Ethereum is at a pivotal moment. With the rollup-centric roadmap now the undisputed north star for Ethereum scaling, every trader, developer, and investor needs to re-evaluate what it means for the network’s future. At the time of writing, Ethereum (ETH) is trading at $4,467.15 – reflecting both optimism in scalability solutions and lingering skepticism about unresolved challenges.

Why Ethereum Went All-In on Rollups

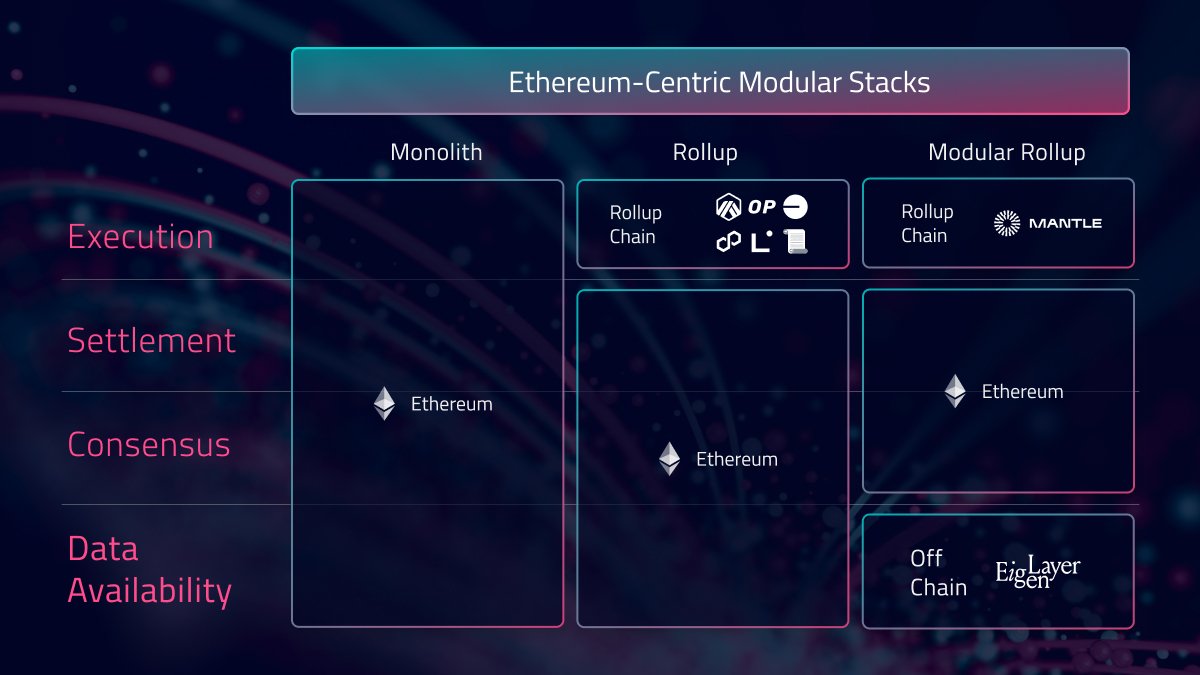

Let’s get visual: imagine Ethereum as a congested highway in 2020. Gas fees were sky-high, traffic was bumper-to-bumper, and even simple swaps felt like luxury purchases. The old roadmap promised sharding as relief – with a theoretical ~3,000 TPS ceiling – but progress was slow and complexity was mounting (source). Enter rollups: modular Layer 2 networks that compress hundreds of transactions into batches and settle them on Layer 1.

This pivot wasn’t just technical; it was philosophical. By making Layer 1 the ultimate security anchor and pushing execution to rollups, Ethereum could scale without sacrificing decentralization or security – at least in theory (source). The result? Today’s rollup-centric roadmap is not just a plan; it’s an ecosystem-wide bet on modularity.

The Pros: Scalability, Lower Fees, Unleashed Innovation

Top 3 Benefits of Ethereum’s Rollup-Centric Roadmap

-

Massive Scalability Gains: By leveraging Layer 2 rollups, Ethereum now processes an average of 250 transactions per second (TPS)—a dramatic increase from its previous capacity. This scaling solution alleviates network congestion and supports a growing user base without sacrificing decentralization.

