The Ethereum Superchain is entering a new era – one where composability, not just speed, is the ultimate prize. In 2025, the landscape is crowded with over 70 and live Layer 2 rollups, each promising cheaper and faster transactions. But beneath that surface lies a splintered ecosystem: liquidity pools are siloed, user experiences are fragmented, and cross-rollup trades still feel like navigating a maze of bridges and delays. This is the coordination problem that Espresso Systems’ shared sequencer aims to solve.

Why Rollup Fragmentation Is Ethereum’s Biggest Bottleneck

Let’s get visual: imagine each rollup as its own bustling city, but with only a single highway in or out. Every city runs on its own traffic rules (sequencers), making it hard for people (liquidity and data) to move freely between them. This isolation leads to:

- Liquidity fragmentation: Capital gets stuck in separate rollups, driving up slippage and reducing DeFi efficiency.

- Complex cross-rollup interactions: Developers must build custom bridges or relayers for even simple multi-chain apps.

- Centralized bottlenecks: Most rollups use a single sequencer (often run by the project team), creating points of failure and censorship risk.

This isn’t just an inconvenience – it’s an existential threat to Ethereum’s modular vision. The more isolated each rollup becomes, the less value the Superchain can deliver as a whole.

What Is a Shared Sequencer? The Espresso Approach Explained

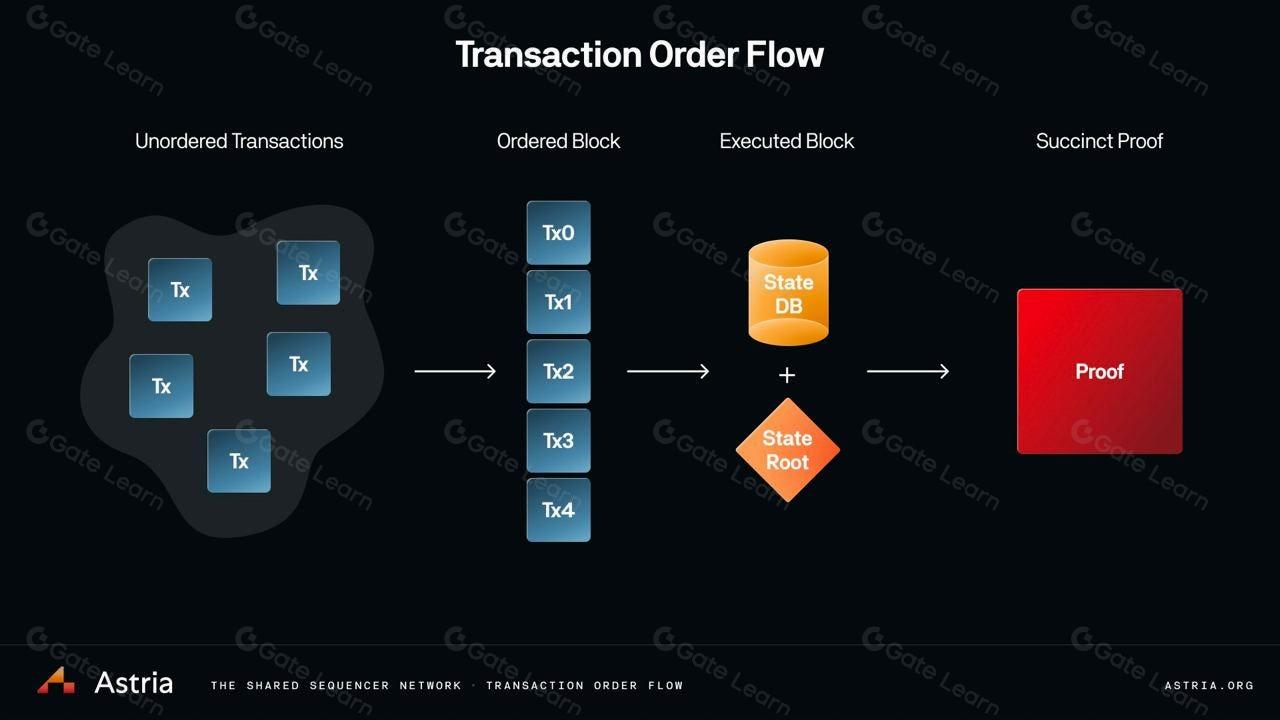

A shared sequencer acts like a universal traffic controller for multiple cities at once. Instead of every rollup scheduling its own transactions in isolation, they plug into Espresso’s decentralized ordering network. Here’s what makes this breakthrough:

- BFT consensus for fast finality: Espresso uses Byzantine Fault Tolerance to confirm transactions across connected blockchains within six seconds (MEXC). No more waiting for slow bridges or risking reorgs.

