Superchain Upgrade 16 has just landed, and the OP Stack ecosystem is buzzing with anticipation. With Optimism (OP) trading at $0.4855 as of today, this upgrade is more than a technical patch – it’s a strategic leap toward true interoperability and scalability for rollup chains. For developers, investors, and anyone tracking the evolution of Layer 2, understanding the nuances of Upgrade 16 is crucial. Let’s break down the major changes shaping the future of the Superchain.

Why Superchain Upgrade 16 Matters Now

The Superchain vision has always been about creating a network of interoperable rollups, not just siloed chains. Upgrade 16 pushes this vision forward by introducing key infrastructure changes that set the stage for seamless cross-chain interactions. Here’s why this matters:

- Rising demand for scalability as on-chain activity grows.

- Interoperability is critical for DeFi composability and user experience.

- Security and decentralization are under increasing scrutiny from both users and analytics platforms like L2Beat.

With these pressures mounting, Superchain Upgrade 16 arrives as a timely answer – not just for Optimism Mainnet, but for every chain built on the OP Stack, including Base and upcoming rollups.

Key Changes: What’s New in Upgrade 16?

Top 5 Features of Superchain Upgrade 16

-

Interop-Ready Smart Contracts: Upgrade 16 updates core bridge contracts, paving the way for native interoperability between OP Stack chains. This foundational change sets the stage for seamless cross-chain messaging in the Superchain ecosystem.

-

Enhanced Decentralization & Security: By removing the DeputyGuardianModule and updating the DeputyPauseModule, the upgrade meets L2Beat’s Stage 1 requirements, reducing trust assumptions and strengthening the security of OP Stack chains.

-

Increased Gas Limit: The maximum gas limit per block jumps from 200 million to 500 million, dramatically boosting scalability and enabling higher transaction throughput across the Superchain.

-

Go 1.23 Support in Cannon: The upgrade brings Go 1.23 compatibility to Cannon, allowing OP Stack chains to leverage the latest improvements from go-ethereum and future-proofing the stack.

-

Foundation for Future Interoperability: By implementing interop-ready contracts and security upgrades, Upgrade 16 establishes the technical groundwork for seamless cross-chain interactions—a major leap toward unifying the Superchain ecosystem.

Let’s dive into the headline features:

- Interop-Ready Smart Contracts: The upgrade updates core bridge contracts to support native interoperability. While this doesn’t “flip the switch” on cross-chain messaging yet, it lays the essential groundwork for a unified Superchain ecosystem. Read more in the official docs.

- Enhanced Decentralization and Security: By removing the

DeputyGuardianModuleand updating theDeputyPauseModule, Upgrade 16 aligns with L2Beat’s stricter Stage 1 requirements. This reduces trust assumptions and hardens security for all OP Stack-based chains. - Increased Gas Limit: The maximum gas limit per block jumps from 200 million to 500 million. This is a huge deal for scaling – more transactions per block means higher throughput for dApps and users. Full details here.

- Go 1.23 Support in Cannon: Cannon, the OP Stack’s proof system, now supports Go 1.23. This ensures compatibility with upstream go-ethereum changes and keeps the stack modern.