-

Significantly Lower Transaction Fees: With the introduction of Proto-Danksharding (EIP-4844) and ‘blobs’, rollups enjoy much cheaper data posting costs. This innovation has substantially reduced Layer 2 fees, making Ethereum transactions more affordable and accessible for everyday users.

-

Accelerated Ecosystem Innovation: The modular rollup approach empowers developers to build diverse applications and experiment with new execution environments. This flexibility has transformed Ethereum into a vibrant hub for DeFi, NFTs, and next-gen dApps—all secured by Ethereum’s robust Layer 1.

The numbers don’t lie. After Proto-Danksharding (EIP-4844) introduced blobs as cheap data containers for rollups, average L2 transaction throughput hit 250 TPS, with fees plunging across leading rollups (source). Traders can now move assets or execute swaps for cents instead of dollars. Developers are launching new dApps that simply weren’t feasible under old constraints – from high-frequency games to complex DeFi protocols.

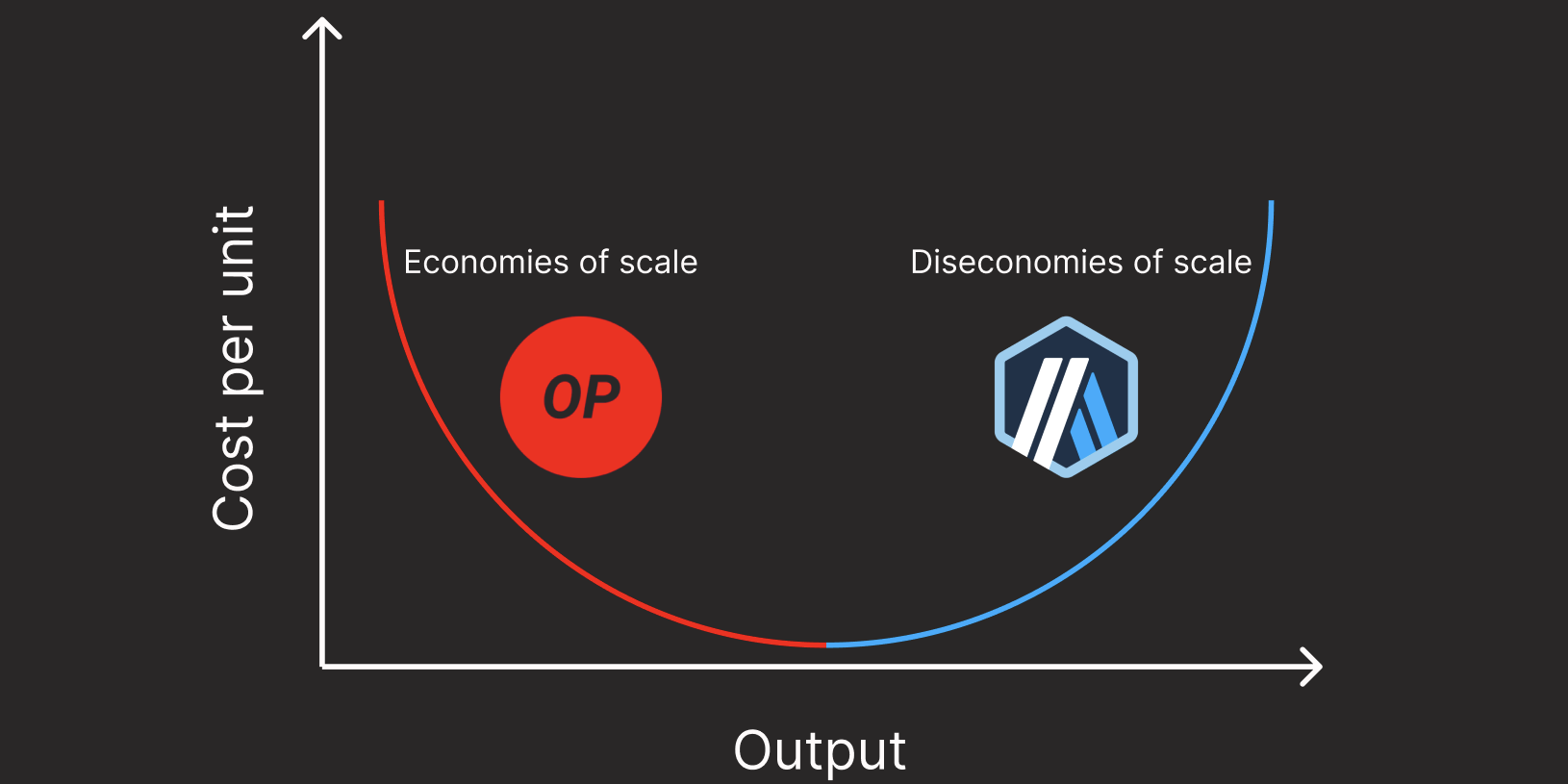

This innovation isn’t theoretical; it’s visible in daily activity spikes across Arbitrum, OP Mainnet, Base, and other OP Stack chains. The composability within each rollup is robust and fast – a playground for builders who want to push boundaries without waiting years for base-layer upgrades (source).

Momentum is opportunity – and right now, Layer 2s are where momentum lives.

