As Ethereum’s Superchain vision accelerates, one persistent challenge has come into sharp focus: liquidity fragmentation across Layer 2 rollups. For users and developers, the ability to move assets and execute transactions seamlessly between OP Stack chains remains a core promise of the multi-rollup future. Yet, traditional architectures, anchored by centralized sequencers, have struggled to deliver on this vision, often siloing liquidity and limiting cross-rollup composability.

Centralized Sequencers: The Bottleneck in Superchain Liquidity

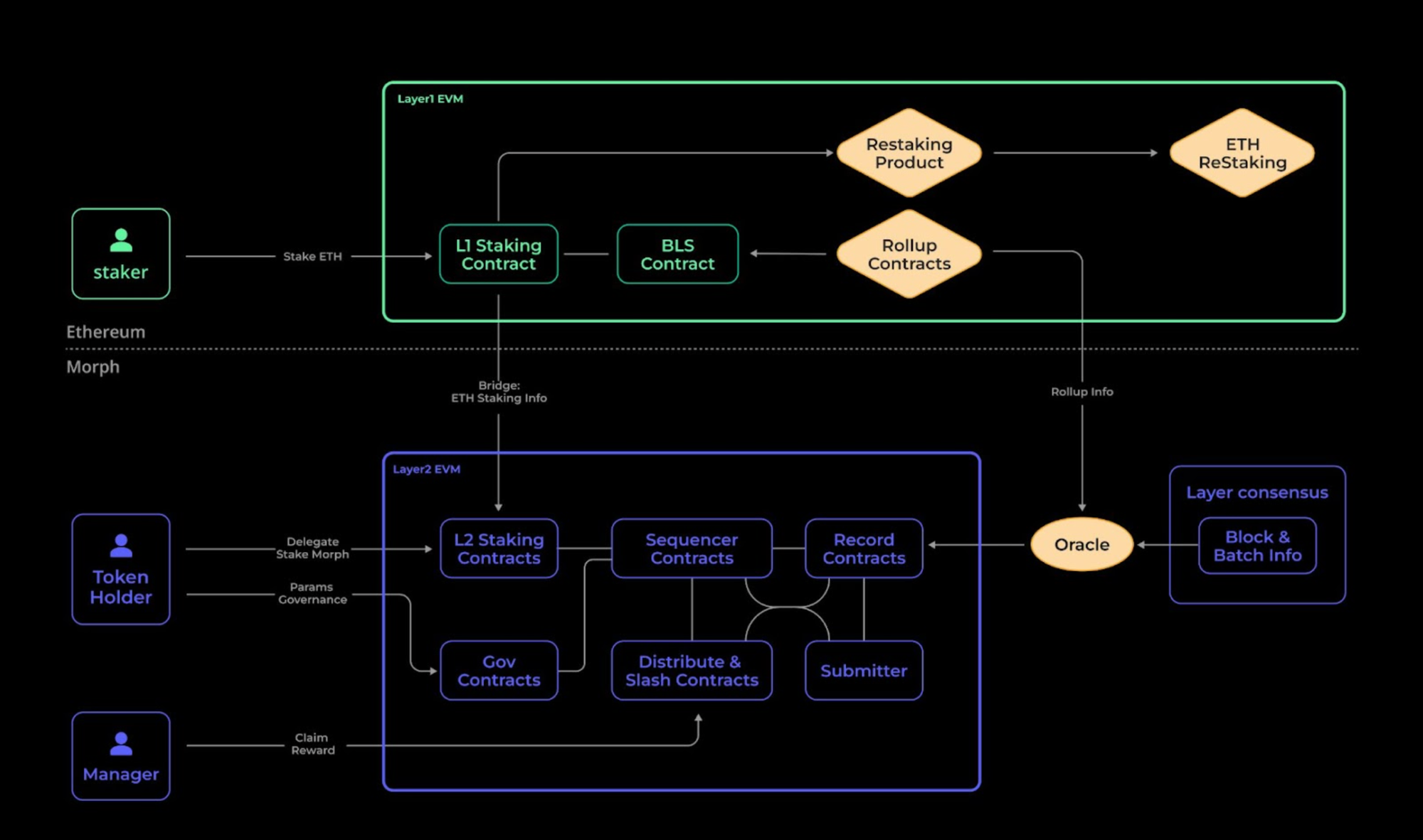

The current state of most rollup ecosystems relies on centralized sequencers, single entities responsible for ordering transactions within their respective chains. While this model offers speed and simplicity, it introduces critical vulnerabilities. Centralized sequencers represent a single point of failure and open the door to censorship or downtime risks. More importantly for the Superchain thesis, they create isolated liquidity pools: assets and order flow are trapped within each rollup unless bridged through slow or trust-minimized solutions.

This fragmentation is more than an inconvenience; it undercuts the core value proposition of a unified Ethereum scaling environment. As cross-rollup DeFi activity grows, so too does the need for synchronous settlement and truly unified liquidity, a need that centralized sequencing simply cannot meet.

Decentralized Sequencers: A New Coordination Layer

Enter decentralized sequencers. By distributing transaction ordering across a network of independent nodes, these systems eliminate single points of failure and dramatically increase censorship resistance. But their most transformative impact lies in how they address liquidity fragmentation.