Superchain Interoperability: The Technical Foundation Emerges

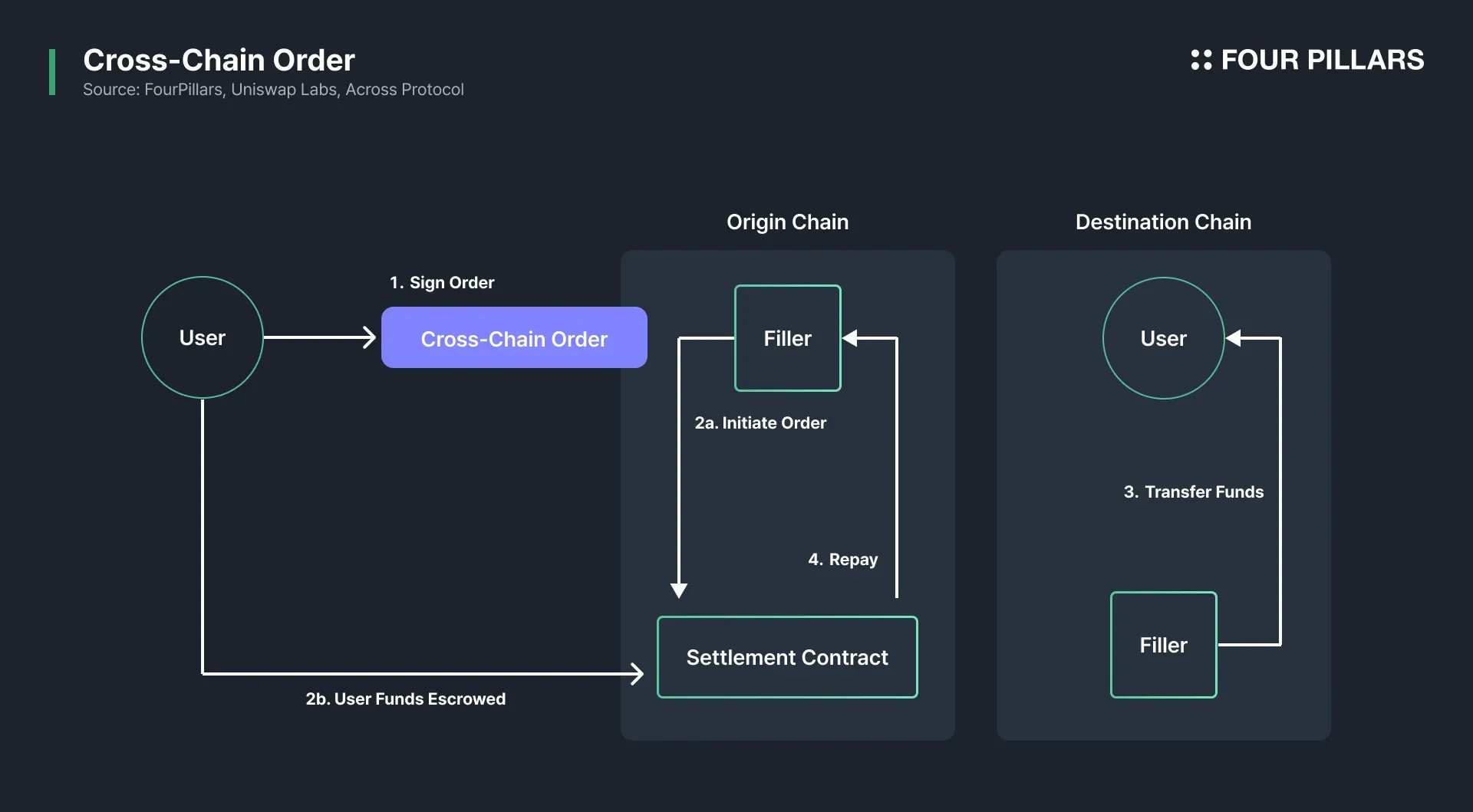

Perhaps the most exciting aspect of Upgrade 16 is its focus on interoperability. By deploying interop-ready contracts, Optimism is preparing for a future where assets and messages can flow natively across all OP Stack chains. While users won’t see instant cross-chain swaps or unified liquidity yet, this upgrade is a necessary step in that direction.

What does this mean for users and builders?

- Developers can start building with future-proof contracts that anticipate cross-chain interactions.

- Projects can plan for a world where liquidity isn’t fragmented across multiple rollups.

- Users will eventually benefit from seamless dApp experiences across chains.

Scalability Unleashed: The Gas Limit Leap

One of the most tangible changes in Upgrade 16 is the increase in the maximum gas limit per block from 200 million to 500 million. This isn’t just a technical tweak – it’s a scalability unlock that directly impacts transaction throughput and dApp performance across all OP Stack chains.

With Optimism (OP) priced at $0.4855, this upgrade arrives at a time when network efficiency and cost-effectiveness are more important than ever. Higher gas limits mean more room for user activity, larger batch transactions, and better support for high-traffic dApps – all without compromising on security or decentralization standards.

But increased gas limits are just the start. The underlying improvements to the OP Stack’s infrastructure and the Cannon proof system mean that chains can safely scale up block production, pushing the limits of what’s possible on Layer 2. For ambitious projects eyeing high-frequency DeFi, NFT drops, or gaming, this is a green light to experiment and grow.

Security, Decentralization, and L2 Standards: Meeting L2Beat’s Stage 1

Security in the Superchain ecosystem isn’t just about code audits. It’s about reducing trust assumptions and aligning with tough, transparent standards. By removing the DeputyGuardianModule and tightening up emergency controls, Upgrade 16 brings OP Stack chains in line with L2Beat’s updated Stage 1 decentralization criteria. This is critical for attracting institutional capital and risk-averse users who demand strong guarantees.

Decentralization is more than a buzzword here. Every reduction in privileged roles and every improvement in on-chain governance brings the Superchain closer to its vision of a truly open, resilient, and censorship-resistant network. For those tracking L2 decentralization, these changes are a clear signal that Optimism is serious about trust minimization.

What’s Next for OP Stack Chains?

With Upgrade 16 live, the roadmap for OP Stack interoperability is coming into sharper focus. While native cross-chain messaging isn’t enabled yet, developers can now architect their protocols with future composability in mind. Expect to see:

Next Major Milestones for OP Stack Interoperability

-

Activation of Cross-Chain Messaging: With interop-ready smart contracts now deployed, the next milestone is enabling native cross-chain messaging between OP Stack chains, unlocking seamless asset and data transfers across the Superchain.

-

Deployment of Interop Protocol (Stage 2): Following the foundational upgrades, the Interop Protocol Stage 2 will introduce live interoperability features, allowing OP Stack chains to communicate and share state in real time.

