As Optimism’s OP token trades at $0.1316, reflecting a negligible 24-hour change of -0.000090% with a daily range between $0.1253 and $0.1339, the Superchain ecosystem stands resilient amid Ethereum’s scalability evolution. In early 2026, advancements like native interoperability protocols, shared sequencing via Espresso and Astria, Flashbots’ 200ms confirmations, and push0’s fault-tolerant proofs underscore the OP Stack’s maturity for optimism superchain rollups. Developers and investors eye OP Stack deployment 2026 strategies to harness this infrastructure for custom rollups, prioritizing superchain interoperability and cost optimization.

Deploying rollups on the Superchain demands strategic alignment with Ethereum’s roadmap. This guide outlines six prioritized ethereum rollup strategies: Leverage Shared Sequencing for Seamless Interoperability, Enable Native Fault Proofs Post-Fermina Upgrade, Optimize Batcher and Proposer Configurations for Cost Efficiency, Integrate with Superchain Governance and Unified Bridges, Adopt Modular Data Availability Layers like Celestia, and Automate Deployment Using OP Stack CLI and CI/CD Pipelines. Mastering these positions projects for scalable, interconnected growth.

Leverage Shared Sequencing for Seamless Interoperability

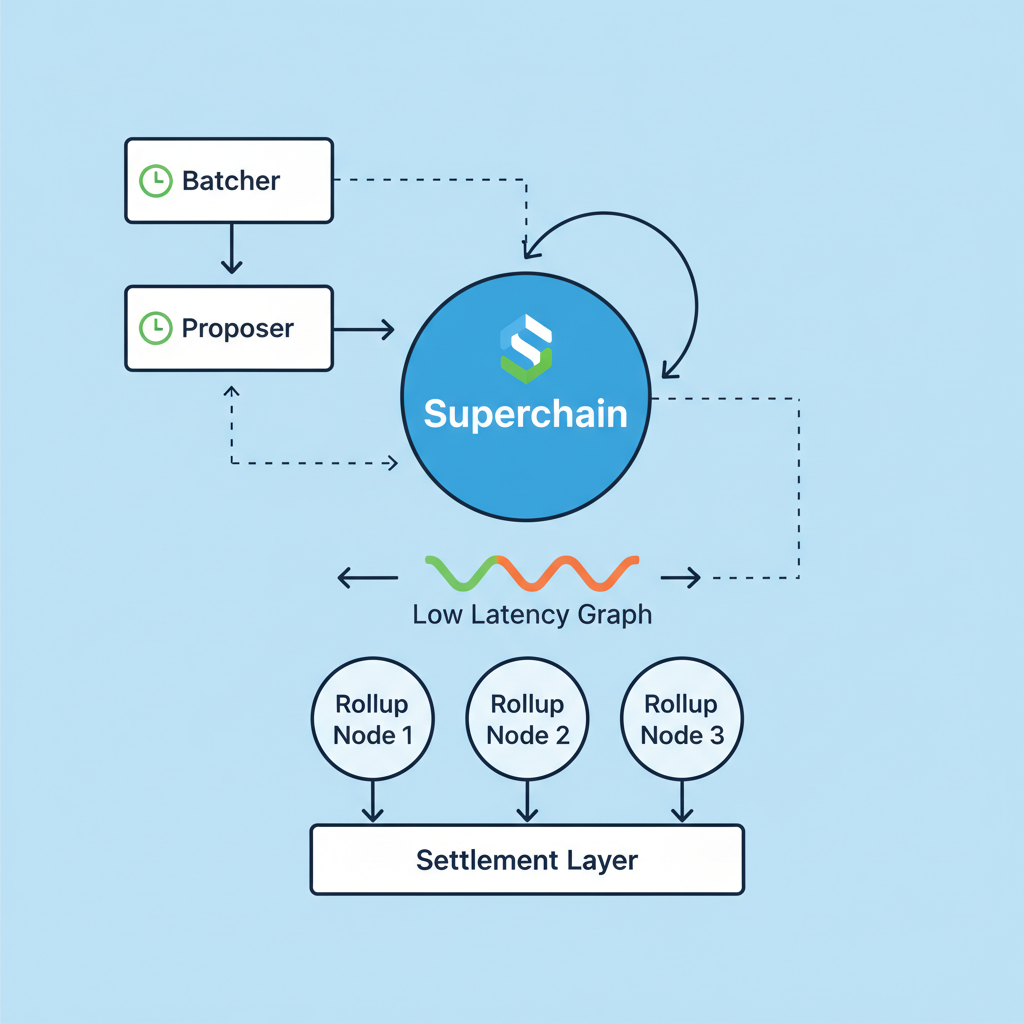

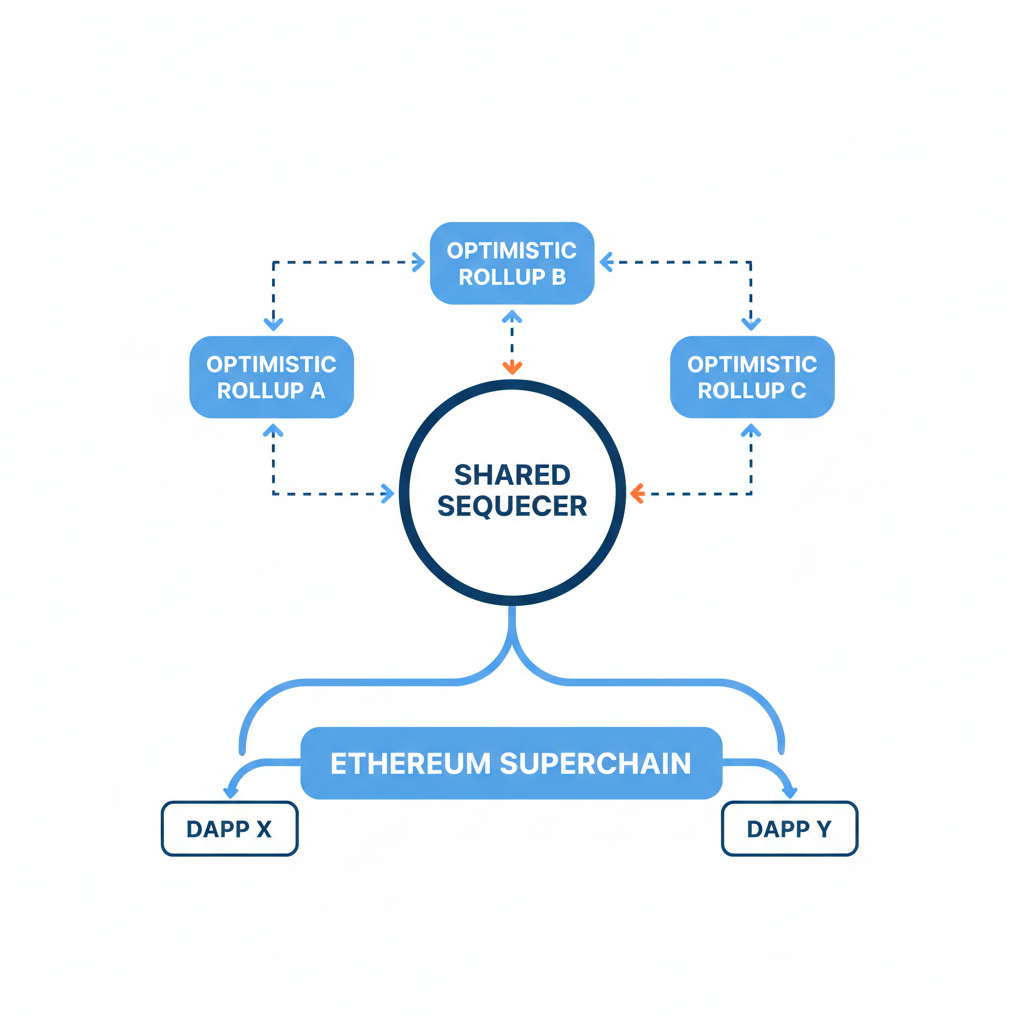

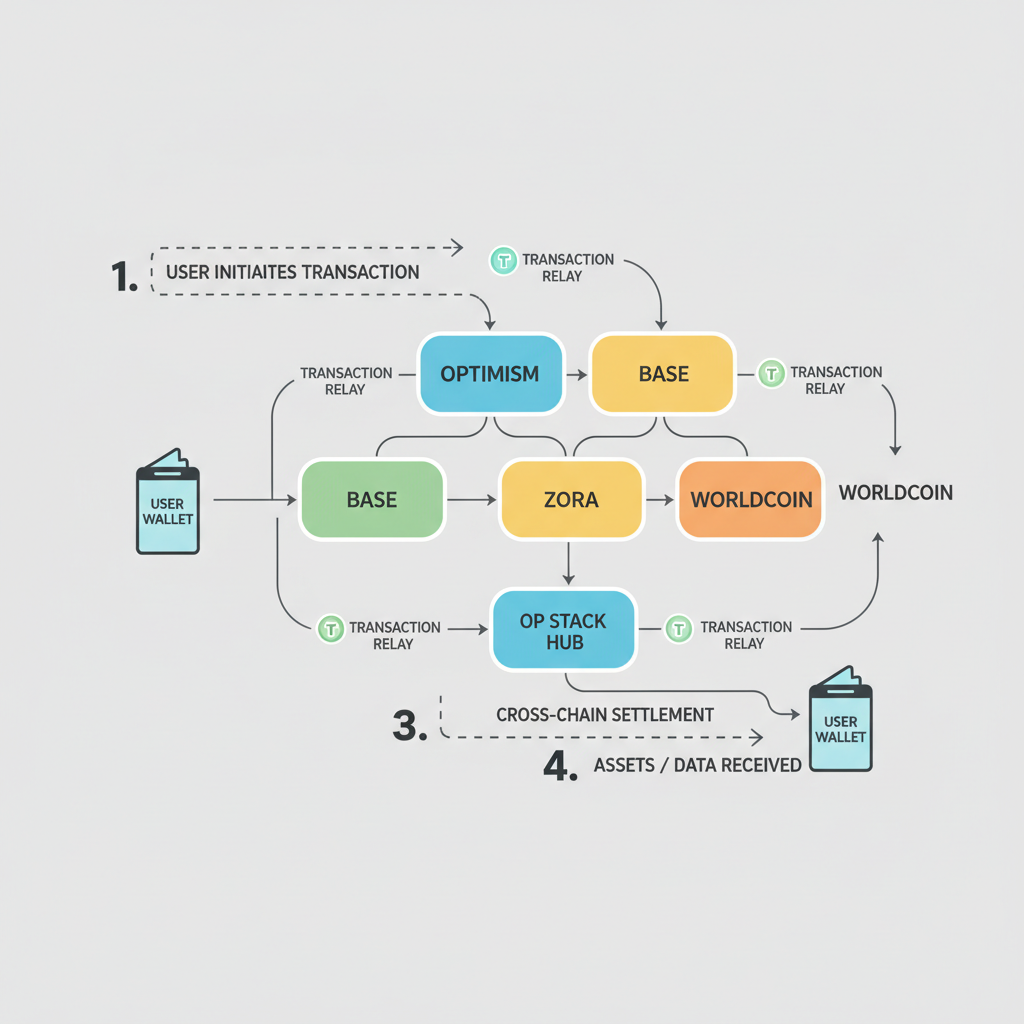

Shared sequencing emerges as the cornerstone of deploy rollup optimism efforts, decoupling block production from individual rollups to enable atomic transactions across chains. Networks like Espresso and Astria, integrated into the Superchain, sequence transactions collectively, ensuring synchronous composability. This mitigates liquidity fragmentation, a persistent hurdle in multi-rollup setups.

Strategically, operators should configure rollups to tap Superchain’s shared sequencers via the message passing protocol. Flashbots’ production-grade infrastructure delivers 200ms confirmations for over 30 partners, slashing latency while upholding fairness. For a custom OP Stack rollup, initialize with op-deployer pointing to shared sequencer endpoints, as detailed in Optimism’s Chain Operator guide. This yields 20-30% throughput gains in cross-chain DeFi flows, per recent benchmarks, without compromising security.

From a portfolio lens, chains leveraging this see elevated TVL retention; OP at $0.1316 reflects market validation of such interoperability bets. Yet, prudent risk management favors diversified sequencer reliance to avert centralization risks.

Enable Native Fault Proofs Post-Fermina Upgrade

The Fermina upgrade activates native fault proofs, supplanting legacy dispute games with efficient, on-chain verification. Push0’s event-driven architecture, leveraging persistent queues for block-sequential proving, minimizes overhead while scaling intra-block parallelism. This fault-tolerant system bolsters Superchain reliability, critical for high-stakes deployments.

