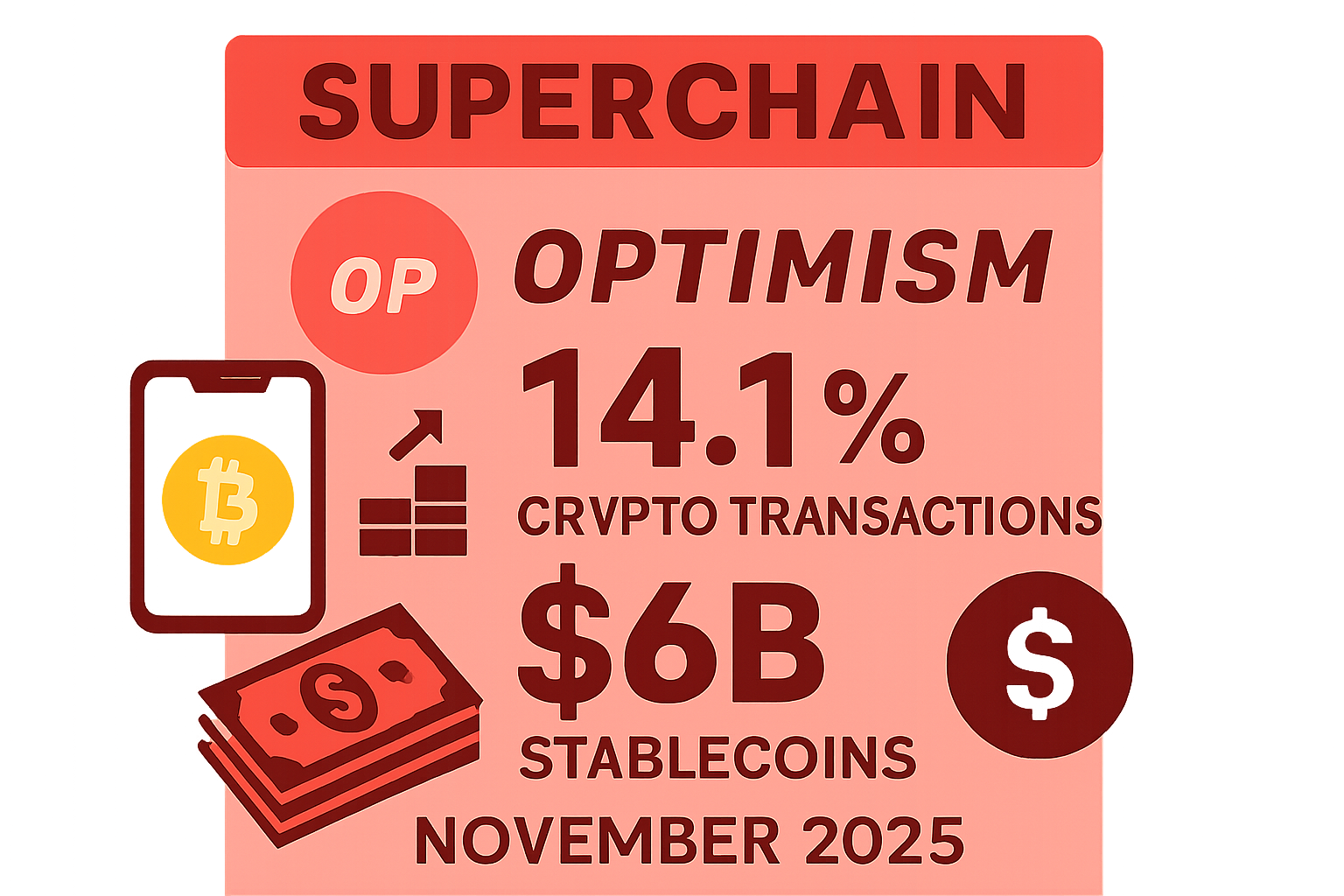

In November 2025, the Superchain solidified its position as a cornerstone of blockchain scalability, capturing 14.1% of all crypto transactions while hosting $6 billion in stablecoins across OP Stack rollups. This surge reflects not just raw numbers, but a maturing ecosystem where Ethereum’s multi-rollup vision is turning into tangible efficiency gains for developers and users alike. Daily transaction volumes hit 24.1 million, underscoring the Superchain’s ability to handle real-world demand without compromising on security or cost.