The Cons: Fragmentation, Centralized Sequencers and Interop Headaches

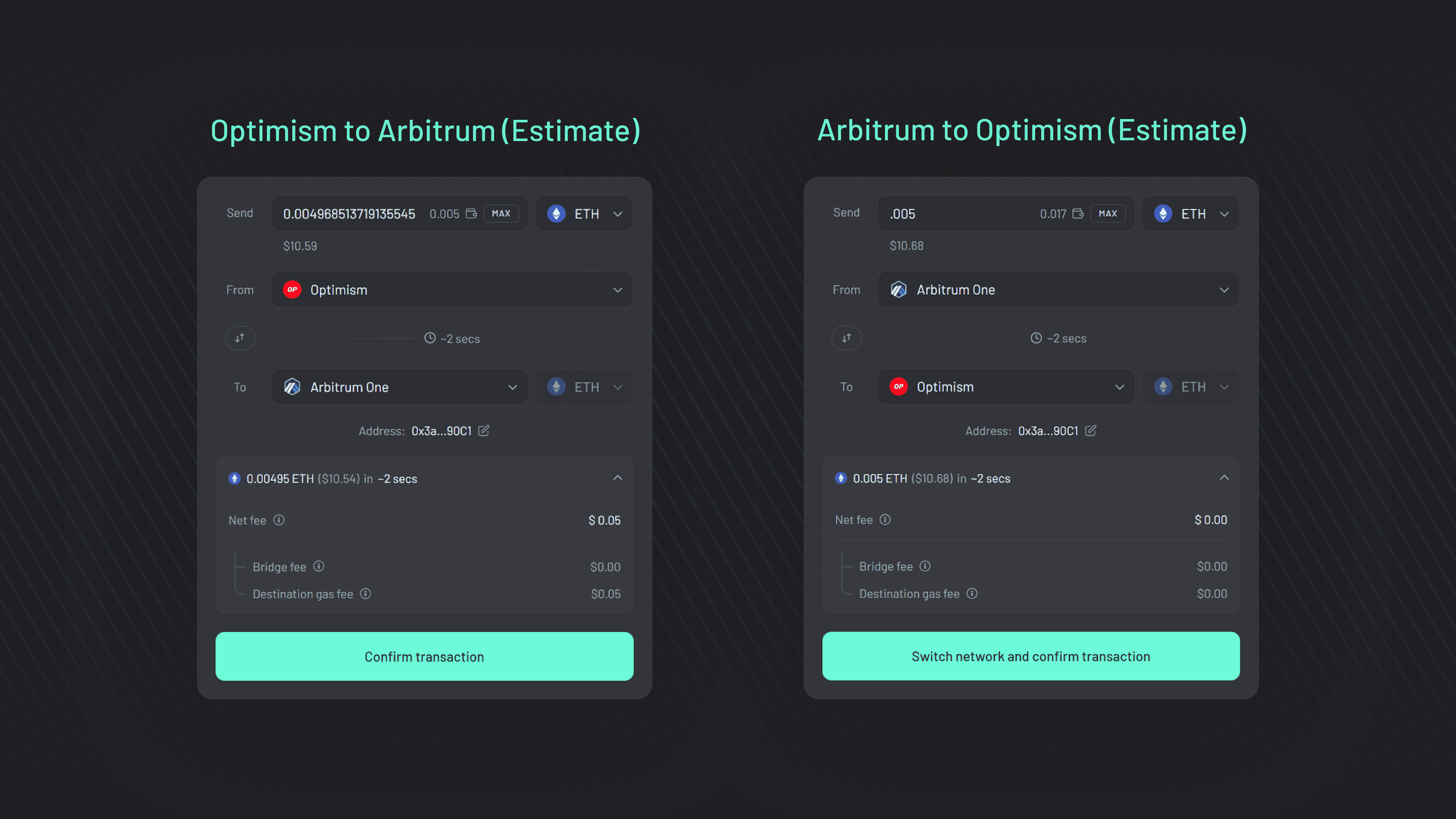

No sugarcoating here: the multi-rollup vision introduces new headaches alongside its benefits. Liquidity fragmentation is real. With dozens of live rollups each hosting their own pools and order books, moving capital seamlessly between networks can be clunky at best (source). For traders chasing fast-moving opportunities or whales seeking deep liquidity for large moves, this fragmentation complicates execution strategies.

