Picture this: it’s February 2026, Optimism’s OP token is hovering at $0.1898, down a smidge at -0.0392% over the last 24 hours, yet the Superchain is cheaper than ever to join. Deploying a rollup on the OP Superchain used to feel like buying a yacht; now it’s more like grabbing a solid used sedan. Thanks to EIP-4844 and based rollups, annual costs have cratered from over $1 million to around $40,000. If you’re eyeing OP Superchain deployment costs 2026, buckle up, because this breakdown will show why it’s a no-brainer for projects chasing scalability without breaking the bank.

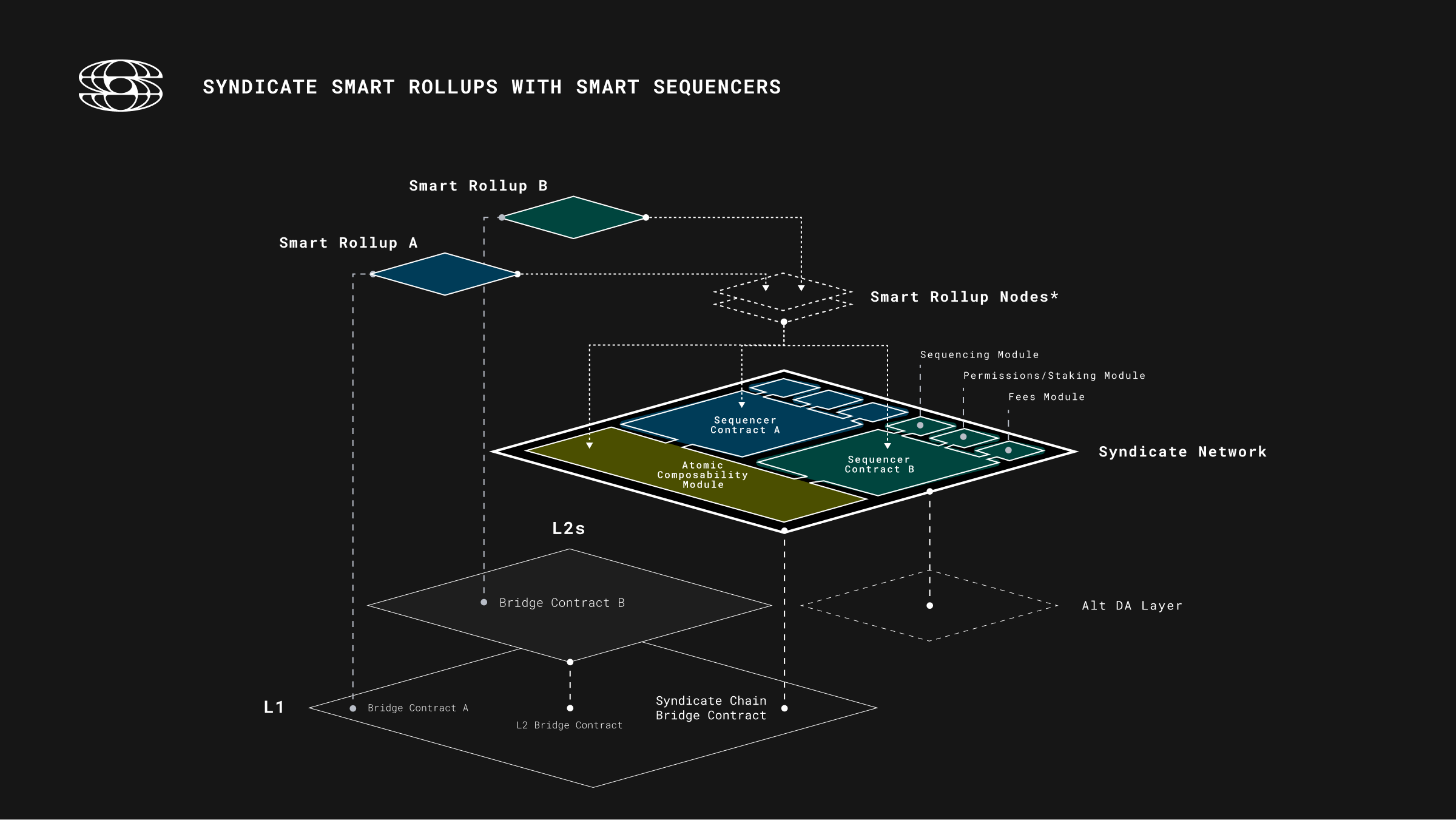

Let’s cut through the hype. The OP Stack remains MIT-licensed and free to fork or deploy solo. No upfront fees to spin up your chain. The real action kicks in when you plug into the Superchain for that sweet interoperability, shared sequencing, and security. But with data availability costs slashed over 90% by proto-danksharding, even L1 posting is a bargain. Traditional L2s were burning $2,000 monthly on infra; based rollups? A crisp $400. That’s an 80% haircut, folks. Pragmatic projects are flocking here, from World Chain prioritizing World ID holders to custom OP Stack rollups on reliable infra like QuickNode’s Titan.

From Million-Dollar Headaches to Pocket Change: Tech Upgrades Driving Costs Down

EIP-4844 changed the game. By introducing blobs for cheaper data availability on Ethereum L1, OP chains post batches without the calldata bloodbath. Pre-2026, you’d shell out north of $1M yearly just to keep the lights on. Now? $40,000 annually for a full Superchain rollup. That’s not hyperbole; it’s straight from the protocol upgrades and market data as of mid-February 2026.

