Bitcoin’s ascent to $122,283.00 has reignited the BTCFi (Bitcoin Finance) narrative, but it’s GOATRollup that is reshaping the very foundation of what Bitcoin DeFi can mean. While Ethereum’s rollups have long dominated the scalability conversation, GOAT Network is pioneering a new era for Bitcoin with modular zkRollups, real yield primitives, and an ecosystem-first approach that places community front and center.

Modular Rollups: The Backbone of Scalable BTCFi

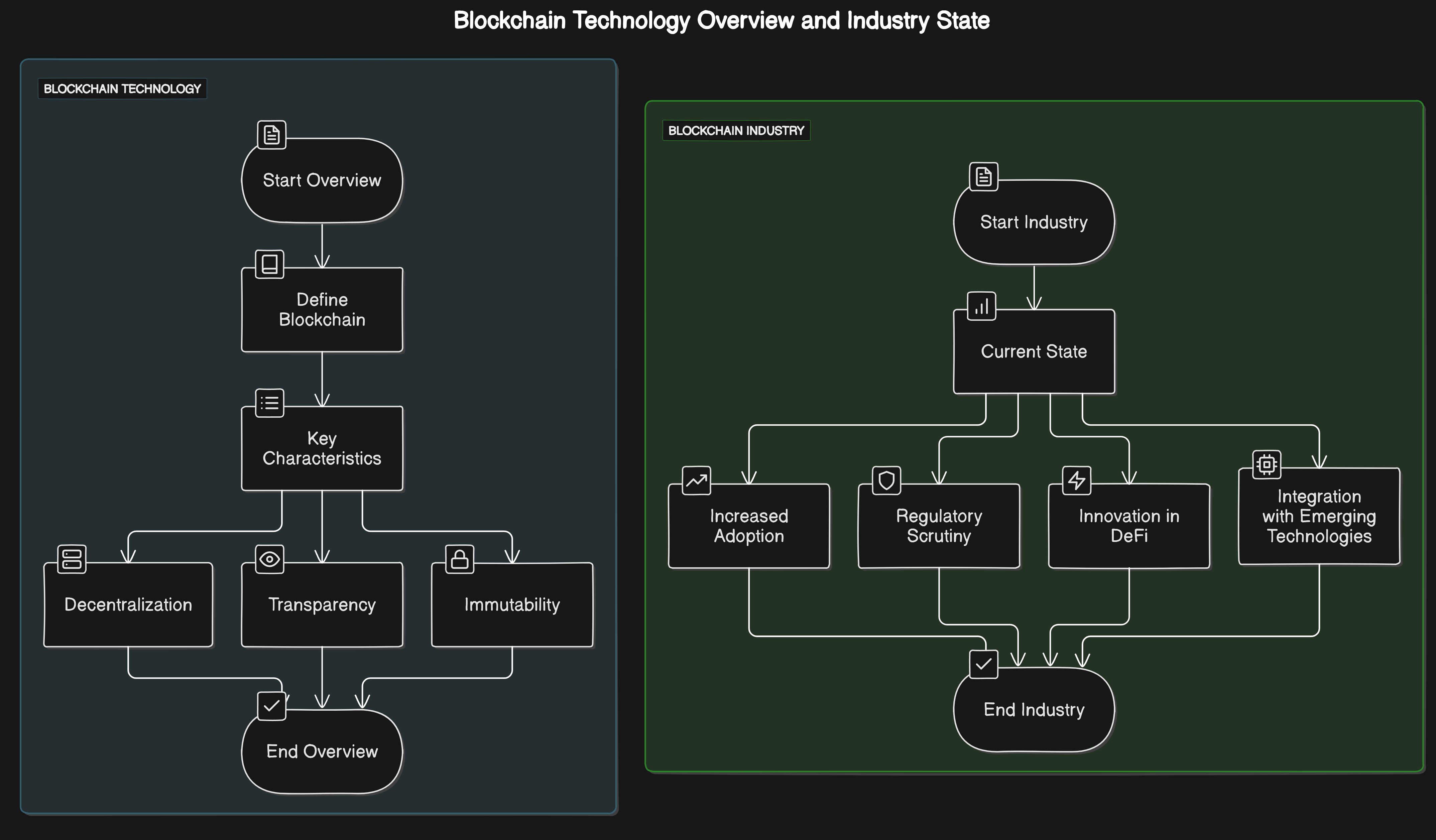

The core innovation behind GOATRollup lies in its production-ready Bitcoin-native zkRollup. Unlike traditional monolithic solutions, this modular architecture separates execution, settlement, and data availability layers, enabling rapid upgrades and specialized functionality. This design is not theoretical; it’s live and solving real incentive gaps seen in prior rollup models.