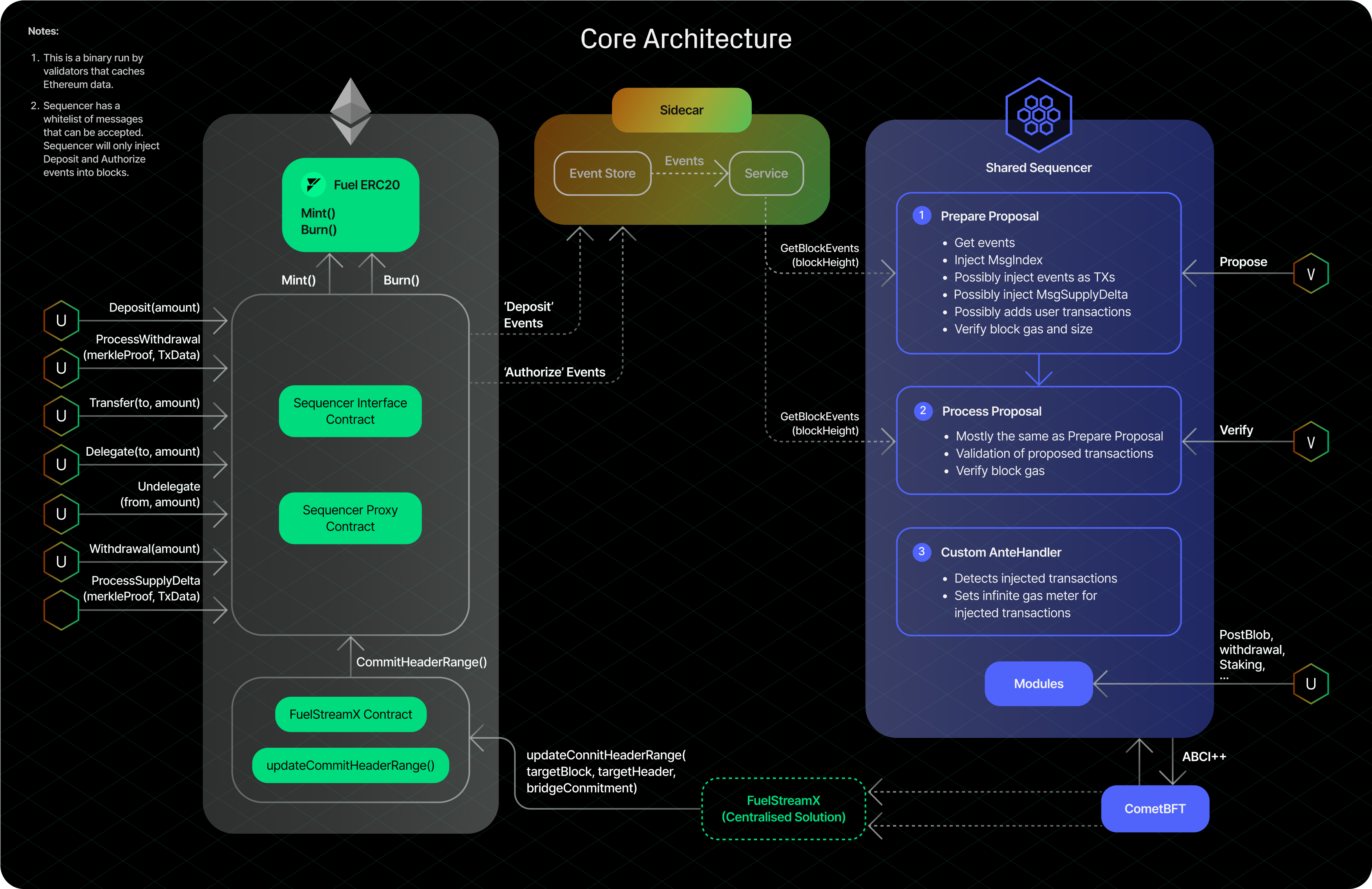

The second pain point? Centralized sequencers. Many top rollups rely on single operators to order transactions – creating risks around censorship or MEV extraction if those sequencers misbehave (source). There’s active R and D into shared sequencing layers but no silver bullet yet.

Finally: interoperability remains an unsolved puzzle. Cross-rollup composability is limited by current bridging solutions and data availability constraints (source). While native bridges secured by Ethereum are coming online fast, seamless user experiences still lag behind what many had hoped for at this stage.

The Road Ahead: Upgrades and Predictions Through Early 2025

The story isn’t finished – not by a long shot. Vitalik Buterin has been vocal that calling the roadmap “done” would be naïve (source). Data availability improvements like PeerDAS (Peer Data Availability Sampling) are slated for early 2025 via the Pectra upgrade; these will help unlock higher throughput while keeping L1 secure and decentralized.

Ethereum (ETH) Price Prediction 2026-2031

Forecast Based on Rollup-Centric Roadmap Adoption and Market Trends (Baseline Price: $4,467.15 as of Q3 2025)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year Change (Avg) | Comments / Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,800 | $5,200 | $7,000 | +16% | Completion of Pectra upgrade, improved rollup adoption, but some fragmentation persists |

| 2027 | $4,200 | $6,000 | $8,500 | +15% | Rollup interoperability solutions mature; DeFi and NFT growth resumes |

| 2028 | $4,800 | $7,250 | $10,000 | +21% | Layer 2 fees decline further, ETH used as settlement layer, increased institutional adoption |

| 2029 | $5,400 | $8,600 | $12,500 | +19% | Global regulatory clarity improves, ETH ETFs expand, composability across rollups |

| 2030 | $6,200 | $10,200 | $15,000 | +19% | Mainstream Web3 applications and stablecoin settlement drive usage |

| 2031 | $7,000 | $12,000 | $18,000 | +18% | Ethereum cements status as global settlement layer, strong competition from other L1s but robust ecosystem |

Price Prediction Summary

Ethereum’s rollup-centric roadmap is expected to steadily boost scalability and lower transaction costs, driving incremental adoption and price growth. While challenges like liquidity fragmentation and centralized sequencers persist, ongoing upgrades (such as Pectra and PeerDAS) and increasing institutional interest support a positive long-term outlook. Price growth is projected to be moderate but consistent, with significant upside in bullish scenarios if Ethereum achieves seamless interoperability and mass adoption.

