Picture this: Ethereum humming at $3,005.09, up a crisp and $36.91 in the last 24 hours, as OP Stack rollups ignite the superchain rollups revolution. Momentum surges not just in price charts, but in the guts of blockchain scalability. Enter the Boundless framework, a powerhouse flipping optimistic to ZK transition on its head, delivering ZK finality OP Stack rollups crave – in minutes, not days. This isn’t hype; it’s the multi-rollup trading edge I’ve been riding for years.

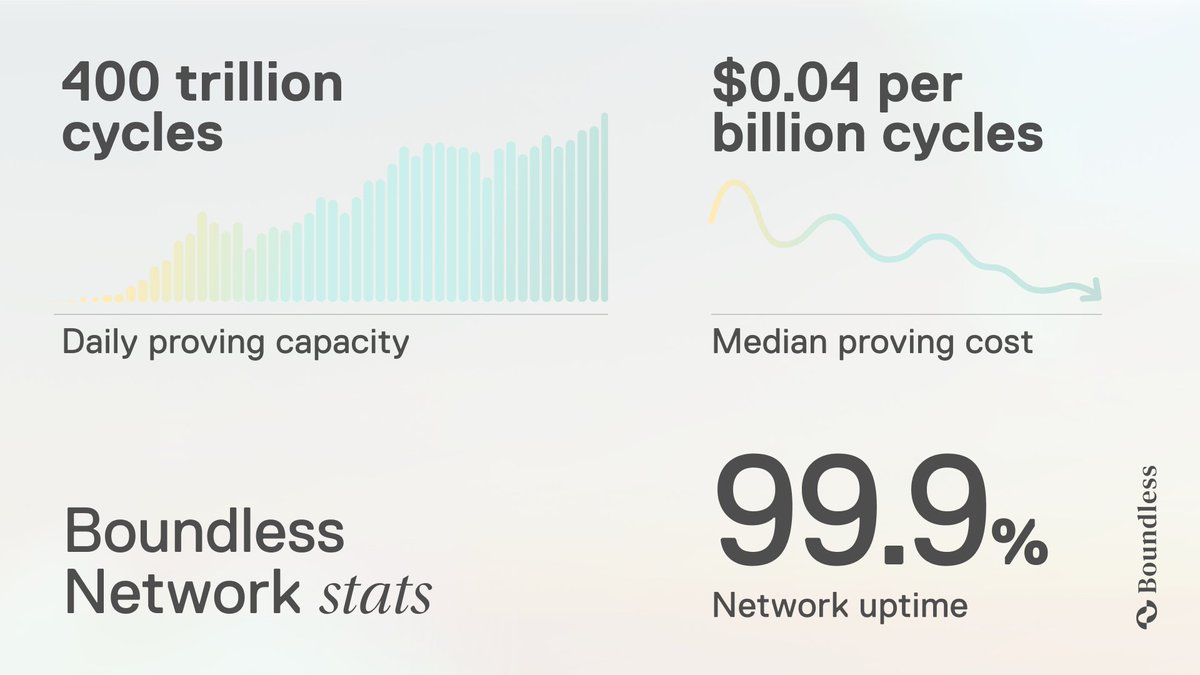

Boundless Network storms the scene with OP Kailua, their killer OP Stack extension cooked up alongside RISC Zero. Rollups built on this beast slash finality times to minute-level glory, hitting Stage 2 readiness while keeping Ethereum compatibility intact. No more watching capital freeze in dispute windows; liquidity flows free, traders pounce faster. As a swing trader glued to high-momentum plays, I see this turbocharging superchain rollups into overdrive.