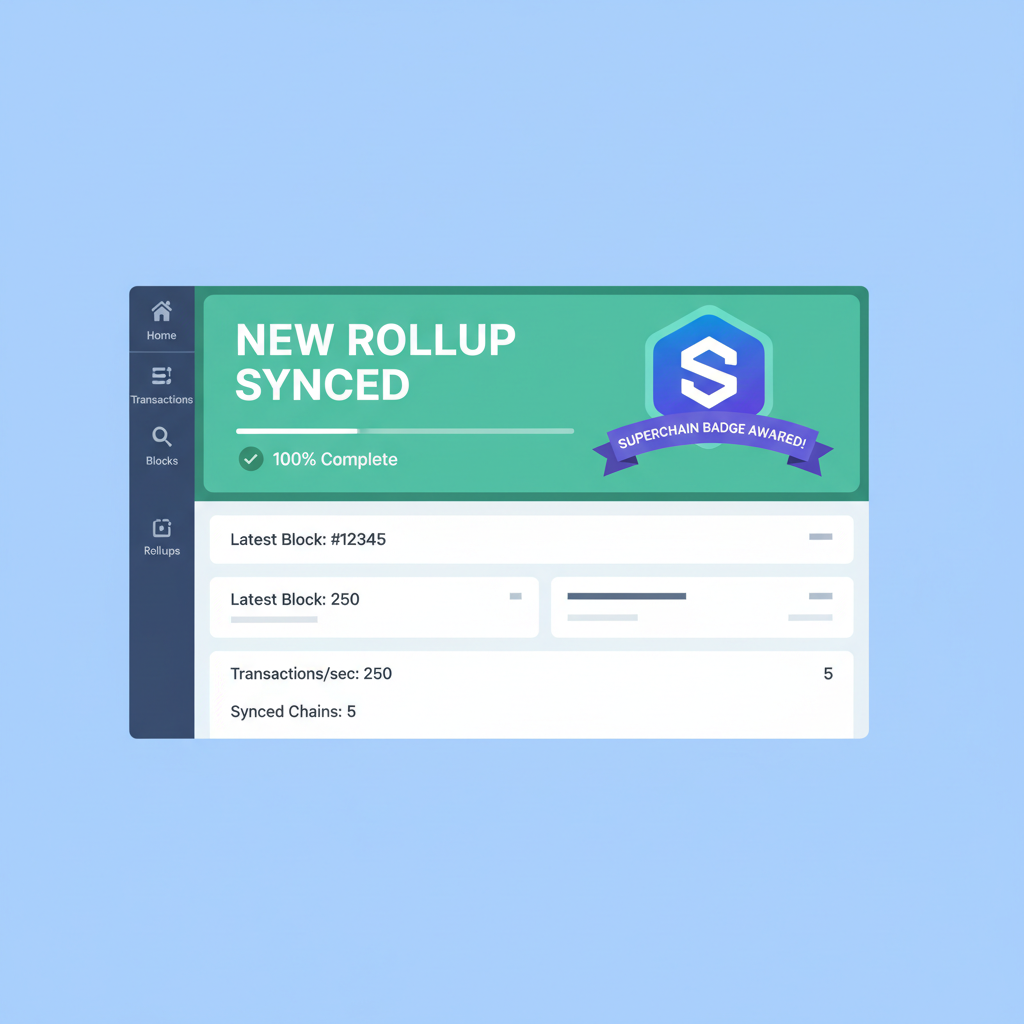

To enable, update your rollup config post-Fermina via OP Stack’s genesis scripts, ensuring dispute game factories align with Superchain standards. Tutorials from Optimism docs and HackMD guide building testnets with rollup nodes validating these proofs. Expect 50% reduction in proof finality times, enhancing user trust and dApp composability.

Strategically, this upgrade correlates with capital efficiency; interoperable chains post-Fermina command premium valuations. Investors note OP’s steady $0.1316 price amid broader L2 volatility, signaling Superchain’s defensive moat.

Optimism (OP) Price Prediction 2027-2032

Projections factoring Superchain rollup deployment strategies, Ethereum scalability milestones, and latest 2026 market developments (current price: $0.1316)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.22 | $0.55 | $1.20 | +320% |

| 2028 | $0.35 | $1.10 | $2.80 | +100% |

| 2029 | $0.60 | $2.00 | $5.00 | +82% |

| 2030 | $1.00 | $3.20 | $8.00 | +60% |

| 2031 | $1.50 | $4.80 | $12.00 | +50% |

| 2032 | $2.20 | $7.00 | $18.00 | +46% |

Price Prediction Summary

Optimism (OP) is set for significant appreciation driven by Superchain advancements like native interoperability, shared sequencing, and low-latency infrastructure. From a 2026 baseline of ~$0.13, average prices could reach $7 by 2032 in a balanced scenario, with min/max reflecting bearish consolidation and bullish adoption surges amid market cycles.

Key Factors Affecting Optimism Price

- Superchain native interoperability reducing liquidity fragmentation

- Shared sequencing and atomic transactions via Espresso/Astria for composability

- Flashbots partnership enabling 200ms confirmations and scalability for 30+ partners

