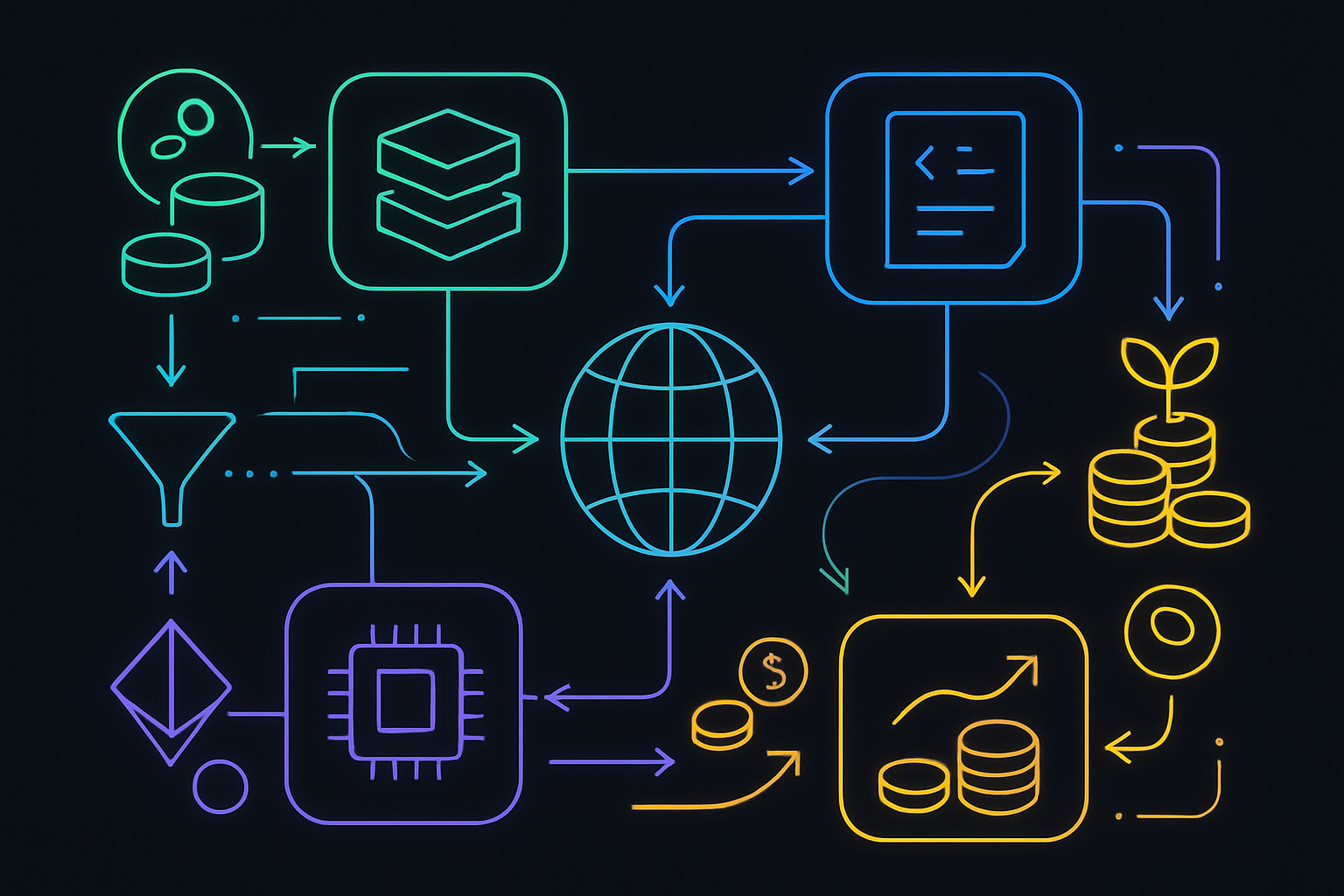

The rapid evolution of the Ethereum ecosystem hinges on its ability to scale and innovate, especially in areas like staking and validator incentives. At the heart of this transformation is the OP Stack, a modular, open-source toolkit developed by Optimism. The OP Stack isn’t just powering the next generation of Layer 2 (L2) chains – it’s serving as the foundational infrastructure for what is now known as the Superchain. This network of interoperable L2s is redefining how staking works, making it more adaptable, secure, and user-centric than ever before.

What Makes the OP Stack Unique for Staking?

