In the high-stakes arena of blockchain scalability, where enterprises demand both speed and sovereignty, Ankr’s Rollup-as-a-Service (RaaS) platform in partnership with Optimism stands out. Businesses can now deploy custom OP Enterprise rollups – fully tailored OP Stack chains within the Superchain – in just 8-12 weeks, arriving with instant liquidity via ankrETH as the gas token. This isn’t mere infrastructure; it’s a strategic accelerator for Web3 adoption, especially as the Superchain dominates with 58.5% of Ethereum L2 transactions. Optimism’s OP token, currently at $0.2270, embodies this momentum, down a modest 0.0135% over the last 24 hours from a high of $0.2400.

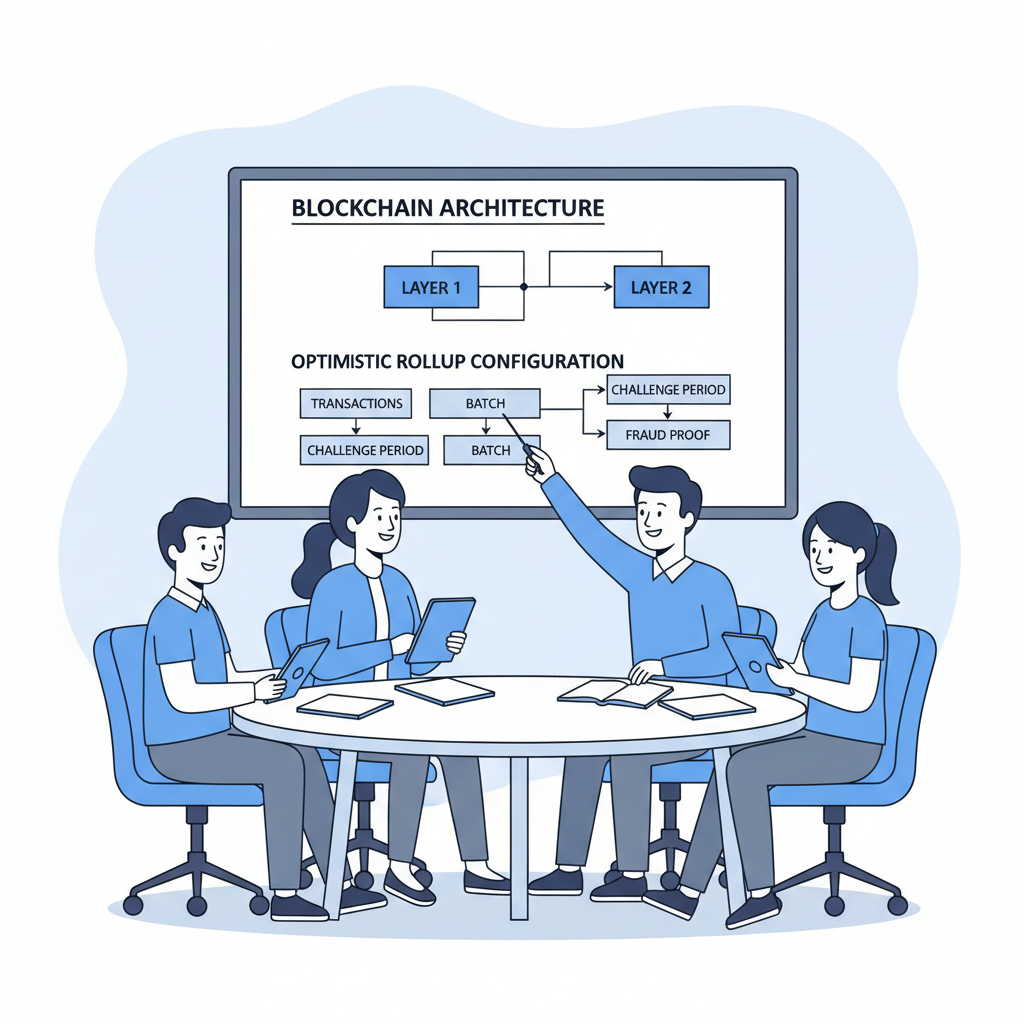

The Superchain, a constellation of interoperable L2s built on the open-source OP Stack, has evolved from a novel concept to the backbone of Ethereum scaling. With 34 chains driving over 50% of L2 activity and 10% of total crypto volume as of H1 2025, its architecture promises shared security, seamless communication, and standardized tooling. Yet, for enterprises wary of DIY rollups, the friction of custom deployment has lingered – until now.

OP Enterprise: Production-Grade Infrastructure Meets Enterprise Demands

Optimism’s OP Enterprise offering, straight from the team behind the OP Stack, provides managed, battle-tested blockchain infrastructure. Think Base, Unichain, and Worldchain: proven successes that underscore the stack’s reliability. But Ankr elevates this with end-to-end support – full engineering, rollup ops, dev tools, audits, and 24/7 maintenance. No more wrestling with node management or sequencer uptime; enterprises get a turnkey Superchain node.

This matters profoundly in a macro environment where capital efficiency reigns. Traditional L1 launches drag on for months, bleeding resources. OP Stack superchain deployment via Ankr compresses timelines to 8-12 weeks, letting firms focus on dApps rather than plumbing. I’ve long argued that rollups win through composability; here, enterprises plug directly into a network already humming with liquidity and users.

Instant Liquidity: ankrETH Powers Day-One Economic Flywheels

What sets Ankr’s RaaS apart is superchain liquidity day one. By defaulting to ankrETH – Ankr’s liquid staking Ethereum token – as the native gas, rollups inherit continuous staking rewards. This bootstraps TVL organically: users stake ETH, earn yields, and fuel transactions without bridging friction. No cold starts; liquidity flows from Ethereum’s $100B and LST ecosystem.

