Optimistic rollups have redefined Ethereum’s path to scalability, and at the heart of this evolution sits the OP Superchain. With 34 interconnected chains powered by the OP Stack, the ecosystem now generates $396.5 million in GDP while securing $21.7 billion across 32 rollups. Daily transactions hit 20.1 million, capturing 58.5% of all Layer 2 activity as of late 2025. This isn’t fleeting hype; it’s a testament to fraud proofs’ elegance in assuming validity until proven otherwise. Even as the OP token trades at $0.1843, up 2.30% in the last 24 hours, the superchain’s momentum underscores optimistic rollups’ grip on the rollup market.

Fraud proofs form the bedrock of this dominance, enabling OP stack fraud proofs that prioritize speed over upfront verification. In optimistic rollups, transactions execute off-chain, with batches posted to Ethereum. Anyone can challenge suspicious state roots during a dispute window. If fraud surfaces, the proposer stakes are slashed, and challengers earn rewards. This permissionless system, recently bolstered on OP Mainnet with fault proofs, decentralizes security far beyond centralized sequencers.

Single-Round Fraud Proofs: Optimism’s Edge Over Multi-Round Rivals

Contrast this with Arbitrum’s multi-round approach. Optimism’s single-round fraud proofs resolve disputes faster, minimizing on-chain computation. Sources highlight this as a key differentiator: while Arbitrum iterates through interactive proofs, Optimism executes one decisive round. Recent upgrades, like permissionless fault proofs, address past criticisms. OP Labs spent years refining this, activating them after a two-year hiatus. The result? Robust state integrity without zk-rollups’ proof generation overhead.

Optimistic rollups host AMMs, lending protocols, and NFT marketplaces with fees far below Layer 1, all shielded by fraud proofs.

Challenges persist, like sequencer centralization, but the OP Superchain tackles them head-on through shared sequencing and cross-chain intents. This fosters superchain rollup interoperability, letting assets and data flow seamlessly across chains like Base and Unichain.

OP Superchain’s Scale: 34 Chains and Surging Metrics

From a handful of chains to 34, the OP Superchain exemplifies Ethereum L2 scalability 2026. Its GDP of $396.5 million reflects real economic activity, not just volume. Securing $21.7 billion in TVL across rollups signals investor trust. Transaction dominance at 58.5% of L2s dwarfs competitors, even as zk-rollups gain ground. Enterprise adoption accelerates this: networks leverage the OP Stack for custom rollups with built-in interoperability.

Read more on this expansion in our deep dive on OP Stack’s explosive growth. The superchain processes more volume than many L1s combined, proving optimistic rollups’ maturity.

Market Share Battle: Optimism’s Lead in Rollup Dominance

Optimistic rollups command the lion’s share of rollup activity, far outpacing zk alternatives in TVL and throughput. Optimism vs. Arbitrum debates rage, but data favors OP’s ecosystem. While Arbitrum boasts AVM compatibility, Optimism’s unified superchain vision wins on cohesion. Both rely on fraud proofs, yet OP’s 58.5% L2 transaction slice highlights superior adoption. As zk proofs mature, optimistic mechanisms hold firm with lower costs and faster finality.

OP’s current price of $0.1843 reflects measured valuation amid this growth. Investors eye further upside as fraud proofs enable bolder scaling.

Optimism (OP) Price Prediction 2027-2032

Projections based on OP Superchain growth, fraud proofs implementation, and Optimistic Rollups’ 58.5% L2 transaction dominance from current price of $0.1843

| Year | Minimum Price | Average Price | Maximum Price | Avg. ROI from Current (%) |

|---|---|---|---|---|

| 2027 | $0.40 | $1.20 | $2.80 | 551% |

| 2028 | $0.70 | $2.00 | $5.00 | 985% |

| 2029 | $1.20 | $3.50 | $8.50 | 1,799% |

| 2030 | $2.00 | $5.50 | $12.00 | 2,884% |

| 2031 | $3.00 | $8.00 | $18.00 | 4,241% |

| 2032 | $4.50 | $12.00 | $25.00 | 6,411% |

Price Prediction Summary

Optimism (OP) is positioned for robust growth amid the OP Superchain’s expansion to 34 chains, $396.5M GDP, and $21.7B secured value, capturing 58.5% of L2 transactions. Average prices are forecasted to rise progressively from $1.20 in 2027 to $12.00 by 2032, reflecting bull cycles driven by adoption, interoperability, and fraud proof enhancements, with min/max ranges accounting for bearish competition from ZK rollups and regulatory risks.