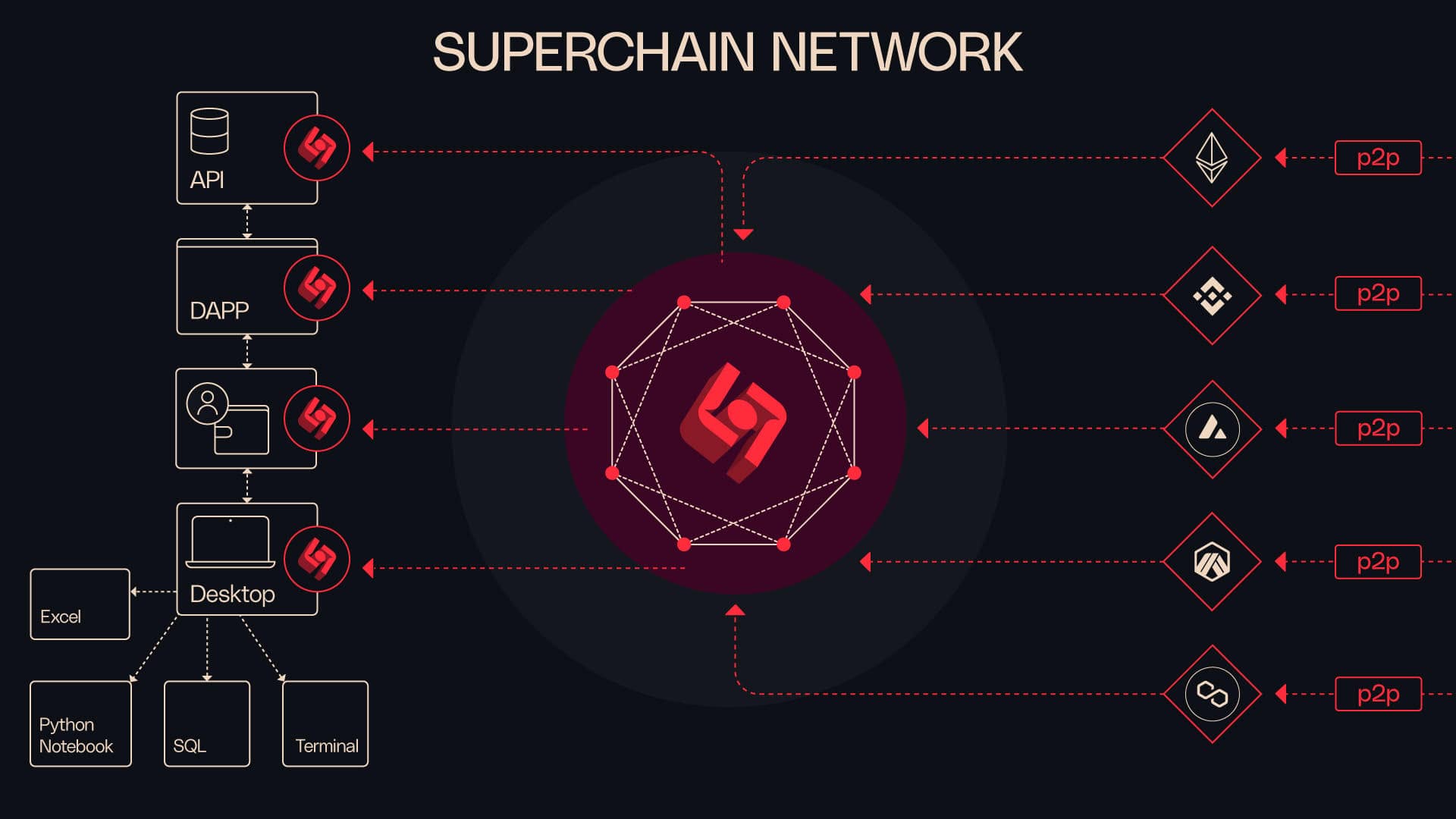

Espresso Systems’ Espresso Sequencer exemplifies this new paradigm. Instead of each rollup running its own isolated sequencer, multiple OP Stack chains can plug into a shared decentralized sequencing layer. This enables atomic inclusion of transactions across rollups, meaning users can execute complex cross-chain trades or asset transfers in a single block without risk of reordering or failed settlements.