Cracking Open the Superchain: OP Stack’s Modular Muscle

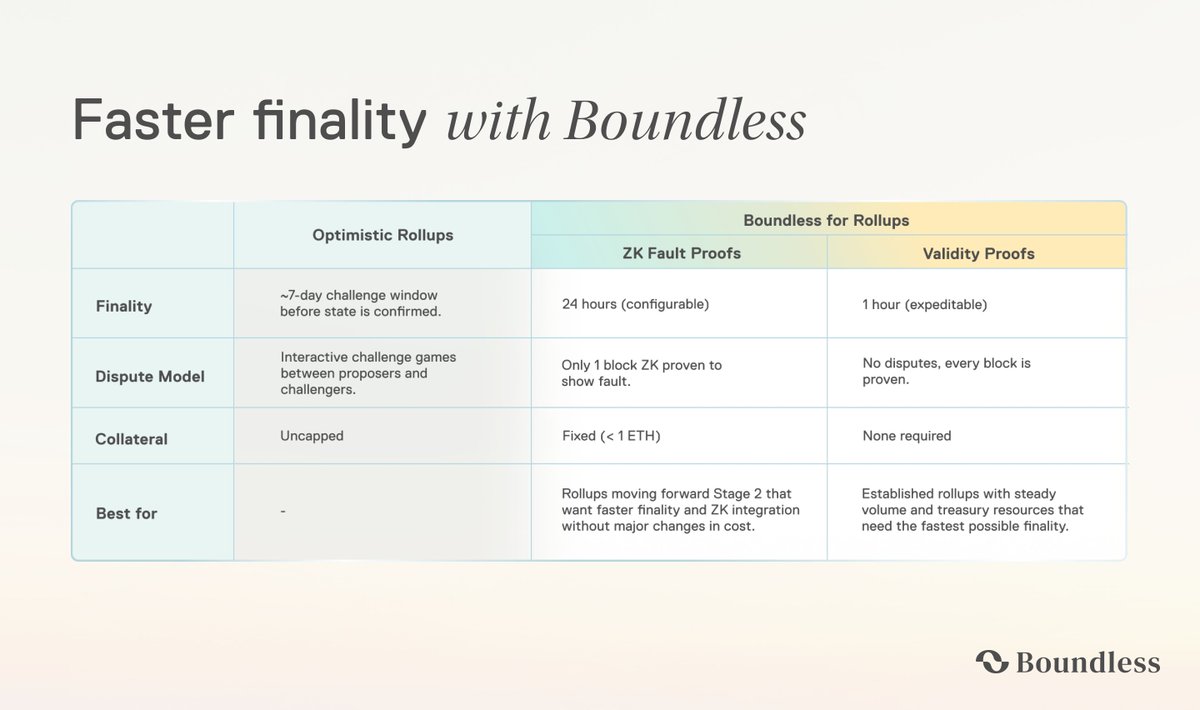

The Superchain isn’t some vague vision – it’s a live network of OP Chains sharing security, comms layers, and that sweet open-source OP Stack. Developers spin up standardized L2 rollups with Ethereum soul, but boundless speed. Traditional optimistic rollups? Solid, but fraud proof delays drag finality to a week-long crawl. Boundless flips the script, injecting ZK proofs without ripping apart your codebase. Imagine deploying a rollup that proves blocks in hybrid mode for three-hour finality or validity mode for under an hour – all while ETH holds steady at $3,005.09.

OP Kailua Unleashed: Hybrid vs Validity Modes in Action

OP Kailua’s dual modes paint a vivid upgrade path. Hybrid Mode swaps clunky interactive fraud proofs for one sleek ZK fraud proof. Boom – finality drops to roughly three hours. Challengers still poke, but proofs resolve disputes lightning-fast, cheaper than ever. Then there’s Validity Mode, the no-holds-barred beast: every block gets proven upfront, nuking the dispute phase entirely. Finality? Under one hour, capital unlocked, users ecstatic.

