Superchain Upgrade 16, activated on July 24,2025, marks a pivotal moment for the OP Stack’s technical roadmap. As the OP ecosystem moves closer to its multi-rollup vision, this upgrade delivers foundational changes to interoperability, security, and scalability. With the OP price at $0.6963 (as of September 24,2025), market participants are closely monitoring how these protocol enhancements will shape both developer experience and network economics.

Key Technical Enhancements in Superchain Upgrade 16

The main thrust of Upgrade 16 is to prepare OP Stack chains for seamless cross-chain communication and higher throughput. Here’s a breakdown of the most critical changes:

- Interoperability Foundations: The

OptimismPortalcontract now supports future cross-chain messaging, setting up OP Chains for eventual asset transfers and data exchange across the Superchain. This feature is not live yet but establishes the technical groundwork for upcoming rollup interop standards. - Security Overhaul: In response to L2Beat’s updated Stage 1 requirements (Jan 2025), Upgrade 16 removes the

DeputyGuardianModule, updates theDeputyPauseModule, and introduces authentication for sensitive contract functions. This reduces trust assumptions and aligns with best-in-class L2 security practices. - Cannon Update: The Cannon proof system now supports Go 1.23, ensuring compatibility with upstream go-ethereum improvements and enhancing node reliability.

- Gas Limit Increase: The block gas limit is raised from 200 million to 500 million gas per block. This directly translates into more complex transactions per block, higher throughput, and improved user experience across all OP Stack chains.

Impact on OP Stack Chains: Interoperability and Scalability in Focus

The implications of these upgrades are immediate for developers but also set the stage for longer-term structural shifts across Base chain Superchain deployments and other OP-powered rollups. With standardized mechanisms for protocol version signaling (critical for coordination among chains), each chain can independently validate compatibility before engaging in cross-chain operations.

The increased gas limit is particularly impactful: with more computational headroom per block, dApps can implement advanced features without running into throughput bottlenecks. For DeFi protocols or gaming platforms operating on OP Mainnet or Base chain Superchain instances, this means less congestion and lower latency during peak usage periods.

OP Governance Updates and Security Alignment

This upgrade also reflects an ongoing shift toward decentralized governance within the OP ecosystem. By removing legacy permissioned modules and aligning security controls with industry benchmarks like those tracked by L2Beat, Optimism demonstrates a commitment to minimizing centralized points of failure. These changes enhance trust among institutional users who demand robust security guarantees before deploying capital or applications onto Layer-2 networks.

How will the increased gas limit from Superchain Upgrade 16 affect your dApp development on OP Stack?

Superchain Upgrade 16 raised the gas limit per block from 200 million to 500 million, enabling more complex transactions and higher throughput. We’re curious how this change impacts your plans or experience as a dApp developer on OP Stack.

OP Price Outlook After Upgrade 16 Implementation

The market has responded cautiously so far; as of September 24th, Optimism (OP) trades at $0.6963, down slightly by -0.007200% over the last day. While this suggests traders are waiting to see operational impacts before repricing risk or growth expectations upward, it’s clear that technical groundwork like Upgrade 16 is essential for sustained adoption.

Optimism (OP) Price Prediction Post-Superchain Upgrade (2026–2031)

Forecasts based on the impact of Superchain Upgrade 16, considering increased throughput, interoperability, and evolving market trends.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.62 | $0.85 | $1.12 | +22% | Post-upgrade adoption grows, but token unlock overhang and market volatility persist. |

| 2027 | $0.75 | $1.08 | $1.52 | +27% | Cross-chain features gain traction; Layer 2 competition intensifies. Regulatory clarity improves. |

| 2028 | $0.94 | $1.38 | $2.05 | +28% | Interoperability widely adopted; OP Stack sees increased enterprise/DeFi usage. |

| 2029 | $1.19 | $1.76 | $2.65 | +27% | OP benefits from Ethereum L2 ecosystem growth; macro crypto cycle turns bullish. |

| 2030 | $1.43 | $2.19 | $3.32 | +24% | Superchain vision matures; OP Stack chains become core DeFi and gaming infrastructure. |

| 2031 | $1.68 | $2.62 | $3.98 | +20% | OP achieves mainstream adoption among L2s; technological and governance upgrades continue. |

Price Prediction Summary

Optimism (OP) is poised for progressive growth following Superchain Upgrade 16. The upgrade’s enhancements in scalability, security, and interoperability set the foundation for increased adoption. While short-term volatility and token unlocks could cap upside, the medium- to long-term outlook is positive as the OP Stack cements its role in the Ethereum Layer 2 ecosystem. Prices are projected to rise steadily, with significant potential for upside if cross-chain use cases and Superchain adoption accelerate.