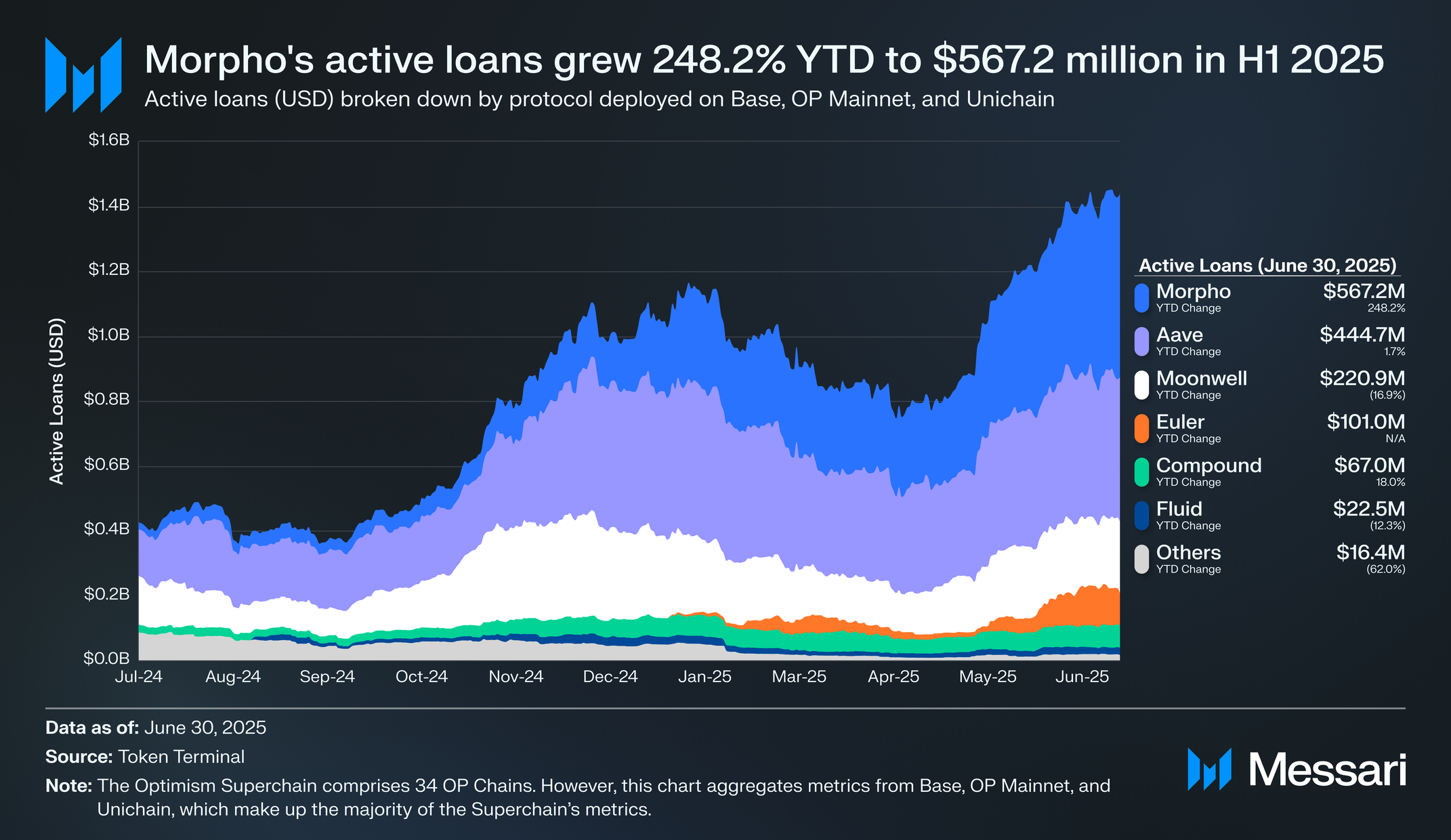

Based rollups take it further, outsourcing sequencing to Ethereum L1. No need for your own beefy node setup. It’s like renting compute from the most secure landlord in town. Combine that with OP Stack’s modular design, and you’ve got rollup deployment fees OP Stack that barely register on your balance sheet. Humor me here: if Base could rake in $74M in 2025 revenue while paying just 2.5% back, imagine what a lean 2026 deployer can pocket.