- Fault-tolerant proof generation with Push0 for reliable ZK proving

- Ethereum L2 adoption trends and OP Stack ease of deployment

- Market cycles with potential 2027-2028 bull run

- Regulatory clarity boosting institutional inflows

- Competition from other L2s like Arbitrum and Base

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

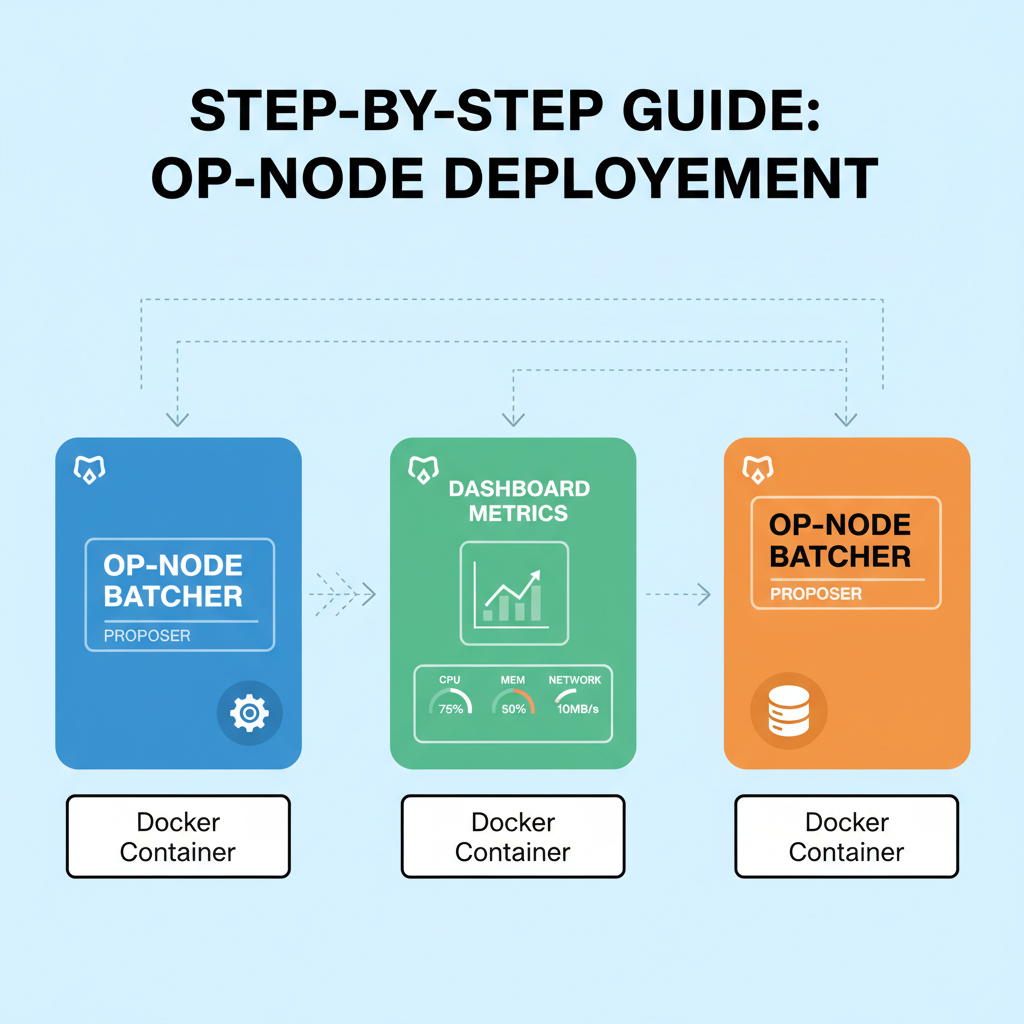

Optimize Batcher and Proposer Configurations for Cost Efficiency

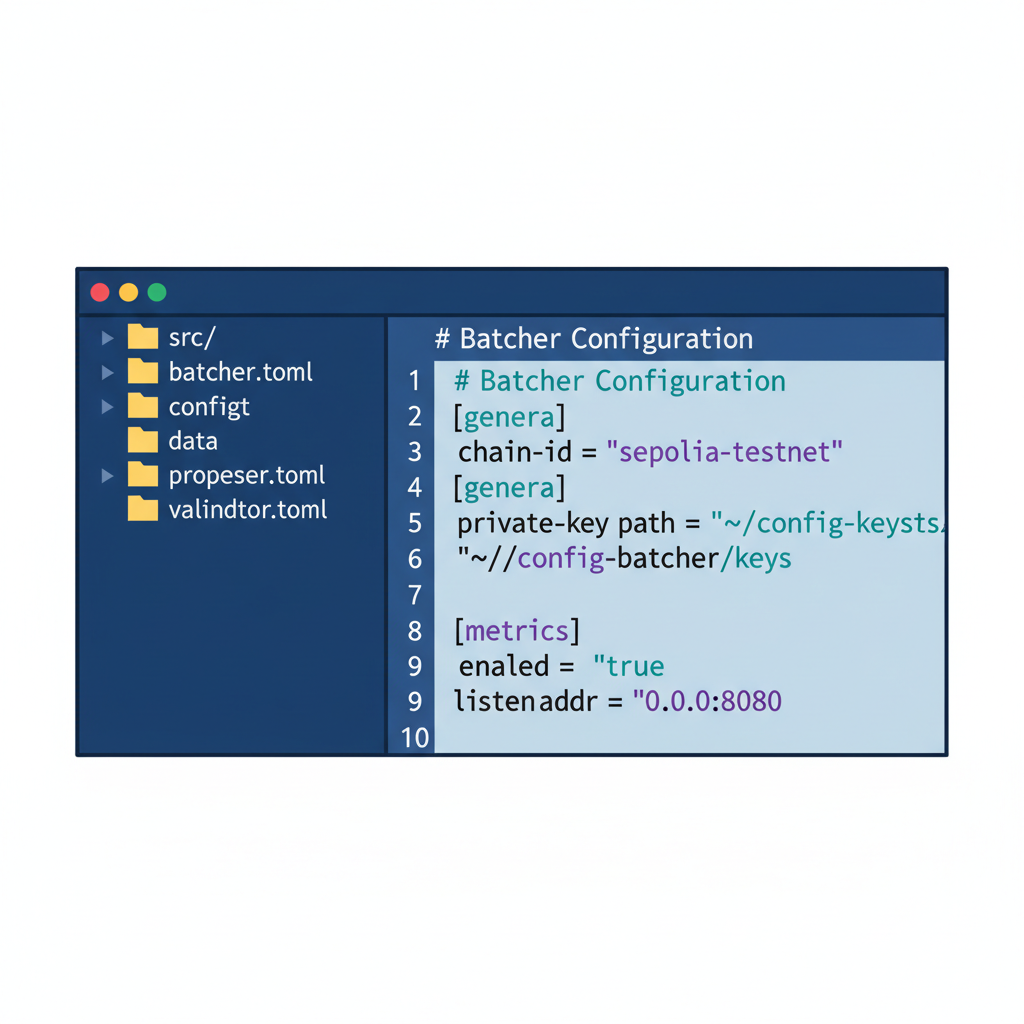

Batcher and proposer nodes form the OP Stack’s efficiency engine, compressing L2 transactions into Ethereum batches. Amid 2026’s gas volatility, tuning these for cost hinges on dynamic fee algorithms and blobspace utilization post-Dencun.

