Imagine seamless access to 15 OP Chains right from your mobile wallet, bridging liquidity and slashing UX friction across the Superchain. With Optimism’s OP token trading at $0.1957, up a modest and 0.0483% in the last 24 hours from a low of $0.1867, whispers of xPortalApp’s deeper Superchain integration are stirring excitement among traders and devs alike. This isn’t just another wallet update; it’s a potential multiplier for rollup adoption in 2026.

The OP Stack powers chains like Base, Unichain, and Worldchain, creating a shared security model and communication layer that defines the Superchain. xPortalApp, fresh off its Base integration, leverages optimistic rollups where transactions post to Ethereum and assume validity unless challenged. This setup delivers cheap, fast txs while inheriting ETH’s security. Now, picture that extended across 15 chains: unified bridging, shared sequencing, and one-click swaps. Traders stay nimble without chain-hopping headaches.

Superchain’s Interoperability Surge Sets the Stage

Optimism’s Superchain isn’t a loose collection of L2s; it’s a coordinated network of OP Chains pumping revenue back to the Optimism Collective. Recent moves like Chainlink’s CCIP compatibility with SuperchainERC20 standards, first live on Soneium via Astar’s ASTR token, unlock cross-chain asset flows between Ethereum, Optimism, and even Polkadot. Add SuperStacks, the points program rewarding multi-chain activity, and you’ve got a flywheel for liquidity. Messari analysts eye a 40-60% TVL bump from such integrations, a boon as OP holds steady at $0.1957.

OP Stack’s open-source blueprint lets anyone spin up a rollup in 30 minutes, as demoed in ETHGlobal workshops. QuickNode highlights Superchain interoperability for efficient L2 interactions. This ecosystem maturity primes it for wallets like xPortalApp to step in, offering rollup wallet support 2026 style.