From my vantage as a portfolio manager focused on multi-chain strategies, these Superchain November 2025 stats signal a strategic pivot point. Investors eyeing Ethereum L2 superchain metrics should note how this infrastructure quietly outpaces competitors, blending interoperability with high throughput. It’s the kind of growth that rewards patient capital, encouraging allocation toward OP Stack-native projects amid broader market volatility.

Transaction Dominance: 14.1% Share and Doubling in Five Months

The Optimism Superchain’s ascent to 14.1% of global crypto transactions marks a pivotal shift. Optimism’s own data highlights 24.1 million daily transactions, a near doubling from earlier in the year. This isn’t hype; it’s powered by chains like Base, which led H1 2025 metrics with substantial GDP contributions totaling $396.5 million across 34 OP Chains.

Deeper dives reveal the Superchain claiming around 30% of total Ethereum L2 transactions, with 44% from OP Stack chains alone. For blockchain enthusiasts, this translates to lower fees and faster confirmations, making it ideal for DeFi protocols and emerging AI-agentic apps. Strategically, it positions the ecosystem to capture more volume as onchain activity explodes, a trend worth watching for diversified portfolios.

Stablecoin Milestone: $6 Billion Secured Across Rollups

Stablecoin supply hitting $6 billion across OP Stack rollups speaks volumes about liquidity and trust. Dashboards from Superchain Eco track this aggregated value, secured by the chains themselves, offering a clear lens on economic health. This OP stack stablecoins TVL growth aligns with Visa’s onchain analytics, where stablecoin transactions represent verifiable, open exchanges fueling everyday crypto use.

Key Chains Fueling Optimism Superchain Transactions Growth

Base remains the powerhouse, dominating activity, while launches like Unichain and Celo propel expansion. Base Soneium Unichain growth exemplifies how OP Stack adoption is winning Web3 quietly, processing millions of transactions for hundreds of millions of users. Zeeve’s analysis pegs Superchain at a hefty slice of L2 pie, with features tailored for DeFi and beyond.

This momentum, detailed in resources like OP Stack’s explosive growth analysis, hints at synchronized rollups tackling scalability head-on. Encouragingly, it invites strategic plays: diversify into these chains for long-term upside, balancing short-term agility with Ethereum’s secured future.

Optimism’s infrastructure stands out as the most used in blockchain today, powering not just volume but serving hundreds of millions through its OP Stack. This positions chains like Soneium alongside Base and Unichain as frontrunners in optimism superchain transactions growth, each bringing unique strengths from DeFi dominance to AI integrations.

Optimism Technical Analysis Chart

Analysis by Sophie Trent | Symbol: BINANCE:OPUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

On this OPUSDT daily chart from August to December 2025, draw a prominent downtrend line connecting the September peak at 2025-09-18 (4.75) to the recent low on 2025-12-05 (2.05), using ‘trend_line’ tool in red with 0.8 confidence. Add horizontal support at 2.00 (strong, green), resistance at 2.80 (moderate, red), and 3.50 (strong, red). Mark a potential accumulation range from 2025-11-15 to 2025-12-08 between 2.00-2.40 with ‘rectangle’ tool. Place long entry zone at 2.20 with ‘long_position’ icon, profit target 3.00 and stop 1.95 using ‘order_line’. Highlight volume spike on 2025-10-20 breakdown with ‘arrow_mark_down’ and callout ‘High Volume Decline’. For MACD, add ‘arrow_mark_down’ at bearish crossover around 2025-11-01. Vertical line at 2025-11-30 for Superchain news catalyst. Use fib retracement from Sep high to Dec low for 50% level at 3.40. Text box summary: ‘Bearish trend but fundamentals suggest reversal.’