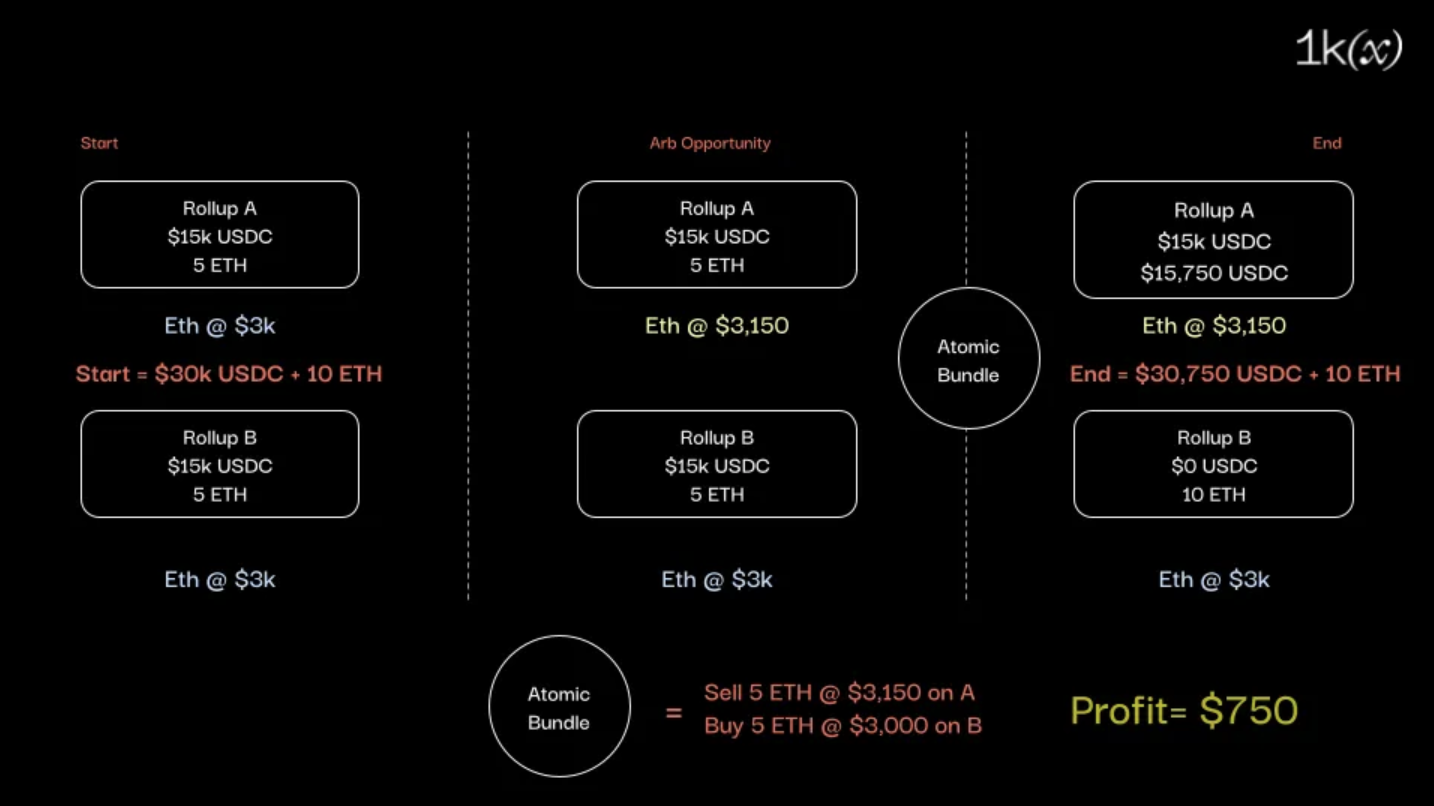

This shared sequencing approach not only streamlines interoperability but also creates opportunities for truly unified liquidity pools spanning multiple chains. Instead of fragmented markets with duplicated order books, DeFi protocols can tap into deeper liquidity sources aggregated across the entire Superchain ecosystem.

How Shared Sequencing Unifies Cross-Rollup Liquidity

Key Benefits of Decentralized Sequencers for Superchain

-

Unified Liquidity Pools: Decentralized sequencers like Espresso Sequencer enable multiple rollups to coordinate transactions, reducing liquidity fragmentation and allowing assets to move seamlessly across the Superchain ecosystem.

-

Enhanced Security and Censorship Resistance: By distributing transaction ordering across multiple nodes, decentralized sequencers remove single points of failure and significantly lower the risk of censorship or malicious control.