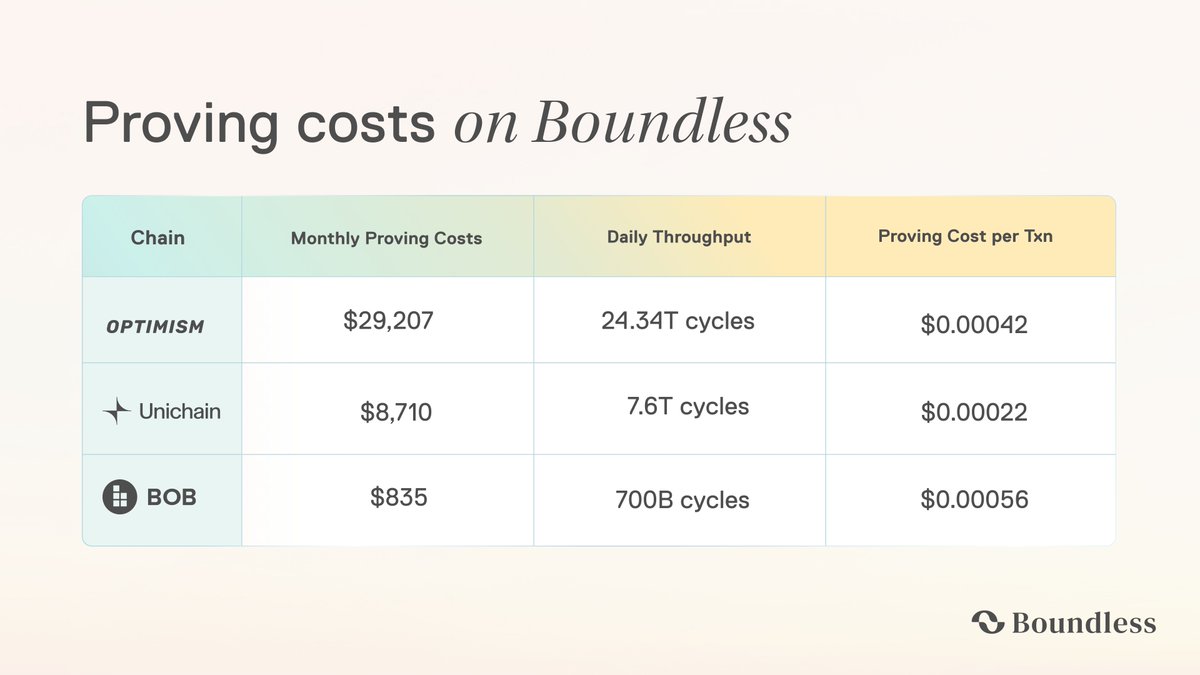

Visualize the dashboard: transactions batch, prove, post to Ethereum – seamless. Boundless backs it with a decentralized prover army, immune to outages, costs plummeting via competition. Projects like BOB and Eclipse already bolted this on, proving real-world rocket fuel for OP Stack rollups.

Ethereum (ETH) Price Prediction 2027-2032

Factoring Superchain ZK Upgrades via Boundless Framework for OP Stack Rollups Achieving Fast Finality | Baseline: ETH at $3,005.09 (2026)

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg) |

|---|---|---|---|---|

| 2027 | $2,500 | $4,200 | $6,800 | +40% |

| 2028 | $3,200 | $5,800 | $9,500 | +38% |

| 2029 | $4,000 | $8,000 | $13,000 | +38% |

| 2030 | $5,200 | $11,000 | $18,000 | +38% |

| 2031 | $6,800 | $15,000 | $25,000 | +36% |

| 2032 | $9,000 | $20,500 | $34,000 | +37% |

Price Prediction Summary

Ethereum is positioned for robust growth through 2032, propelled by the Boundless Framework’s OP Kailua enabling minute-level ZK finality on OP Stack rollups. This boosts Superchain scalability, L2 adoption, and ETH demand. From $3,005 in 2026, average prices could reach $20,500 by 2032, with bullish maxima over $34,000 amid market cycles and tech upgrades, while minima reflect bearish corrections.

Key Factors Affecting Ethereum Price

- Boundless Framework and OP Kailua for hybrid/validity ZK proofs reducing finality to <1 hour

- Superchain expansion driving L2 TVL and transaction volume

- Increased dApp migration to secure, low-cost OP rollups

- Bullish market cycles post-2026 with Bitcoin halving influences

- Regulatory clarity fostering institutional inflows

- Ethereum’s dominance vs. L1 competition

- Macro trends, stablecoin growth, and onchain activity resurgence

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Boundless is Your Rollup’s Fast-Track to ZK Dominance

In this multi-rollup frenzy, speed wins. Optimistic rollups shone for dev-friendliness, but ZK finality beckons for trustless security and instant settles. Boundless framework bridges that chasm effortlessly – plug in OP Kailua, minimal tweaks, zero user hiccups. Security skyrockets, no more seven-day waits tying up funds. Traders like me thrive on this: faster finality means tighter spreads, momentum chains across superchain rollups.