Key optimizations include setting batcher gas limits to 80% of proposer capacity, enabling paymaster integrations for subsidized txs, and monitoring via Superchain Eco tools. Medium guides and YouTube workshops, like ETHGlobal’s 30-minute rollout, demonstrate CLI tweaks yielding 40% lower batch costs. For production, CI/CD pipelines automate these, preempting deployment snags seen in GitHub issues.

This strategy amplifies ROI; a lean config on shared sequencing can halve opEx, positioning rollups for sustained profitability as Ethereum throughput surges.

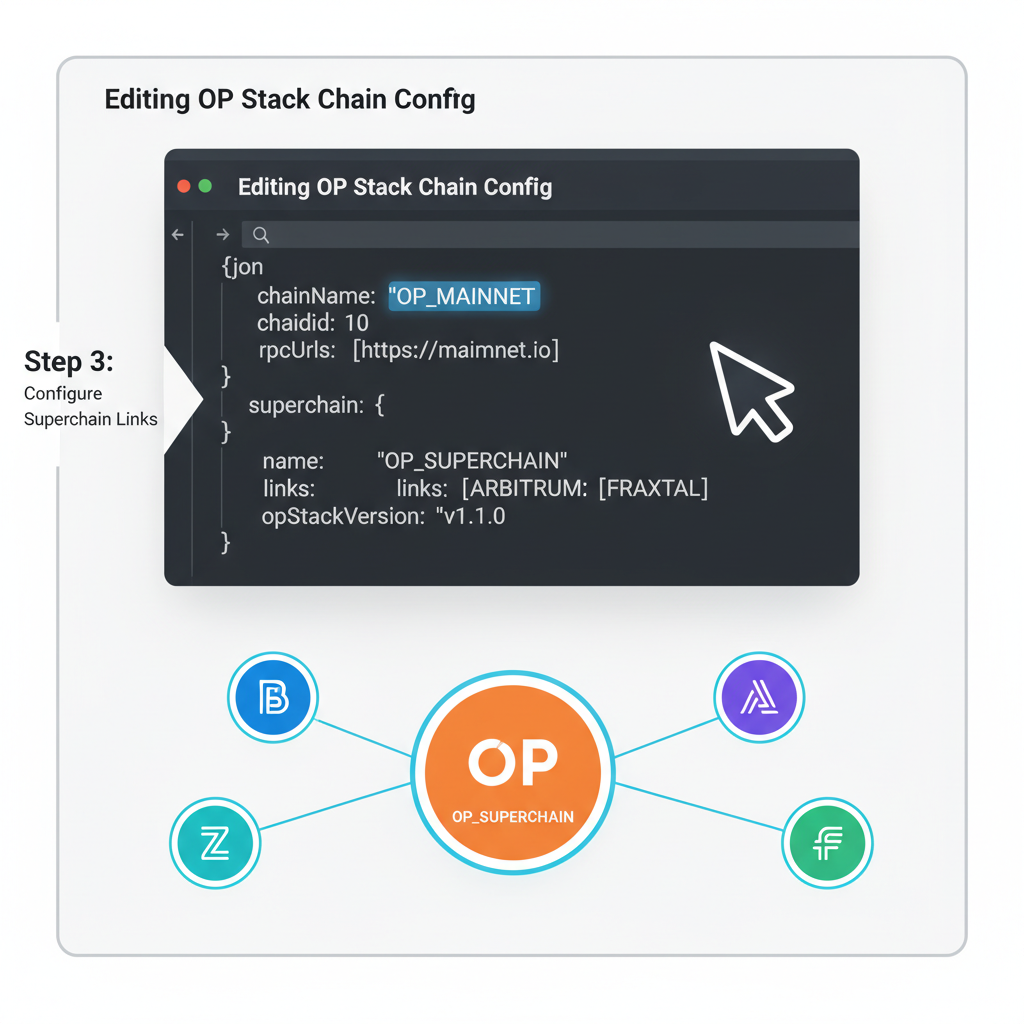

Superchain governance, anchored by the Optimism Collective, enforces standards across rollups via unified bridges and the SuperchainERC20 token framework. This integration streamlines asset flows, curtailing fragmentation that erodes capital efficiency in siloed L2s.