Key Factors Affecting Optimism Price

- OP Superchain expansion and 58.5% L2 transaction dominance

- Permissionless fraud proofs decentralizing security

- Interoperability across 32+ rollups boosting TVL and volume

- Ethereum scalability synergies and enterprise adoption

- Competition from ZK rollups and sequencer centralization risks

- Market cycles with bull runs in 2027, 2029, and 2031

- Favorable regulatory developments for L2s

- Overall crypto market cap growth enabling higher OP valuations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Permissionless fraud proofs elevate this further, inviting any holder of ETH to police the network. This shift, live on OP Mainnet, mirrors Ethereum’s ethos of decentralized trust minimization. Challengers post bonds, resolved via interactive disputes that pinpoint errors in a single round. Successful verifiers claim stakes, aligning incentives for vigilance without constant computation.

Optimism vs Arbitrum: Decoding Market Share in Fraud Proof Era

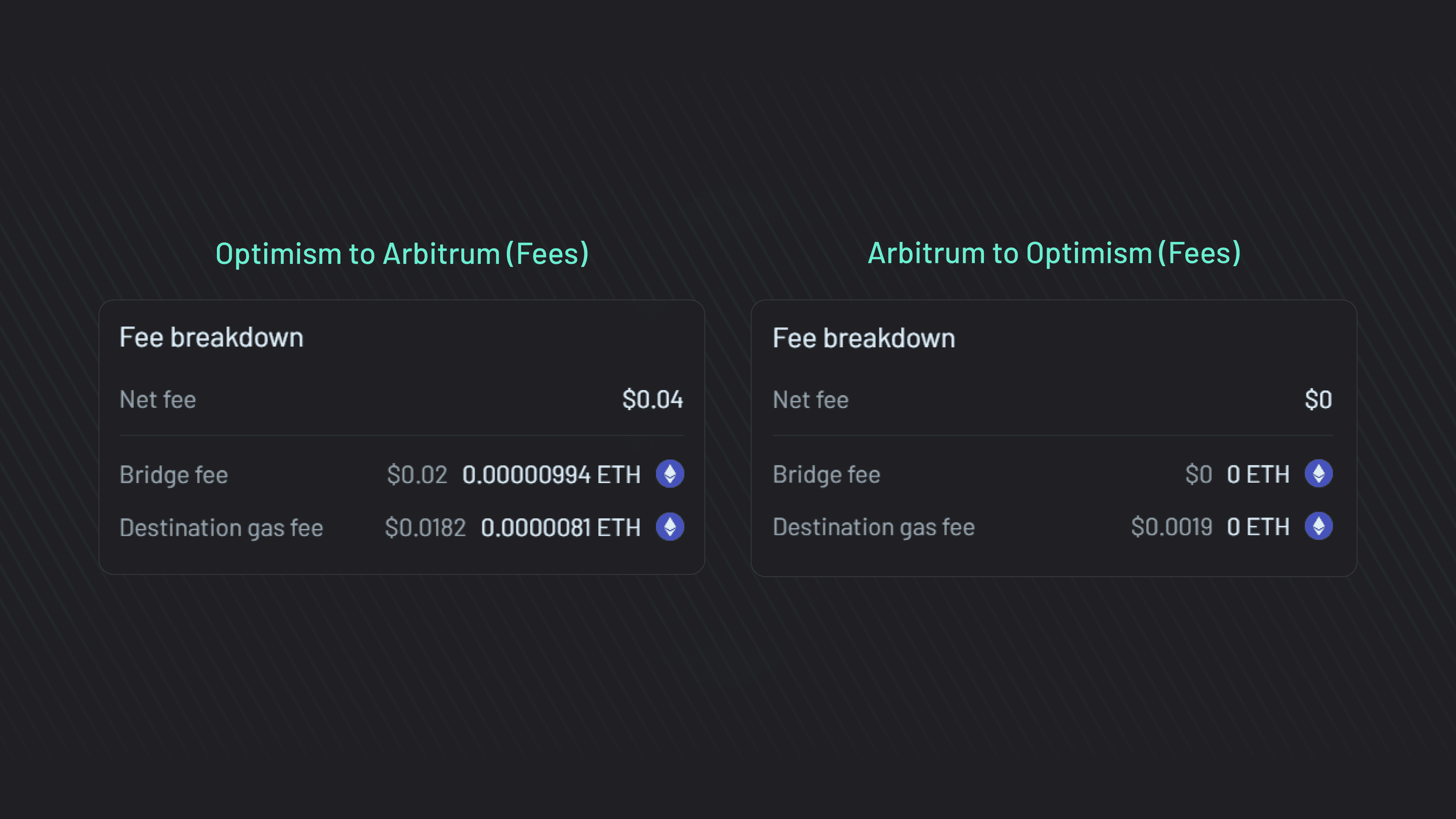

Debates on Optimism Arbitrum market share often center on fraud proof mechanics. Arbitrum’s multi-round system delves deeper into code execution traces, potentially catching nuanced bugs. Yet Optimism counters with efficiency: single-round proofs settle faster, crucial for high-throughput chains. Data as of late 2025 shows OP Superchain’s 58.5% L2 transaction dominance, edging Arbitrum through sheer ecosystem scale. Optimistic rollups overall claim over 90% of rollup TVL when excluding nascent ZK stacks, per aggregated L2 metrics. Arbitrum shines in EVM parity via AVM, but OP Stack’s permissionless upgrades close the gap.

Both stacks evolve: Arbitrum Orbit offers customizable chains, akin to OP Stack. Still, superchain cohesion – unified bridges, shared security – tips adoption toward Optimism. Base, built on OP Stack by Coinbase, exemplifies this, onboarding millions with seamless UX.

Optimism (OP Stack) vs Arbitrum Orbit: Key Comparison

| Metric | Optimism (OP Stack) | Arbitrum Orbit |

|---|---|---|

| Fraud Proofs | Single-round fraud proofs (permissionless) 🔒 | Multi-round fraud proofs 🔒 |