-

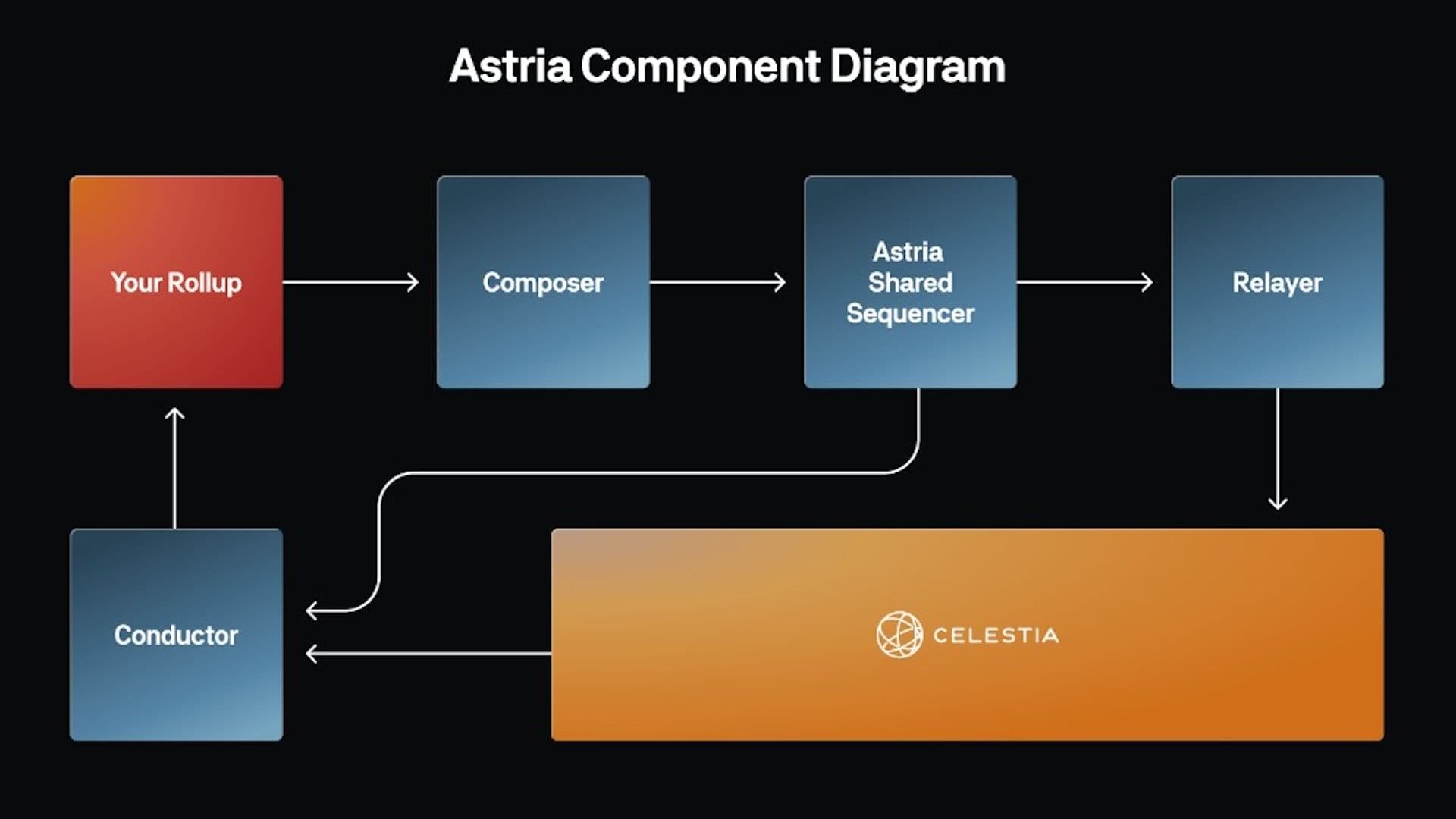

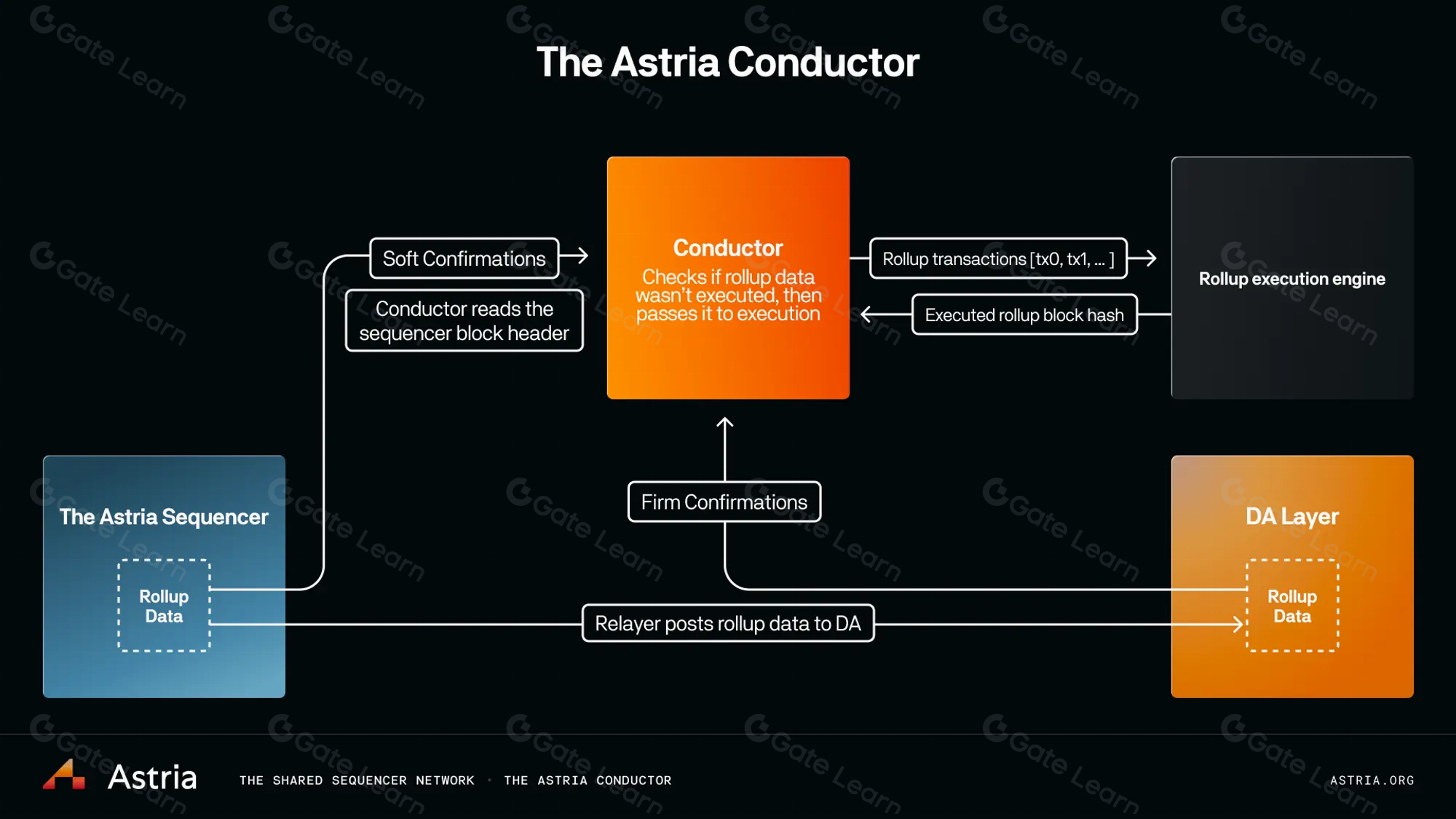

Seamless Cross-Rollup Interoperability: Shared sequencer networks such as Astria and Espresso facilitate atomic transactions and fast message passing between rollups, enabling composability and unified user experiences.

-

Faster and More Reliable Bridging: Decentralized sequencers improve the speed and reliability of bridging assets between rollups, helping developers and users avoid delays and risks associated with traditional bridging solutions.

-

Open Participation and Ecosystem Growth: By democratizing sequencing, networks like Espresso and Astria allow more participants to contribute to transaction ordering, fostering innovation and resilience in the Superchain ecosystem.

The mechanics behind this unification are both technical and economic:

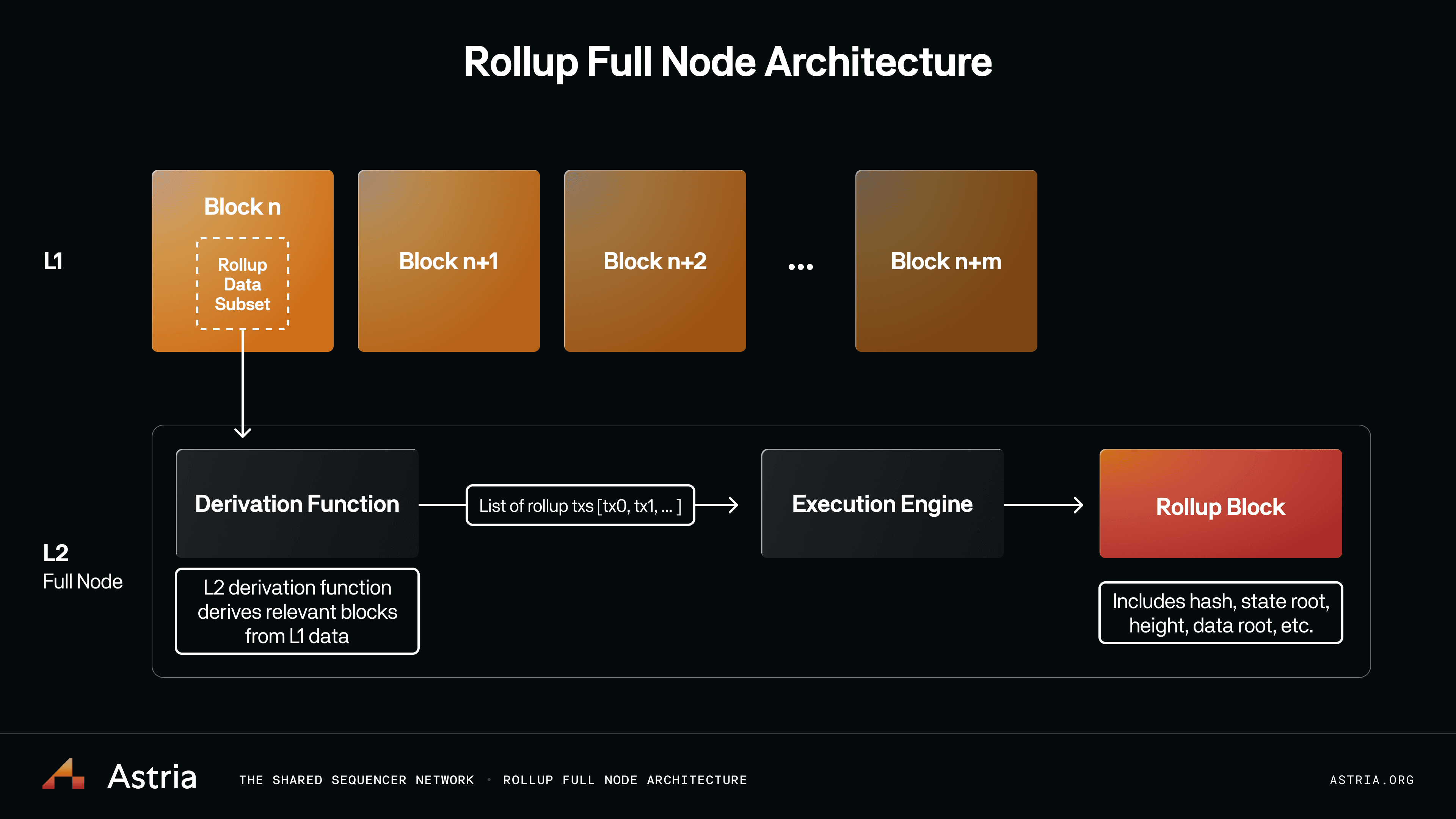

- Synchronous Atomic Inclusion: Decentralized sequencers like those developed by Espresso Systems or Astria allow transactions touching multiple rollups to be included atomically in the same block. This eliminates race conditions and slippage risks that plague asynchronous bridging models.

- Censorship Resistance: By decentralizing control over transaction ordering, malicious actors cannot freeze funds or block cross-chain activity, critical for maintaining trust in high-value DeFi applications.

- Unified Fee Markets: Shared sequencing layers enable novel fee market designs where transaction fees are balanced across participating rollups, further incentivizing deep liquidity aggregation rather than fragmentation.

The result is an environment where assets can flow freely between OP Stack chains without friction, a foundational shift that unlocks new composability primitives for both developers and end-users.