Operators must join the interoperable chain set during deployment, configuring bridges to Superchain protocols as per Alchemy’s RaaS insights and Optimism docs. This exposes rollups to governance proposals, like sequencing upgrades, fostering network effects. Zeeve’s guides highlight value accrual: unified liquidity pools boost TVL by 25-35%, mirroring OP’s stable $0.1316 amid L2 competition.

Risk-adjusted, this demands vigilance on voting power concentration; diversified participation mitigates veto risks while unlocking grants from the RetroPGF ecosystem.

Adopt Modular Data Availability Layers like Celestia

Data availability (DA) bottlenecks constrain rollup scalability; Celestia’s modular DA layer decouples it from Ethereum, slashing costs via light-node verification and namespaced blobs. For OP Stack chains, this hybrid approach amplifies throughput without native DA assumptions.

Deployment entails patching op-node with Celestia DA hooks, leveraging Zeeve or Alchemy tools for seamless integration. LearnWeb3 lessons and Superchain Eco kits provide starters, yielding 70% DA cost reductions per benchmarks. Post-Dencun, this stacks with blobspace for resilient scaling, vital as Ethereum eyes 100k and TPS.

Strategically, Celestia-adopters gain edge in high-data apps like gaming or AI; cross-market correlations show DA innovators outperforming, with OP at $0.1316 underscoring Superchain’s pivot to modularity.