Traditional staking models on Ethereum have been limited by the constraints of Layer 1. The OP Stack changes this paradigm by enabling each L2 chain within the Superchain to customize its own gas token, governance structure, and economic incentives. This flexibility unlocks a new era of staking innovation in the OP ecosystem, where projects can align rewards with their specific goals and user bases.

For example, some chains might choose ETH as their gas token to maintain a familiar environment for users. Others may opt for native tokens or even experiment with dynamic reward mechanisms tailored to their application’s needs. This diversity not only attracts different types of validators but also paves the way for novel DeFi protocols and cross-chain staking opportunities.

The OP Stack’s modularity is a game-changer: it empowers developers to design unique staking mechanisms while ensuring all chains remain interoperable within the Superchain.: OAK Research

Superchain Staking Infrastructure: A Multi-Rollup Vision

The Superchain is more than just a collection of rollups – it’s a unified network where security, communication layers, and upgrades are shared across participating L2s. By leveraging standardized modules from the OP Stack, developers can launch new chains that instantly benefit from mature staking infrastructure and robust validator incentives.

This architecture supports diverse economic models:

- Custom Gas Tokens: Chains can select ETH, OP, or project-native tokens to power transactions and reward validators.

- Differentiated Governance: Each chain can implement its own governance system while still participating in Superchain-wide decisions when needed.

- Composable Staking: Validators can participate across multiple rollups without duplicating effort or capital – thanks to shared security guarantees.

This approach not only streamlines onboarding for new projects but also creates fertile ground for experimentation with multi-rollup staking models – a key theme in today’s rapidly evolving DeFi landscape.

The Role of Layer 3 Chains in Expanding Staking Innovation

The introduction of Layer 3 (L3) chains marks another leap forward in superchain staking infrastructure. L3s are designed for highly specialized applications – think gaming platforms or social networks that need ultra-low fees and high throughput. Thanks to features like custom gas tokens and Plasma Mode within the OP Stack, these L3s can fine-tune their transaction fees and data availability strategies while integrating seamlessly into existing validator ecosystems.

This means developers can deploy application-specific rollups that offer unique staking rewards or governance rights tied directly to platform usage. For users and validators alike, this translates into greater choice and potentially higher yields as new economic models emerge across interconnected layers of the Superchain.

If you’re curious about how interoperability between these rollups works under the hood, check out our deep dive on how the OP Stack enables seamless interoperability between Ethereum rollups.