Key features include:

- Universal Operator Role: Distributes responsibilities across validators to ensure decentralization without sacrificing throughput.

- Multi-Round Challenge Process: Reduces withdrawal finality to under 24 hours, critical for user confidence and institutional adoption.

- Dual-Slashing Mechanisms: Discourages malicious behavior through both financial penalties and operator rotation.

This structure supports robust MEV resistance and fair distribution of network rewards, an essential step for sustainable BTCFi growth. For a deep dive into operator rotation, multi-round proofs, and fair MEV distribution, see the latest analysis on HOZK Journal.

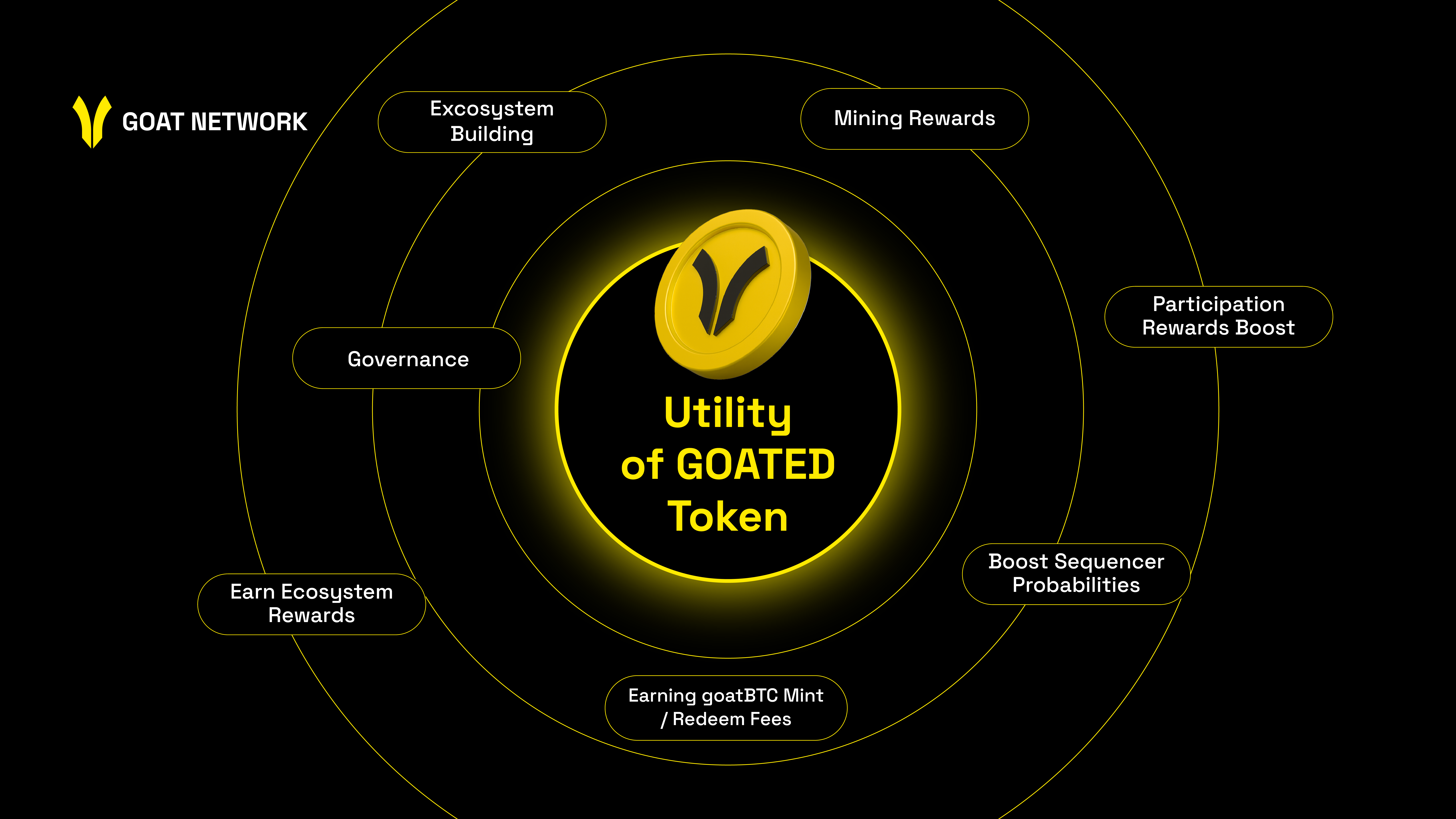

Real Yield: Sustainable Returns Without Centralized Custody

The promise of “real yield” on Bitcoin has often been clouded by opaque custodial services or risky off-chain products. GOAT Network flips this paradigm by offering a suite of chain-level yield instruments directly on Bitcoin. Users can now earn sustainable returns without relinquishing control over their assets or relying on mining rigs.