Key Factors Affecting Optimism Price

- Adoption of Superchain features and OP Stack chains across DeFi, gaming, and enterprise use cases.

- Implementation of cross-chain messaging and interoperability, unlocking new value flows.

- Layer 2 competition (e.g., Arbitrum, zkSync) and differentiation of OP Stack.

- Regulatory developments affecting Ethereum L2s and token markets.

- Macro crypto market cycles (bull/bear phases) influencing investor sentiment.

- Impact of scheduled token unlocks and OP governance decisions.

- Scalability improvements and fee reductions attracting more on-chain activity.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This phase of upgrades positions the Superchain as a serious contender among Ethereum scaling solutions – not just in terms of raw transaction capacity but also in its ability to coordinate secure interoperability between diverse rollup chains.

Looking ahead, the OP Stack’s modular architecture is now better equipped to accommodate rapid innovation. Developers gain flexibility through system-level feature toggles introduced in the SystemConfig contract, enabling each OP Chain to opt into or out of new protocol features as they stabilize. This granular configurability is critical for ecosystem-wide upgrades, where chains can coordinate rollouts without risking fragmentation or downtime.

Another subtle but important change is the upgrade’s provision for standardized protocol version signaling. This allows all Superchain participants to programmatically check which protocol version a given chain is running before initiating cross-chain operations. In practical terms, this reduces the risk of failed transactions and incompatibilities during future interop upgrades, a key requirement for scaling beyond isolated rollups.

Developer and User Experience: What Changes Now?

For builders, the immediate effect is a more robust development environment. The updated Cannon proof system and authentication controls reduce attack surfaces and make it easier to maintain node infrastructure as upstream dependencies evolve. For end-users, most changes are invisible but result in smoother transaction processing and fewer disruptions during network upgrades.

Importantly, the increased block gas limit means dApps on OP Stack chains can scale up transaction complexity, think batch settlements for DeFi protocols or richer gameplay mechanics for blockchain games, without facing prohibitive gas constraints. This scalability improvement is especially relevant as Base chain Superchain instances and other OP-powered rollups compete for user adoption against alternative Layer-2s.

Top 5 Use Cases Enabled by Higher Gas Limits in Superchain Upgrade 16

-

On-Chain Gaming and Metaverse Applications: Projects such as Decentraland and Immutable can now process more in-game actions, asset trades, and user interactions per block, improving user experience and scalability.