Superchain Rollup Economics: The 2.5% Reality Check

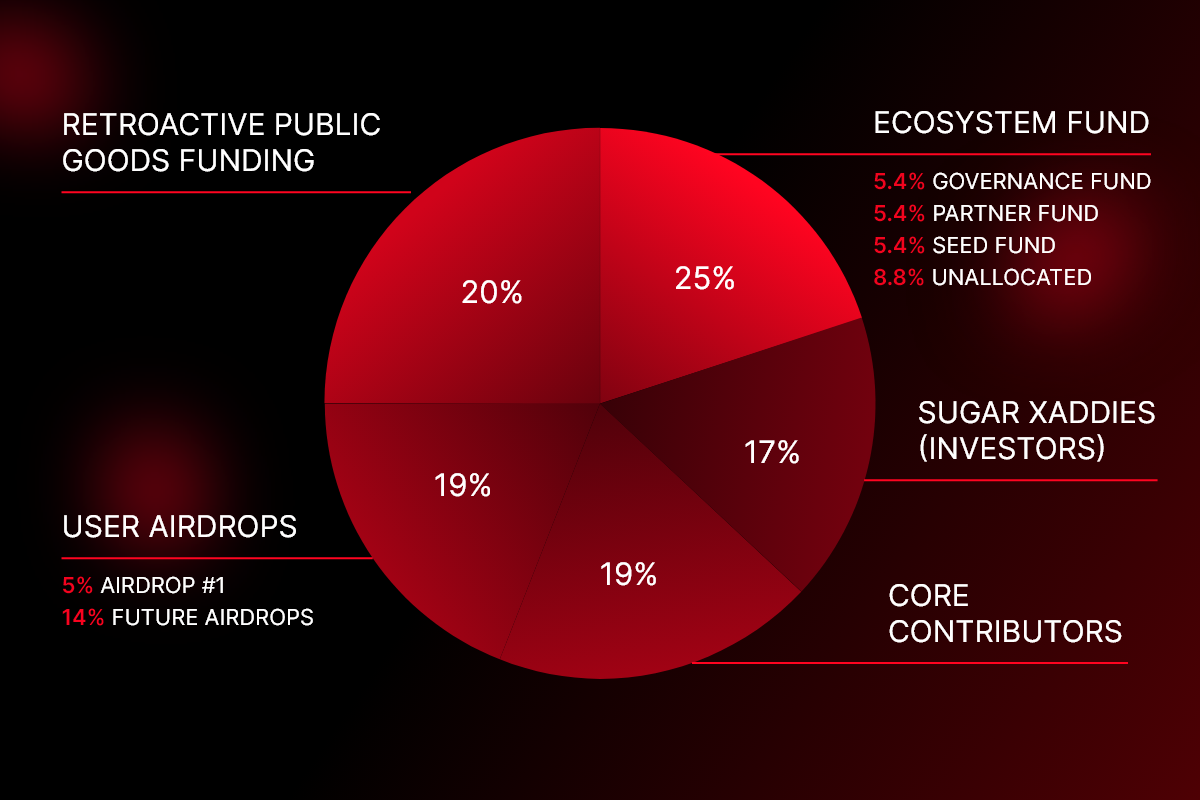

Here’s the pragmatic truth on superchain rollup economics. Join the Superchain, and you pledge the greater of 2.5% of sequencer revenue or 15% of onchain profit to the Optimism Collective. Free to deploy OP Stack anywhere, but Superchain perks demand skin in the game. Messari’s H2 2025 report nails it: every OP Chain must contribute per the Standard Rollup Charter. Base dominated with 71% of fees but skimped at 2.5%; smaller chains might hit the profit threshold first.

OP Stack is an MIT-licensed public good. Clone it free, but Superchain sharing drives collective growth.

Tracing revenue flows via Zeeve data, it’s clear: high-volume chains like Base fuel the ecosystem, but low-cost entry means more players. For OP Stack custom rollup costs, factor in zero platform fees from providers like QuickNode, 400ms updates, and meta-aggregation for best execution. World Chain’s Proof of Personhood scaling? Pure Superchain magic at minimal cost.

Price Predictions Amid Surging Adoption

With deployment barriers vaporized, OP’s trajectory hinges on Superchain adoption. MEXC forecasts tie $OP gains to this multi-rollup vision. At $0.1898, it’s undervalued if chains proliferate. Investors, take note: low OP Superchain deployment costs 2026 could spark a rollup boom, boosting sequencer fees and token demand.

Optimism (OP) Price Prediction 2026-2030

Projections based on Superchain growth, EIP-4844 cost reductions, and L2 adoption from current price of $0.1898

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $0.15 | $0.40 | $1.00 |