- GOAT Safebox: Secure vaults for native BTC with transparent yield generation mechanisms.

- BTCB/DOGEB Vault: Dual-asset strategies catering to diversified risk profiles.

- Sequencer PoS Staking: Participate directly in network consensus for additional rewards.

- BTC Lending Markets: Non-custodial lending with dynamic rates set by actual supply/demand, not arbitrary admin controls.

This approach not only democratizes yield but also aligns incentives between users, operators, and protocol developers. For more on how these products are driving adoption at scale, check out the official release from GOAT Network on their BTC Yield Dashboard launch.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on evolving BTCFi landscape, GOAT Network innovations, and latest 2025 market data ($122,283.00 baseline)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $98,000 | $135,000 | $175,000 | +10.4% | BTCFi growth, increased L2 adoption, moderate volatility |

| 2027 | $110,000 | $162,000 | $220,000 | +20.0% | Mainstream BTCFi integration, institutional flows, regulatory clarity |

| 2028 | $125,000 | $189,000 | $255,000 | +16.7% | Sustained yield demand, new DeFi primitives, global macro tailwinds |

| 2029 | $140,000 | $210,000 | $285,000 | +11.1% | Market consolidation, higher on-chain activity, potential regulation |

| 2030 | $130,000 | $230,000 | $320,000 | +9.5% | Wider BTCFi adoption, interoperability, halving cycle impact |

| 2031 | $145,000 | $256,000 | $360,000 | +11.3% | Mature BTCFi ecosystem, stable yields, mainstream institutionalization |

Price Prediction Summary

Bitcoin is positioned for continued long-term growth, supported by innovations like GOAT Network’s modular rollups and sustainable yield products. While short-term volatility is expected, the expanding BTCFi ecosystem, institutional adoption, and regulatory clarity could drive average prices from $135,000 in 2026 to $256,000 by 2031. Bullish scenarios see BTC testing the $300,000+ level in the next cycle, while bearish cases reflect macro or regulatory headwinds.

Key Factors Affecting Bitcoin Price

- GOAT Network’s zkRollup adoption driving BTCFi scalability and real yield demand

- Increased institutional participation in yield-bearing Bitcoin products

- Regulatory developments impacting DeFi and BTCFi operations

- Global macroeconomic conditions affecting risk appetite and capital flows

- Halving cycles and BTC supply dynamics

- Competition from other Layer 2s and alternative blockchains

- Advancements in interoperability and composability within DeFi

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ecosystem Growth Through Community Ownership

No superchain project can thrive without an engaged community, and here GOAT Network truly differentiates itself. Strategic partnerships with projects like Pell (for enhanced security), Stable Jack (expanding yield markets), and Avalon Finance (introducing decentralized BTC borrowing) have rapidly broadened the utility layer atop GOATRollup. These collaborations are not mere integrations; they’re designed to empower users as co-owners of network value flow.

The recent launch of a 34 BTC Pilot Fund further demonstrates this ethos, fueling liquidity incentives and rewarding active participation across governance forums. This marks a first for any Bitcoin Layer 2 platform at current market levels above $122,000. For context on these partnership-driven expansions within the BTCFi landscape, see details from GOAT Network’s blog: GOAT x Pell Security Partnership.

Bitcoin Technical Analysis Chart

Analysis by Sophia Rowland | Symbol: BINANCE:BTCUSDT | Interval: 4h | Drawings: 5

Technical Analysis Summary

Begin by drawing a major uptrend line connecting the lows from early September 2025 through early October 2025. Mark horizontal resistance at $122,700 and support at $112,000 and $110,500. Highlight the recent breakout above $120,000 with an arrow_marker and callout. Use rectangles to denote the consolidation range between $112,000 and $118,000 throughout most of September 2025. Place a long_position tool just above $120,000 to represent potential entry on confirmation of breakout. Use a fib_retracement from $110,500 (recent swing low) to $122,700 (current high) for retracement targets.

Risk Assessment: medium

Analysis: Momentum is strong and BTC is breaking out of a multi-week consolidation. However, the rapid ascent increases risk of a short-term pullback or failed breakout. Confirm volume and look for retest opportunities.

Sophia Rowland’s Recommendation: Wait for a retest of the $120,000 breakout zone for lower-risk long entries. Place stops below $110,500. Take partial profits at new highs and trail stops to lock in gains.

Key Support & Resistance Levels

📈 Support Levels:

-

$112,000 – Support formed by multiple bounces in mid to late September 2025.

strong -

$110,500 – Absolute swing low and key inflection point preceding the current rally.

moderate

📉 Resistance Levels:

-

$122,700 – Current price region; all-time high for this chart and psychological resistance.