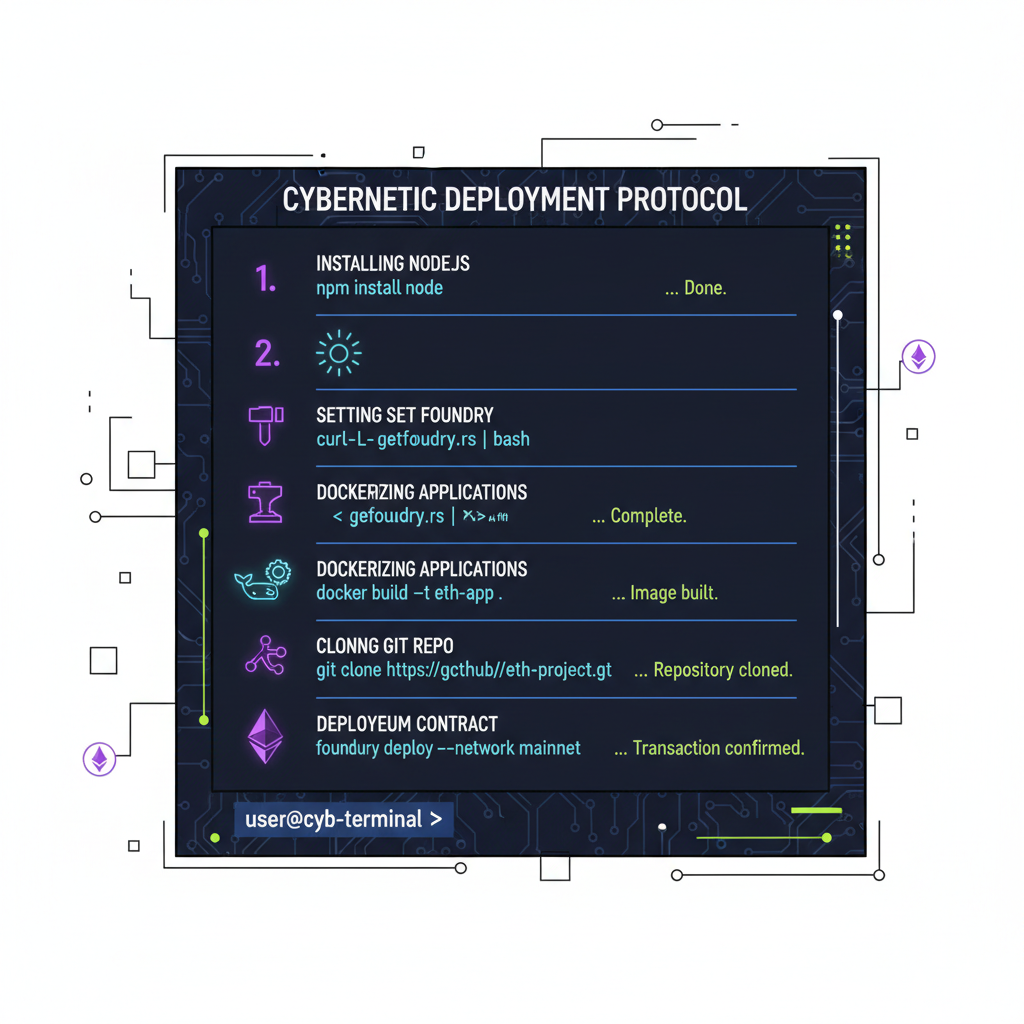

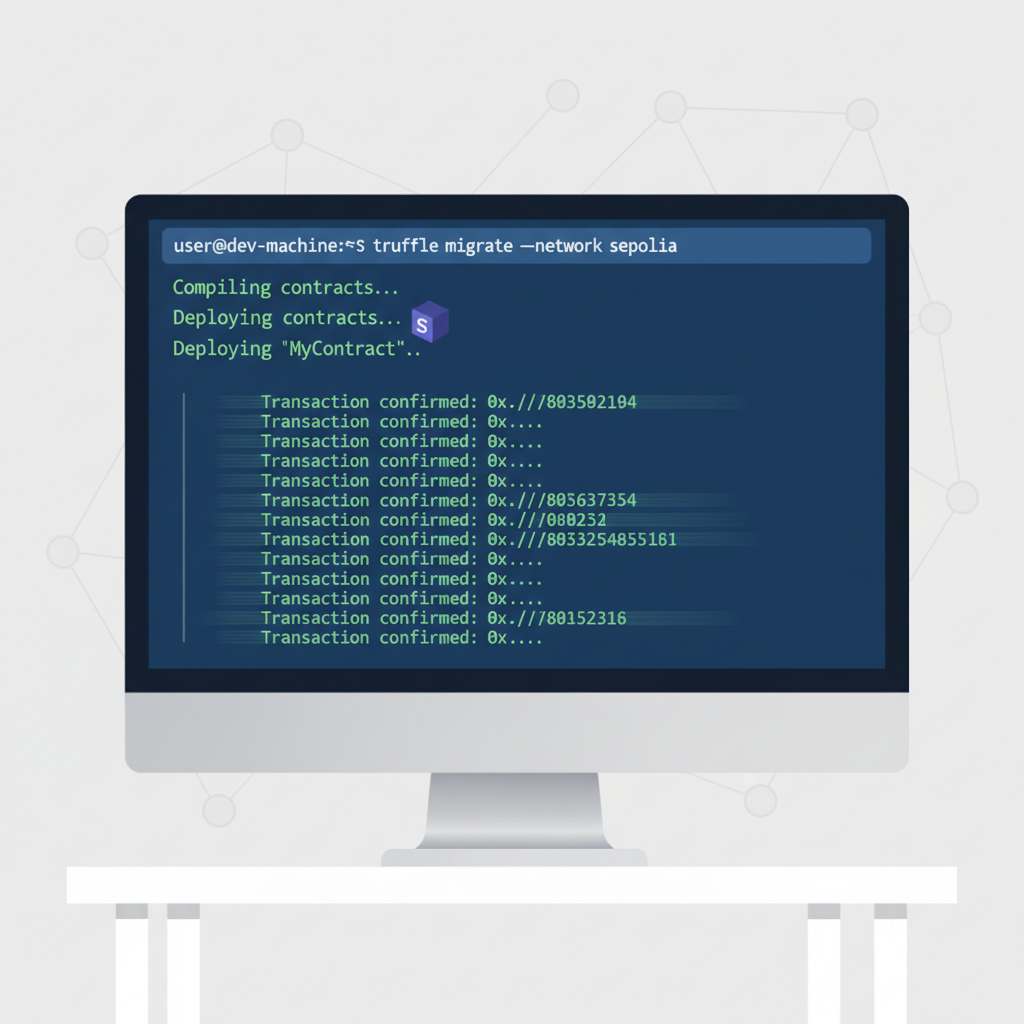

Automate Deployment Using OP Stack CLI and CI/CD Pipelines

Manual deployments falter under iteration pressure; OP Stack CLI, paired with CI/CD via GitHub Actions or Zeeve, automates genesis, upgrades, and monitoring. Optimism’s multi-part tutorial navigates op-deployer pitfalls, from key generation to testnet spins.

Pipeline blueprints: trigger on merges, apply configs for Fermina proofs and Celestia DA, validate via rollup node simulations. ETHGlobal videos and Medium posts detail 30-minute launches scaling to mainnet. This cuts deployment time by 80%, enabling rapid experimentation in Superchain’s dynamic governance.

Portfolio managers favor automated chains for agility; they adapt to Flashbots latencies or push0 proofs without downtime, sustaining yields as interoperability matures.

These strategies – from shared sequencing to CLI automation – forge OP Stack rollups resilient for 2026’s Ethereum surge. With native proofs, modular DA, and governance ties, developers unlock compounded scalability, drawing liquidity to Superchain’s unified frontier. OP’s $0.1316 price anchors this thesis, rewarding prudent execution over hype.