Risk Assessment: medium

Analysis: Bearish trend intact but fundamentals (Superchain growth) and volume exhaustion mitigate downside; aligns with my medium tolerance

Sophie Trent’s Recommendation: Scale in long on support hold, diversify 5-10% portfolio allocation for OP exposure

Key Support & Resistance Levels

📈 Support Levels:

-

$2 – Strong multi-touch low from Nov-Dec, aligns with 61.8% fib

strong -

$1.85 – Weak prior low extension

weak

📉 Resistance Levels:

-

$2.8 – Moderate recent swing high Nov, 38.2% fib retrace

moderate -

$3.5 – Strong Oct breakdown level

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$2.2 – Bounce from strong support 2.00 with volume divergence

medium risk

🚪 Exit Zones:

-

$3 – Profit target at 38.2% fib retrace

💰 profit target -

$1.95 – Stop below strong support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Declining on downtrend, spike on Oct breakdown

Bearish volume confirmation early, now drying up signaling potential reversal

📈 MACD Analysis:

Signal: Bearish crossover mid-Nov, momentum fading

MACD histogram contracting, bullish divergence possible

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Sophie Trent is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Such metrics from the Superchain Ecosystem Index, updated November 30, paint a vivid picture of interconnected chains pulling from the official registry. For developers, this means seamless deployment across OP Stack rollups; for investors, it signals diversified exposure without the silos of fragmented L2s.

Ethereum L2 Leadership: 30% Share and OP Stack’s 44% Edge

Diving into ethereum L2 superchain metrics, the Superchain commands roughly 30% of Ethereum’s Layer 2 transactions, with OP Stack chains contributing 44%. This edge comes from deliberate design: shared sequencing, fault proofs, and cross-chain messaging that minimize friction. Messari’s H1 report showed 34 chains generating $396.5 million in GDP, a baseline now eclipsed by November’s feats.

Token Metrics ranks top optimistic rollups, placing Arbitrum One high but underscoring OP Stack’s mainnet prowess in DeFi, perps volume, and stablecoin flows. Base’s lead isn’t isolated; it’s symbiotic, with Unichain’s launch amplifying collective throughput. Strategically, this L2 dominance encourages portfolio tilts toward Superchain tokens and dApps, balancing Ethereum’s security with OP’s speed.

Explore further in Superchain’s secured value growth, where similar trends forecast sustained expansion. My advice: layer in positions now, as these chains mature into interoperability hubs.

Investment Strategies for Superchain Momentum

As a portfolio manager, I see the Superchain’s November stats as a call for strategic diversification. With $6 billion in stablecoins providing ballast, volatility feels contained. Allocate across Base for high-volume plays, Soneium for innovative apps, and Unichain for fresh liquidity inflows. OP Mainnet’s DefiLlama dashboards reveal chain revenues and DEX volumes climbing in tandem, hinting at fee-sharing models that reward governance participants.

Superbundler innovations, as covered in cross-chain transaction guides, streamline intents across rollups, cutting costs further. This isn’t speculative; it’s engineered resilience. For long-term holders, stake into OP governance or yield farm stablecoins here, blending short-term yields with Ethereum’s multi-rollup ascent.

Challenges persist, like coordination across dozens of chains, but layered designs address them head-on. See coordination strategies for tactical insights. Encouragingly, the Superchain invites builders and investors alike to scale with Ethereum, turning November’s 14.1% share into tomorrow’s standard.

These benchmarks affirm the OP Stack’s quiet conquest of Web3. Daily volumes at 24.1 million, stablecoins at $6 billion: markers of an ecosystem ready for mass adoption. Position accordingly, and ride the wave of blockchain’s scalable future.