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$120,000 – Breakout retest—potential for continuation if prior resistance becomes support.

medium risk

🚪 Exit Zones:

-

$110,500 – Stop-loss just below recent swing lows to protect against failed breakout.

🛡️ stop loss -

$122,700 – Initial profit target near current highs; reevaluate if momentum persists.

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume not visible, but recommended to use a callout at the breakout candle for confirmation if volume data is available.

Look for high volume on breakout above $120,000 for confirmation.

📈 MACD Analysis:

Signal: Presumed bullish as price accelerates upward—look for MACD cross and histogram expansion.

MACD likely showing bullish momentum; annotate with arrow_mark_up at breakout.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Sophia Rowland is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

GOATRollup’s emphasis on community-driven blockchain governance is more than a slogan, it is a tangible mechanism for aligning incentives across all stakeholders. By distributing ownership and protocol rewards via transparent, on-chain processes, GOAT Network cultivates an ecosystem where users, developers, and liquidity providers are all incentivized to grow the BTCFi pie together. This approach not only increases network resilience but also encourages long-term participation over short-term speculation.

As Bitcoin maintains its position above $122,283.00, the appetite for bitcoin defi yield and scalable infrastructure continues to accelerate. GOATRollup’s open model for liquidity mining, operator onboarding, and governance voting ensures that growth is organic and widely distributed, contrasting starkly with VC-heavy or centralized L2s.

How GOATRollup Stands Out in the Superchain Movement

What Sets GOATRollup Apart in the BTCFi Landscape

-

First Production-Ready Bitcoin-Native zkRollup: GOATRollup is the first to launch a modular, zero-knowledge rollup purpose-built for Bitcoin, preserving Bitcoin’s security while enabling faster withdrawals and decentralized BTCFi applications.

-

Universal Operator Role and Dual-Slashing: GOATRollup introduces a Universal Operator role for balanced network responsibilities and implements a dual-slashing mechanism, enhancing security and aligning incentives—features not found in most existing Bitcoin rollups.

-

Multi-Round Challenge Process: GOATRollup’s innovative multi-round proof system reduces withdrawal finality to under 24 hours, offering a significant speed advantage over traditional optimistic rollups on Bitcoin.

-

Real Yield Products for Bitcoin Holders: Unlike many BTCFi platforms, GOAT Network delivers sustainable, chain-level Bitcoin yield through products like GOAT Safebox, BTCB/DOGEB Vault, Sequencer PoS Staking, and BTC Lending—all without centralized custody or mining rigs.

-

Strategic Ecosystem Partnerships: GOAT Network’s collaborations with Pell (for security and scalability), Stable Jack (for expanded yield markets), and Avalon Finance (for BTC borrowing) create a robust BTCFi ecosystem, distinguishing it from isolated rollup projects.

-

Community-Driven Growth and Incentives: GOAT Network has launched initiatives like the 34 BTC Pilot Fund to support liquidity incentives and community participation, fostering active engagement and growth within the BTCFi space.

GOAT Network’s modular rollups aren’t just about scalability; they’re about unlocking new forms of value creation for Bitcoin holders. By integrating zkVM and BitVM2, the network achieves robust security guarantees while enabling permissionless innovation, a critical requirement as BTCFi matures into a multi-chain reality.

“With zkVM and BitVM2, Bitcoin can operate safely on L2 while remaining anchored to the main chain, giving both security and room for #BTCFi applications to grow. “

This ethos is reflected in how MEV (Miner Extractable Value) is handled: through fair distribution mechanisms that avoid centralization risks seen in earlier DeFi cycles. Operator rotation, multi-round proofs, and dual-slashing further ensure that no single party can dominate or exploit the system, an essential ingredient for institutional trust as well as grassroots adoption.

What’s Next? The Roadmap for Cross-Chain Liquidity and Community Expansion

The next phase for GOAT Network centers on deepening cross-chain liquidity pools and preparing for a broader token generation event (TGE). With current partnerships already bridging assets from Stable Jack and Avalon Finance into the ecosystem, users will soon see seamless movement of value across superchain projects, without sacrificing the native security guarantees of Bitcoin.

This commitment to interoperability positions GOATRollup at the intersection of modular rollups, real yield innovation, and community-first economics. As BTCFi evolves beyond simple wrapped assets toward truly composable financial primitives on Bitcoin itself, expect GOAT Network to remain at the vanguard of this transformation.

The bottom line: With Bitcoin holding above $122,283.00 and demand for sustainable DeFi solutions at an all-time high, GOATRollup offers a credible blueprint for scaling BTCFi, one built on transparency, shared ownership, and technical excellence.