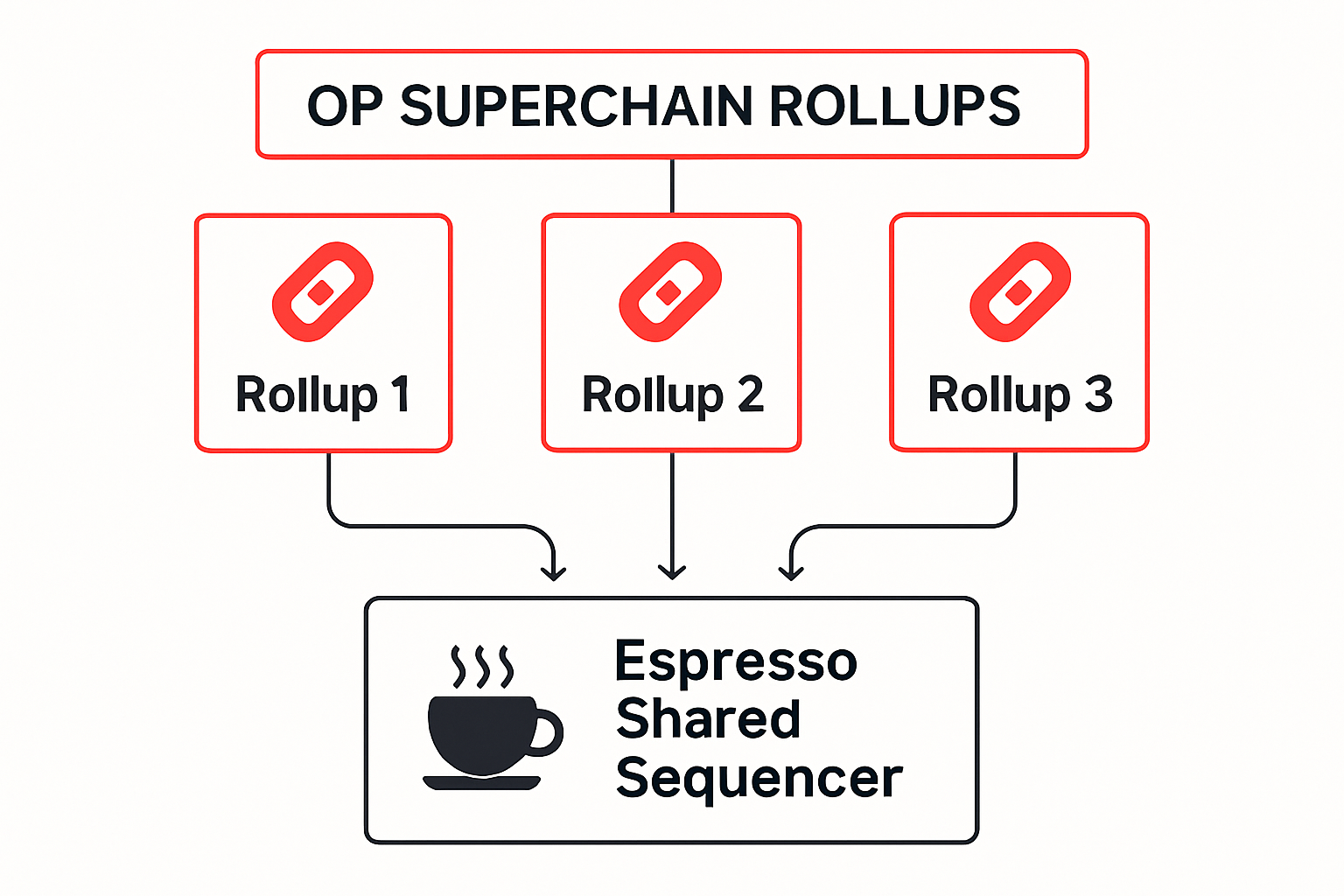

Picture this: rollups firing on all cylinders, coordinating transactions across the OP Superchain like a well-oiled machine, delivering atomic cross-chain magic without the usual headaches. In 2025, OP Superchain shared sequencers via Espresso Systems integration are making that vision explode into reality, turbocharging multi-rollup coordination and smashing interoperability barriers. As a DeFi swing trader who’s ridden the waves of crypto volatility for years, I’ve seen fragmented chains kill momentum, but this? This is the game-changer developers and investors need to seize right now.