-

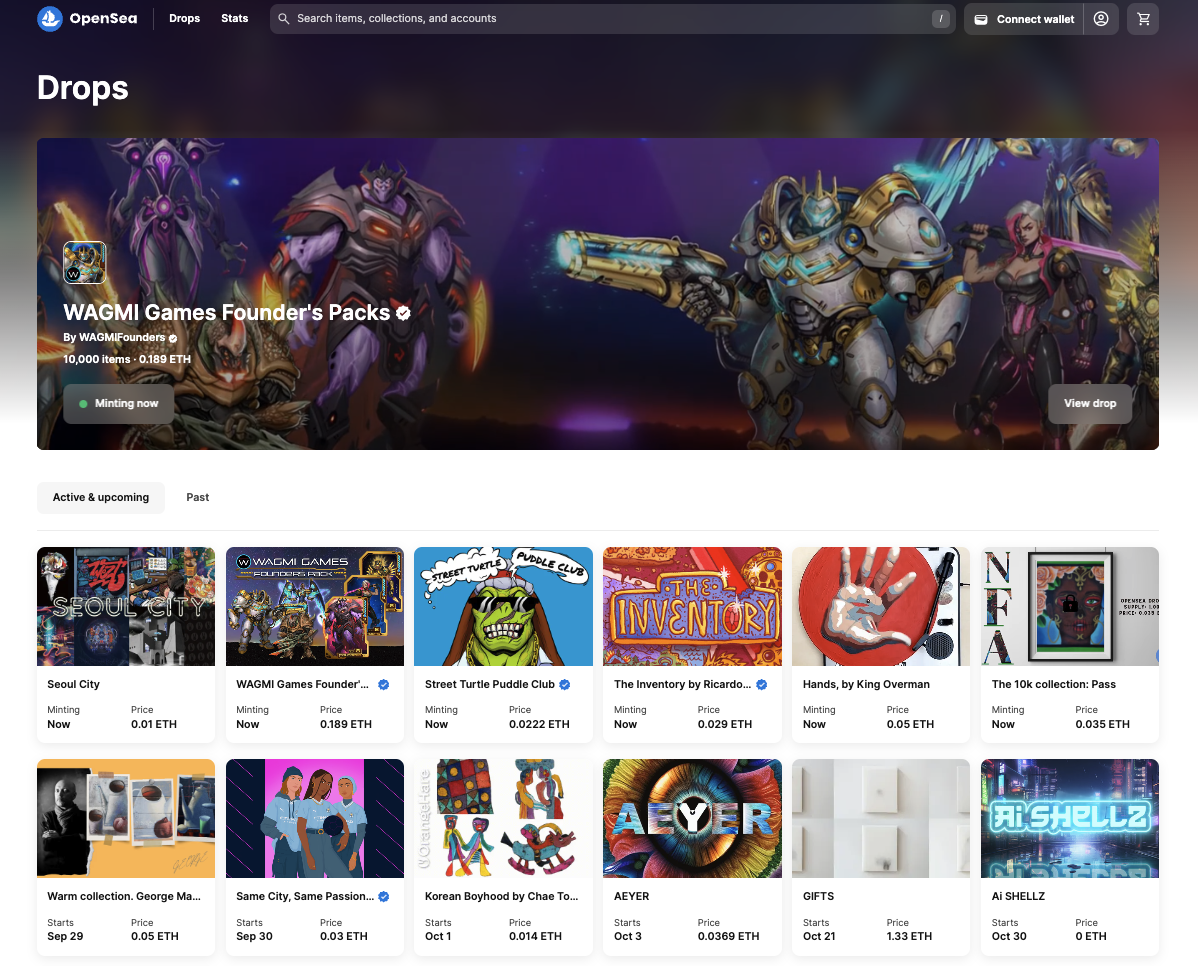

Batch Processing for NFT Marketplaces: Marketplaces like OpenSea can handle larger batch minting, transfers, and complex auctions, streamlining operations and reducing user costs.