The Road Ahead: Espresso Systems and The Expanding Multi-Rollup Ecosystem

The deployment of shared decentralized sequencers is rapidly moving from theory to practice. Espresso Systems has launched testnets such as Cortado to demonstrate live cross-rollup atomicity, a foundational step toward production-grade interoperability (source). Meanwhile, integration efforts with networks like Omni further highlight how collaborative infrastructure is addressing liquidity fragmentation head-on.

One of the most compelling aspects of this evolution is the way decentralized sequencers enable new forms of cross-rollup DeFi. Protocols can now route trades, lending, and complex financial primitives across multiple OP Stack rollups in a single, atomic transaction. This unification means users no longer need to manage fragmented balances or rely on slow, trust-heavy bridges to move assets between chains. Instead, liquidity flows natively wherever it is needed, maximizing capital efficiency and opening up new markets for developers to build upon.

For Superchain developers, shared sequencing frameworks like Espresso bring a suite of practical advantages:

Key Benefits of Decentralized Sequencers for Superchain

-

Unified Liquidity Across Rollups: Decentralized sequencers like Espresso Sequencer enable seamless cross-rollup transactions, reducing liquidity fragmentation and allowing assets to move freely between Superchain rollups.

-

Enhanced Censorship Resistance: By distributing transaction ordering across multiple independent nodes, decentralized sequencers minimize single points of failure and reduce the risk of censorship or transaction denial.

-

Atomic Cross-Rollup Transactions: Shared sequencer networks such as Astria and Espresso support synchronous atomic inclusion, enabling users and developers to execute complex operations across rollups in a single, unified transaction.

-

Improved Interoperability: Decentralized sequencers facilitate interoperability by coordinating transaction ordering and settlement between different rollups, paving the way for a more cohesive Superchain ecosystem.

-

Stronger Security and Reliability: Decentralized sequencing prevents central points of failure and leverages consensus among multiple parties, increasing the security and uptime of rollup networks.

-

Developer and User Flexibility: With shared sequencing layers, developers can build applications that interact with multiple rollups without complex bridging, while users benefit from faster, more intuitive cross-chain experiences.

This model also creates fertile ground for experimentation with fee markets and MEV (maximal extractable value) capture. By aggregating transaction flow from many rollups into a single sequencer set, the ecosystem can design more robust mechanisms for fee sharing and value redistribution, aligning incentives across what were previously isolated chains.

Challenges and Open Questions

Despite its promise, the transition to decentralized sequencing is not without hurdles. Performance remains a key concern: achieving both high throughput and low latency with a distributed network of sequencers requires significant engineering finesse. Early testnets have demonstrated strong results in controlled settings but scaling these solutions to mainnet volumes will be a critical test.

There are also open questions about governance. Who gets to operate sequencer nodes? How are disputes resolved if two rollups disagree on transaction ordering? Projects like Espresso Systems are actively researching permissionless participation models and robust consensus mechanisms that can keep pace with the demands of Superchain-scale activity (read more here).

The impact on liquidity providers is equally profound. As unified fee markets emerge and deep liquidity pools become accessible across all participating chains, there is potential for new forms of yield generation and risk management strategies that simply weren’t feasible under siloed architectures. This could reshape incentive structures throughout the multi-rollup ecosystem.

Looking Forward: The Path to Seamless Superchain Liquidity

The next 12-18 months will be pivotal as projects move from testnet pilots to production deployments. The success or failure of decentralized sequencing will hinge on its ability to deliver both security guarantees and tangible improvements in user experience, particularly around speed, cost, and reliability.

If these systems prove resilient at scale, they could finally fulfill the Superchain’s promise: an Ethereum ecosystem where users interact with any application or asset, regardless of which OP Stack rollup it lives on, with the same ease as using a single monolithic chain.

For investors, developers, and end-users alike, watching how solutions like Espresso Sequencer evolve will be critical in understanding the next phase of Ethereum’s multi-rollup journey. As shared sequencing matures from research into production-grade infrastructure, expect rapid innovation, and fierce competition, to define who ultimately orchestrates the flow of assets across tomorrow’s unified blockchain economy.