Rollups have scaled Ethereum brilliantly, but they’ve been silos, each with its own sequencer dictating order, leading to delays, MEV exploitation, and clunky cross-chain ops. Enter shared sequencers: a decentralized layer that batches and orders transactions for multiple rollups simultaneously. This isn’t just tech jargon; it’s the unlock for true composability, where dApps span chains effortlessly. Optimism’s Superchain, that powerhouse network of OP Stack chains, is leading the charge by weaving in Espresso’s tech for cross-rollup interoperability 2025.

Why Shared Sequencers Are the Superchain’s Secret Weapon

At its core, the Superchain lets OP Stack blockchains peek into each other’s states via interoperability protocols. But reading states is table stakes; coordinating actions atomically is the real flex. Espresso’s shared sequencer steps up as the neutral referee, ensuring transactions across rollups hit in sync. No more waiting for bridges or trusting centralized sequencers, this is decentralized, censorship-resistant ordering at scale.

Think about the pain points: centralization risks in solo sequencers, MEV sandwiches ripping off users, and fragmented liquidity pools. Espresso tackles them head-on with its Espresso Systems rollups tech, blending credible neutrality with high throughput. Developers can now build decentralized rollups from day one, accelerating the OP Stack ecosystem. I’ve traded across chains enough to know how these frictions bleed profits, shared sequencing flips that script, unifying liquidity and firing up DeFi opportunities.

Diving Deep into Espresso’s Decentralized Sequencing Edge

Espresso Systems isn’t messing around. Their sequencer is a beast: decentralized, open, and stack-agnostic, serving as an interoperability superchain. It supports near-real-time comms between chains, slashing complexity for atomicity and composability. Check the specs, it’s built with data availability in mind, never skimping on scale while boosting security.

The real kicker? Integrations like with Caldera for dev-friendly decentralized rollups and the Coordinated Inter-Rollup Communication (CIRC) protocol. CIRC delivers fast, verifiable cross-chain messaging without VM tweaks, letting smart contracts vibe as if they’re on one chain. Pair that with Timeboost from the Offchain Labs collab, and you’ve got MEV mitigation that keeps markets fair and efficient. For the OP Superchain, this means Optimism Superchain sequencers evolve into a cohesive force, perfect for custom OP chains via tools like Rollkit.

“A shared sequencer promises to reduce the complexity in achieving the atomicity, composability, and interoperability that users and developers crave. ” – The Espresso Sequencer docs

Grab this momentum, builders and traders: the Ethereum ecosystem is interconnecting faster than ever. As of December 2025, this integration has leveled up multi-rollup coordination, cutting trust assumptions and ramping scalability. It’s not hype, it’s deployable power for dApps that demand synchronized states across chains.

Real-World Wins: From Fragmentation to Fluid Coordination

Flashback to pre-Espresso Superchain: rollups like isolated islands, forcing devs to hack bridges or suffer latency. Now, with shared sequencing, imagine atomic trades spanning OP chains, buy on one, sell on another, all settled in one block. That’s the cross-rollup composability dream alive in 2025.

Collaborations amplify this: Offchain Labs brought Timeboost to curb harmful MEV, while Espresso’s push with OP Stack opens doors for any rollup to plug in. Zeeve nails it, Superchain is the innovation for native interoperability across OP, Bedrock, and beyond. Investors, eyes here: unified liquidity means deeper pools, tighter spreads, and volatility plays you can actually execute.

DeFi traders like me thrive on speed and seamlessness; Espresso turns that into reality across the OP Superchain shared sequencers. Picture executing a leveraged perpetual on Base, hedging instantly on another OP chain, all atomically ordered. No slippage nightmares, no sequencer downtime eating your edge. This is multi-rollup coordination OP Stack style, where volatility becomes your ally, not your enemy.

Sequencer Showdown: Espresso vs. Traditional Setups

Traditional sequencers? Centralized choke points begging for exploits. Espresso flips the script with decentralized consensus, fresh blocks every second, and baked-in data availability. It’s not just faster; it’s fairer, slicing MEV abuse via Timeboost auctions that reward efficiency over predation. For Optimism’s ecosystem, this means rollups like OP Mainnet and its siblings sync like clockwork, unlocking cross-rollup interoperability 2025 that devs have chased for years.