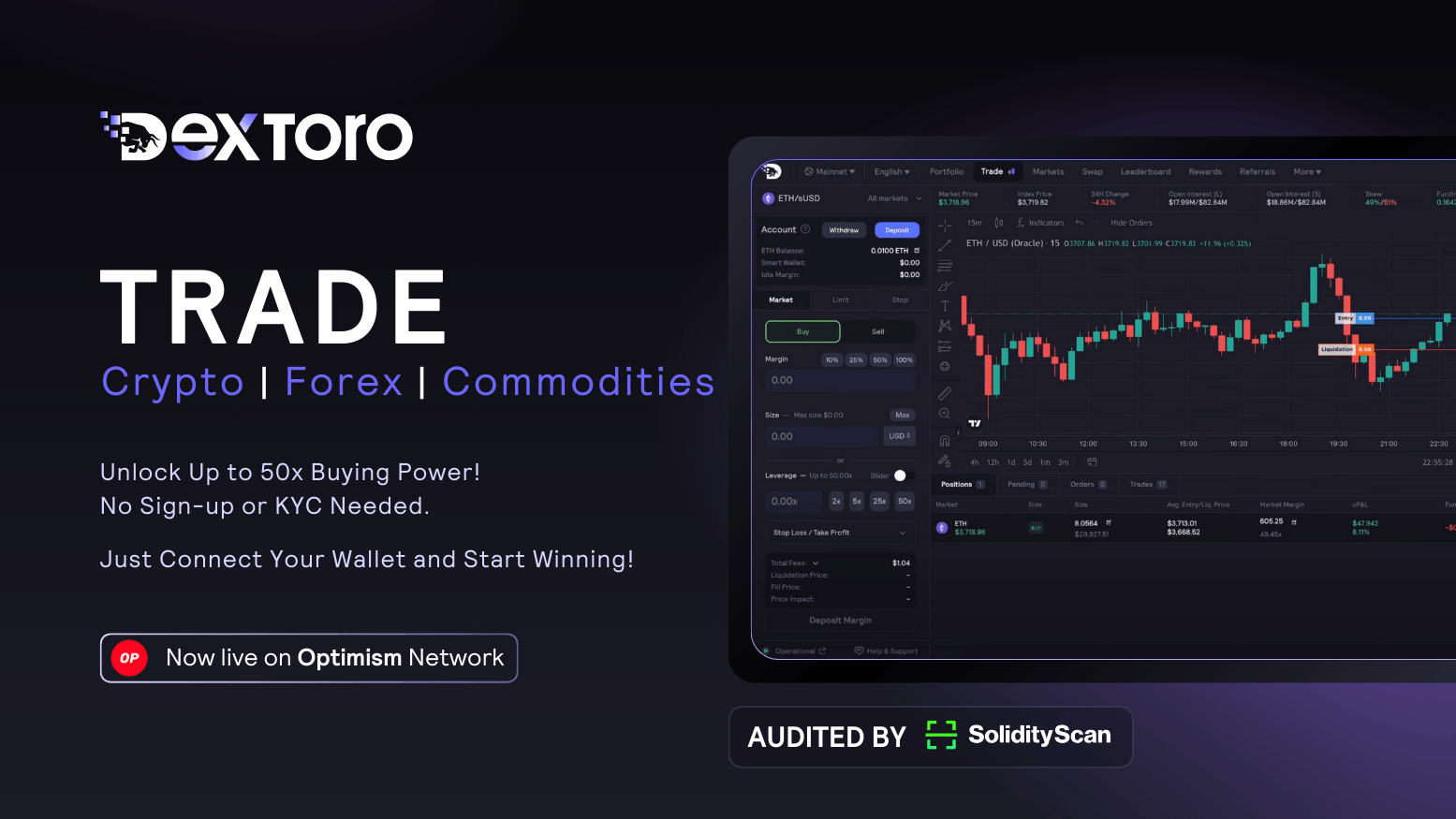

As Superchain adoption accelerates, the OP Stack’s standardized yet customizable modules are already fueling a wave of staking innovation. Developers are experimenting with everything from liquid staking derivatives to protocol-native reward tokens, all while benefiting from unified security and interoperability. This experimentation is not theoretical: projects like DexToro and Dinero are live examples, offering protocol revenue sharing and dynamic staking rewards tailored to their communities.

The impact is measurable. According to recent research, revenue on OP Stack chains now comes from a blend of transaction fees, sequencing fees, MEV (Maximal Extractable Value), and both staking and governance activities. By allowing each chain to select its own optimal mix of incentives, the Superchain ecosystem supports a broader spectrum of validator participation than ever before.

Validator Incentives: Aligning Security and Growth

One of the most powerful outcomes of this modular approach is the ability for each rollup to design unique validator incentive structures without sacrificing interoperability or security. For instance, some chains boost validator returns through protocol fees or additional token emissions, while others focus on governance rights as an incentive mechanism. This flexibility enables protocols to target different types of validators, whether they’re seeking immediate yield or long-term influence in protocol governance.

Top Superchain Projects Leading Staking Innovation

-

Base – Coinbase’s OP Stack-powered chain is pioneering user-friendly staking by integrating Ethereum-native assets and offering seamless access to DeFi protocols. Its focus on security and interoperability makes it a flagship for Superchain staking models.

-

Optimism Mainnet – As the original OP Stack chain, Optimism Mainnet enables native OP token staking and governance. It supports innovative staking rewards and is central to Superchain’s shared security vision.

-

Mode Network – Built on the OP Stack, Mode Network introduces a unique staking and rewards system that incentivizes both users and developers. Its modular approach allows for flexible staking products tailored to different DeFi needs.