Consider the implications. A gaming enterprise launches an enterprise OP Stack chain, optimized for high-throughput sessions. Players pay gas in ankrETH, which accrues rewards, drawing stakers and amplifying TVL. This self-reinforcing loop mirrors DeFi’s best primitives, but scaled across the Superchain. With interoperability upgrades slated for early 2026, assets and data will glide frictionlessly, no external bridges required.

Optimism (OP) Price Prediction 2027-2032

Forecasts based on Superchain revenue buybacks, RaaS growth, and L2 dominance amid market cycles

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.40 | $1.05 | $2.60 |

| 2028 | $0.75 | $2.10 | $5.20 |

| 2029 | $1.40 | $3.75 | $9.00 |

| 2030 | $2.20 | $5.50 | $13.50 |

| 2031 | $3.50 | $8.00 | $18.00 |

| 2032 | $5.00 | $10.50 | $22.00 |

Price Prediction Summary

OP token is expected to see substantial appreciation from its 2026 baseline of ~$0.23, fueled by Superchain buybacks (50% of revenue), rapid RaaS deployments (8-12 weeks via Ankr), and 58.5% L2 tx share. Bullish max reflects adoption peaks; min accounts for bear cycles and competition. Overall 10x+ growth potential by 2032 in optimistic scenarios.

Key Factors Affecting Optimism Price

- Superchain revenue buybacks starting Feb 2026 (50% allocation to OP)

- Ankr RaaS enabling fast OP Stack chain launches with instant liquidity

- Superchain interoperability layer in early 2026 for seamless transfers

- Dominance in L2 activity (58.5% Ethereum L2 txns as of late 2025)

- Ethereum scaling demand and OP Stack adoption (Base, Unichain, etc.)

- Market cycles: post-halving bull runs in 2028/29; regulatory clarity boosts

- Competition from other L2s (Arbitrum, Polygon) and tech upgrades

- Macro factors: BTC/ETH correlation, institutional inflows, TVL growth via ankrETH gas

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategic Tailwinds: Revenue Alignment and Superchain Dominance

Optimism’s governance sharpens the pencil further. A proposed buyback dedicates 50% of Superchain revenue to OP tokens over 12 months from February 2026, directly tying token value to ecosystem growth. At $0.2270, OP trades at levels that scream undervaluation for a network commanding L2 primacy. Enterprises launching via Ankr aren’t just building chains; they’re anchoring into this revenue flywheel.

From a fundamentals-first lens, this convergence of fast Optimism rollup launch 8-12 weeks, native liquidity, and tokenomics positions the Superchain as Ethereum’s default scaling layer. I’ve seen cycles where infrastructure moats crumble under hype; OP Enterprise rollups fortify theirs with pragmatism and execution. For developers and investors eyeing 2026, the message is clear: customize, launch swiftly, and capture Superchain’s tide.

Institutions poised to capitalize on this shift benefit from Ankr’s blueprint, which demystifies the journey from concept to live chain. This isn’t vaporware; it’s executable strategy, honed by teams managing billions in TVL across LSTs and rollups.

Deployment Demystified: Your 8-12 Week Path to Superchain Sovereignty

Launching an enterprise OP Stack chain demands precision, not guesswork. Ankr’s RaaS handles the heavy lifting: bespoke configuration of the OP Stack, sequencer optimization for your workload, and integration with Superchain governance. Security audits from top firms ensure no weak links, while dev tools like standardized bridges and oracles accelerate dApp porting. The payoff? A chain tuned for your vertical – be it supply chain tracking or tokenized RWAs – live in under three months.

This timeline crushes legacy alternatives. I’ve evaluated countless infra plays over two decades; few match this blend of velocity and robustness. Pair it with OP Stack’s explosive growth, and enterprises sidestep the pitfalls of fragmented L2s. Your chain inherits Superchain’s sequencer diversity and fault proofs, fortifying against downtime that plagues solo deployments.

ankrETH’s role amplifies this. As gas token, it embeds yield generation from day one, sidestepping the liquidity trenches that doom many rollups. Stakers earn real returns, transactions hum, and TVL compounds – a flywheel I’ve championed in LST analyses. With Superchain’s interoperability layer dropping early 2026, your assets bridge natively to Base or Mode, unlocking composability without wrapped tokens or exploits.

Risks Mitigated, Rewards Amplified: Enterprise Realities

Critics might flag centralization risks in managed services, yet Ankr’s model decentralizes post-launch via Superchain standards. Sequencers can migrate to permissionless sets, and node operators draw from Ethereum’s vast pool. Cost-wise, expect predictability: fixed engineering fees dwarf the opportunity cost of delayed launches. At OP’s current $0.2270 price – holding steady amid 24-hour lows of $0.2249 – the ecosystem’s undervaluation underscores entry asymmetry for early movers.

Zoom out macro: Ethereum’s L2 wars crown pragmatic winners. Superchain’s 58.5% transaction share isn’t luck; it’s execution on shared security and comms layers. Optimism’s revenue-to-OP buyback, kicking off February 2026, funnels 50% of growth back to holders, aligning incentives sharper than most protocols. Enterprises deploying now via Ankr don’t just build; they embed in this virtuous cycle, where chain launches fuel revenue, buybacks lift OP to fairer valuations, and adoption snowballs.

I’ve navigated bond rallies and crypto winters; patterns repeat. Infrastructure that scales without sovereignty loss prevails. OP Enterprise rollups deliver exactly that, with Ankr slashing deployment friction to 8-12 weeks. For strategists, the calculus tilts heavily toward action: secure your slice of Superchain dominance before the herd arrives. Chains like yours will define Ethereum’s next era, powered by liquidity that sticks and economics that endure.