xPortalApp Levels Up from Base to Superchain

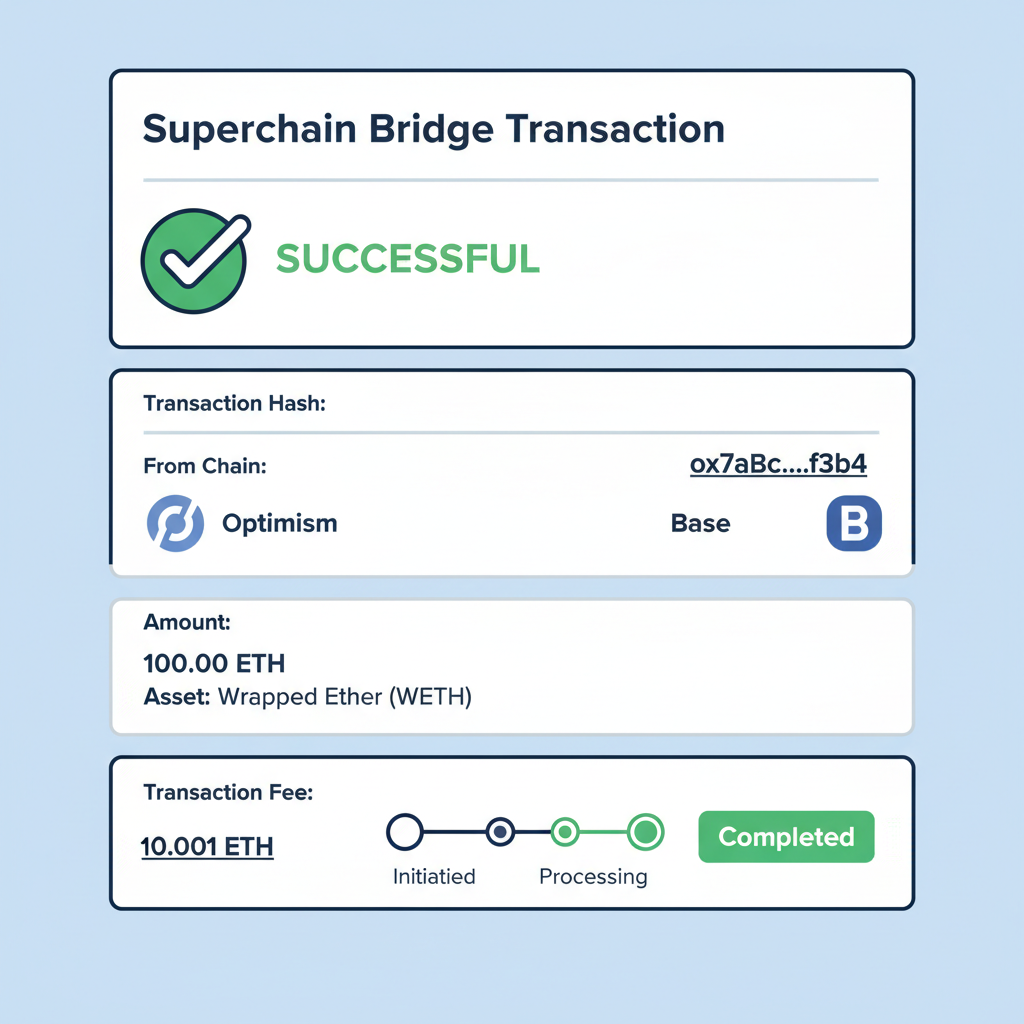

xPortalApp’s Base rollout showcased optimistic rollups in action: post txs, challenge window, settle on L1. Users loved the speed. Expanding to Superchain means tapping Unichain, Worldchain, and beyond, hitting Optimism Superchain xPortalApp synergy. No official word yet as of February 14,2026, but trends scream inevitability. Boundless_xyz’s dual proving modes cut verification to hours, making multi-chain viable for retail.

Optimism (OP) Price Prediction 2027-2032

Projections factoring Superchain integrations, OP Stack adoption, and L2 ecosystem growth from current $0.1957 baseline

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.25 | $0.50 | $0.90 | +150% |

| 2028 | $0.40 | $0.80 | $1.40 | +60% |

| 2029 | $0.65 | $1.30 | $2.20 | +63% |

| 2030 | $1.00 | $2.00 | $3.50 | +54% |

| 2031 | $1.50 | $2.80 | $5.00 | +40% |

| 2032 | $2.00 | $3.80 | $7.00 | +36% |

Price Prediction Summary

Optimism (OP) is expected to experience substantial growth from its 2026 low of $0.1957, driven by Superchain expansions and increased TVL (40-60% projected). Conservative minimums reflect bearish market cycles and competition, while maximums capture bullish adoption scenarios, with average prices compounding at ~55% CAGR through 2032.

Key Factors Affecting Optimism Price

- Superchain integrations boosting TVL by 40-60% (Messari)