| 2027 | $0.35 | $0.90 | $2.20 |

| 2028 | $0.70 | $1.80 | $4.50 |

| 2029 | $1.20 | $3.00 | $7.00 |

| 2030 | $1.80 | $4.50 | $9.50 |

Price Prediction Summary

Optimism (OP) is set for strong growth fueled by the Superchain’s low-cost rollup deployments (down to $40k/year), revenue sharing from OP Chains, and Ethereum scaling synergies. Average prices are forecasted to rise progressively from $0.40 in 2026 to $4.50 in 2030, reflecting bullish adoption amid market cycles, with max potentials capturing bull market peaks.

Key Factors Affecting Optimism Price

- Superchain revenue accrual: 2.5% of L2 sequencer revenue or 15% of profits to OP Collective

- EIP-4844 (Proto-Danksharding) slashing data costs by 90%

- Based rollups reducing infra costs by 80% to ~$400/month

- Growing OP Stack adoption (e.g., World Chain, Base contributions)

- Interoperability advantages over competitors like Arbitrum Orbit

- Bullish crypto market cycles, especially post-2028 Bitcoin halving

- Regulatory tailwinds for L2 solutions and potential ETF approvals

- Risks: Competition, execution delays, broader market downturns

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

But let’s get granular on what those OP Superchain deployment costs 2026 actually look like for a project spinning up today. Upfront? Zilch for the OP Stack itself. Grab the code, tweak for your needs, deploy on testnet. Production launch to Superchain involves governance approval, but that’s more politics than wallet drain. Ongoing: sequencer revenue share starts only after you’re live and minting fees. At $400 monthly infra, you’re laughing compared to Arbitrum Orbit’s pricier alternatives.