Gate. com lit it up: Boundless-powered rollups hit minute-level finality. Blockworks echoes with cheaper fraud challenges finalized in minutes. Optimism’s own X thread hails it as the single framework for full ZK freedom. This is no side quest; it’s the core upgrade propelling OP Stack into Ethereum’s scalability endgame.

Picture the trading floor lighting up as ZK finality OP Stack slashes those draggy dispute windows. Rollups finalize batches while ETH pulses at $3,005.09, capital spins back into plays faster than a momentum spike. Boundless doesn’t just promise; it delivers the infrastructure with provers competing globally, costs crashing, uptime ironclad.

Hands-On Rollup Turbocharge: Integrating Boundless Step by Step

Enough theory – let’s bolt this onto your OP Stack rollups. As a trader who’s flipped multi-rollup positions on razor-thin edges, I dig frameworks that deploy without drama. Boundless shines here: fork the OP Stack, weave in OP Kailua, pick your mode, and launch. Devs keep EVM compatibility, users see zero downtime. Security? ZK proofs lock it down, no trust assumptions crumbling under load.

BOB and Eclipse jumped first, their rollups now flexing sub-hour settles. Your turn: hybrid for quick wins, validity for ZK purists. Provers decentralize the heavy lift, so even if one node flakes, proofs keep flowing. Costs? Slashed by rivalry, making superchain rollups viable for DeFi blasts and NFT drops alike.

Mode Matchup: Stack Your Edge

Swing trading superchain assets demands precision. Traditional optimistic rollups tie funds for a week; Boundless hybrid cuts to three hours, validity to minutes. Liquidity explodes, arbitrage windows widen. ETH at $3,005.09 with that and 0.0124% 24-hour nudge signals stability – perfect soil for rollup momentum to erupt.

Comparison: Optimistic Rollups vs. Boundless Hybrid vs. Validity Mode (ETH at $3,005.09)

| Mode | Finality Time | Capital Efficiency | Security Model | Cost (ETH at $3,005.09) |

|---|---|---|---|---|

| Optimistic Rollups | 7 days | Low (high capital lockup for full challenge period) | Optimistic with interactive fraud proofs | Low (no ZK proving; minimal challenge costs) |

| Boundless Hybrid | ~3 hours | Improved (reduced lockup during short dispute phase) | ZK Fraud Proof (single ZK proof replaces interactive proofs) | Cheaper fraud challenges (decentralized ZK provers) |

| Boundless Validity Mode | <1 hour (minutes) | Highest (no dispute phase or capital lockup) | Full ZK Validity Proofs (every block proved) | Cost-effective (optimized decentralized provers) |

That table screams opportunity. Hybrid mode nips fraud proofs into ZK elegance; validity mode proves every block upfront, trustless finality that crushes competitors. Succinct’s OP take echoes this dev-friendly ZK pivot, but Boundless pairs it with prover muscle. Alchemy nails the modular vibe: standardized yet flexible, Ethereum heart pumping at warp speed.

Zoom out to the Boundless framework ecosystem. Zeeve calls OP Stack simple power for standalone chains; OKX ties it to sustainable public goods via revenue loops. OAK Research spotlights Superchain cohesion – Boundless cements it with fast optimistic to ZK transition. YBB’s multichain madness? Tamed by this one-click upgrade path.

For traders, it’s pure alpha. Scan superchain dashboards: faster finality tightens spreads across OP Chains, momentum cascades from Base to Zora. I ride these waves – position in pre-upgrade dips, exit on finality pops. With ETH steady at $3,005.09, rollups like these fuel the next leg up. Deploy now, or watch liquidity lap you.

Boundless Framework isn’t a gadget; it’s the accelerator pedal for OP Stack’s dominance. Minute-level finality unlocks the multi-rollup frenzy, security scales, traders feast. Momentum is opportunity – grab it before the pack piles in.