- OP Stack powering chains like Base, Unichain, and Worldchain

- Enhanced interoperability via Chainlink CCIP and SuperStacks

- Ethereum L2 scaling demand and optimistic rollup advancements

- Market cycles with potential bull runs post-2026

- Regulatory developments favoring scalable solutions

- Competition from other L2s and L1 alternatives

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

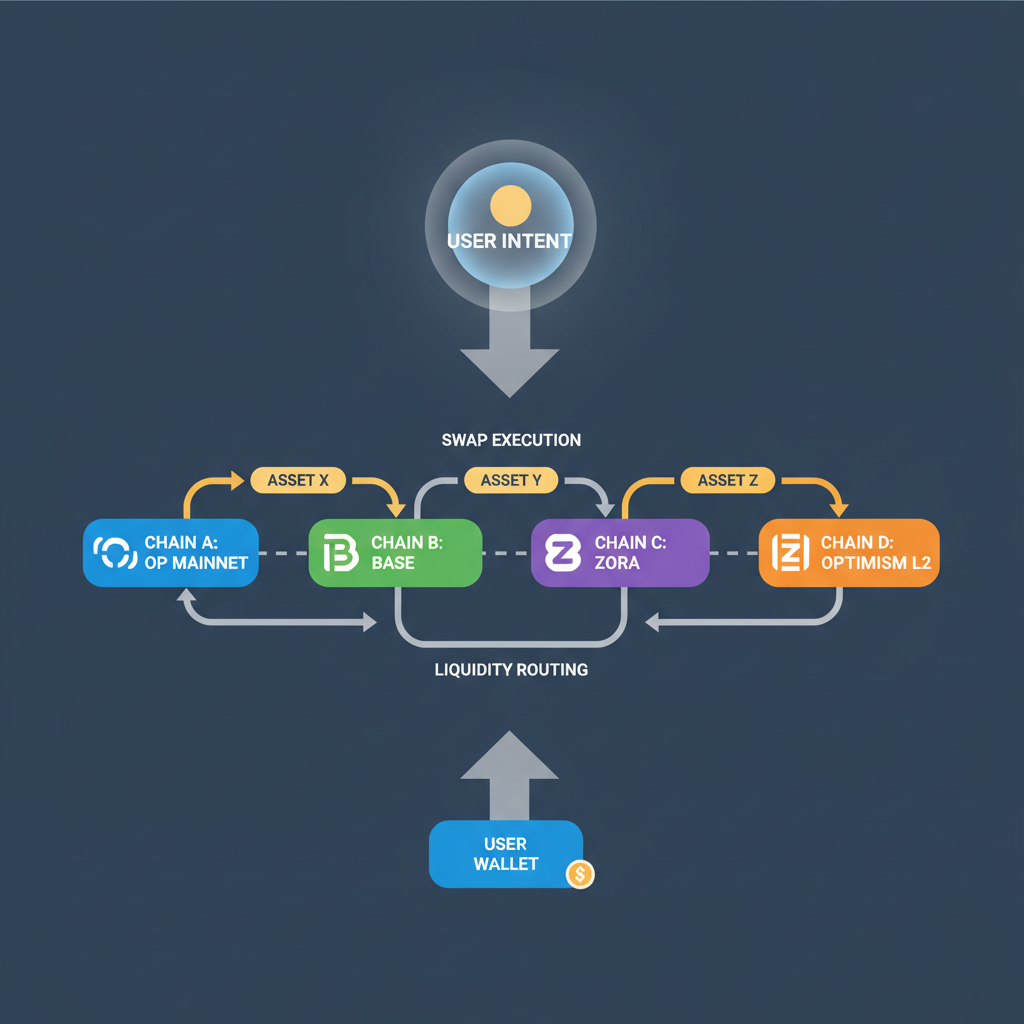

For devs, OP Stack chain integrations mean standardized bridges and governance. Investors see alpha in Superchain multi-chain accessibility; one wallet rules them all. I’ve traded these ecosystems for years, and friction kills volume. xPortalApp could flip that script, routing intents across 15 chains with minimal gas.

Actionable Plays for Traders Watching OP at $0.1957

OP’s 24h high hit $0.1957 after dipping to $0.1867, signaling resilience. Stake on Optimism for yields, bridge via SuperchainERC20, or farm SuperStacks points early. If xPortalApp confirms Optimism rollup expansions, expect TVL inflows. Position in OP Mainnet liquidity pools now; the Superchain’s multi-rollup vision rewards the prepared. Watch for announcements; this integration could ignite the next leg up.

Deeper dives into Superchain mechanics reveal shared sequencing as the secret sauce, batching txs across chains for atomic composability. xPortalApp’s mobile-first design fits perfectly, turning complex rollup navigation into swipeable simplicity.

Shared sequencing isn’t hype; it’s the backbone enabling cross-chain intents without endless bridging loops. Imagine approving a swap on Base that executes on Unichain seamlessly, all orchestrated by a unified sequencer. xPortalApp could package this into a clean interface, making Superchain multi-chain accessibility feel like using a single chain.

OP Stack chain integrations standardize this across 15 chains, from governance to bridges. Devs deploy via shared blueprints, investors chase TVL growth. Messari’s 40-60% projection hinges on wallets like xPortalApp driving adoption. I’ve seen siloed L2s bleed volume to unified ecosystems; Superchain flips that with revenue sharing to the Collective.

Traders, here’s your edge: as Optimism rollup expansions accelerate, position in low-friction pools. OP’s 24-hour change of and 0.0483% masks building momentum from CCIP on Soneium and SuperStacks rewards. Farm points now; they compound across chains. xPortalApp’s mobile UX could onboard millions, spiking tx volume and OP demand at $0.1957.

Why This Matters for Your Portfolio

Superchain isn’t just tech; it’s a liquidity magnet. Chainlink’s CCIP bridges Ethereum, Optimism, Polkadot seamlessly, starting with ASTR on Soneium. This interoperability, paired with xPortalApp’s potential Optimism Superchain xPortalApp tie-in, creates atomic trades spanning ecosystems. No more fragmented positions; one dashboard rules. With OP Stack powering Base to Worldchain, revenue flows back, funding upgrades that boost token value.

Picture 2026: swipe to swap on 15 OP Chains, yields auto-compound via shared security. Devs launch rollups weekly, wallets evolve fast. xPortalApp leads by extending Base’s success, cutting gas 90% via batching. My take? Buy the dip resilience at $0.1957; Superchain’s flywheel spins harder with each integration. Stake, bridge, engage multi-chain. Stay nimble; alpha hides in the sequencer.

Optimism’s vision scales Ethereum without compromises. xPortalApp integration would cement rollup dominance, rewarding early movers. Watch volume on Unichain and Worldchain; spikes signal the shift. Your move: dive into OP Stack docs, test SuperStacks, prep for wallet upgrades. The Superchain era demands action over observation.