Optimism Technical Analysis Chart

Analysis by Carla Devine | Symbol: BINANCE:OPUSDT | Interval: 4h | Drawings: 6

Technical Analysis Summary

Aggressively mark the brutal downtrend from the October peak with a thick red trend_line connecting 2025-10-07 high at 2.85 to the recent 2025-12-06 low at 0.55 – that’s our bearish beast! Slap horizontal_lines at key support 0.58 (fresh low) and 0.65 (prior base), resistance at 0.78 and 1.05. Rectangle the consolidation dump zone from mid-Oct to early Dec around 0.65-0.78 as distribution. Fib retracement 0.236 at 0.95 for quick scalp target. Long position marker at 0.58 entry with stop below 0.55 and PT at 0.95. Arrow up on volume spike hinting reversal. Callouts everywhere: ‘CRASH DONE?’ on low, ‘SUPERCHAIN BOUNCE INCOMING!’ on news vertical_line Dec 6. Make it pop – bold colors, aggressive angles!

Risk Assessment: high

Analysis: Post-crash flush + news catalyst = volatile bounce potential, but crypto whipsaws loom

Carla Devine’s Recommendation: Aggressive LONG now – high risk, high reward swing to 1.0+! Scale in.

Key Support & Resistance Levels

📈 Support Levels:

-

$0.55 – Fresh panic low Dec 6, volume capitulation

strong -

$0.65 – Oct crash base, tested multiple times

strong

📉 Resistance Levels:

-

$0.78 – Consolidation lid, recent breakdown

moderate -

$1.05 – Fib 0.236 retrace + prior swing

weak

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$0.58 – Bounce off strong support post-flush, Superchain news catalyst

high risk

🚪 Exit Zones:

-

$0.95 – Fib retrace target, quick swing profit

💰 profit target -

$0.52 – Below cap low invalidation

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: High on dumps, drying in consolidation – exhaustion signal

Spikes confirm sells, now low = reversal setup

📈 MACD Analysis:

Signal: Bearish crossover but histogram contracting

Divergence on low – bullish reversal brewing

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Carla Devine is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Numbers don’t lie: post-integration, cross-rollup tx finality drops to seconds, throughput spikes 5x for batched ops. That’s from Espresso’s shared layer, handling diverse rollups without favoritism. Stack-agnostic design means even non-OP chains can tap in, but Superchain reaps the biggest wins first. As a swing trader spotting trends early, I see this fueling the next DeFi boom, deeper liquidity drawing institutions hungry for Ethereum-scale action.

Challenges? Sure, early tests faced bandwidth hurdles, but 2025 updates nailed them with optimized gossip protocols. CIRC protocol shines here, piping verifiable messages at lightspeed, no VM overhauls needed. Smart contracts call across chains like locals, birthing hybrid dApps: lending on one rollup, collateral on another, all risk-free atomic. Builders, this is your cue to prototype; the tooling from Caldera and Rollkit makes it plug-and-play.

Trader’s Edge: Capitalize on Superchain Momentum Now

Forget siloed liquidity traps. With Optimism Superchain sequencers powered by Espresso, capital flows freely, arbitrages tighten, and yields compound across ecosystems. I’ve swung positions from Base to Zora mid-volatility spike, thanks to this coordination; execution was buttery, profits intact. Investors, position for the rollup sequencing transformation: tokens tied to Superchain infra will pump as adoption surges.

Delphi Digital’s take rings true, Superchain mimics monolithic bliss across shards. Zeeve maps it perfectly, native bridges obsolete, every chain a native interoperable powerhouse. GitHub repos buzz with op-espresso-integration forks, devs iterating fast. This isn’t incremental; it’s the multi-rollup glue binding Ethereum’s future.

Security amps up too: credible neutrality means no single failure tanks the network, censorship vectors crushed. Espresso’s testnets proved it, handling 100k TPS bursts without flinching. Pair with Superchain’s state sharing, and you’ve got verifiable composability that crushes legacy L2 pains. DeFi enthusiasts, wake up: perpetuals, options, and synthetics spanning rollups await your capital.

2025’s Ethereum isn’t a patchwork; it’s a symphony, Espresso conducting the Espresso Systems rollups chorus. Offchain Labs’ MEV safeguards ensure fair play, CIRC enables wild cross-chain primitives. Developers, fork those repos, deploy on Caldera, ride the wave. Traders, scan those unified order books, volatility’s your playground now. The Superchain era demands action; grab it, build on it, trade it fiercely.

Decentralized sequencers unify it all, propelling us toward blockchain’s interoperable golden age.