-

Expansion of Superchain Ecosystem: As interoperability matures, more Layer 2 chains are expected to join the Superchain, increasing network effects and utility for users and developers.

-

Integration with Major Bridges and DApps: Key protocols and dApps, such as Hop Protocol and Uniswap, will integrate interoperability features, making cross-chain swaps and interactions frictionless for end users.

-

Continuous Security and Decentralization Upgrades: Ongoing enhancements to meet L2Beat’s evolving security standards will further decentralize governance and strengthen the Superchain’s trust model.

For chains like Base and other emerging rollups, this means less technical debt and more alignment with Superchain-wide standards. As more chains adopt Upgrade 16, the network effect compounds – setting up an environment where liquidity, users, and developers can move frictionlessly across ecosystems.

Market Impact: Reading Between the Price Lines

Optimism (OP) is currently trading at $0.4855, reflecting a 24-hour change of -$0.2024 (-0.2943%). While price action alone doesn’t tell the whole story, upgrades like this often serve as catalysts for renewed developer interest and speculative attention. The real value will emerge as new projects leverage these foundational changes to deliver experiences previously impossible on fragmented Layer 2s.

Optimism Technical Analysis Chart

Analysis by Nina Hollis | Symbol: BINANCE:OPUSDT | Interval: 4h | Drawings: 8

Technical Analysis Summary

Draw a strong horizontal support line at $0.4850, aligning with the current price, as this is the immediate level where price has paused after the violent breakdown. Add a horizontal resistance at $0.6500 (prior consolidation and breakdown origin). Mark the dramatic vertical breakdown with a vertical line and use a rectangle to highlight the sudden collapse zone from $0.70 to $0.32. Draw a downward sloping trend line from $0.75 (Oct 9, 2025) through to $0.48 (current). Use a callout to emphasize the breakdown event, referencing Upgrade 16 and heightened volatility. Plot a possible accumulation rectangle between $0.32-$0.49, where price may base. Aggressively mark potential long entries just above $0.49 with tight stops, and highlight a high-risk, high-reward swing opportunity.

Risk Assessment: high

Analysis: The price action is extremely volatile with a historic breakdown. While aggressive mean-reversion plays are possible, the risk of further downside or failed recovery is high. Only suitable for experienced, nimble traders.

Nina Hollis’s Recommendation: If you’re wired for high-octane trading, this is a prime setup for aggressive, tightly risk-managed long attempts. Wait for volume to subside and signs of stabilization—then strike with conviction, but be ruthless with stops below the $0.32 panic floor.

Key Support & Resistance Levels

📈 Support Levels:

-

$0.485 – Immediate support at the current price. Market paused here after the liquidation flush.

strong -

$0.32 – Flash-crash low; may act as a secondary support if current level fails.

moderate

📉 Resistance Levels:

-

$0.65 – Breakdown origin and former consolidation zone.

strong -

$0.7 – Pre-breakdown swing high; psychological resistance.

moderate

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$0.49 – Potential aggressive long entry just above current support; bet on mean reversion and post-liquidation bounce.

high risk -

$0.325 – Panic bid zone if another flush occurs; attempt to catch a bottom if $0.48 fails.

high risk

🚪 Exit Zones:

-

$0.65 – First major profit target if bounce develops.

💰 profit target -

$0.32 – Hard stop loss for aggressive longs; cut if flash crash repeats.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Expect a massive spike in volume during the breakdown; this is where institutional hands may have absorbed panic selling.

Volume surge marking capitulation; use a callout at the breakdown candle to highlight.

📈 MACD Analysis:

Signal: Likely extremely oversold; look for early bullish divergence on smaller timeframes for aggressive entries.

MACD likely at extreme lows, watch for early reversal signals. Annotate with arrow_mark_up when bullish cross appears.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Nina Hollis is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

For investors watching OP and other Superchain assets, it’s worth monitoring how increased throughput and reduced trust assumptions translate into user adoption and protocol growth in Q4 2025 and beyond.

Upgrade 16 in Context: Why This Matters for Builders and Users

The OP Stack’s evolution is happening in real time – not just in code repos but in live markets and user experiences. With Superchain Upgrade 16, Optimism is delivering on its promise to build a scalable, interoperable foundation for Ethereum’s Layer 2 future. For builders, this means less friction when deploying multi-chain dApps. For users, it signals lower fees, faster transactions, and eventually seamless movement between rollups.

In a landscape where every basis point of efficiency counts and composability is king, Upgrade 16 stands out as a pivotal moment. It’s not just another upgrade – it’s Optimism’s bet on a unified Superchain future where silos are broken down for good.

If you’re building on or investing in the OP ecosystem, now’s the time to dig into the details and position yourself ahead of the next wave of cross-chain innovation. Patterns repeat – but after Upgrade 16, the context for every rollup has changed dramatically.