-

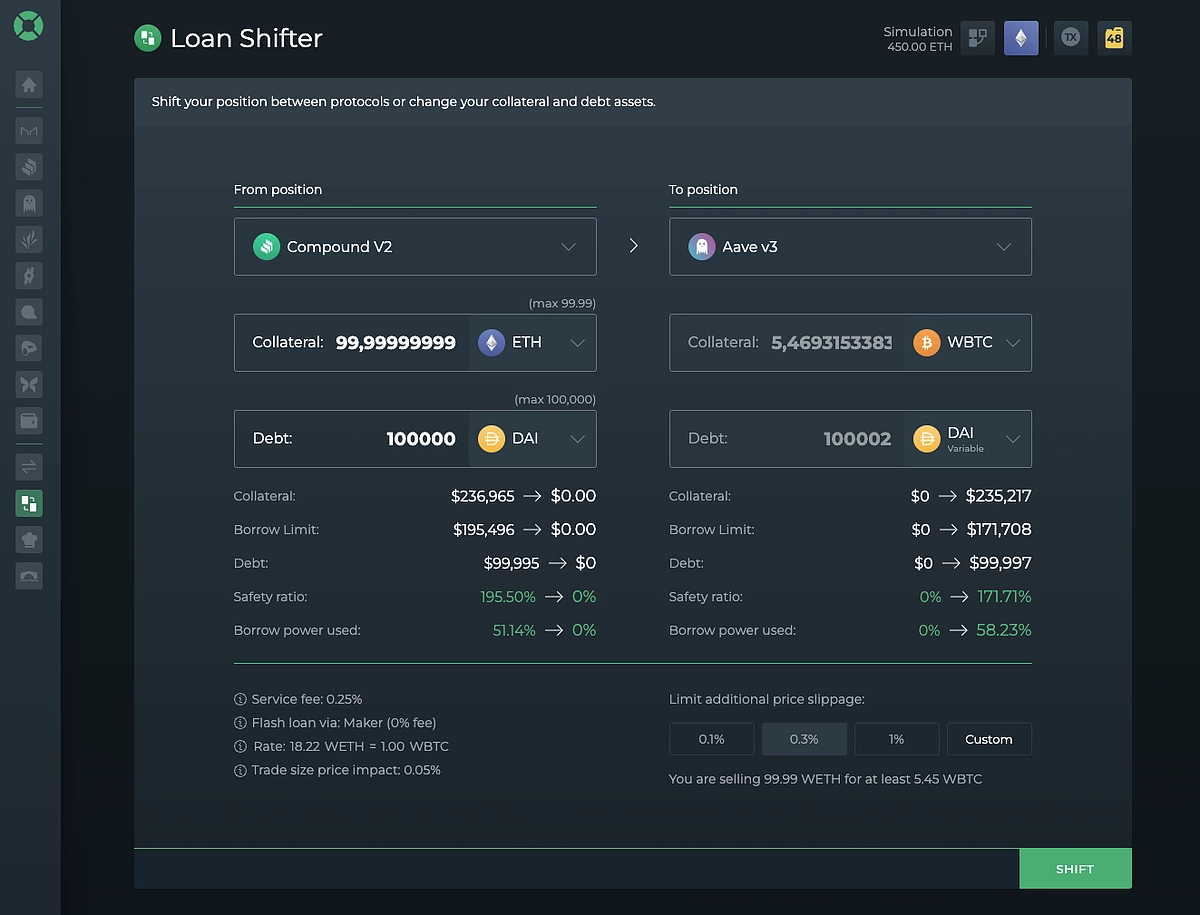

DexToro – This decentralized derivatives platform leverages the OP Stack to offer DTORO token staking, letting users earn protocol revenue and governance rights. DexToro’s model exemplifies how Superchain projects align incentives with platform growth.

-

SuperStacks – As a pilot rewards program on the Superchain, SuperStacks tests new staking mechanisms by rewarding DeFi users with points for interoperable assets. It showcases how Superchain fosters cross-chain staking innovation.

Moreover, the composability at the heart of the OP Stack means validators can participate in multiple rollups simultaneously. This reduces capital fragmentation and lets stakers diversify their exposure across several projects, an attractive proposition in an increasingly competitive DeFi landscape.

Experimentation and the Future of Multi-Rollup Staking

The open-source nature of the OP Stack encourages rapid iteration. Developers can swap out modules for experimental alternatives, such as new consensus mechanisms or reward distribution algorithms, without breaking compatibility with other Superchain chains. This creates a dynamic environment where best practices for staking can emerge organically based on real-world performance data.

We’re already seeing pilot programs like SuperStacks test interoperable DeFi rewards that span multiple L2s, rewarding liquidity providers not just within one chain but across the entire Superchain network. As more L3s come online with application-specific needs, expect even greater diversity in how validator incentives are structured, and how users earn yield by participating in these networks.

For those looking to understand how these multi-rollup models interact at a technical level, our comprehensive analysis on how the OP Stack powers multi-rollup interoperability in the Superchain offers a deeper exploration.

Looking Ahead: The Next Frontier for Staking Innovation

The modularity and openness at the core of the OP Stack position it as a catalyst for ongoing evolution in staking infrastructure. As more teams leverage its tools to launch specialized rollups, from high-speed gaming platforms to next-generation DeFi protocols, the boundaries of what’s possible with superchain staking will continue to expand.

This is just the beginning: as validator incentives become more sophisticated and cross-chain composability matures, both developers and users stand to benefit from a new era where security, scalability, and economic opportunity go hand in hand within Ethereum’s most ambitious scaling ecosystem yet.