.

-

💧 Dilution Risks: Treasury-held OP could dilute if used for incentives instead of burns.

Forward momentum builds. As Base and peers scale, Superchain TVL could double, fees tripling in step. Monthly buys at market prices like today’s create algorithmic support, smoothing paths for listings and integrations. Traders, watch for governance follow-ups: burn votes could spark fireworks. My take? This cements OP as Superchain’s economic heartbeat, blending governance punch with revenue muscle. Patterns scream upside when ecosystems close the value loop.

Charting OP’s Path Through Superchain Expansion

Envision the horizon: Superchain as Ethereum’s velvet rope, rollups queuing for OP Stack magic. Buybacks fuel that expansion, drawing devs chasing interoperability dreams. Holders at $0.2503 hold a front-row ticket to scalability’s gold rush. Revenue allocation isn’t just policy; it’s rocket fuel, propelling OP amid L2 wars. With 84.4% backing, the DAO bets big on multi-rollup dominance, and markets love conviction. Stay visual, spot the patterns, ride the wave.