| TVL | $21.7B 💰 (34 chains) | Emerging, lower than OP Superchain 📈 |

| Daily Tx | 20.1M ⚡ | Lower volume 📉 |

| Market Share | 58.5% L2 📊 | Less dominant share |

| Interoperability | Superchain native 🔗 | Orbit stacks 🔗 |

Explore deeper interoperability strategies in our guide on how the OP Stack powers multi-rollup interoperability. Cross-chain intents and ERC-7683 standards enable atomic swaps across 34 chains, minimizing fragmentation risks plaguing solo rollups.

ZK Rollups Rising: Why Fraud Proofs Retain the Crown

Zero-knowledge proofs promise succinct verification, but generation costs remain prohibitive for everyday dApps. Optimistic rollups sidestep this with challenge-based security, achieving sub-second latencies post-challenge window. OP Superchain’s $396.5 million GDP underscores viability: DeFi protocols, gaming hubs, and social apps thrive under fraud proofs, hosting sophisticated AMMs and order books at fractions of L1 gas.

Critics note optimistic systems’ seven-day withdrawal delays, yet upgrades like preconfirmations slash effective times to minutes. As Ethereum’s danksharding unlocks data availability, optimistic throughput scales unbound. ZK tech trails in developer mindshare; OP Stack’s open-source ethos, with enterprise plays like Unichain, cements lead.

Sequencer risks linger – single points funneling tx – but distributed sequencers roadmap addresses this. Early pilots on testnets hint at permissionless ordering, bolstering resilience. Meanwhile, OP token at $0.1843 captures governance value accrual, with fees funneled via retroactive rewards.

The superchain’s ascent ties to broader Ethereum L2 scalability 2026 trends. With 20.1 million daily transactions, it rivals Visa pilots while securing billions. Fraud proofs, refined over years, deliver proven security at scale. Investors tracking cycles recognize this: patient capital flows to stacks blending speed, security, and interoperability.

OP Superchain charts the default path for rollups, where optimistic assumptions fuel exponential growth. As chains proliferate, fraud proofs ensure integrity, powering the next wave of onchain economies.