-

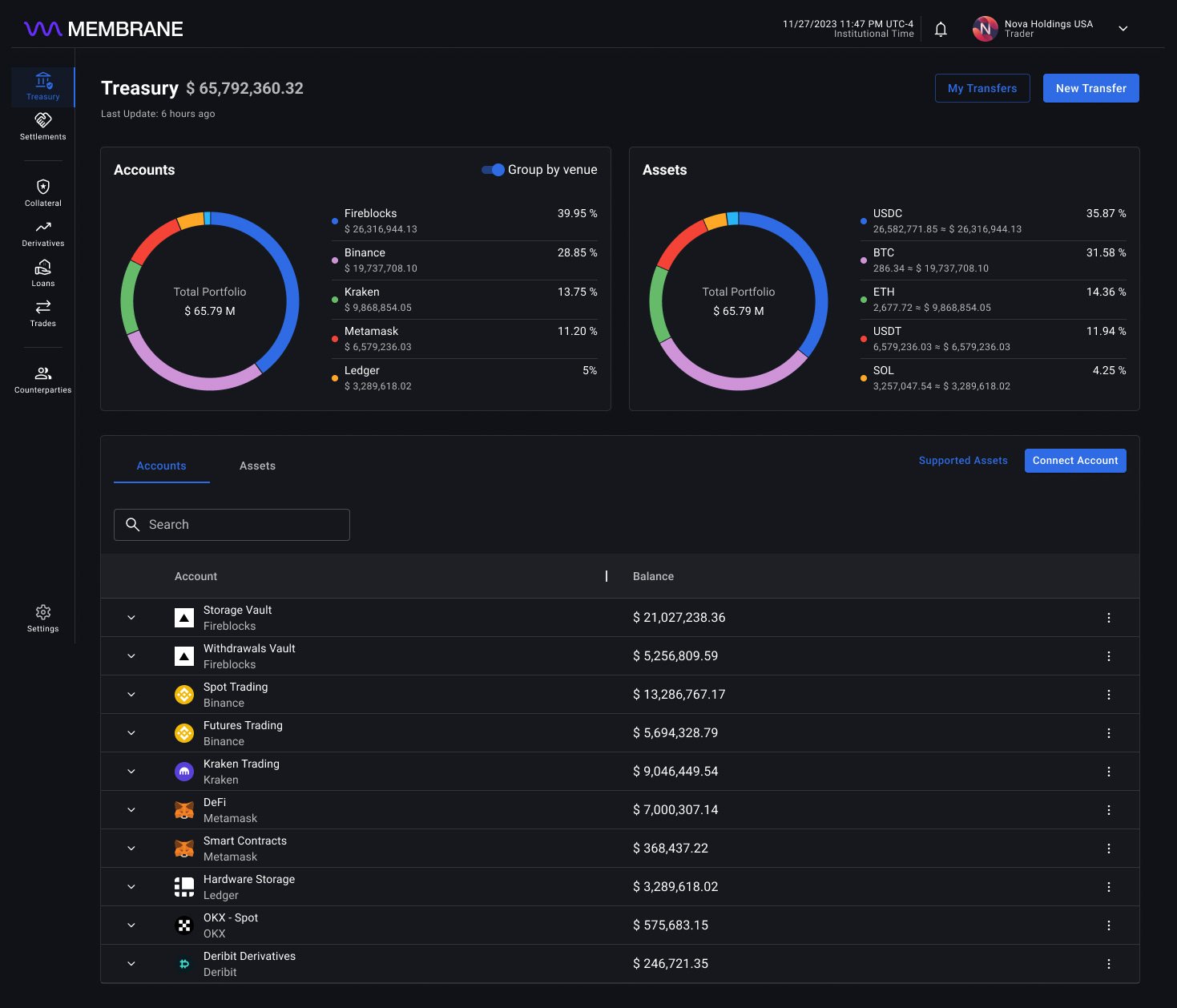

Enterprise and Institutional Settlement: Platforms such as Circle and Fireblocks can settle higher transaction volumes and more complex multi-party transactions on-chain, supporting institutional adoption.