Key Factors Affecting Ethereum Price

- Adoption and success of rollup-centric scaling solutions

- Implementation and impact of upgrades like Pectra and PeerDAS

- Resolution of liquidity fragmentation and centralized sequencer risks

- Regulatory clarity in major markets (US, EU, Asia)

- Increased institutional adoption (ETFs, funds)

- Expansion of real-world use cases (DeFi, NFTs, stablecoins, Web3 apps)

- Competition from other Layer 1 blockchains (e.g., Solana, Avalanche, Aptos)

- General macroeconomic environment and crypto market cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

But the technical roadmap is only half the equation. The real test is adoption: will users, protocols, and liquidity providers embrace the multi-rollup world, or will friction keep them siloed? As of September 2025, Ethereum’s network activity is surging on L2s, but cross-chain UX still has miles to go before it matches the seamlessness of traditional finance.

What could tip the scales? If Pectra and PeerDAS deliver as promised, we could see a new baseline for transaction costs and throughput across the entire rollup network. That’s not just an incremental upgrade, it’s a fundamental shift in how Ethereum can serve both high-frequency DeFi traders and everyday users. EIP-7702 will further streamline contract interactions, opening doors for more complex applications and automated strategies that simply weren’t viable at higher fee levels.

What Traders and Builders Should Watch Next

Key Signals to Watch in Ethereum’s Rollup-Centric Era

-

Layer 2 Transaction Fees and Throughput: Watch for continued reductions in L2 fees, especially after upgrades like EIP-4844 (Proto-Danksharding). Sustained low fees and rising transactions per second (TPS) are critical for mainstream adoption.

-

Decentralization of Sequencers: Monitor the progress of rollups moving from centralized to decentralized sequencer models. Projects like Fuel and Cartesi are pioneering decentralized sequencing, reducing risks of censorship and MEV extraction.

-

Cross-Rollup Interoperability Solutions: Look for the emergence of robust bridges and protocols such as Hop Protocol and Connext that enable seamless asset and data transfers between rollups. Interoperability is key to overcoming liquidity fragmentation.

-

Implementation of Peer Data Availability Sampling (PeerDAS): The rollout of PeerDAS, expected in the Pectra upgrade (early 2025), will be a major milestone for data availability and rollup scalability. Its adoption will impact network efficiency and L2 performance.

-

Ethereum Price and Market Sentiment: Keep an eye on Ethereum (ETH) price—currently at $4,467.15. Price trends often reflect broader confidence in the rollup-centric roadmap and ecosystem health.

If you’re trading or building on Ethereum right now, here are your leading indicators:

- Sequencer decentralization: Look for announcements around shared sequencing layers or new protocols that distribute transaction ordering across multiple parties. This could be a game-changer for censorship resistance and MEV protection.

- Liquidity bridges: Watch which bridges gain traction for moving assets between rollups with minimal slippage and risk. The first truly seamless bridge will capture outsized market share.

- L2 incentive programs: Keep an eye on which rollups are attracting new protocols through grants or rewards, these ecosystems may see explosive growth as capital chases yield opportunities across chains.

The next six months are critical. If current upgrades land successfully and user experience improves, we could see ETH’s price break out from its current level of $4,467.15, especially if network effects compound around a handful of dominant rollups. But if fragmentation persists or sequencer risks aren’t addressed, capital may remain sticky in established L1s or migrate to competing L2s with better UX.

The modular thesis isn’t just about scaling, it’s about optionality. Whoever cracks seamless composability between rollups wins the next phase of DeFi and beyond.

The Superchain Vision: Where Does It All Lead?

The ultimate ambition isn’t just scaling Ethereum, it’s creating a superchain: a mesh of interoperable rollups where assets and data flow as freely as on any single monolithic chain. That vision is still under construction, but every upgrade brings us closer. For investors and builders willing to navigate short-term complexity, the opportunity set is massive.

The playbook? Stay nimble, track ecosystem upgrades obsessively, and position ahead of major liquidity migrations. The era of one-chain-to-rule-them-all is over; welcome to the age of modular blockchains where momentum really is opportunity.

Will Ethereum’s rollup-centric roadmap achieve true mass adoption by 2026?

Ethereum’s rollup-centric roadmap has boosted scalability and reduced fees, with ETH currently at $4,467.15. However, challenges like liquidity fragmentation and centralized sequencers remain. Do you think these improvements will be enough for Ethereum to reach mass adoption by 2026?