Dissecting OP Stack Custom Rollup Costs

Pragmatically, budget for these buckets. Node hosting: $400/month with based rollups. DA via blobs: pennies per batch post-EIP-4844. Dev time? That’s on you, but QuickNode’s zero-fee Titan makes RPC a breeze with 400ms latency. No hidden gotchas; Zeeve traces show chains paying 2.5% revenue cleanly. For a modest chain pulling $100k yearly sequencer fees, your Superchain tribute is $2,500. Pocket the rest, scale with Superchain bridges.

Detailed Monthly Cost Breakdown for OP Stack Custom Rollup (2026) 🚀

| Category 💼 | 2026 Monthly Cost 💰 | Est. Pre-2026 Cost 💸 | 2026 Savings 🔥 |

|---|---|---|---|

| Infrastructure 🖥️ | $400 | $2,000 | 80% ($1,600) |

| DA Posting 📤 | $50 | $500 | 90% ($450) |

| Node Operations 🔄 | $100 | $300 | 67% ($200) |

| Governance/Misc ⚖️ | $50 | $200 | 75% ($150) |

| Total 📊 | $600 | $3,000 | 80% ($2,400) |

Humor in the numbers: pre-upgrades, you’d fund a small army of devs just for calldata fees. Now, deploy World Chain-style Proof of Personhood rollups without selling a kidney. L2BEAT logs it; Superchain’s shared security means your chain inherits Ethereum’s might at fraction of solo cost.

Top 5 Perks of OP Superchain Cost Cuts

-

90% DA Savings via EIP-4844: Proto-Danksharding slashes data costs from $1M+ to pennies – your L2 breathes easy! 💸

-

$40k Annual Total: Down from millions pre-2026 – deploy OP rollups without selling your yacht. Pragmatic win! 🛥️

-

Instant Interoperability: Superchain links OP Chains seamlessly – bridge assets faster than your coffee brews. ☕

-

Revenue Share Only on Success: Pay 2.5% revenue or 15% profit to join – free ride till you moon! 🚀

-

Based Rollup Infra Slash: $400/mo vs $2k old-school – Ethereum L1 sequencing cuts 80%, hello cheap scaling! ⚡

Real Chains, Real Savings: Case Studies

Base’s 2025 haul? $74M revenue, 71% of OP Chain fees, 2.5% payback. Efficient beast. World Chain? Prioritizes World ID blocks on OP Stack, deploys cheap, scales personhood sans L1 congestion. Medium pieces hype Superlane variants, but core Superchain delivers: common codebase, unified bridging. Alchemy spells it: fees only on join. Deploy solo OP Stack free, upgrade to Superchain when revenue flows.

Messari’s charter enforces fairness; no freeloading. High-profit chains hit 15% cap quicker, but low-entry hooks bootstrappers. At OP’s $0.1898, collective treasury swells with more chains, burning tokens, juicing demand. Traders, this is momentum: low rollup deployment fees OP Stack equals chain explosion equals $OP pumps.

Trade the trend, trust the process. Superchain’s not hype; it’s economics bending toward accessibility.

Flash to providers: QuickNode’s Jan 2026 post touts Titan for OP rollups, zero fees, best execution. Zerocap nails the vision: interoperable rollup ecosystem. Paul Timofeev on Medium? Superchain as L2 network sharing bridges, sequencing. All converging on one truth: 2026 is peak deploy time.

Projects hesitate? Foolish. $40k barrier means indie devs, DAOs, even memes can launch. Superchain rollup economics reward volume: more chains, thicker liquidity pools, faster cross-chain swaps. OP at $0.1898 with 24h low $0.1873, high $0.2001? Dip-buy territory if adoption ticks up. Protocol’s public good ethos scales; your chain contributes, thrives.

Your Playbook: Deploy Smart in 2026

Step one: Fork OP Stack. Customize via docs. Test based sequencing. Apply Superchain governance. Launch, monetize, share 2.5%. Rinse, scale. Costs? Negligible. Upside? Superchain’s flywheel. MEXC predictions bank on this; $OP moons with rollup proliferation. Investors eyeing superchain rollup economics, position now. Devs hunting OP Stack custom rollup costs, pull trigger. The yacht’s now a speedboat, and it’s yours for pennies.