-

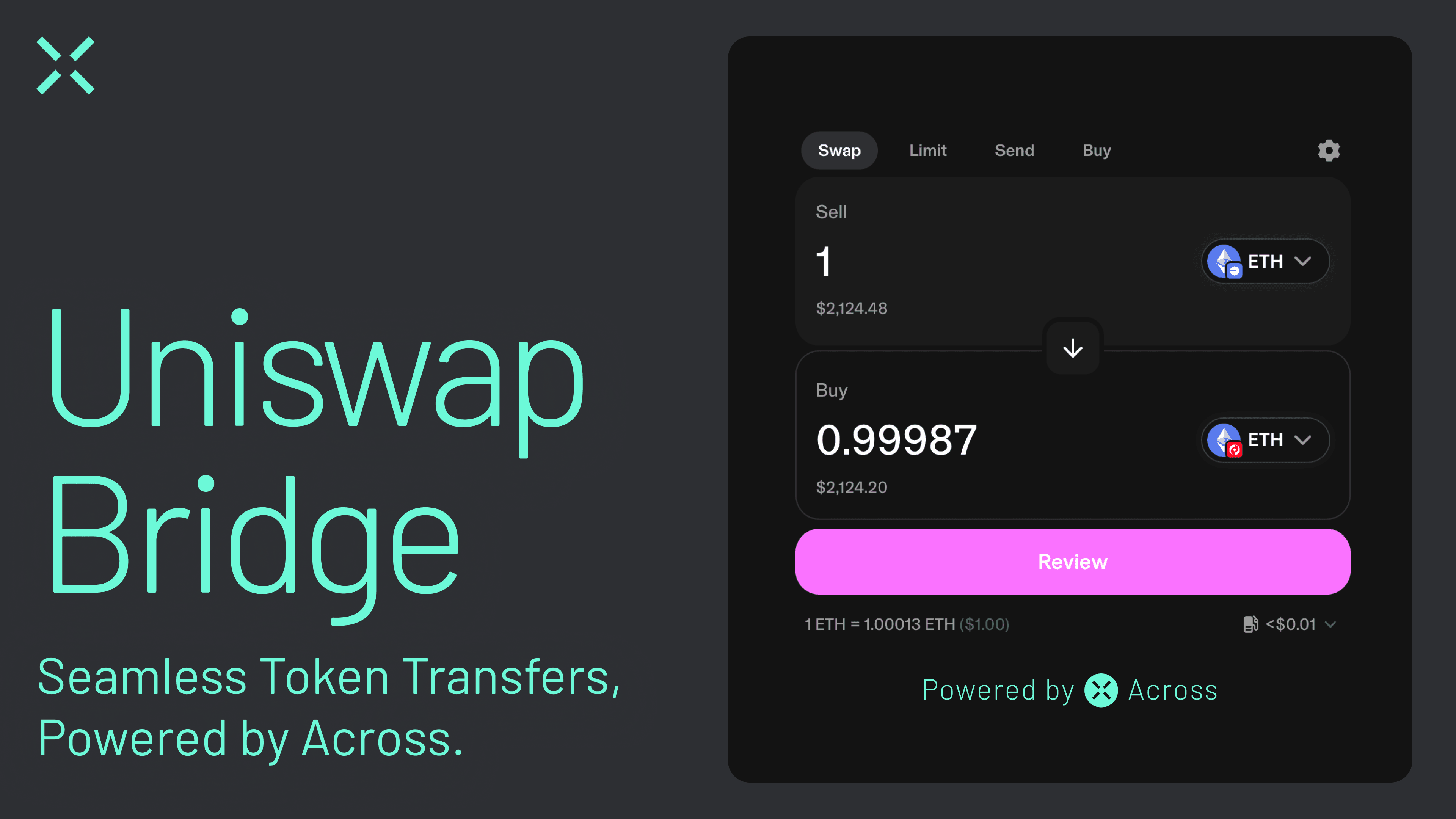

Cross-Chain Bridges and Interoperability Solutions: Enhanced gas limits facilitate more robust bridging solutions like Synapse Protocol and LayerZero, enabling higher throughput for asset transfers and messaging between OP Chains and other networks.

Ecosystem Coordination and Next Steps

The Superchain vision hinges on seamless coordination between independently governed chains. With Upgrade 16’s technical foundations in place, future protocol releases will likely activate dormant interop features, such as live cross-chain messaging, unlocking new composability across DeFi, NFT marketplaces, and data availability layers within the Superchain.

From a governance perspective, these upgrades also streamline how protocol changes are proposed and adopted across heterogeneous chains. By reducing trust assumptions through permission removals and authentication hardening, OP governance sets a precedent for transparent upgrade processes that other L2s may emulate.

What to Watch: Metrics After Upgrade 16

As Superchain Upgrade 16 settles in, several metrics warrant close attention:

- Block utilization rates: Are chains making full use of the new 500 million gas per block ceiling?

- dApp migration trends: Do developers shift more workloads to OP Mainnet or Base chain Superchain due to improved throughput?

- Interoperability pilots: When do we see testnet or mainnet demonstrations of live cross-chain messaging?

- Security audits: How do third-party reviews assess the impact of removed permissioned modules?

The answers will shape both price action, currently anchored at $0.6963: and developer sentiment heading into Q4 2025.

The bottom line: Superchain Upgrade 16 cements Optimism’s position at the forefront of Ethereum scalability by delivering not just raw performance gains but also a forward-compatible blueprint for secure multi-rollup interoperability.