- Atomic cross-rollup execution: With unified ordering, users can perform actions across multiple rollups in a single step – think atomic swaps or complex DeFi arbitrage without bridge risk.

- Decentralized coordination layer: By distributing sequencing power among many nodes, Espresso reduces censorship risk and aligns with Ethereum’s ethos of trustless infrastructure.

This model turns fragmented rollups into a cohesive network where apps can finally talk to each other natively, unlocking new possibilities for developers and users alike.

The Polygon Partnership: Building Bridges Without Bridges

The recent collaboration between Espresso Systems and Polygon Labs on AggLayer is a turning point for superchain scalability (Blockworks). Polygon’s AggLayer aggregates liquidity from various L2s; by integrating Espresso’s shared sequencer, it ensures that transaction ordering remains decentralized but globally consistent across all participating chains. This means:

- No more manual bridging or risky lock-and-mint systems when moving assets between rollups supported by AggLayer.

- Smoother user experience as apps can execute multi-rollup logic atomically – all confirmed within seconds via BFT consensus.

- A real shot at solving cross-rollup MEV (maximal extractable value) issues by providing fair sequencing opportunities across the entire superchain ecosystem (SwapSpace Medium).

If you want to dive deeper into how these shared sequencers are transforming interoperability in the OP Stack and beyond, check out our detailed guide: How Shared Sequencers Like Espresso Are Enabling Cross-Rollup Composability in the OP Superchain.

But what does this mean in practice for developers, traders, and the entire modular blockchain ecosystem? Let’s zoom in on the real-world impact of Espresso Systems’ shared sequencer as 2025 unfolds.

Unlocking Atomic Cross-Rollup Execution

Imagine executing a complex DeFi strategy that spans multiple rollups, swapping assets on one L2, borrowing on another, and providing liquidity on a third. Previously, this required juggling bridges, waiting for confirmations, and exposing yourself to bridge risk or failed atomicity. With Espresso’s shared sequencer, all these steps can be bundled into a single transaction flow with atomic execution. If any part fails, the whole operation is rolled back, no more partial fills or stuck funds.

This unlocks a new era of bridge-free cross-chain transactions, where users interact with the Superchain as if it were a single unified system. For developers, it means building dApps that natively span multiple rollups without custom relayers or brittle integrations. For users, it’s seamless DeFi composability at last.

Taming Cross-Rollup MEV and Economic Finality

One of the thorniest issues in multi-rollup environments is cross-rollup MEV (Maximal Extractable Value). When each rollup sequences transactions independently, arbitrageurs can exploit delays and fragmented ordering to siphon value from unsuspecting users. Espresso’s shared sequencer levels the playing field by giving all connected rollups access to a common ordering layer. This dramatically reduces frontrunning opportunities and brings greater predictability to transaction outcomes.

And thanks to BFT-powered consensus, rollup economic finality is achieved within seconds, not minutes, across all participating chains. This rapid confirmation is crucial for power users who need certainty for high-value trades or time-sensitive operations.

Espresso’s Shared Sequencer: Key Benefits Illustrated

-

Unified Liquidity Pools: Espresso’s shared sequencer brings together liquidity from multiple Ethereum rollups, allowing assets to flow seamlessly and reducing fragmentation across the Superchain.

-

Atomic Swaps Across Rollups: With Espresso, users can execute atomic swaps between different rollups, enabling instant, trustless trading and composability that wasn’t possible with isolated sequencers.

-

Decentralized Sequencing: By decentralizing transaction ordering, Espresso eliminates single points of failure and censorship risk, making rollup networks more secure and resilient.

-

Improved User Experience: Espresso delivers faster, more predictable transaction confirmations and a unified interface for interacting with multiple rollups—making DeFi and dApps smoother for everyone.

The Road Ahead: Superchain Scalability and Interoperability

The momentum behind shared sequencing is undeniable. As standards like ERC-7683 and EIP-7781 mature alongside solutions like Espresso Systems, we’re witnessing the birth of a truly modular blockchain ecosystem. The days of isolated L2 silos are numbered; instead, we’re moving toward an era where interoperability is built into the foundation of every major rollup project.

The partnership with Polygon Labs signals that even heavyweight players recognize the need for unified transaction ordering, and that decentralized coordination layers will be essential for scaling Ethereum without sacrificing its core values.

If you’re hungry for more technical deep-dives or want to see how these innovations are reshaping OP Stack interoperability in real time, explore our related resources:

- How Espresso Systems Is Transforming Rollup Sequencing for the Superchain (2025 Guide)

- How Shared Sequencers Enable Atomic Cross-Rollup Trades in the OP Stack

The superchain future isn’t just about speed, it’s about composability without compromise. Thanks to innovations like Espresso’s shared sequencer, Ethereum’s modular vision is finally coming into focus: one network, many chains, unified by design.